State Street Announces Partnership with Harris | Oakmark for State Street Alpha®

December 10 2024 - 1:10PM

Business Wire

- Ahead of schedule, Harris | Oakmark now live with State Street

Alpha’s transaction lifecycle management services after awarding

State Street a middle office mandate at the end of 2023

State Street Corporation (NYSE: STT) announced today that Harris

| Oakmark has gone live with State Street Alpha®, the firm’s

front-to-back asset servicing platform for institutional investment

managers, following the selection of State Street to be their

strategic operating partner less than a year ago. Harris | Oakmark,

a Chicago-based investment management firm with approximately $104

billion of assets under management as of September 30, 2024, serves

as the adviser to the Oakmark Funds, a mutual fund family that

utilizes a long-term value investment approach.

“Harris | Oakmark marks another significant milestone for our

Alpha business broadly,” says John Plansky, head of State Street

Alpha. “Providing middle office services to more than 2,000 of

their private wealth and retail SMA accounts allows us to deepen

our relationship with Harris | Oakmark and further showcase our

data capabilities for wealth managers.”

The first phase of the migration focused on transaction

lifecycle management services and was successfully completed ahead

of schedule, ten months after awarding the mandate. The second and

final phase of the migration is targeted for completion in Q1

2026.

“We are excited to partner with State Street on their Alpha

platform,” said Young Lee, chief operating officer from Harris |

Oakmark. “We have been very pleased with the progress made during

the first phase of the migration as the platform will allow us to

operate in a highly efficient operating environment and continue to

provide exceptional services to our clients.”

State Street Alpha provides its clients a centralized operating

model and technology platform to manage all their public and

private assets investment products underpinned by its cloud native,

enterprise Alpha Data Platform. With State Street Alpha, clients

can focus on executing their growth strategy without the drag and

limitations of a segregated operating model.

About State Street Corporation State Street Corporation

(NYSE: STT) is one of the world's leading providers of financial

services to institutional investors including investment servicing,

investment management and investment research and trading. With

$46.8 trillion in assets under custody and/or administration and

$4.7 trillion* in assets under management as of September 30, 2024,

State Street operates globally in more than 100 geographic markets

and employs approximately 53,000 worldwide. For more information,

visit State Street's website at www.statestreet.com.

* Assets under management as of September 30, 2024 includes

approximately $83 billion of assets with respect to SPDR® products

for which State Street Global Advisors Funds Distributors, LLC

(“SSGA FD”) acts solely as the marketing agent. SSGA FD and State

Street Global Advisors are affiliated.

© 2024 State Street Corporation

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241210112395/en/

Media Contact: Brendan Paul Mobile: +1 401 644 9182

Bpaul2@statestreet.com

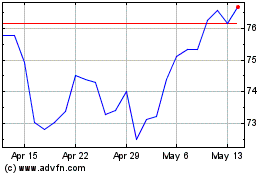

State Street (NYSE:STT)

Historical Stock Chart

From Dec 2024 to Jan 2025

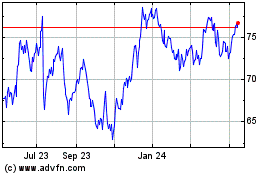

State Street (NYSE:STT)

Historical Stock Chart

From Jan 2024 to Jan 2025