Teekay Corporation Announces Update on $25 Million Share Repurchase Program and Announces New Share Repurchase Program

September 09 2024 - 5:59AM

Teekay Corporation (Teekay or the Company) (NYSE:TK) today

announced that the Company has nearly completed the

previously-announced $25 million share repurchase program,

repurchasing 3.25 million common shares at an average price of

$7.49 per share. Since August 2022, Teekay has repurchased a total

of 14.97 million common shares, or 14.7% of the outstanding common

shares immediately prior to commencement of the initial share

repurchase plan announced in August 2022, for a total cost of $84.4

million, representing an average repurchase price of $5.64 per

share.

In addition, the Company’s Board of Directors

has authorized a new share repurchase program for the repurchase of

up to $40 million of the Company’s outstanding common shares. Under

the program, repurchases can be made from time to time in the open

market, through privately-negotiated transactions and by any other

means permitted under the rules of the U.S. Securities and Exchange

Commission, in each case at times and prices considered appropriate

by the Company. The timing of any purchases and the exact number of

shares to be purchased under the program will be subject to the

discretion of the Company and upon market conditions and other

factors. The Company intends to make all open market repurchases

under the plan in accordance with Rule 10b-18 of the U.S.

Securities Exchange Act of 1934, as amended.

About Teekay

Teekay is a leading provider of international

crude oil marine transportation and other marine services. Teekay

provides these services directly and through its controlling

ownership interest in Teekay Tankers Ltd. (NYSE: TNK), one of the

world’s largest owners and operators of mid-sized crude tankers.

The consolidated Teekay entities manage and operate approximately

65 conventional tankers and other marine assets, including vessels

operated for the Australian government. With offices in eight

countries and approximately 2,200 seagoing and shore-based

employees, Teekay provides a comprehensive set of marine services

to the world’s leading energy companies.

Teekay’s common stock is listed on the New York

Stock Exchange where it trades under the symbol “TK”.

For Teekay Investor Relations enquiries

contact:

E-mail: investor.relations@teekay.comWebsite: www.teekay.com

Forward-Looking Statements

This release contains forward-looking statements

within the meaning of Section 27A of the U.S. Securities Act of

1933, as amended, and Section 21E of the U.S. Securities Exchange

Act of 1934, as amended. All statements included in this release,

other than statements of historical fact, are forward-looking

statements. When used in this report, the words “expect,”

“believe,” “anticipate,” “plan,” “intend,” “estimate,” “may,”

“will” or similar words are intended to identify forward-looking

statements. Readers are cautioned not to place undue reliance on

these forward-looking statements and any such forward-looking

statements are qualified in their entirety by reference to the

following cautionary statements. All forward-looking statements

speak only as of the date hereof and are based on current

expectations and involve a number of assumptions, risks and

uncertainties that could cause actual results to differ materially

from such forward-looking statements. Forward-looking statements

contained in this release include, among others, statements

regarding the expected amount and timing of repurchases of Teekay’s

common shares under the Company’s share repurchase program.

The following factors are among those that could

cause actual results to differ materially from the forward-looking

statements, which involve risks and uncertainties, and that should

be considered in evaluating any such statement: changes in the

Company’s liquidity and financial leverage; the Company’s capital

requirements; changes in the demand for oil and refined products;

changes in trading patterns significantly affecting overall vessel

tonnage requirements; greater or less than anticipated levels of

vessel newbuilding orders and deliveries and greater or less than

anticipated rates of vessel scrapping; changes in global oil prices

or tanker rates; higher than expected costs and expenses, off-hire

days or dry-docking requirements (both scheduled and unscheduled);

changes in the trading price and trading volume of the Company’s

common shares; and other factors discussed in Teekay’s filings from

time to time with the SEC, including its Annual Report on Form 20-F

for the fiscal year ended December 31, 2023. Teekay expressly

disclaims any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statements contained

herein to reflect any change in Teekay’s expectations with respect

thereto or any change in events, conditions or circumstances on

which any such statement is based.

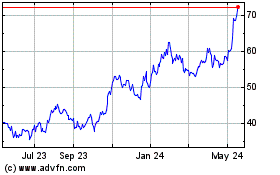

Teekay Tankers (NYSE:TNK)

Historical Stock Chart

From Nov 2024 to Dec 2024

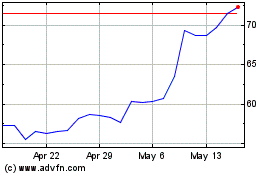

Teekay Tankers (NYSE:TNK)

Historical Stock Chart

From Dec 2023 to Dec 2024