Form 8-K - Current report

June 14 2024 - 3:06PM

Edgar (US Regulatory)

False000139305201-3100013930522024-06-122024-06-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________________________________________________________________

FORM 8-K

_____________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 12, 2024

_____________________________________________________________________________

Veeva Systems Inc.

(Exact name of registrant as specified in its charter)

_____________________________________________________________________________

| | | | | | | | | | | | | | |

| Delaware | 001-36121 | 20-8235463 | |

| (State or other jurisdiction

of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | |

4280 Hacienda Drive

Pleasanton, California 94588

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (925) 452-6500

Not Applicable

(Former name or former address, if changed since last report)

_____________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Class A Common Stock,

par value $0.00001 per share | | VEEV | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging growth company | | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ☐

|

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Veeva Systems Inc. (“Veeva”) filed its Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”), which was approved by its shareholders on June 12, 2024 at the Annual Meeting of Shareholders (the “Annual Meeting”), with the Delaware Secretary of State effective June 14, 2024. A description of the changes to the Certificate of Incorporation is contained in Appendix A of the definitive proxy statement on Schedule 14A filed with the U.S. Securities and Exchange Commission on April 23, 2024 (the “2024 Proxy Statement”), which Appendix A is incorporated herein by reference. The changes relate to an added provision exculpating certain of Veeva’s officers from liability in specific circumstances, as permitted by Delaware law. The description above is qualified in its entirety by reference to the full text of the Certificate of Incorporation, which is attached as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated into this Item 5.03 by reference.

Item 5.07. Submission of Matters to a Vote of Security Holders.

On June 12, 2024 at its Annual Meeting, Veeva’s shareholders voted on four proposals, each of which is described in more detail in the 2024 Proxy Statement.

Only shareholders of record as of the close of business on April 15, 2024 (the “Record Date”) were entitled to vote at the Annual Meeting. As of the Record Date, 161,613,941 shares of Veeva’s Class A common stock (“Common Stock”) were outstanding and entitled to vote at the Annual Meeting. In deciding all matters at the Annual Meeting, each holder of Common Stock was entitled to one vote for each share of Common Stock held as of the close of business on the Record Date.

The matters voted on at the Annual Meeting and the voting results with respect to each such matter are set forth below.

Proposal 1: The vote for each director nominee is set forth in the table below:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| NAME | | FOR | | AGAINST | | ABSTAIN | | BROKER

NON-VOTES |

| Tim Cabral | | 133,388,513 | | 1,829,864 | | 89,646 | | 12,349,219 |

Mark Carges | | 133,905,682 | | 1,257,595 | | 144,746 | | 12,349,219 |

Peter P. Gassner | | 134,241,233 | | 984,530 | | 82,260 | | 12,349,219 |

Mary Lynne Hedley | | 120,339,201 | | 14,776,481 | | 192,341 | | 12,349,219 |

| Priscilla Hung | | 132,180,559 | | 2,975,504 | | 151,960 | | 12,349,219 |

| Tina Hunt | | 133,691,780 | | 1,468,299 | | 147,944 | | 12,349,219 |

| Marshall Mohr | | 124,140,519 | | 11,015,235 | | 152,269 | | 12,349,219 |

Gordon Ritter | | 129,788,756 | | 5,426,496 | | 92,771 | | 12,349,219 |

Paul Sekhri | | 66,050,424 | | 69,136,450 | | 121,149 | | 12,349,219 |

Matthew J. Wallach | | 89,231,772 | | 45,992,862 | | 83,389 | | 12,349,219 |

Each of the director nominees named above, except for Mr. Sekhri, were elected to serve as directors until the 2025 annual meeting of shareholders or until his or her successor is duly elected and qualified.

In accordance with Veeva’s Corporate Governance Guidelines (the “Guidelines”), Mr. Sekhri tendered his conditional resignation as a director for consideration by the Nominating and Governance Committee (the “Committee”) of the Board of Directors of Veeva (the “Board”) and for the ultimate decision of the Board. The disinterested members of the Committee recommended, after due consideration, that the Board should not accept Mr. Sekhri’s tendered resignation. The Board will consider the resignation offer and make a determination as to whether to accept or reject the tendered resignation, in each case with Mr. Sekhri recusing himself from participating in the decision. Promptly thereafter, Veeva will publicly disclose the Board’s decision regarding the tendered resignation. Pursuant to Delaware law, Mr. Sekhri will continue to serve as a director pending the Board’s determination with respect to his conditional resignation.

Proposal 2: The appointment of KPMG LLP as Veeva’s independent registered public accounting firm for the fiscal year ending January 31, 2025 was ratified by the shareholders based on the following results of voting:

| | | | | | | | | | | | | | |

| FOR | | AGAINST | | ABSTAIN |

| 146,206,639 | | 1,354,375 | | 96,228 |

Proposal 3: The proposal to amend and restate Veeva’s Certificate of Incorporation to reflect Delaware law provisions regarding officer exculpation, to take effect immediately, was approved by the affirmative vote of a majority of the voting power of Veeva’s capital stock:

| | | | | | | | | | | | | | | | | | | | |

| FOR | | AGAINST | | ABSTAIN | | BROKER

NON-VOTES |

| 121,286,984 | | 13,920,955 | | 100,084 | | 12,349,219 |

Proposal 4: The named executive officer compensation was approved by the shareholders on an advisory basis based on the following results of voting:

| | | | | | | | | | | | | | | | | | | | |

| FOR | | AGAINST | | ABSTAIN | | BROKER

NON-VOTES |

| 123,209,618 | | 12,000,479 | | 97,926 | | 12,349,219 |

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 3.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Veeva Systems Inc. |

| |

| By: | /s/ Josh Faddis |

| | Josh Faddis |

| | Senior Vice President, General Counsel |

| | |

Dated: June 14, 2024 | | |

-1- AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF VEEVA SYSTEMS INC. (A PUBLIC BENEFIT CORPORATION) Veeva Systems Inc., a public benefit corporation organized and existing under the laws of the State of Delaware, hereby certifies as follows: 1. The corporation was originally incorporated under the name of Rags2Riches, Inc., and the original certificate of incorporation was filed with the Secretary of State of the State of Delaware on January 12, 2007. 2. This Amended and Restated Certificate of Incorporation was duly adopted in accordance with Sections 242 and 245 of the DGCL, and restates, integrates and further amends the provisions of the corporation’s certificate of incorporation. 3. The certificate of incorporation of the corporation is hereby amended and restated in its entirety to read as follows: FIRST: The name of the corporation is Veeva Systems Inc. (hereinafter called the “Corporation”). SECOND: The address of the registered office of the Corporation in the State of Delaware is 251 Little Falls Drive in the City of Wilmington, County of New Castle, 19808. The name of the registered agent of the Corporation in the State of Delaware at such address is Corporation Service Company. THIRD: The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized and incorporated under the General Corporation Law of the State of Delaware or any applicable successor act thereto, as the same may be amended from time to time (the “DGCL”). The Corporation shall be a public benefit corporation, as contemplated by subchapter XV of the DGCL, and is to be managed in a manner that balances our stockholders’ pecuniary (financial) interests, the best interests of those materially affected by the corporation’s conduct (including customers, employees, partners, and the communities in which we operate), and the public benefits identified in this certificate of incorporation. We believe this corporate structure reflects our guiding principle, “do the right thing.” The specific public benefits to be promoted by the Corporation are to provide products and services that are intended to help make the industries we serve more productive, and to create high-quality employment opportunities in the communities in which we operate. FOURTH: The total number of shares of all classes of capital stock that the Corporation is authorized to issue is 810,000,000 shares, consisting of 800,000,000 shares of Class A Common Stock, par value $0.00001 per share (“Class A Common Stock” or “Common Stock”) and 10,000,000 shares of Preferred Stock, par value $0.00001 per share (“Preferred Stock”).

-2- Subject to the rights of the holders of any series of Preferred Stock, the number of authorized shares of the Common Stock or Preferred Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority in voting power of the capital stock of the Corporation entitled to vote thereon irrespective of the provisions of Section 242(b)(2) of the DGCL, and no vote of the holders of the Common Stock or Preferred Stock voting separately as a class shall be required therefor. A. Class A Common Stock. The powers, preferences and relative participating, optional or other special rights, and the qualifications, limitations and restrictions of the Class A Common Stock are as follows: 1. Ranking The voting, dividend and liquidation rights of the holders of the Common Stock are subject to and qualified by the rights of the holders of the Preferred Stock of any series as may be designated by the Board of Directors of the Corporation (the “Board”) upon any issuance of the Preferred Stock of any series. 2. Voting. (a) Except as otherwise expressly provided by this Amended and Restated Certificate of Incorporation (as amended from time to time, including the terms of any Preferred Stock Designation (as defined below), this “Certificate of Incorporation”) or as provided by law, the holders of shares of Class A Common Stock will be entitled to (i) notice of any stockholders’ meeting in accordance with the Amended and Restated Bylaws of the Corporation (as amended from time to time, the “Bylaws”) and (ii) vote upon such matters and in such manner as may be provided by applicable law. Except as otherwise expressly provided herein or required by applicable law, each holder of Class A Common Stock will have the right to one (1) vote per share of Class A Common Stock held of record by such holder. (b) Except as otherwise provided by law or by the resolution or resolutions providing for the issue of any series of Preferred Stock, the holders of outstanding shares of Common Stock shall have the exclusive right to vote for the election and removal of directors and for all other purposes. Notwithstanding any other provision of this Certificate of Incorporation to the contrary, the holders of Common Stock shall not be entitled to vote on any amendment to this Certificate of Incorporation (including any Preferred Stock Designation) that relates solely to the terms of one or more outstanding series of Preferred Stock if the holders of such affected series are entitled, either separately or together as a class with the holders of one or more other such series, to vote thereon pursuant to this Certificate of Incorporation (including any Preferred Stock Designation) or the DGCL. 3. Dividends. Subject to the rights of the holders of Preferred Stock, the holders of shares of Class A Common Stock shall be entitled to receive such dividends and distributions and other distributions in cash, stock or property of the Corporation when, as and if declared thereon by the Board from time to time, out of assets or funds of the Corporation legally available therefor. 4. Liquidation. Subject to the rights of the holders of Preferred Stock, holders of shares of Class A Common Stock shall be entitled to receive ratably the assets and funds of the Corporation available for distribution in the event of any liquidation, dissolution or winding up of the affairs of the Corporation, whether voluntary or involuntary. A liquidation, dissolution or winding up of the affairs of the Corporation, as such terms are used in this Section A.4, shall not be deemed to be occasioned by or to include any consolidation or merger of the Corporation with or into any other person or a sale, lease, exchange or conveyance of all or a part of its assets.

-3- 5. Redemption. The Class A Common Stock is not redeemable. B. Preferred Stock. Shares of Preferred Stock may be issued from time to time in one or more series. The Board is hereby authorized to provide by resolution or resolutions from time to time for the issuance, out of the unissued shares of Preferred Stock, of one or more series of Preferred Stock, without stockholder approval, by filing a certificate pursuant to the applicable law of the State of Delaware (the “Preferred Stock Designation”), setting forth such resolution and, with respect to each such series, establishing the number of shares to be included in such series, and fixing the voting powers, full or limited, or no voting power of the shares of such series, and the designation, preferences and relative, participating, optional or other special rights, if any, of the shares of each such series and any qualifications, limitations or restrictions thereof. The powers, designation, preferences and relative, participating, optional and other special rights of each series of Preferred Stock, and the qualifications, limitations and restrictions thereof, if any, may differ from those of any and all other series at any time outstanding. The authority of the Board with respect to each series of Preferred Stock shall include, but not be limited to, the determination of the following: (a) the designation of the series, which may be by distinguishing number, letter or title; (b) the number of shares of the series, which number the Board may thereafter (except where otherwise provided in the Preferred Stock Designation) increase or decrease (but not below the number of shares thereof then outstanding); (c) the amounts or rates at which dividends will be payable on, and the preferences, if any, of shares of the series in respect of dividends, and whether such dividends, if any, shall be cumulative or noncumulative; (d) the dates on which dividends, if any, shall be payable; (e) the redemption rights and price or prices, if any, for shares of the series; (f) the terms and amount of any sinking fund, if any, provided for the purchase or redemption of shares of the series; (g) the amounts payable on, and the preferences, if any, of shares of the series in the event of any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation; (h) whether the shares of the series shall be convertible into or exchangeable for, shares of any other class or series, or any other security, of the Corporation or any other corporation, and, if so, the specification of such other class or series or such other security, the conversion or exchange price or prices or rate or rates, any adjustments thereof, the date or dates at which such shares shall be convertible or exchangeable and all other terms and conditions upon which such conversion or exchange may be made; (i) restrictions on the issuance of shares of the same series or any other class or series; (j) the voting rights, if any, of the holders of shares of the series generally or upon specified events; and

-4- (k) any other powers, preferences and relative, participating, optional or other special rights of each series of Preferred Stock, and any qualifications, limitations or restrictions of such shares, all as may be determined from time to time by the Board and stated in the resolution or resolutions providing for the issuance of such Preferred Stock. Without limiting the generality of the foregoing, the resolutions providing for issuance of any series of Preferred Stock may provide that such series shall be superior or rank equally or be junior to any other series of Preferred Stock to the extent permitted by law. FIFTH: This Article FIFTH is inserted for the management of the business and for the conduct of the affairs of the Corporation. A. General Powers. The business and affairs of the Corporation shall be managed by or under the direction of the Board, except as otherwise provided by law. B. Number of Directors; Election of Directors. Subject to the rights of holders of any series of Preferred Stock to elect directors, the number of directors of the Corporation shall be fixed from time to time by resolution of the majority of the Whole Board. For purposes of this Certificate of Incorporation, the term “Whole Board” will mean the total number of authorized directors whether or not there exist any vacancies or other unfilled seats in previously authorized directorships. No decrease in the number of directors constituting the Board shall shorten the term of any incumbent director. C. Terms of Office. Each director shall serve for a term ending on the date of the next annual meeting of stockholders following the annual meeting of stockholders at which such director was elected. The term of each director shall continue until the election and qualification of his or her successor and be subject to his or her earlier death, disqualification, resignation or removal. D. Vacancies. Subject to the rights of holders of any series of Preferred Stock, any newly created directorship that results from an increase in the number of directors or any vacancy on the Board that results from the death, disability, resignation, disqualification or removal of any director or from any other cause shall be filled solely by the affirmative vote of a majority of the total number of directors then in office, even if less than a quorum, or by a sole remaining director and shall not be filled by the stockholders. Any director elected to fill a vacancy not resulting from an increase in the number of directors shall hold office for the remaining term of his or her predecessor. E. Removal. Any director or the entire Board may be removed from office at any time, with or without cause, by the affirmative vote of the holders of at least 66 2/3% in voting power of the stock of the Corporation entitled to vote thereon. F. Committees. Pursuant to the Bylaws, the Board may establish one or more committees to which may be delegated any or all of the powers and duties of the Board to the full extent permitted by law. G. Stockholder Nominations and Introduction of Business. Advance notice of stockholder nominations for election of directors and other business to be brought by stockholders before a meeting of stockholders shall be given in the manner provided by the Bylaws. SIXTH: Unless and except to the extent that the Bylaws shall so require, the election of directors of the Corporation need not be by written ballot.

-5- SEVENTH: To the fullest extent permitted by the DGCL as it now exists and as it may hereafter be amended, no director of the Corporation shall be personally liable to the Corporation or any of its stockholders for monetary damages for breach of fiduciary duty as a director; provided, however, that nothing contained in this Article SEVENTH shall eliminate or limit the liability of a director (i) for any breach of the director’s duty of loyalty to the Corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) pursuant to the provisions of Section 174 of the DGCL, or (iv) for any transaction from which the director derived an improper personal benefit. No repeal or modification of this Article SEVENTH shall apply to or have any adverse effect on any right or protection of, or any limitation of the liability of, a director of the Corporation existing at the time of such repeal or modification with respect to acts or omissions occurring prior to such repeal or modification. EIGHTH: The Corporation may indemnify, and advance expenses to, to the fullest extent permitted by law, any person who was or is a party to or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative by reason of the fact that the person is or was a director, officer, employee or agent of the Corporation, or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise. NINTH: Subject to the terms of any series of Preferred Stock, any action required or permitted to be taken by the stockholders of the Corporation must be effected at an annual or special meeting of the stockholders called in accordance with the Bylaws and may not be effected by written consent in lieu of a meeting. TENTH: Special meetings of stockholders for any purpose or purposes may be called at any time by: (i) the majority of the Whole Board, (ii) the Chairman of the Board, (iii) the Chief Executive Officer of the Corporation or (iv) the Chairman of the Board or the Chief Executive Officer of the Corporation at the written request of one or more stockholders of record who have delivered such request in accordance with and subject to the procedures and conditions and any other provisions set forth in the Bylaws (as amended from time to time). Special meetings of stockholders may not be called by any other person or persons. Business transacted at any special meeting of stockholders shall be limited to matters relating to the purpose or purposes stated in the notice of meeting. ELEVENTH: If any provision or provisions of this Certificate of Incorporation shall be held to be invalid, illegal or unenforceable as applied to any circumstance for any reason whatsoever: (i) the validity, legality and enforceability of such provisions in any other circumstance and of the remaining provisions of this Certificate of Incorporation (including, without limitation, each portion of any paragraph of this Certificate of Incorporation containing any such provision held to be invalid, illegal or unenforceable that is not itself held to be invalid, illegal or unenforceable) shall not in any way be affected or impaired thereby and (ii) to the fullest extent possible, the provisions of this Certificate of Incorporation (including, without limitation, each such portion of any paragraph of this Certificate of Incorporation containing any such provision held to be invalid, illegal or unenforceable) shall be construed so as to permit the Corporation to protect its directors, officers, employees and agents from personal liability in respect of their good faith service or for the benefit of the Corporation to the fullest extent permitted by law. The Corporation reserves the right at any time from time to time to amend, alter, change or repeal any provision contained in this Certificate of Incorporation, and any other provisions authorized by the DGCL may be added or inserted, in the manner now or hereafter prescribed by law; and all rights, preferences and privileges of whatsoever nature conferred upon stockholders,

-6- directors or any other persons whomsoever by and pursuant to this Certificate of Incorporation in its present form or as hereafter amended are granted subject to the right reserved in this Article ELEVENTH. Notwithstanding any other provision of this Certificate of Incorporation or any provision of law that might otherwise permit a lesser vote or no vote, but in addition to any affirmative vote of the holders of any series of Preferred Stock required by law, by this Certificate of Incorporation or by any Preferred Stock Designation, the affirmative vote of the holders of a majority in voting power of the stock of the Corporation entitled to vote thereon shall be required to amend, alter, change or repeal any provision of this Certificate of Incorporation, or to adopt any new provision of this Certificate of Incorporation; provided, however, that the affirmative vote of the holders of at least 66 2/3% in voting power of the stock of the Corporation entitled to vote thereon shall be required to amend, alter, change or repeal, or adopt any provision inconsistent with, any of Article FIFTH, Article SEVENTH, Article EIGHTH, Article NINTH, Article TENTH, Article TWELFTH, and this sentence of this Certificate of Incorporation, or in each case, the definition of any capitalized terms used therein or any successor provision (including, without limitation, any such article or section as renumbered as a result of any amendment, alteration, change, repeal or adoption of any other provision of this Certificate of Incorporation). Any amendment, repeal or modification of any of Article SEVENTH, Article EIGHTH, and this sentence shall not adversely affect any right or protection of any person existing thereunder with respect to any act or omission occurring prior to such repeal or modification. TWELFTH: In furtherance and not in limitation of the powers conferred upon it by law, the Board is expressly authorized and empowered to adopt, amend and repeal the Bylaws by the affirmative vote of a majority of the Whole Board. Notwithstanding any other provision of this Certificate of Incorporation or any provision of law that might otherwise permit a lesser vote or no vote, but in addition to any affirmative vote of the holders of any series of Preferred Stock required by law, by this Certificate of Incorporation or by any Preferred Stock Designation, the Bylaws may also be amended, altered or repealed and new Bylaws may be adopted by the affirmative vote of the holders of at least 66 2/3% in voting power of the stock of the Corporation entitled to vote thereon. THIRTEENTH: To the fullest extent permitted by the DGCL as it now exists and as it may hereafter be amended, no officer of the Corporation shall be personally liable to the Corporation or any of its stockholders for monetary damages for breach of fiduciary duty as an officer; provided, however, that nothing contained in this Article THIRTEENTH shall eliminate or limit the liability of an officer (i) for any breach of the officer’s duty of loyalty to the Corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) for any transaction from which the officer derived an improper personal benefit, or (iv) in any action by or in the right of the Corporation. No repeal or modification of this Article THIRTEENTH shall apply to or have any adverse effect on any right or protection of, or any limitation of the liability of, an officer of the Corporation existing at the time of such repeal or modification with respect to acts or omissions occurring prior to such repeal or modification. IN WITNESS WHEREOF, the undersigned has executed this Amended and Restated Certificate of Incorporation as of this 12th day of June. By: /s/ Josh Faddis Josh Faddis Corporate Secretary

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

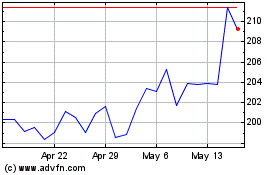

Veeva Systems (NYSE:VEEV)

Historical Stock Chart

From May 2024 to Jun 2024

Veeva Systems (NYSE:VEEV)

Historical Stock Chart

From Jun 2023 to Jun 2024