UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________

FORM 6-K

_________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

Date of Report: October 30, 2024

Commission file number 1-33867

_________________________

TEEKAY TANKERS LTD.

(Exact name of Registrant as specified in its charter)

_________________________

2nd Floor, Swan Building, 26 Victoria Street, Hamilton, HM12, Bermuda

(Address of principal executive office)

_________________________

| | |

| Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. |

Form 20-F ý Form 40-F ¨ |

|

|

|

|

Item 1 — Information Contained in this Form 6-K Report

Attached as Exhibit 1 is a copy of an announcement of Teekay Tankers Ltd. dated October 30, 2024.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| TEEKAY TANKERS LTD. |

| |

| Date: October 30, 2024 | By: | | /s/ Brody Speers |

| | | Brody Speers

Chief Financial Officer

(Principal Financial and Accounting Officer) |

TEEKAY TANKERS LTD. REPORTS

THIRD QUARTER 2024 RESULTS

Highlights

•Reported GAAP net income of $58.8 million, or $1.70 per share; and adjusted net income(1) of $63.5 million, or $1.84 per share, in the third quarter of 2024 (excluding items listed in Appendix A to this release).

•The Company has agreed to acquire Teekay Corporation Ltd.'s (Teekay's) Australian operations (collectively, Teekay Australia), which include ship management services companies primarily servicing the Government of Australia, for $65.0 million in cash. The Company has also agreed to acquire from Teekay all management services companies not currently owned by the Company at their net working capital value, transforming Teekay Tankers into a fully-integrated shipping company containing all shore-based employees and seafarers in one platform.

•The Company secured quarter to-date average spot rates of $29,700 per day for Suezmax vessels and $35,500 per day for Aframax / LR2 vessels with current spot tanker rates well above these levels.

•In October 2024, completed the previously-announced sale of a 2005-built Suezmax tanker for $34.0 million.

•Declared a cash dividend of $0.25 per share for the quarter ended September 30, 2024.

Hamilton, Bermuda, October 30, 2024 - Teekay Tankers Ltd. (Teekay Tankers or the Company) (NYSE: TNK) today reported the Company's results for the quarter ended September 30, 2024:

Consolidated Financial Summary

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| (in thousands of U.S. dollars, except per share data) | September 30,

2024 | June 30,

2024 | September 30,

2023 | | | |

| (unaudited) | (unaudited) | (unaudited) | | | |

| GAAP FINANCIAL COMPARISON | | | | | | | | | | | |

| Total revenues | 243,278 | | | 296,590 | | | 285,858 | | | | | | | |

| Income from operations | 52,465 | | | 102,135 | | | 81,575 | | | | | | | |

| Net income | 58,815 | | | 106,970 | | | 81,366 | | | | | | | |

| Earnings per share - basic | 1.70 | | | 3.11 | | | 2.38 | | | | | | | |

| | | | | | | | | | | |

| NON-GAAP FINANCIAL COMPARISON | | | | | | | | | | |

Adjusted EBITDA (1) | 75,876 | | | 124,481 | | | 106,084 | | | | | | | |

Adjusted net income (1) | 63,542 | | | 106,970 | | | 76,611 | | | | | | | |

Adjusted earnings per share - basic (1) | 1.84 | | | 3.11 | | | 2.24 | | | | | | | |

Net cash (2) | 463,518 | | | 427,520 | | | 83,263 | | | | | | | |

(1) These are non-GAAP financial measures. Please refer to "Definitions and Non-GAAP Financial Measures" and the Appendices to this release for definitions of these terms and reconciliations of these non-GAAP financial measures as used in this release to the most directly comparable financial measures under United States generally accepted accounting principles (GAAP).

(2) Net cash is a non-GAAP financial measure and represents (a) cash and cash equivalents and restricted cash, less (b) short-term debt, current and long-term debt and current and long-term obligations related to finance leases.

1

Teekay Tankers Ltd. Investor Relations E-mail: TeekayTankers@IGBIR.com www.teekaytankers.com

2nd Floor, Swan Building, 26 Victoria Street, Hamilton, HM12, Bermuda

Third Quarter of 2024 Compared to Second Quarter of 2024

GAAP net income and non-GAAP adjusted net income for the third quarter of 2024 decreased compared to the second quarter of 2024, primarily due to lower average spot tanker rates, a higher number of scheduled dry dockings and the redelivery of two chartered-in vessels, partially offset by the acquisition of one vessel. In addition, GAAP net income in the third quarter of 2024 included restructuring charges of $6.0 million related to changes made to the Company's senior management team.

Third Quarter of 2024 Compared to Third Quarter of 2023

GAAP net income and non-GAAP adjusted net income for the third quarter of 2024 decreased compared to the same period of the prior year, primarily due to lower average spot tanker rates, the sale of two vessels during late 2023 and early 2024, a higher number of scheduled dry dockings, as well as the redelivery of two chartered-in vessels, partially offset by lower net interest expense and the acquisition of one vessel. In addition, GAAP net income in the third quarter of 2024 included restructuring charges of $6.0 million related to changes made to the Company's senior management team, while GAAP net income in the third quarter of 2023 included a $5.8 million reversal of income tax accruals.

CEO Commentary

“Teekay Tankers continued to generate strong earnings and free cash flow through the third quarter, as rates remained historically strong for what is typically the weakest quarter of the year,” commented Kenneth Hvid, Teekay Tankers’ President and Chief Executive Officer. “Tanker tonne-mile demand has remained firm, near-term fleet supply growth remains limited, and we are seeing several of the market’s seasonal headwinds already transitioning into tailwinds for the fourth quarter. With a large number of dry dockings completed within the third quarter and a fleet deployment strategy heavily weighted towards the spot market, we believe Teekay Tankers is well-positioned to benefit from the anticipated seasonal uplift.”

“Over the past few years, the Teekay Group has taken several important steps to streamline the organization, including the recent changes to our management team structure. With the planned accretive acquisition by Teekay Tankers of Teekay Australia -- the Group’s asset-light ship management operations primarily servicing the Australian Government that currently generates approximately $10 million in annual EBITDA -- Teekay Tankers becomes the sole operating platform within the Teekay Group. Teekay Tankers' strategy and convictions remain consistent, and we are optimistic about the operating environment and the value-creation prospects for our fleet of Suezmax and Aframax / LR2 vessels. We believe that our discipline in deploying capital and our focus on long-term shareholder value have been key to our ability to generate best-in-class shareholder returns in recent years, and we intend to maintain that strategy moving forward.”

Summary of Recent Events

In October 2024, the Company agreed to acquire Teekay Australia from Teekay for $65.0 million in cash. Teekay Australia provides crew management, technical management, asset management, and procurement services primarily to the Australian government, as well as to other oil and gas customers in Australia. The Company's Board of Directors' Conflicts Committee, comprised of independent directors, reviewed the financial valuation of Teekay Australia and obtained an independent fairness opinion from Deloitte LLP (Canada) in respect of the purchase price.

In addition, the Company agreed to acquire from Teekay all management service companies not currently owned by the Company for a purchase price equal to their net working capital value. Following the completion of these acquisitions, the Company will employ directly all of the employees supporting its businesses and be the sole operating platform within the Teekay Group. These transactions are subject to customary closing conditions and are expected to be completed by December 31, 2024.

In July 2024, a 2021-built Aframax tanker acquired by Teekay Tankers for $70.5 million was delivered. The previously-announced purchase was completed with cash, and the vessel is currently unencumbered.

In October 2024, the Company completed the previously announced sale of a 2005-built Suezmax vessel for $34.0 million. The gain on sale, which will be reflected in our fourth quarter results, was approximately $9.5 million. Additionally, a 2005-built Aframax tanker from a previously announced sale is expected to be delivered to the buyer during the first quarter of 2025.

In October 2024, the Company transferred its legal domicile by changing its jurisdiction of incorporation from the Republic of the Marshall Islands to Bermuda.

The Company's Board of Directors declared a fixed quarterly cash dividend in the amount of $0.25 per outstanding common share for the quarter ended September 30, 2024. This dividend is payable on November 22, 2024 to all of Teekay Tankers' shareholders of record on November 12, 2024.

Tanker Market

Mid-size crude tanker spot rates fell seasonally during the third quarter of 2024, but remained well above long-term average levels. Lower crude oil export volumes due to seasonal and various short-term factors led to reduced tanker tonne-mile demand through the summer, while the onset of autumn refinery maintenance also impacted demand towards the end of the quarter. However, crude tanker spot rates have firmed at the start of the fourth quarter of 2024, in line with seasonal norms, and we expect rates to remain well supported through the winter.

Seaborne crude oil trade flows declined by approximately 1 million barrels per day (mb/d) during the third quarter of 2024. OPEC+ supply cuts continued to weigh on volumes from the Middle East, compounded by reduced exports from Saudi Arabia as more oil was used domestically for power generation. Lower exports from the North Sea and Brazil due to offshore oilfield maintenance and lower volumes from the U.S. Gulf due to adverse weather and high domestic demand also weighed on crude tanker demand. Finally, volumes from Libya declined during September as a dispute between the two regional governments cut exports in half. However, most of these supply issues seem to be in the process of being resolved, and we expect a steady increase in seaborne crude oil trade volumes through the remainder of the year which, coupled with normal seasonal weather delays, should support crude tanker spot rates in the coming months.

Global oil demand is projected to grow by 1.2 mb/d in 2024 and 1.3 mb/d in 2025 as per the average of forecasts from the International Energy Agency (IEA), the U.S. Energy Information Administration (EIA) and OPEC. This is lower than last quarter’s forecast, primarily due to lower-than-expected Chinese oil demand. However, the Chinese government recently announced an economic stimulus package which could lead to a recovery in local oil demand and, therefore, increases in crude oil import volumes by China.

Oil supply from non-OPEC+ countries is projected to increase by 1.5 mb/d in both 2024 and 2025 as per the IEA, with the majority of growth led by the United States, Brazil, Guyana, and Canada. Export growth from Canada is being supported by the commencement in May 2024 of operations of the Trans Mountain Pipeline Expansion (TMX), which has averaged around 20 Aframax loadings per month, with volumes largely flowing to the U.S. West Coast and Asia. In addition to higher non-OPEC+ supply, volumes from the OPEC+ group could rise from December 2024 onwards as the group has announced plans to start unwinding 2.2 mb/d of voluntary production cuts over the course of the next 12 months, although the pace of the unwind will likely depend on future oil demand and price developments.

Geopolitical events continue to shape crude oil trade flows, particularly in the Middle East where ongoing attacks on shipping in the Red Sea region are causing a large number of tankers, particularly in the product sector, to divert around the Cape of Good Hope, thereby adding to voyage distances and boosting tanker tonne-mile demand. Recent events in the Middle East have the potential to further destabilize the region, which could impact oil production and shipping should they escalate. The full effects of any such disruption are uncertain, but they have the potential to further add to tanker market volatility in the near term.

2024 remains on track to be one of the lowest years for new tanker deliveries in recent history, with just 5.3 million deadweight tons (mdwt) delivered during the first nine months of the year. Deliveries are set to increase in 2025 and 2026 due to new vessel orders placed over the past 18-24 months; however, at just under 13% of the existing fleet, the global orderbook is still well below the long-term average of around 20%. Furthermore, forward orderbook cover at the major shipyards currently stretches three years or more with a lack of available shipyard capacity until the second half of 2027. In addition, the global tanker fleet continues to get older, with the average age of the tanker fleet currently at its highest level since 2002. We believe the combination of a modest orderbook, limited shipyard capacity, and an aging fleet should ensure that tanker fleet growth remains at relatively low levels over the next two to three years.

In sum, the Company expects a period of firm tanker rates in the coming months due to an anticipated rebound in global seaborne crude oil trade volumes and normal seasonality through the winter. We believe that the medium-term outlook continues to look positive due to supportive tanker demand and supply fundamentals, with geopolitical events adding a further layer of volatility.

Operating Results

The following table highlights the operating performance of the Company’s time-charter vessels and spot vessels trading in revenue sharing arrangements (RSAs), on voyage charters and in full service lightering, in each case measured in net revenues(1) per revenue day(2), or time-charter equivalent (TCE) rates, before off-hire bunker expenses:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | |

| September 30, 2024 | June 30, 2024 | September 30, 2023 | | | |

| Time Charter-Out Fleet | | | | | | | | | | | |

Suezmax revenue days | 92 | | 91 | | 92 | | | | | | |

| Suezmax TCE per revenue day | $37,513 | | $37,513 | | $37,513 | | | | | | |

Aframax / LR2 revenue days | 92 | | 30 | | 92 | | | | | | |

| Aframax / LR2 TCE per revenue day | $49,123 | | $49,124 | | $47,288 | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | |

| Spot Fleet | | | | | | | | | | | |

Suezmax revenue days | 2,103 | | 2,163 | | 2,251 | | | | | | |

Suezmax spot TCE per revenue day (3) | $31,024 | | $44,898 | | $34,954 | | | | | | |

Aframax / LR2 revenue days | 2,058 | | 2,082 | | 2,256 | | | | | | |

Aframax / LR2 spot TCE per revenue day (4) | $35,876 | | $43,590 | | $36,579 | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | |

| Total Fleet | | | | | | | | | | | |

Suezmax revenue days | 2,195 | | 2,254 | | 2,343 | | | | | | |

| Suezmax TCE per revenue day | $31,300 | | $44,600 | | $35,055 | | | | | | |

Aframax / LR2 revenue days | 2,150 | | 2,112 | | 2,348 | | | | | | |

| Aframax / LR2 TCE per revenue day | $36,443 | | $43,668 | | $36,999 | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1) Net revenues is a non-GAAP financial measure. Please refer to "Definitions and Non-GAAP Financial Measures" for a definition of this term and Appendix C to this release for a reconciliation of this non-GAAP financial measure as used in this release to the most directly comparable financial measure under GAAP.

(2) Revenue days are the total number of calendar days the Company's vessels were in its possession during a period, less the total number of off-hire days during the period associated with major repairs or modifications, dry dockings or special or intermediate surveys. Consequently, revenue days represent the total number of days available for the vessel to earn revenue. Idle days, which are days when the vessel is available to earn revenue but is not employed, are included in revenue days.

(3) Includes Suezmax vessels trading in the Teekay Suezmax RSA and non-RSA voyage charters.

(4) Includes Aframax and LR2 vessels trading in the Teekay Aframax RSA and non-RSA voyage charters.

Fourth Quarter of 2024 Spot Tanker Performance Update

The following table presents Teekay Tankers’ TCE rates booked to-date in the fourth quarter of 2024 for its spot-traded fleet only, together with the percentage of total revenue days currently fixed for the fourth quarter:

| | | | | | | | |

| Fourth Quarter 2024 To-Date Spot Tanker Rates |

| TCE Rates Per Day | % Fixed |

| Suezmax | $29,700 | 45% |

Aframax / LR2 (1) | $35,500 | 37% |

(1) Rates and percentage booked to date include Aframax RSA and non-RSA voyage charters and full service lightering for all Aframax and LR2 vessels, whether trading in the clean or dirty spot market.

Teekay Tankers Fleet

The following table summarizes the Company’s fleet as of October 28, 2024:

| | | | | | | | | | | |

| Owned

Vessels | Chartered-in Vessels | Total |

| Fixed-rate: | | | |

Suezmax Tanker(1) | — | 1 | 1 |

| Aframax Tanker / LR2 Product Tanker | 1 | — | 1 |

| | | |

| Total Fixed-Rate Fleet | 1 | 1 | 2 |

| Spot-rate: | | | |

| Suezmax Tankers | 24 | — | 24 |

Aframax Tankers / LR2 Product Tankers(2)(3) | 17 | 5 | 22 |

| | | |

VLCC Tanker(4) | 1 | — | 1 |

| Total Spot Fleet | 42 | 5 | 47 |

| Total Tanker Fleet | 43 | 6 | 49 |

| STS Support Vessels | — | 2 | 2 |

| Total Teekay Tankers Fleet | 43 | 8 | 51 |

(1) Includes one Suezmax tanker with a charter-in contract that is scheduled to expire in June 2027 with an option to extend for one additional year.

(2) Includes five Aframax / LR2 tankers with charter-in contracts that are scheduled to expire in November 2024, March 2025, August 2025, February 2026, and January 2030, three of which have options to extend for one additional year, and one of which has options to extend for up to three years.

(3) Includes one Aframax / LR2 tanker that is classified as held for sale as at September 30, 2024 and is expected to be delivered to its purchaser between the fourth quarter of 2024 and first quarter of 2025.

(4) The Company’s ownership interest in this vessel is 50 percent.

Liquidity Update

As at September 30, 2024, the Company had total liquidity of $750.8 million (comprised of $462.9 million in cash and cash equivalents and $287.9 million in undrawn capacity from its credit facility), compared to total liquidity of $714.7 million as at June 30, 2024. The increase of $36.1 million in liquidity compared to the prior quarter is primarily due to positive net operating cash flow, partially offset by the purchase of an Aframax tanker and cash dividends paid on our common shares.

Conference Call

Teekay and Teekay Tankers (collectively, the Teekay Group) plan to host a conference call on Thursday, October 31, 2024 at 11:00 a.m. (ET) to discuss the Teekay Group's results for the third quarter of 2024. All shareholders and interested parties are invited to listen to the live conference call by choosing from the following options:

•By dialing 1(800) 239-9838 or 1(647) 794-4605, if outside of North America, and quoting conference ID code 6243411.

•By accessing the webcast, which will be available on Teekay Tankers’ website at www.teekay.com (the archive will remain on the website for a period of one year).

An accompanying Teekay Group Third Quarter of 2024 Earnings Presentation will also be available at www.teekay.com in advance of the conference call start time.

About Teekay Tankers

Teekay Tankers has a fleet of 42 double-hull tankers (including 24 Suezmax tankers and 18 Aframax / LR2 tankers), and also has six time chartered-in tankers. Teekay Tankers’ vessels are typically employed through a mix of spot tanker market trading and short- or medium-term fixed-rate time charter contracts. Teekay Tankers also owns a Very Large Crude Carrier (VLCC) through a 50 percent-owned joint venture. In addition, Teekay Tankers owns a ship-to-ship transfer business that performs full service lightering and lightering support operations in the U.S. Gulf and Caribbean. Teekay Tankers was formed in December 2007 by Teekay Corporation Ltd. as part of its strategy to expand its oil tanker business.

Teekay Tankers’ Class A common shares trade on the New York Stock Exchange under the symbol “TNK.”

For Investor Relations enquiries contact:

E-mail: TeekayTankers@IGBIR.com

Definitions and Non-GAAP Financial Measures

This release includes various financial measures that are non-GAAP financial measures as defined under the rules of the Securities and Exchange Commission (SEC). These non-GAAP financial measures, which include Adjusted Net Income, Adjusted EBITDA, and Net Revenues, are intended to provide additional information and should not be considered substitutes for measures of performance prepared in accordance with GAAP. In addition, these measures do not have standardized definitions across companies, and therefore may not be comparable to similar measures presented by other companies. These non-GAAP measures are used by management, and the Company believes that these supplemental metrics assist investors and other users of its financial reports in comparing financial and operating performance of the Company across reporting periods and with other companies.

Non-GAAP Financial Measures

Adjusted net income excludes certain items of income or loss from GAAP net income that are typically excluded by securities analysts in their published estimates of the Company’s financial results. The Company believes that certain investors use this information to evaluate the Company’s financial performance, as does management. Please refer to Appendix A of this release for a reconciliation of this non-GAAP financial measure to net income, the most directly comparable GAAP measure reflected in the Company’s consolidated financial statements.

Adjusted EBITDA represents EBITDA (i.e. net income before interest, taxes, and depreciation and amortization) adjusted to exclude certain items whose timing or amount cannot be reasonably estimated in advance or that are not considered representative of core operating performance. Such adjustments include foreign exchange gains and losses, write-downs of assets, gains and losses on sale of assets, unrealized credit loss adjustments, unrealized gains and losses on derivative instruments, realized gains or losses on derivative instruments resulting from amendments or terminations of the underlying instruments, equity income or loss from unconsolidated joint ventures and any write-offs and certain other income or expenses. Adjusted EBITDA also excludes realized gains or losses on interest rate swaps (as management, in assessing the Company's performance, views these gains or losses as an element of interest expense). Adjusted EBITDA is a non-GAAP financial measure used by certain investors and management to measure the operational performance of companies. Please refer to Appendix B of this release for a reconciliation of Adjusted EBITDA to net income, the most directly comparable GAAP measure reflected in the Company’s consolidated financial statements.

Net revenues represents income from operations before vessel operating expenses, time-charter hire expenses, depreciation and amortization, general and administrative expenses, gain or loss on sale and write-down of assets, and restructuring charges. Since the amount of voyage expenses the Company incurs for a particular charter depends on the type of the charter, the Company includes these costs in net revenues to improve the comparability between periods of reported revenues that are generated by the different types of charters and contracts. The Company principally uses net revenues, a non-GAAP financial measure, because the Company believes it provides more meaningful information about the deployment of the Company's vessels and their performance than does income from operations, the most directly comparable financial measure under GAAP. Please refer to Appendix C of this release for a reconciliation of this non-GAAP financial measure to income from operations, the most directly comparable GAAP measure reflected in the Company’s consolidated financial statements.

Teekay Tankers Ltd.

Summary Consolidated Statements of Income

(in thousands of U.S. dollars, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | June 30, | September 30, | | September 30, | September 30, | |

| | 2024 | 2024 | 2023 | | 2024 | 2023 | |

| | (unaudited) | (unaudited) | (unaudited) | | (unaudited) | (unaudited) | |

| | | | | | | | |

Voyage charter revenues (1) | 231,665 | | 287,974 | | 274,774 | | | 848,580 | | 1,019,484 | | |

| Time-charter revenues | 8,184 | | 5,048 | | 8,119 | | | 18,355 | | 23,124 | | |

Other revenues (2) | 3,429 | | 3,568 | | 2,965 | | | 11,276 | | 8,553 | | |

| Total revenues | 243,278 | | 296,590 | | 285,858 | | | 878,211 | | 1,051,161 | | |

| | | | | | | | | |

Voyage expenses (1) | (93,984) | | (100,097) | | (113,274) | | | (310,612) | | (355,543) | | |

| Vessel operating expenses | (38,091) | | (38,356) | | (36,366) | | | (113,942) | | (112,348) | | |

| Time-charter hire expenses | (18,465) | | (19,670) | | (19,378) | | | (57,651) | | (51,014) | | |

| Depreciation and amortization | (23,445) | | (22,373) | | (24,565) | | | (69,136) | | (72,924) | | |

| General and administrative expenses | (10,876) | | (13,959) | | (10,700) | | | (38,678) | | (35,087) | | |

Gain on sale of vessel (3) | — | | — | | — | | | 11,601 | | — | | |

| Restructuring charges | (5,952) | | — | | — | | | (5,952) | | (1,248) | | |

| Income from operations | 52,465 | | 102,135 | | 81,575 | | | 293,841 | | 422,997 | | |

| | | | | | | | |

| Interest expense | (825) | | (979) | | (6,440) | | | (6,670) | | (23,565) | | |

| Interest income | 5,772 | | 5,726 | | 3,119 | | | 16,972 | | 7,120 | | |

Realized and unrealized gain

on derivative instruments | — | | — | | — | | | — | | 449 | | |

Equity (loss) income (4) | (121) | | 905 | | 666 | | | 2,152 | | 2,916 | | |

| Other income (expense) | 942 | | 1,465 | | (82) | | | 1,628 | | (65) | | |

| Net income before income tax | 58,233 | | 109,252 | | 78,838 | | | 307,923 | | 409,852 | | |

| | | | | | | |

| Income tax recovery (expense) | 582 | | (2,282) | | 2,528 | | | 2,633 | | (7,875) | | |

| Net income | 58,815 | | 106,970 | | 81,366 | | | 310,556 | | 401,977 | | |

| | | | | | | | |

| Earnings per share attributable | | | | | | | |

| | to shareholders of Teekay Tankers | | | | | | | |

| | - Basic | 1.70 | | 3.11 | | 2.38 | | | 9.03 | | 11.77 | | |

| | - Diluted | 1.69 | | 3.08 | | 2.35 | | | 8.95 | | 11.63 | | |

| - Cash dividends declared | 0.25 | | 2.25 | | 0.25 | | | 2.75 | | 1.50 | | |

| | | | | | | | | |

| | | | | | | | |

| Weighted-average number of total common | | | | | | |

| | shares outstanding | | | | | | | |

| | - Basic (5) | 34,496,757 | | 34,383,813 | | 34,201,415 | | | 34,381,247 | | 34,145,219 | | |

| | - Diluted | 34,765,008 | | 34,705,613 | | 34,571,439 | | | 34,706,817 | | 34,552,933 | | |

| | | | | | | | |

| Number of outstanding common shares | | | | | | |

| at the end of the period | 34,356,257 | | 34,317,589 | | 34,079,721 | | | 34,356,257 | | 34,079,721 | | |

(1)Voyage charter revenues include revenues earned from full service lightering activities. Voyage expenses include certain costs associated with full service lightering activities, which include: short-term in-charter expenses, bunker fuel expenses and other port expenses totaling $1.8 million, $7.2 million and $9.0 million for the three months ended September 30, 2024, June 30, 2024 and September 30, 2023, respectively, and $16.1 million and $34.3 million for the nine months ended September 30, 2024 and September 30, 2023, respectively.

(2)Other revenues include lightering support revenue, revenue earned from the Company's responsibilities in employing the vessels subject to the RSAs, and bunker commissions earned.

(3)Gain on sale of vessel for the nine months ended September 30, 2024 includes a gain of $11.6 million relating to one Aframax / LR2 tanker, which was sold in February 2024.

(4)Equity income relates to the Company’s 50 percent interest in the High-Q Investments Ltd. joint venture, which owns one VLCC tanker.

(5)Includes common shares related to non-forfeitable stock-based compensation.

Teekay Tankers Ltd.

Summary Consolidated Balance Sheets

(in thousands of U.S. dollars)

| | | | | | | | | | | | | | | | | | | | |

| As at | As at | As at |

| September 30, | June 30, | December 31, |

| 2024 | 2024 | 2023 |

| (unaudited) | (unaudited) | (unaudited) |

| ASSETS | | | | | | |

| Cash and cash equivalents | 462,851 | | 426,841 | | 365,251 | |

| Restricted cash | 667 | | 679 | | 691 | |

| Accounts receivable | 79,576 | | 95,209 | | 99,940 | |

| Bunker and lube oil inventory | 45,440 | | 49,760 | | 53,219 | |

| Prepaid expenses | 10,000 | | 13,007 | | 12,332 | |

| Accrued revenue and other current assets | 51,385 | | 67,082 | | 70,156 | |

Assets held for sale (1) | 37,239 | | 36,446 | | 11,910 | |

| Total current assets | 687,158 | | 689,024 | | 613,499 | |

| | | | | | |

| Vessels and equipment – net | 1,151,862 | | 1,090,899 | | 929,237 | |

| Vessels related to finance leases – net | — | | — | | 228,973 | |

| Operating lease right-of-use assets | 53,999 | | 63,704 | | 76,314 | |

| Investment in and advances to equity-accounted joint venture | 15,382 | | 18,004 | | 15,731 | |

| Other non-current assets | 5,037 | | 12,616 | | 6,656 | |

| Intangible assets – net | 390 | | 3,918 | | 658 | |

| Goodwill | 2,426 | | 2,426 | | 2,426 | |

| Total assets | 1,916,254 | | 1,880,591 | | 1,873,494 | |

| | | | | | |

| LIABILITIES AND EQUITY | | | | | | |

| Accounts payable and accrued liabilities | 66,286 | | 67,659 | | 73,587 | |

| | | | | | |

| | | | | | |

| | | | | | |

| Current obligations related to finance leases | — | | — | | 20,517 | |

| Current portion of operating lease liabilities | 27,646 | | 32,747 | | 35,882 | |

| | | | | | |

| Due to affiliates | 2,886 | | 1,278 | | 5,013 | |

| Other current liabilities | 4,275 | | 3,914 | | 4,289 | |

| Total current liabilities | 101,093 | | 105,598 | | 139,288 | |

| | | | | | |

| Long-term obligations related to finance leases | — | | — | | 119,082 | |

| Long-term operating lease liabilities | 26,354 | | 30,957 | | 40,432 | |

| Other long-term liabilities | 43,869 | | 48,093 | | 48,907 | |

| Equity | 1,744,938 | | 1,695,943 | | 1,525,785 | |

| Total liabilities and equity | 1,916,254 | | 1,880,591 | | 1,873,494 | |

| | | | | | |

Net cash (2) | 463,518 | | 427,520 | | 226,343 | |

(1)Assets held for sale at September 30, 2024 and June 30, 2024 include one Suezmax tanker and one Aframax / LR2 tanker. Assets held for sale at December 31, 2023, includes one Aframax / LR2 tanker, which was sold in February 2024 for gross proceeds of $23.5 million.

(2)Net cash is a non-GAAP financial measure and represents (a) cash and cash equivalents and restricted cash, less (b) short-term debt, current and long-term debt and current and long-term obligations related to finance leases.

Teekay Tankers Ltd.

Summary Consolidated Statements of Cash Flows

(in thousands of U.S. dollars)

| | | | | | | | | | | | | | | | | |

| | Nine Months Ended |

| | September 30, | September 30, |

| | 2024 | 2023 |

| | (unaudited) | (unaudited) |

| Cash, cash equivalents and restricted cash provided by (used for) | | | | |

| OPERATING ACTIVITIES | | | | |

| Net income | 310,556 | | | 401,977 | | |

| Non-cash items: | | | | |

| Depreciation and amortization | 69,136 | | | 72,924 | | |

| Gain on sale of vessel | (11,601) | | | — | | |

| Unrealized loss on derivative instruments | — | | | 3,709 | | |

| Equity income | (2,152) | | | (2,916) | | |

| Income tax (recovery) expense | (3,452) | | | 6,566 | | |

| Other | 9,647 | | | 4,013 | | |

| Change in operating assets and liabilities | 31,843 | | | 13,651 | | |

| Expenditures for dry docking | (19,633) | | | (6,209) | | |

| Net operating cash flow | 384,344 | | | 493,715 | | |

| | | | |

| FINANCING ACTIVITIES | | | | |

| Proceeds from short-term debt | — | | | 50,000 | | |

| Prepayments of short-term debt | — | | | (50,000) | | |

| Proceeds from long-term debt | — | | | 1,000 | | |

| Issuance costs related to long-term debt | — | | | (4,536) | | |

| | | | |

| Prepayments of long-term debt | — | | | (1,000) | | |

| | | | |

| Scheduled repayments of obligations related to finance leases | (5,213) | | | (28,900) | | |

| Prepayment of obligations related to finance leases | (136,955) | | | (364,201) | | |

| Issuance of common shares upon exercise of stock options | 2,858 | | | — | | |

| | | | |

| Cash dividends paid | (94,230) | | | (50,995) | | |

| Other | (4,103) | | | (2,386) | | |

| Net financing cash flow | (237,643) | | | (451,018) | | |

| | | | |

| INVESTING ACTIVITIES | | | | |

| Proceeds from sale of vessel | 23,425 | | | — | | |

| Expenditures for vessels and equipment | (4,546) | | | (5,975) | | |

| | | | |

| Loan repayments from equity-accounted joint venture | 2,500 | | | 3,900 | | |

| Vessel acquisition | (70,504) | | | — | | |

| Net investing cash flow | (49,125) | | | (2,075) | | |

| | | | |

| Increase in cash, cash equivalents and restricted cash | 97,576 | | | 40,622 | | |

| Cash, cash equivalents and restricted cash, beginning of the period | 365,942 | | | 187,361 | | |

| Cash, cash equivalents and restricted cash, end of the period | 463,518 | | | 227,983 | | |

Teekay Tankers Ltd.

Appendix A - Reconciliation of Non-GAAP Financial Measures

Adjusted Net Income

(in thousands of U.S. dollars, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | September 30,

2024 | June 30,

2024 | September 30,

2023 |

| | | (unaudited) | (unaudited) | (unaudited) |

| | | $ | $ Per Share(1) | $ | $ Per Share(1) | $ | $ Per Share(1) |

| Net income - GAAP basis | 58,815 | | | $1.70 | | | 106,970 | | | $3.11 | | | 81,366 | | | $2.38 | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Add (subtract) specific items affecting net income: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Restructuring charges (2) | | 5,952 | | | $0.17 | | | — | | | — | | | — | | | — | | |

| | | | | | | | | | | | | |

| | Other (3) | (1,225) | | | ($0.03) | | | — | | | — | | | (4,755) | | | ($0.14) | | |

| Total adjustments | 4,727 | | | $0.14 | | | — | | | — | | | (4,755) | | | ($0.14) | | |

| Adjusted net income attributable to | | | | | | | | | | | | |

| | shareholders of Teekay Tankers | 63,542 | | | $1.84 | | | 106,970 | | | $3.11 | | | 76,611 | | | $2.24 | | |

(1)Basic per share amounts.

(2)The amount recorded for the three months ended September 31, 2024, relates to changes made to the Company's senior management team.

(3)The amount recorded for the three months ended September 31, 2024, primarily relates to a recovery related to the settlement of a prior year claim. The amount recorded for the three months ended September 30, 2023, primarily relates to adjustments to income tax accruals of prior years.

Teekay Tankers Ltd.

Appendix B - Reconciliation of Non-GAAP Financial Measures

Total Adjusted EBITDA

(in thousands of U.S. dollars)

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30,

2024 | June 30,

2024 | September 30,

2023 |

| (unaudited) | (unaudited) | (unaudited) |

| Net income - GAAP basis | 58,815 | | | 106,970 | | | 81,366 | | |

| Depreciation and amortization | 23,445 | | | 22,373 | | | 24,565 | | |

| Net interest (income) expense | (4,947) | | | (4,747) | | | 3,321 | | |

| Income tax (recovery) expense | (582) | | | 2,282 | | | (2,528) | | |

| EBITDA | 76,731 | | | 126,878 | | | 106,724 | | |

| | | | | | |

| Add (subtract) specific items affecting EBITDA: | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Equity loss (income) | 121 | | | (905) | | | (666) | | |

Other (1) | (976) | | | (1,492) | | | 26 | | |

| Adjusted EBITDA | 75,876 | | | 124,481 | | | 106,084 | | |

(1) The amount recorded for the three months ended September 30, 2024, primarily relates to a recovery related to the settlement of a claim and foreign exchange losses. The amount recorded for the three months ended June 30, 2024, primarily relates to foreign exchange gains and a recovery related to the settlement of a claim. The amount recorded for the three months ended September 30, 2023, primarily relates to the premium paid as part of the exercise of early purchase options in relation to the repurchase of four sale-leaseback vessels and foreign exchange gains.

Teekay Tankers Ltd.

Appendix C - Reconciliation of Non-GAAP Financial Measures

Net Revenues

(in thousands of U.S. dollars)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | |

| | September 30, 2024 | June 30,

2024 | September 30, 2023 |

| | (unaudited) | (unaudited) | (unaudited) |

| Income from operations - GAAP basis | 52,465 | | | 102,135 | | | 81,575 | | |

| | | | | | | |

| Add specific items affecting income from operations: | | | | |

| Vessel operating expenses | 38,091 | | | 38,356 | | | 36,366 | | |

| Time-charter hire expenses | 18,465 | | | 19,670 | | | 19,378 | | |

| Depreciation and amortization | 23,445 | | | 22,373 | | | 24,565 | | |

| General and administrative expenses | 10,876 | | | 13,959 | | | 10,700 | | |

| | | | | | | |

| Restructuring charges | 5,952 | | | — | | | — | | |

| Total adjustments | 96,829 | | | 94,358 | | | 91,009 | | |

| Net revenues | 149,294 | | | 196,493 | | | 172,584 | | |

Forward-Looking Statements

This release contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. All statements included in this release, other than statements of historical fact, are forward-looking statements. When used in this release, the words "expect", "believe", "anticipate", "plan", "intend", "estimate", "may", "will" or similar words are intended to identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements and any such forward-looking statements are qualified in their entirety by reference to the following cautionary statements. All forward-looking statements speak only as of the date hereof and are based on current expectations and involve a number of assumptions, risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. Forward-looking statements contained in this release include, among others, statements regarding: our expectations regarding vessel sales, including the occurrence and timing of vessel delivery; the occurrence and timing of the completion of the acquisition of Teekay Australia and certain management services companies by the Company from Teekay, and the impacts of these transactions on the Company; the timing of payments of cash dividends; any future dividends; geopolitical events and the impact thereof on the industry, the Company's business and on the tanker rate environment; management's view of the tanker operating environment, the strength of the tanker market and of the tanker rate environment, and related effects on the Company and its operations; crude oil and refined product tanker market fundamentals; forecasts of worldwide tanker fleet growth or contraction, vessel scrapping levels, and newbuilding tanker orders; and the Company's liquidity and market position.

The following factors are among those that could cause actual results to differ materially from the forward-looking statements, which involve risks and uncertainties, and that should be considered in evaluating any such statement: potential changes to or termination of the Company's capital allocation plan or dividend policy; the declaration by the Company's Board of Directors of any future cash dividends on the Company's common shares; the Company's available cash and the levels of its capital needs; changes in the Company's liquidity and financial leverage; the Company and Teekay's ability to satisfy the customary closing conditions related to the sale and purchase of Teekay Australia and management services companies, and changes in the annual EBITDA levels of Teekay Australia; changes in tanker rates, including spot tanker market rate fluctuations, and in oil prices; changes in the production of, or demand for, oil or refined products and for tankers; changes in trading patterns affecting overall vessel tonnage requirements; non-OPEC+ and OPEC+ production and supply levels; the impact of geopolitical tensions and conflicts, and changes in global economic conditions; greater or less than anticipated levels of tanker newbuilding orders and deliveries and greater or less than anticipated rates of tanker scrapping; the potential for early termination of charter contracts on existing vessels in the Company's fleet; the inability of charterers to make future charter payments; delays of vessel deliveries; changes in applicable industry laws and regulations and the timing of implementation of new laws and regulations and the impact of such changes; increased costs; and other factors discussed in Teekay Tankers’ filings from time to time with the United States Securities and Exchange Commission, including its Annual Report on Form 20-F for the fiscal year ended December 31, 2023. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with respect thereto or any change in events, conditions or circumstances on which any such statement is based.

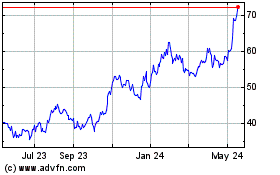

Teekay Tankers (NYSE:TNK)

Historical Stock Chart

From Nov 2024 to Dec 2024

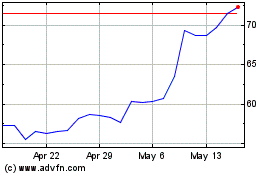

Teekay Tankers (NYSE:TNK)

Historical Stock Chart

From Dec 2023 to Dec 2024