- Providing Access to Derivative Income, Emerging Markets

ex-China and Commodities, SPIN, XCNY and CERY Are Designed to Help

Investors Customize Portfolios

State Street Global Advisors, the asset management business of

State Street Corporation (NYSE: STT), today announced the launch of

three new ETFs: the SPDR® SSGA US Equity Premium Income ETF

(SPIN), the SPDR® S&P® Emerging Markets ex-China ETF

(XCNY), and the SPDR® Bloomberg Enhanced Roll Yield

Commodity Strategy No K-1 ETF (CERY). The funds are

designed to help investors capture opportunities and manage

risk.

“As investors increasingly turn to ETFs to optimize their

portfolios, we’re excited to be expanding our SPDR ETF offering to

help them create better outcomes,” said Anna Paglia, Chief Business

Officer at State Street Global Advisors. “SPIN, XCNY, and CERY were

each developed to expand the range of investment options that can

be expressed by clients who are looking for innovative tools to

fine-tune their portfolios and better meet their investment

objectives.”

The SPDR SSGA US Equity Premium Income ETF (SPIN) is an

actively managed ETF that is designed to enhance income generation

through a dynamic call writing program while also maintaining the

potential for long-term growth of capital by constructing an

underlying portfolio of high quality large- and mid-cap US stocks

that exhibit strong fundamentals and long-term growth prospects.

Priced at 25 basis points, SPIN may be a compelling offer for

investors seeking enhanced income.

The SPDR S&P Emerging Markets ex-China ETF (XCNY)

seeks to track a market capitalization-weighted index of large-,

mid-, and small-cap emerging market companies that excludes

companies domiciled in China. By removing Chinese equities, XCNY

may allow investors to manage their China risk exposure separately,

while still seeking high growth and capital appreciation potential

from emerging market economies. And priced at 15 basis points, XCNY

is the lowest-cost fund offering exposure to EM ex-China.1

The SPDR Bloomberg Enhanced Roll Yield Commodity Strategy No

K-1 ETF (CERY) seeks to track the total return performance of

the Bloomberg Enhanced Roll Yield Total Return Index. Designed to

provide broad commodities market exposure with a focus on

diversification and enhanced roll yields, CERY may potentially

reduce the costs associated with rolling over commodity futures

contracts while providing the potential diversification and

inflation-hedging benefits of the asset class.

For more information on these SPDR ETFs visit www.ssga.com.

About State Street Global Advisors

For four decades, State Street Global Advisors has served the

world’s governments, institutions, and financial advisors. With a

rigorous, risk-aware approach built on research, analysis, and

market-tested experience, we build from a breadth of index and

active strategies to create cost-effective solutions. As pioneers

in index and ETF investing, we are always inventing new ways to

invest. As a result, we have become the world’s fourth-largest

asset manager* with US $4.37 trillion† under our care.

*Pensions & Investments Research Center, as of 12/31/23.

†This figure is presented as of June 30, 2024 and includes ETF AUM

of $1,393.92 billion USD of which approximately $69.35 billion USD

is in gold assets with respect to SPDR products for which State

Street Global Advisors Funds Distributors, LLC (SSGA FD) acts

solely as the marketing agent. SSGA FD and State Street Global

Advisors are affiliated. Please note all AUM is unaudited.

1 Morningstar, as of 09/05/2024. Based on 17 US-domiciled funds

in the category of US Diversified Emerging Markets and name

containing ‘ex-China.’

Important Risk Information

Investing involves risk of including the risk of loss of

principal.

The information provided does not constitute investment advice

and it should not be relied on as such. It should not be considered

a solicitation to buy or an offer to sell a security. It does not

take into account any investor's particular investment objectives,

strategies, tax status or investment horizon. You should consult

your tax and financial advisor.

The whole or any part of this work may not be reproduced, copied

or transmitted or any of its contents disclosed to third parties

without SSGA’s express written consent.

All information is from SSGA unless otherwise noted and has been

obtained from sources believed to be reliable, but its accuracy is

not guaranteed. There is no representation or warranty as to the

current accuracy, reliability or completeness of, nor liability

for, decisions based on such information and it should not be

relied on as such.

This communication is not intended to promote or recommend the

use of options or options trading strategies and should not be

relied upon as such.

ETFs trade like stocks, are subject to investment risk,

fluctuate in market value and may trade at prices above or below

the ETFs net asset value. Brokerage commissions and ETF expenses

will reduce returns.

While the shares of ETFs are tradable on secondary markets, they

may not readily trade in all market conditions and may trade at

significant discounts in periods of market stress.

Actively managed funds, like SPIN, do not seek to

replicate the performance of a specified index. An actively managed

fund may underperform its benchmark. An investment in the fund is

not appropriate for all investors and is not intended to be a

complete investment program. Investing in the fund involves risks,

including the risk that investors may receive little or no return

on the investment or that investors may lose part or even all of

the investment.

Equity securities may fluctuate in value and can decline

significantly in response to the activities of individual companies

and general market and economic conditions.

Foreign (non-U.S.) Securities may be subject to greater

political, economic, environmental, credit and information risks.

Foreign securities may be subject to higher volatility than U.S.

securities, due to varying degrees of regulation and limited

liquidity. These risks are magnified in emerging

markets.

Non-diversified funds that focus on a relatively small

number of stocks tend to be more volatile than diversified funds

and the market as a whole.

Options investing entails a high degree of risk and may

not be appropriate for all investors. SPIN’s use of call options

involves speculation and can lead to losses because of adverse

movements in the price or value of the underlying stock, index, or

other asset, which may be magnified by certain features of the

options.

Passively managed funds, like CERY and XCNY, invest by

sampling the index, holding a range of securities that, in the

aggregate, approximates the full Index in terms of key risk factors

and other characteristics. This may cause the fund to experience

tracking errors relative to performance of the index.

Investing in commodities entails significant risk and is

not appropriate for all investors. Commodities investing entails

significant risk as commodity prices can be extremely volatile due

to wide range of factors. A few such factors include overall market

movements, real or perceived inflationary trends, commodity index

volatility, international, economic and political changes, change

in interest and currency exchange rates.

Commodities and commodity-index linked securities may be

affected by changes in overall market movements, changes in

interest rates, and other factors such as weather, disease,

embargoes, or political and regulatory developments, as well as

trading activity of speculators and arbitrageurs in the underlying

commodities.

Investing in futures is highly risky. Futures positions

are considered highly leveraged because the initial margins are

significantly smaller than the cash value of the contracts. The

smaller the value of the margin in comparison to the cash values of

the futures contract, the higher the leverage. There are a number

of risks associated with futures investing including but not

limited to counterparty credit risk, basis risk, currency risk,

derivatives risk, foreign issuer exposure risk, sector

concentration risk, leveraging and liquidity risks.

Investing in swaps is highly risky. Swap contracts are

not standardized, nor are they traded on an index. Rather, they are

negotiated privately between the counterparties and are not settled

by a centralized clearing-house. As such, swap contracts subject a

party to significant counterparty risk. Swap positions are

considered highly leveraged because the initial margins are

significantly smaller than the notional value of the contracts. The

smaller the value of the margin in comparison to the notional value

of the swap contract, the higher the leverage. There are a number

of risks associated with forward investing including but not

limited to counterparty credit risk, currency risk, derivatives

risk, foreign issuer exposure risk, sector concentration risk,

leveraging and liquidity risks.

CERY seeks to achieve its investment objective primarily through

exposure to commodity-linked derivative instruments based on the

Fund’s benchmark index. The Fund expects to gain exposure to these

investments by investing in a wholly-owned subsidiary, an exempted

limited company organized under the laws of the Cayman Islands (the

“Subsidiary”). The Subsidiary is not registered under the

Investment Company Act of 1940, as amended (“1940 Act”) and is not

subject to all of the investor protections of the 1940 Act. Thus,

the Fund, as an investor in the Subsidiary, will not have all of

the protections offered to investors in registered investment

companies. In addition, changes in the laws of the United States

and/or the Cayman Islands could result in the inability of the Fund

to operate as intended and could negatively affect the Fund and its

shareholders.

The trademarks and service marks referenced herein are the

property of their respective owners. Third party data providers

make no warranties or representations of any kind relating to the

accuracy, completeness or timeliness of the data and have no

liability for damages of any kind relating to the use of such

data.

Intellectual Property Information: The S&P 500® Index

is a product of S&P Dow Jones Indices LLC or its affiliates

(“S&P DJI”) and have been licensed for use by State Street

Global Advisors. S&P®, SPDR®, S&P 500®,US 500 and the 500

are trademarks of Standard & Poor’s Financial Services LLC

(“S&P”); Dow Jones® is a registered trademark of Dow Jones

Trademark Holdings LLC (“Dow Jones”) and has been licensed for use

by S&P Dow Jones Indices; and these trademarks have been

licensed for use by S&P DJI and sublicensed for certain

purposes by State Street Global Advisors. The fund is not

sponsored, endorsed, sold or promoted by S&P DJI, Dow Jones,

S&P, their respective affiliates, and none of such parties make

any representation regarding the advisability of investing in such

product(s) nor do they have any liability for any errors,

omissions, or interruptions of these indices.

Distributor: State Street Global Advisors Funds

Distributors, LLC, member FINRA, SIPC, an indirect wholly owned

subsidiary of State Street Corporation. References to State Street

may include State Street Corporation and its affiliates. Certain

State Street affiliates provide services and receive fees from the

SPDR ETFs.

Before investing, consider the funds’ investment objectives,

risks, charges and expenses. To obtain a prospectus or summary

prospectus which contains this and other information, call

1-866-787-2257 or visit ssga.com. Read it carefully.

Not FDIC Insured - No Bank Guarantee - May Lose Value

State Street Global Advisors Fund Distributors, LLC,

member FINRA, SIPC

© 2024 State Street Corporation. All Rights Reserved. State

Street Global Advisors Funds Distributors, LLC, One Iron Street,

Boston, MA 02210

6772609.1.1.AM.RTL Exp. Date: 09/30/2025

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240829590833/en/

Deborah Heindel 617-662-9927 dheindel@statestreet.com

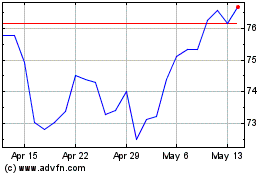

State Street (NYSE:STT)

Historical Stock Chart

From Nov 2024 to Dec 2024

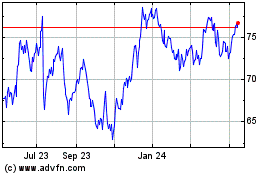

State Street (NYSE:STT)

Historical Stock Chart

From Dec 2023 to Dec 2024