New Verizon + Openbank Savings account

offers qualified Verizon customers up to $180 per year off their

bill and maximizes savings with a top-tier interest rate 10 times

the national average

- Partnership brings together industry leaders in mobility and

banking to provide a secure, seamless digital banking experience to

Verizon customers with no fees, low minimum deposits and 24/7

access to funds.

- Relationship significantly expands Santander’s national scale

and reach as part of its strategy to become a leading digital bank

with branches and enhances Verizon’s financial service portfolio

with added benefits for customers.

Verizon and Santander Bank, N.A., part of the

global banking leader Santander1, today announced a multi-year U.S.

partnership to bring a new, competitive high yield savings account

to millions of Verizon mobile and 5G Home customers. Introducing

Verizon + Openbank Savings: a digital high yield savings account

with a rate 10 times the national average and the ability to save

up to $180 a year on your Verizon bill. Verizon + Openbank Savings

joins Verizon’s portfolio of financial services offerings, yet

another example of outstanding value and benefits on top of mobile

and home connectivity.

“Verizon has long been committed to delivering value and savings

beyond wireless services,” said Hans Vestberg, Chairman and CEO of

Verizon. “Our scale enables the creation of exclusive financial

services solutions and savings accessible only to Verizon

customers. Adding the power of Openbank’s secure, simple high yield

savings account to our financial offerings provides Verizon

customers with unique and differentiated value in the telco and

financial services category. This collaboration reinforces our

dedication to delivering meaningful and exclusive benefits that

support how our customers live, work, play AND save.”

Ana Botín, Banco Santander Executive Chair, added, “By

partnering with Verizon, the nation’s leading mobile provider,

Openbank can offer a differentiated savings opportunity and digital

experience to millions of consumers across the U.S. The Verizon

partnership is a significant milestone for Santander as we scale

our U.S. business further by bringing Openbank’s secure and simple

banking experience and compelling rewards to Verizon’s customers

nationwide – backed by a leading global bank that has earned the

trust of more than 173 million customers. This is an important step

in our growth strategy, and I am excited for what’s ahead.”

Incredible savings with Verizon +

Openbank

In addition to maximizing savings with Verizon + Openbank’s

competitive interest rate at 10 times the national average,

customers can also save on their Verizon wireless bill, starting

with a minimum average daily balance of $1,000. The higher the

average daily balance, the higher the wireless bill savings – up to

$180 per year.

Signing up is simple

Starting in April, Verizon customers can easily sign up for an

Openbank high yield savings account via verizon.com or the

MyVerizon app. Customers will then be directed to the Openbank site

to complete the account registration process. After opening their

account, customers can use the Openbank app to deposit and withdraw

funds, check their monthly interest rate and manage their accounts.

To learn more, you can visit verizon.com/startsaving.

Unlocking a savings growth

opportunity

Santander US research reveals that while interest rates have

been at their highest levels in nearly two decades, many consumers

have not taken advantage of high-rate products, such as high yield

savings accounts, to grow their savings. The research also found

consumers’ top consideration for selecting a banking partner are

safety, stability, and 24/7 digital access. Openbank’s digital

platform provides a secure, seamless banking experience with no

fees, low minimum deposits and 24/7 access to funds and customer

support.

The Openbank digital banking platform launched in the U.S.

market in late 2024 with a high yield savings account offering that

quickly reached more than $3 billion (USD) in deposits. The digital

platform is now available nationwide, and will begin offering

additional products, such as Certificates of Deposit (CDs) and

Checking Accounts, later in 2025. Openbank in the U.S. is a

division of Santander Bank, N.A., which is a Member of the FDIC.

For more information about Openbank by Santander, including

eligibility, please visit openbank.us.

With exclusive savings, top-tier perks, the flexibility to

customize your plan with myPlan and myHome, and now the incredible

Verizon + Openbank Savings account, it’s never been a better time

to be a Verizon customer.

1 Banco Santander is a leading commercial bank, founded in 1857

and headquartered in Spain and one of the largest banks in the

world by market capitalization. The group’s activities are

consolidated into five global businesses: Retail & Commercial

Banking, Digital Consumer Bank, Corporate & Investment

Banking (CIB), Wealth Management & Insurance and Payments

(PagoNxt and Cards). This operating model allows the bank to better

leverage its unique combination of global scale and local

leadership. Santander aims to be the best open financial services

platform providing services to individuals, SMEs, corporates,

financial institutions and governments. The bank’s purpose is to

help people and businesses prosper in a simple, personal and fair

way. Santander is building a more responsible bank and has made a

number of commitments to support this objective, including raising

€220 billion in green financing between 2019 and 2030. At the end

of 2024, Banco Santander had €1.3 trillion in total funds, 173

million customers, 8,000 branches and 207,000 employees.

Verizon + Openbank Savings is offered exclusively by Openbank, a

division of Santander Bank, N.A., and is not managed, housed, or

controlled by Verizon. Santander Bank, N.A., offering your account

through its Openbank division, is a Federal Deposit Insurance

Corporation (“FDIC”) insured institution. Deposits at Santander

Bank, N.A. and its Openbank division are combined for FDIC

insurance purposes (FDIC Cert. 29950) and are not separately

insured. There is a maximum of $250,000 of deposit insurance from

the FDIC per depositor for each category of account ownership.

Please visit fdic.gov for details. Verizon is not a chartered

banking institution and is not insured by FDIC.

Verizon Communications Inc. (NYSE, Nasdaq: VZ) powers and

empowers how its millions of customers live, work and play,

delivering on their demand for mobility, reliable network

connectivity and security. Headquartered in New York City, serving

countries worldwide and nearly all of the Fortune 500, Verizon

generated revenues of $134.8 billion in 2024. Verizon’s world-class

team never stops innovating to meet customers where they are today

and equip them for the needs of tomorrow. For more, visit

verizon.com or find a retail location at verizon.com/stores.

About Santander Bank, N.A

Santander Bank, N.A. is one of the country’s leading retail and

commercial banks, with $102 billion in assets as of December 31,

2024. With its corporate offices in Boston, the Bank’s more than

4,400 employees and more than 1.8 million customers are principally

located in Massachusetts, New Hampshire, Connecticut, Rhode Island,

New York, New Jersey, Pennsylvania and Delaware. The Bank is a

wholly-owned subsidiary of Madrid-based Banco Santander, S.A.

(NYSE: SAN), recognized as one of the world’s most admired

companies by Fortune Magazine in 2024, with approximately 173

million customers in the U.S., Europe, and Latin America. Santander

Bank is overseen by Santander Holdings USA, Inc., Banco Santander’s

intermediate holding company in the U.S. For more information on

Santander Bank, please visit www.santanderbank.com. © 2025

Santander Bank, N.A. All rights reserved. Santander, Santander

Bank, Openbank, the Flame Logo are trademarks of © 2025 Santander

Bank, N.A. All rights reserved. Santander, Santander Bank,

Openbank, the Flame Logo are trademarks of Banco Santander, S.A. or

its subsidiaries in the United States or other countries. All other

trademarks are the property of their respective owners. For more

information on Openbank in the United States, please visit

www.openbank.us.

VERIZON’S ONLINE MEDIA CENTER: News releases, stories, media

contacts and other resources are available at verizon.com/news.

News releases are also available through an RSS feed. To subscribe,

visit www.verizon.com/about/rss-feeds/.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250318565587/en/

Verizon media contact:

George Koroneos george.koroneos@verizon.com Social:

@GLKcreative

Santander media contact:

Andrew Simonelli andrew.simonelli@santander.us

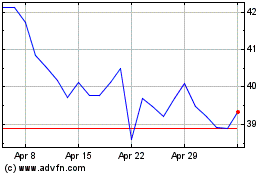

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2025 to Apr 2025

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2024 to Apr 2025