Westlake Corporation (NYSE: WLK) (the "Company" or "Westlake")

today announced third quarter 2024 results.

SUMMARY FINANCIAL HIGHLIGHTS (in

millions of dollars, except per share data and

percentages)

Three Months Ended September

30, 2024

Three Months Ended June 30,

2024

Three Months Ended September

30, 2023

Westlake Corporation

Net sales

$

3,117

$

3,207

$

3,115

Income from operations

$

180

$

406

$

349

Net income attributable to Westlake

Corporation

$

108

$

313

$

285

Diluted earnings per common share

$

0.83

$

2.40

$

2.20

Identified Item (1)

$

75

$

—

$

—

Net income attributable to Westlake

Corporation excl. Identified Item

$

183

$

313

$

285

Diluted earnings per common share excl.

Identified Item

$

1.41

$

2.40

$

2.20

EBITDA

$

505

$

744

$

682

EBITDA excl. Identified Item

$

580

$

744

$

682

EBITDA margin (2)

19%

23%

22%

Performance and Essential Materials

("PEM") Segment

Net sales

$

2,019

$

2,013

$

1,971

Income from operations

$

(9

)

$

157

$

105

EBITDA

$

222

$

391

$

339

Identified Item (1)

$

75

$

—

$

—

EBITDA excl. Identified Item

$

297

$

391

$

339

EBITDA margin (2)

15%

19%

17%

Housing and Infrastructure Products

("HIP") Segment

Net sales

$

1,098

$

1,194

$

1,144

Income from operations

$

202

$

266

$

256

EBITDA

$

262

$

336

$

327

EBITDA margin

24%

28%

29%

______________________________

(1)

"Identified Item" represents $75

million accrued expense to temporarily cease operations

("mothball") of the allyl chloride (AC) and epichlorohydrin (ECH)

units at the Company's site in Pernis, the Netherlands

(2)

Excludes Identified Item

RESULTS

Consolidated Results

(Unless otherwise noted the financial numbers below exclude the

Identified Item)

For the third quarter of 2024, the Company reported net sales of

$3.1 billion, net income of $183 million, or $1.41 per share, and

EBITDA (earnings before interest expense, income taxes,

depreciation and amortization) of $580 million. During the third

quarter of 2024, we experienced extended maintenance outages at our

ethylene JV facility, which drove higher purchases of ethylene

feedstock, and one of our chlorovinyl facilities.

Third quarter 2024 sales of $3.1 billion declined by 3% compared

to the second quarter of 2024. Company sales volume decreased 4%

sequentially while average sales price increased 1% from the

previous quarter. Net income of $183 million decreased by $130

million as compared to the second quarter of 2024. The sequential

decrease in net income compared to the prior quarter was primarily

due to the aforementioned production outages, higher ethylene

feedstock costs and lower sales volume.

EBITDA of $580 million for the third quarter of 2024 decreased

by $102 million as compared to third quarter 2023 EBITDA of $682

million. Third quarter 2024 EBITDA decreased by $164 million as

compared to second quarter 2024 EBITDA of $744 million.

A reconciliation of EBITDA (including and excluding the

Identified Item) to net income, income from operations and net cash

provided by operating activities can be found in the financial

schedules at the end of this press release. Reconciliations of

segment EBITDA (including and excluding the Identified Item) to net

income and income from operations can be found in the financial

schedules at the end of this press release.

Mothball Expenses ("Identified Item")

During the third quarter of 2024, the Company accrued $75

million of mothball expenses in the Performance and Essential

Materials segment related to the previously announced decision to

mothball two units within our European epoxy business to align our

manufacturing footprint and costs with changing global conditions.

Consistent with our previous disclosure, cash outflows related to

these mothball expenses are expected to occur over several years

starting in 2025.

Cash and Debt

Net cash provided by operating activities was $474 million for

the third quarter of 2024 and capital expenditures were $220

million. $300 million of maturing senior notes were redeemed during

the quarter, resulting in cash and cash equivalents of $2.9 billion

and total debt of $4.6 billion as of September 30, 2024.

Performance and Essential Materials Segment

(Unless otherwise noted the financial numbers below exclude the

Identified Item)

For the third quarter of 2024, PEM sales of $2.0 billion were in

line with the second quarter of 2024. PEM sales volume decreased 1%

quarter-over-quarter while average sales price increased 1%

sequentially.

PEM income from operations was $66 million in the third quarter

of 2024 as compared to income from operations of $157 million in

the second quarter of 2024. This sequential decrease of $91 million

was primarily driven by unplanned outages and higher ethylene

feedstock costs, which were partially offset by higher average

sales price, particularly for polyethylene.

Compared to the prior year period, PEM income from operations

decreased by $39 million. This decrease in income from operations

versus the third quarter of 2023 was primarily driven by unplanned

outages and lower average sales price that were partially offset by

higher sales volume, particularly for chlorine, caustic soda and

epoxy resin.

Housing and Infrastructure Products Segment

For the third quarter of 2024, HIP sales of $1.1 billion

decreased from second quarter of 2024 sales of $1.2 billion as a

result of lower sales volume due to slower North American

residential construction activity and weather disruptions.

HIP income from operations was $202 million in the third quarter

of 2024 as compared to income from operations of $266 million in

the second quarter of 2024. This sequential decrease of $64 million

was primarily due to lower sales volume at most product categories

as a result of slower North American residential construction

activity and weather disruptions.

Compared to the prior year period, HIP income from operations

decreased by $54 million. This decrease in income from operations

versus the third quarter of 2023 was primarily driven by lower

average sales price and lower sales volume, particularly for pipe

& fittings.

EXECUTIVE COMMENTARY

"During the third quarter of 2024, global macroeconomic trends

modestly improved from the environment we saw in the second quarter

of 2024 with relatively solid and improving conditions in North

America, a continuing recovery in Asia, and slow improvement in

Europe. Demand for our products during the third quarter was

consistent with these market conditions, and our third quarter

financial results would have reflected these trends if it had not

been for extended maintenance outages at two plants during the

quarter in our PEM segment. While we are disappointed with this

operational performance, we have completed the maintenance and

these plants have returned to service. Furthermore, we are applying

the lessons learned from these incidents to other plants, while

increasing our focus on preventive maintenance across our

organization to improve the reliability of our plants," said

Jean-Marc Gilson, President and Chief Executive Officer.

"The pace of the recovery from the recent trough in global

industrial and manufacturing activity remains uneven. However,

recent monetary and fiscal stimulus, including actions by the

Federal Reserve and the Chinese government, have the potential to

accelerate the pace and duration of the macroeconomic recovery.

Meanwhile, we will continue to focus on our levers for growth,

including developing and commercializing innovative new products to

help our customers address their needs, improving the profitability

and reliability of our plants, and redeploying our investment-grade

balance sheet to create long-term shareholder value," concluded Mr.

Gilson.

Forward-Looking Statements

The statements in this release and the related teleconference

relating to matters that are not historical facts, including

statements regarding our outlook for the performance of our

business segments, global macroeconomic conditions, continuing

stabilization or increases in sales prices, volumes, margins and

profitability in both domestic and export markets for most of our

products, industrial, manufacturing, residential construction and

infrastructure activity in our target markets, our ability to

weather economic volatility, raw material costs, higher energy

prices, the earnings potential of our assets, monetary and fiscal

policies domestically and abroad, the pace and duration of economic

recovery, our ability to improve profitability and reliability of

our plants, future preventative maintenance activities, our ability

to continue to execute our strategies, and our ability to create

long-term value for our shareholders are forward-looking

statements.

These forward-looking statements are subject to significant

risks and uncertainties. Actual results could differ materially,

based on factors including, but not limited to: general economic

and business conditions; the cyclical nature of the chemical and

building products industries; the availability, cost and volatility

of raw materials and energy; the results of acquisitions and our

integration efforts; uncertainties associated with the United

States, European and worldwide economies, including those due to

political tensions and conflict in the Middle East, Russia and

Ukraine and elsewhere; uncertainties associated with pandemic

infectious diseases; uncertainties associated with climate change;

the potential impact on demand for ethylene, polyethylene and

polyvinyl chloride due to initiatives such as recycling and

customers seeking alternatives to polymers; current and potential

governmental regulatory actions in the United States and other

countries; industry production capacity and operating rates; the

supply/demand balance for Westlake's products; competitive products

and pricing pressures; instability in the credit and financial

markets; access to capital markets; terrorist acts; operating

interruptions (including explosions, fires, weather-related

incidents, unscheduled downtime and environmental risks); changes

in laws and regulations, including trade policies; technological

developments; information systems failures and cyberattacks;

foreign currency exchange risks; our ability to implement our

business strategies; creditworthiness of our customers; the effect

and results of litigation and settlements of litigation; and other

risk factors. For more detailed information about the factors that

could cause actual results to differ materially, please refer to

Westlake's Annual Report on Form 10-K for the year ended December

31, 2023, which was filed with the SEC in February 2024, and

Westlake's Quarterly Report on Form 10-Q for the quarter ended June

30, 2024, which was filed with the SEC in August 2024.

Use of Non-GAAP Financial Measures

This release makes reference to certain "non-GAAP" financial

measures, such as EBITDA, EBITDA margin and certain financial

measures adjusted to exclude the effect of the Identified Item, as

defined in Regulation G of the U.S. Securities Exchange Act of

1934, as amended. For this purpose, a non-GAAP financial measure is

generally defined by the Securities and Exchange Commission (SEC)

as a numerical measure of a registrant's historical or future

financial performance, financial position or cash flows that (1)

excludes amounts, or is subject to adjustments that have the effect

of excluding amounts, that are included in the most directly

comparable measure calculated and presented in accordance with GAAP

in the statement of income, balance sheet or statement of cash

flows (or equivalent statements) of the registrant; or (2) includes

amounts, or is subject to adjustments that have the effect of

including amounts, that are excluded from the most directly

comparable measure so calculated and presented. We report our

financial results in accordance with U.S. generally accepted

accounting principles (U.S. GAAP), but believe that certain

non-GAAP financial measures, such as EBITDA, EBITDA margin and

certain financial measures that exclude the effect of the

Identified Item, provide useful supplemental information to

investors regarding the underlying business trends and performance

of the Company's ongoing operations and are useful for

period-over-period comparisons of such operations. These non-GAAP

financial measures should be considered as a supplement to, and not

as a substitute for, or superior to, the financial measures

prepared in accordance with U.S. GAAP. A reconciliation of (i)

EBITDA to net income, income from operations and net cash provided

by operating activities (including and excluding the Identified

Item), and (ii) segment EBITDA to segment income from operations

(including and excluding the Identified Item) can be found in the

financial schedules at the end of this press release.

About Westlake

Westlake is a global manufacturer and supplier of materials and

innovative products that enhance life every day. Headquartered in

Houston, with operations in Asia, Europe and North America, we

provide the building blocks for vital solutions — from housing and

construction, to packaging and healthcare, to automotive and

consumer goods. For more information, visit the Company's web site

at www.westlake.com.

Westlake Corporation Conference Call Information:

A conference call to discuss Westlake Corporation's third

quarter 2024 results will be held Tuesday, November 5, 2024 at

11:00 AM Eastern Time (10:00 AM Central Time). To access the

conference call, it is necessary to pre-register at

https://register.vevent.com/register/BI9dd3d967e2694f52b0a3216544d073e3.

Once registered, you will receive a phone number and unique PIN

number.

A replay of the conference call will be available beginning two

hours after its conclusion. The conference call and replay will be

available via webcast at

https://edge.media-server.com/mmc/p/te7pi7po.

WESTLAKE CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(in millions of dollars,

except per share data and share amounts)

Net sales

$

3,117

$

3,115

$

9,299

$

9,722

Cost of sales

2,618

2,529

7,670

7,702

Gross profit

499

586

1,629

2,020

Selling, general and administrative

expenses

215

206

648

641

Amortization of intangibles

29

31

89

92

Restructuring, transaction and

integration-related costs

75

—

83

6

Income from operations

180

349

809

1,281

Interest expense

(39

)

(40

)

(120

)

(124

)

Other income, net

44

56

153

101

Income before income taxes

185

365

842

1,258

Provision for income taxes

65

70

214

249

Net income

120

295

628

1,009

Net income attributable to noncontrolling

interests

12

10

33

33

Net income attributable to Westlake

Corporation

$

108

$

285

$

595

$

976

Earnings per common share attributable to

Westlake Corporation:

Basic

$

0.84

$

2.22

$

4.61

$

7.61

Diluted

$

0.83

$

2.20

$

4.58

$

7.56

Weighted average common shares

outstanding:

Basic

128,638,632

127,854,464

128,525,531

127,685,210

Diluted

129,340,461

128,583,927

129,237,560

128,509,618

WESTLAKE CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

September 30,

2024

December 31,

2023

(in millions of

dollars)

ASSETS

Current assets

Cash and cash equivalents

$

2,915

$

3,304

Accounts receivable, net

1,754

1,601

Inventories

1,747

1,622

Prepaid expenses and other current

assets

133

82

Total current assets

6,549

6,609

Property, plant and equipment, net

8,602

8,519

Other assets, net

5,958

5,907

Total assets

$

21,109

$

21,035

LIABILITIES AND EQUITY

Current liabilities (accounts payable and

accrued and other liabilities)

$

2,351

$

2,491

Current portion of long-term debt, net

—

299

Long-term debt, net

4,616

4,607

Other liabilities

2,956

2,874

Total liabilities

9,923

10,271

Total Westlake Corporation stockholders'

equity

10,662

10,241

Noncontrolling interests

524

523

Total equity

11,186

10,764

Total liabilities and equity

$

21,109

$

21,035

WESTLAKE CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Nine Months Ended September

30,

2024

2023

(in millions of

dollars)

Cash flows from operating

activities

Net income

$

628

$

1,009

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

833

815

Deferred income taxes

(58

)

(67

)

Net loss on disposition and others

51

43

Other balance sheet changes

(574

)

(37

)

Net cash provided by operating

activities

880

1,763

Cash flows from investing

activities

Additions to investments in unconsolidated

subsidiaries

(24

)

(18

)

Additions to property, plant and

equipment

(723

)

(752

)

Other, net

11

20

Net cash used for investing activities

(736

)

(750

)

Cash flows from financing

activities

Distributions to noncontrolling

interests

(31

)

(33

)

Dividends paid

(197

)

(156

)

Proceeds from exercise of stock

options

13

39

Repayment of senior notes

(300

)

—

Repurchase of common stock for

treasury

—

(23

)

Other, net

(2

)

(2

)

Net cash used for financing activities

(517

)

(175

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(15

)

(12

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

(388

)

826

Cash, cash equivalents and restricted cash

at beginning of period

3,319

2,246

Cash, cash equivalents and restricted cash

at end of period

$

2,931

$

3,072

WESTLAKE CORPORATION

SEGMENT INFORMATION

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(in millions of

dollars)

Net external sales

Performance and Essential Materials

Performance Materials

$

1,164

$

1,127

$

3,505

$

3,549

Essential Materials

855

844

2,458

2,907

Total Performance and Essential

Materials

2,019

1,971

5,963

6,456

Housing and Infrastructure Products

Housing Products

937

963

2,826

2,699

Infrastructure Products

161

181

510

567

Total Housing and Infrastructure

Products

1,098

1,144

3,336

3,266

$

3,117

$

3,115

$

9,299

$

9,722

Income (loss) from operations

Performance and Essential Materials

$

(9

)

$

105

$

170

$

723

Housing and Infrastructure Products

202

256

678

589

Corporate and other

(13

)

(12

)

(39

)

(31

)

$

180

$

349

$

809

$

1,281

Depreciation and amortization

Performance and Essential Materials

$

225

$

225

$

669

$

652

Housing and Infrastructure Products

54

51

157

157

Corporate and other

2

1

7

6

$

281

$

277

$

833

$

815

Other income, net

Performance and Essential Materials

$

6

$

9

$

27

$

14

Housing and Infrastructure Products

6

20

27

30

Corporate and other

32

27

99

57

$

44

$

56

$

153

$

101

WESTLAKE CORPORATION

RECONCILIATION OF EBITDA TO

NET INCOME, INCOME FROM OPERATIONS AND

NET CASH PROVIDED BY OPERATING

ACTIVITIES (INCLUDING AND EXCLUDING IDENTIFIED ITEM)

(Unaudited)

Three Months Ended June

30,

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2024

2023

2024

2023

(in millions of dollars,

except percentages)

Net cash provided by operating

activities

$

237

$

474

$

696

$

880

$

1,763

Changes in operating assets and

liabilities and other

50

(354

)

(417

)

(310

)

(821

)

Deferred income taxes

36

—

16

58

67

Net income

323

120

295

628

1,009

Add:

Mothball expenses

—

75

—

75

—

Net income excl. Identified

Item

$

323

$

195

$

295

$

703

$

1,009

Net income

323

120

295

628

1,009

Less:

Other income, net

59

44

56

153

101

Interest expense

(41

)

(39

)

(40

)

(120

)

(124

)

Provision for income taxes

(101

)

(65

)

(70

)

(214

)

(249

)

Income from operations

406

180

349

809

1,281

Add:

Mothball expenses

—

75

—

75

—

Income from operations excl. Identified

Item

406

255

349

884

1,281

Add:

Depreciation and amortization

279

281

277

833

815

Other income, net

59

44

56

153

101

EBITDA excl. Identified Item

744

580

682

1,870

2,197

Less:

Mothball expenses

—

75

—

75

—

EBITDA

$

744

$

505

$

682

$

1,795

$

2,197

Net external sales

$

3,207

$

3,117

$

3,115

$

9,299

$

9,722

Operating Income Margin

13%

6%

11%

9%

13%

Operating income margin excl.

Identified Item

13%

8%

11%

10%

13%

EBITDA Margin

23%

16%

22%

19%

23%

EBITDA margin excl. Identified

Item

23%

19%

22%

20%

23%

WESTLAKE CORPORATION

RECONCILIATION OF DILUTED

EARNINGS PER COMMON SHARE TO DILUTED EARNINGS PER COMMON SHARE

EXCLUDING IDENTIFIED ITEM

(Unaudited)

Three Months Ended June

30,

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2024

2023

2024

2023

(per share data)

Diluted earnings per common share

attributable to Westlake Corporation

$

2.40

$

0.83

$

2.20

$

4.58

$

7.56

Add:

Mothball expenses

—

0.58

—

0.58

—

Diluted earnings per common share

attributable to Westlake Corporation excl. Identified Item

$

2.40

$

1.41

$

2.20

$

5.16

$

7.56

WESTLAKE CORPORATION

RECONCILIATION OF FREE CASH

FLOW TO NET CASH PROVIDED BY OPERATING ACTIVITIES

(Unaudited)

Three Months Ended June

30,

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2024

2023

2024

2023

(in millions of

dollars)

Net cash provided by operating

activities

$

237

$

474

$

696

$

880

$

1,763

Less:

Additions to property, plant and

equipment

231

220

$

245

723

752

Free cash flow

$

6

$

254

$

451

$

157

$

1,011

WESTLAKE CORPORATION

RECONCILIATION OF PEM SEGMENT

EBITDA TO INCOME FROM OPERATIONS (INCLUDING AND EXCLUDING

IDENTIFIED ITEM)

(Unaudited)

Three Months Ended June

30,

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2024

2023

2024

2023

(in millions of dollars,

except percentages)

Performance and Essential Materials

Segment

Income (loss) from operations

$

157

$

(9

)

$

105

$

170

$

723

Add:

Mothball expenses

—

75

—

75

—

Income (loss) from operations excl.

Identified Item

157

66

105

245

723

Add:

Depreciation and amortization

224

225

225

669

652

Other income, net

10

6

9

27

14

EBITDA excl. Identified Item

391

297

339

941

1,389

Less:

Mothball expenses

—

75

—

75

—

EBITDA

$

391

$

222

$

339

$

866

$

1,389

Net external sales

$

2,013

$

2,019

$

1,971

$

5,963

$

6,456

Operating Income Margin

8%

—%

5%

3%

11%

Operating income margin excl.

Identified Item

8%

3%

5%

4%

11%

EBITDA Margin

19%

11%

17%

15%

22%

EBITDA margin excl. Identified

Item

19%

15%

17%

16%

22%

WESTLAKE CORPORATION

RECONCILIATION OF HIP SEGMENT

EBITDA TO INCOME FROM OPERATIONS

(Unaudited)

Three Months Ended June

30,

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2024

2023

2024

2023

(in millions of dollars,

except percentages)

Housing and Infrastructure Products

Segment

Income from operations

$

266

$

202

$

256

$

678

$

589

Add:

Depreciation and amortization

53

54

51

157

157

Other income, net

17

6

20

27

30

EBITDA

$

336

$

262

$

327

$

862

$

776

Net external sales

$

1,194

$

1,098

$

1,144

$

3,336

$

3,266

Operating Income Margin

22%

18%

22%

20%

18%

EBITDA Margin

28%

24%

29%

26%

24%

WESTLAKE CORPORATION

SUPPLEMENTAL

INFORMATION

PRODUCT SALES PRICE AND VOLUME

VARIANCE BY OPERATING SEGMENTS

(Unaudited)

Third Quarter 2024 vs. Third

Quarter 2023

Third Quarter 2024 vs. Second

Quarter 2024

Average

Sales Price

Volume

Average

Sales Price

Volume

Performance and Essential Materials

-3

%

+6

%

+1

%

-1

%

Housing and Infrastructure Products

-3

%

-1

%

—

%

-9

%

Company

-3

%

+3

%

+1

%

-4

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105355131/en/

Contact—(713) 960-9111 Investors—Steve Bender Media—L. Benjamin

Ederington

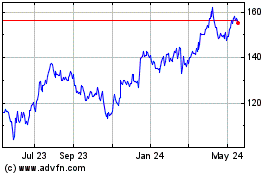

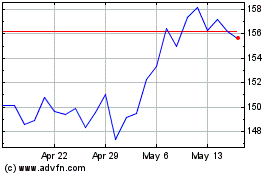

Westlake (NYSE:WLK)

Historical Stock Chart

From Mar 2025 to Apr 2025

Westlake (NYSE:WLK)

Historical Stock Chart

From Apr 2024 to Apr 2025