Sitio Royalties Announces $500 Million Offering of Senior Notes

September 26 2023 - 6:45AM

Business Wire

Sitio Royalties Corp. (NYSE: STR) (“Sitio” or the “Company”)

today announced that its subsidiaries, Sitio Royalties Operating

Partnership, LP (the “Partnership”) and Sitio Finance Corp. (the

“Co-Issuer” and together with the Partnership, the “Issuers”),

subject to market conditions, intend to offer and sell to qualified

institutional buyers pursuant to Rule 144A under the Securities Act

of 1933, as amended (the “Securities Act”), and to non-U.S. persons

outside of the United States pursuant to Regulation S under the

Securities Act, $500 million in aggregate principal amount of

senior unsecured notes due 2028 (the “Notes Offering”). The Issuers

intend to use the net proceeds from the Notes Offering to (i) fund

the redemption of all of the outstanding aggregate principal amount

of the Partnership’s senior unsecured notes due 2026 (the “Existing

2026 Notes,” and such redemption, the “2026 Notes Redemption”),

which is expected to occur concurrently with or shortly following

the consummation of the Notes Offering, and (ii) repay a portion of

the outstanding borrowings under the Partnership’s revolving credit

facility.

The securities to be offered in the Notes Offering have not been

and will not be registered under the Securities Act, or any state

securities laws or the securities laws of any other jurisdiction,

and unless so registered, the securities may not be offered or sold

in the United States or for the benefit of U.S. persons except

pursuant to an applicable exemption from, or in a transaction not

subject to, the registration requirements of the Securities Act and

applicable state securities or blue sky laws. Accordingly, the

securities to be offered are being offered only to persons

reasonably believed to be “qualified institutional buyers” under

Rule 144A under the Securities Act and to non-U.S. persons outside

the United States pursuant to Regulation S under the Securities

Act. This announcement shall not constitute an offer to sell or a

solicitation of an offer to buy any of these securities, except as

required by law. No offer, solicitation, purchase or sale will be

made in any jurisdiction in which such offer, solicitation or sale

would be unlawful. This press release does not constitute a notice

of redemption for the Existing 2026 Notes.

About Sitio Royalties Corp.

Sitio is a shareholder returns-driven company focused on

large-scale consolidation of high-quality oil & gas mineral and

royalty interests across premium basins, with a diversified set of

top-tier operators.

Forward-Looking Statements

Certain statements in this release are “forward-looking

statements” for purposes of federal securities laws.

Forward-looking statements include, but are not limited to,

statements that refer to projections, forecasts, or other

characterizations of future events or circumstances, including any

underlying assumptions. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “may,”

“might,” “plan,” “seeks,” “possible,” “potential,” “predict,”

“project,” “prospects,” “guidance,” “outlook,” “should,” “would,”

“will,” and similar expressions may identify forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking. These statements include, but are

not limited to, statements about the Company’s future plans,

expectations, and objectives for the Company’s operations,

including statements about strategy, synergies and future

operations, financial position, the Notes Offering and the use of

proceeds therefrom, including the 2026 Notes Redemption. While

forward-looking statements are based on assumptions and analyses

made by us that we believe to be reasonable under the

circumstances, whether actual results and developments will meet

our expectations and predictions depend on a number of risks and

uncertainties that could cause our actual results, performance, and

financial condition to differ materially from our expectations and

predictions. See Part I, Item 1A “Risk Factors” in the Company’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2022, filed with the SEC on March 8, 2023, and its subsequent

Quarterly Reports on Form 10-Q, under the caption “Risk Factors,”

as may be updated from time to time in Sitio’s periodic filings

with the SEC, for a discussion of risk factors that affect Sitio’s

business. Any forward-looking statement made in this release speaks

only as of the date on which it is made. Factors or events that

could cause actual results to differ may emerge from time to time,

and it is not possible to predict all of them. Sitio undertakes no

obligation to publicly update any forward-looking statement,

whether as a result of new information, future development, or

otherwise, except as may be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230926196084/en/

IR contact: Ross Wong (720) 640–7647 IR@sitio.com

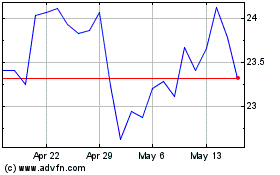

Sitio Royalties (NYSE:STR)

Historical Stock Chart

From Jan 2025 to Feb 2025

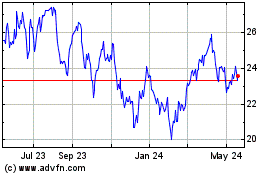

Sitio Royalties (NYSE:STR)

Historical Stock Chart

From Feb 2024 to Feb 2025