UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

SCHEDULE

13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

____________________

WHITESTONE REIT

(Name

of Issuer)

Common Shares of Beneficial Interest, $0.001 par value per share

(Title

of Class of Securities)

966084204

(CUSIP

Number)

David Bramble

2002 Clipper Park Rd.

Suite 105

Baltimore, MD 21211

(410) 340-1665

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

June 3, 2024

(Date

of Event Which Requires Filing of This Statement)

____________________

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

Rule 13d-1(f) or Rule 13d-1(g), check the following box. o

| Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for other parties to whom copies are to be sent. |

| * | The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior

cover page. |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

CUSIP No. 966084204

| 1 |

Name of Reporting Person

MCB PR Capital LLC |

| 2 |

Check the Appropriate Box if a Member of a Group

(A): o (B): o |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

OO |

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant to Items

2(d) or 2(e)

o |

| 6 |

Citizenship or Place of Organization

Delaware |

| Number of Shares Beneficially Owned by Each Reporting Person with |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

4,690,000 shares, all of which are directly owned by MCB PR Capital

LLC, a Delaware limited liability company (“MCB”).

MCB Acquisitions Manager LLC, a Maryland limited liability company

(“Acquisitions”) is the sole Manager of MCB and has the sole right to make any and all decisions and take any and all actions

on behalf of MCB and may therefore be deemed to indirectly beneficially own the shares of the Issuer directly owned by MCB.

P. David Bramble is the sole member of Acquisitions with full control

of Acquisitions and may therefore be deemed to indirectly beneficially own the shares of the Issuer directly owned by MCB. |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

See response to Row 8. |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

4,690,000 Common Shares |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

o |

| 13 |

Percent of Class Represented by Amount in Row (11)

9.4% |

| 14 |

Type of Reporting Person

OO (Limited Liability Company) |

| |

|

|

|

CUSIP No. 966084204

| 1 |

Name of Reporting Person

MCB Acquisitions Manager LLC |

| 2 |

Check the Appropriate Box if a Member of a Group

(A): o (B): o |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

OO |

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant to Items

2(d) or 2(e)

o |

| 6 |

Citizenship or Place of Organization

Maryland |

| Number of Shares Beneficially Owned by Each Reporting Person with |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

4,690,000 shares, all of which are directly owned by MCB PR Capital

LLC, a Delaware limited liability company (“MCB”).

MCB Acquisitions Manager LLC, a Maryland limited liability company

(“Acquisitions”) is the sole Manager of MCB and has the sole right to make any and all decisions and take any and all actions

on behalf of MCB and may therefore be deemed to indirectly beneficially own the shares of the Issuer directly owned by MCB.

P. David Bramble is the sole member of Acquisitions with full control

of Acquisitions and may therefore be deemed to indirectly beneficially own the shares of the Issuer directly owned by MCB. |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

See response to Row 8. |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

4,690,000 Common Shares |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

o |

| 13 |

Percent of Class Represented by Amount in Row (11)

9.4% |

| 14 |

Type of Reporting Person

OO |

| |

|

|

|

CUSIP No. 966084204

| 1 |

Name of Reporting Person

P. David Bramble |

| 2 |

Check the Appropriate Box if a Member of a Group

(A): o (B): o |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

OO |

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant to Items

2(d) or 2(e)

o |

| 6 |

Citizenship or Place of Organization

United States |

| Number of Shares Beneficially Owned by Each Reporting Person with |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

4,690,000 shares, all of which are directly owned by MCB PR Capital

LLC, a Delaware limited liability company (“MCB”).

MCB Acquisitions Manager LLC, a Maryland limited liability company

(“Acquisitions”) is the sole Manager of MCB and has the sole right to make any and all decisions and take any and all actions

on behalf of MCB and may therefore be deemed to indirectly beneficially own the shares of the Issuer directly owned by MCB.

P. David Bramble is the sole member of Acquisitions with full control

of Acquisitions and may therefore be deemed to indirectly beneficially own the shares of the Issuer directly owned by MCB. |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

See response to Row 8. |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

4,690,000 Common Shares |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

o |

| 13 |

Percent of Class Represented by Amount in Row (11)

9.4% |

| 14 |

Type of Reporting Person

IN |

| |

|

|

|

| Item 1. | Security and Issuer. |

This statement

on Schedule 13D (the “Schedule 13D”) relates to the common shares of beneficial interest, $0.001 par value per share (the

“Common Shares”), of Whitestone REIT, a Maryland real estate investment trust (the “Issuer”), whose principal

executive office is located at 2600 South Gessner, Suite 500, Houston, Texas 77063.

| Item 2. | Identity and Background. |

This Schedule 13D is being filed by the following

entities (each a “Reporting Person” and collectively, the “Reporting Persons”):

MCB PR Capital LLC, a Delaware limited liability company

(“MCB”)

MCB Acquisitions Manager LLC, a Maryland limited liability

company (“Acquisitions”)

P. David Bramble, an individual and citizen of the United

States of America

The principal business address of each of the Reporting

Persons is 2002 Clipper Park Road, Suite 105, Baltimore, Maryland 21211.

The Reporting Persons are principally engaged in

the business of real estate investments.

During the last five years, none of the Reporting

Persons (i) has been convicted in any criminal proceeding (excluding traffic violations or similar misdemeanors) or (ii) was a party to

a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject

to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state

securities laws or finding any violation with respect to such laws.

| Item 3. | Source and Amount of Funds or Other Consideration. |

As of the date

of this Schedule 13D, MCB had invested an aggregate of approximately $58,462,183 to purchase the Common Shares. MCB obtained such funds

through contributions by third-party investors. None of the purchase price is or will be

represented by funds or other consideration borrowed or otherwise obtained for the purpose of acquiring, holding, trading or voting the

securities.

| Item 4. | Purpose of Transaction |

The Reporting Persons purchased the Common Shares for investment purposes.

As with their other investments, the Reporting Persons continuously evaluate the Issuer, including but not limited to its businesses,

results of operations, and prospects. In light of that ongoing evaluation, on June 3, 2024, MCB sent an acquisition proposal to the Issuer,

a copy of which is filed as Exhibit 7.01 to this Schedule 13D (the “Proposal”) and is incorporated by reference herein. The

Proposal provides that it is non-binding and subject to confirmatory diligence, as well as the execution of definitive transaction agreements.

The Reporting Persons intend to engage in discussions with the Issuer

and its representatives concerning the Proposal and to enter into negotiations with the Issuer with respect thereto. The Reporting Persons

may enter into appropriate confidentiality or similar agreements with the Issuer to facilitate the exchange of information with the Issuer

in connection with such negotiations. There can be no certainty as to whether discussions will occur, or if they do, the outcome of such

discussions. The Reporting Persons may determine to accelerate or terminate discussions with the Issuer concerning the Proposal, change

the terms of or withdraw the Proposal, take any action to facilitate or increase the likelihood of consummation of the Proposal or change

their intentions with respect to any such matters, in each case at any time and without prior notice. The Reporting Persons will, directly

or indirectly, take such additional steps as they may deem appropriate to further the Proposal or otherwise support their investment in

the Issuer, including but not limited to entering into financing commitments and other agreements, arrangements and understandings concerning

the Proposal.

While the Reporting Persons intend to pursue the transaction described

in the Proposal, in connection with their investment in the Issuer, the Reporting Persons may, subject to applicable law and regulation,

further purchase, hold, vote, trade, dispose of or otherwise deal in the Common Shares at times, and in such manner, as they deem advisable

to benefit from, among other things: (1) changes in the market price of the Common Shares; (2) changes in the Issuer’s operations,

business strategy or prospects; or (3) the sale or merger of the Issuer. To evaluate such alternatives, the Reporting Persons will

continue to closely monitor the Issuer’s operations, prospects, business development, management, competitive and strategic matters,

capital structure, and prevailing market conditions, as well as other economic, securities markets and investment considerations. Consistent

with their investment research methods and evaluation criteria, the Reporting Persons may discuss such matters with the management or

Board of Trustees of the Issuer, industry analysts, existing or potential strategic partners, financing sources, competitors and investment

and financing professionals. Such evaluations and discussions may materially affect, and result in, among other things, the Reporting

Persons (1) consummating the transaction contemplated by the Proposal; (2) modifying their ownership of the Common Shares; (3)

proposing changes in the Issuer’s operations, governance or capitalization; or (4) pursuing one or more of the other actions

described in Item 4 of this Schedule 13D.

In addition to the information disclosed in this Schedule 13D, the

Reporting Persons reserve the right to: (1) engage in discussions with other shareholders, potential sources of financing, advisors, and

other relevant parties; (2) formulate other plans and proposals; (3) take any actions with respect to their investment in the Issuer,

including any or all of the actions set forth in Item 4 of this Schedule 13D; and (4) subject to applicable law and regulation, acquire

additional Common Shares or dispose of some or all of the Common Shares beneficially owned by them, in each case in the open market, through

privately negotiated transactions or otherwise. The Reporting Persons may at any time reconsider and/or change their plans or proposals

relating to the foregoing.

| Item 5. | Interest in Securities of the Issuer. |

(a) – (b)

The information required for each Reporting Person

by Item 5 (a) – (b) is set forth in Rows 7 – 13 on pages 1, 2 and 3 of this Schedule 13D and is incorporated herein by reference,

respectively, for each Reporting Person.

The information with respect to the percentage of the outstanding Common

Shares of the Issuer beneficially owned by each Reporting Person is calculated based on the last reported outstanding share information

for the Issuer from its Quarterly Report on Form 10-Q for the quarter ended March 31, 2024:

(c) The transactions in the Common Shares by each

Reporting Person during the past sixty days are set forth in Schedule A and are incorporated herein by reference.

(d) None.

(e) Not applicable.

| Item 6. | Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

The information described under Item 3 regarding

the source of funds used by MCB to purchase the Common Shares reported in this Schedule 13D and the information regarding the Proposal

described under Item 4 are incorporated herein by reference in their entirety.

Except as provided herein, there are no other contracts,

arrangements, understandings or relationships (legal or otherwise) among the Reporting Persons and between any of the Reporting Persons

and any other person with respect to any securities of the Issuer, joint ventures, loan or option arrangements, puts or calls, guarantees

of profits, divisions of profits or loss, or the giving or withholding of proxies, or a pledge or contingency, the occurrence of which

would give another person voting power over the securities of the Issuer.

| Item 7. | Materials to be Filed as Exhibits |

Exhibit 7.01 Proposal from MCB to the Board of Trustees of the Issuer, dated as of June 3, 2024

SIGNATURES

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: June 3, 2024

| |

/s/ P. David Bramble |

| |

David Bramble, Individually, and |

| |

|

| |

On behalf of MCB Acquisitions Manager LLC, as the sole member

of MCB Acquisitions Manager LLC |

| |

|

| |

On behalf of MCB PR Capital LLC, as the sole manager of

MCB PR Capital LLC |

SCHEDULE A

TRANSACTIONS IN THE ISSUER’S SECURITIES

DURING THE LAST 60 DAYS

| Nature of the Transaction | |

Securities Purchased | | |

Price Per Share

($) | | |

Date of Transaction | |

| Purchase of Common Shares | |

| 125,577 | * | |

$ | 12.15976 | | |

| 5/7/2024 | |

| Purchase of Common Shares | |

| 428,770 | * | |

$ | 12.21910 | | |

| 5/8/2024 | |

| Purchase of Common Shares | |

| 7,035 | * | |

$ | 12.23930 | | |

| 5/9/2024 | |

| Purchase of Common Shares | |

| 43,735 | * | |

$ | 12.37160 | | |

| 5/10/2024 | |

| Purchase of Common Shares | |

| 72,646 | * | |

$ | 12.41920 | | |

| 5/13/2024 | |

| Purchase of Common Shares | |

| 25,349 | | |

$ | 12.44870 | | |

| 5/14/2024 | |

| Purchase of Common Shares | |

| 38,077 | * | |

$ | 12.44390 | | |

| 5/15/2024 | |

| Purchase of Common Shares | |

| 17,387 | * | |

$ | 12.44790 | | |

| 5/16/2024 | |

| Purchase of Common Shares | |

| 44,120 | * | |

$ | 12.40730 | | |

| 5/17/2024 | |

| Purchase of Common Shares | |

| 71,454 | * | |

$ | 12.43940 | | |

| 5/20/2024 | |

| Purchase of Common Shares | |

| 291,397 | * | |

$ | 12.60500 | | |

| 5/21/2024 | |

| Purchase of Common Shares | |

| 219,744 | * | |

$ | 12.67300 | | |

| 5/22/2024 | |

| Purchase of Common Shares | |

| 304,073 | * | |

$ | 12.59960 | | |

| 5/23/2024 | |

| Purchase of Common Shares | |

| 90,215 | * | |

$ | 12.68140 | | |

| 5/24/2024 | |

| Purchase of Common Shares | |

| 150,008 | * | |

$ | 12.93270 | | |

| 5/28/2024 | |

| Purchase of Common Shares | |

| 270,413 | * | |

$ | 12.94080 | | |

| 5/29/2024 | |

| |

* |

Represents transactions made on the open market by MCB. |

Other than as disclosed in this Schedule A, there

was no transaction in the Common Shares by the Reporting Persons during the past sixty days.

Exhibit

7.01

2002 Clipper Park Rd. Suite

105 | Baltimore, MD 21211

dbramble@mcbrealestate.com

410-662-0105

STRICTLY PRIVATE

& CONFIDENTIAL

June 3, 2024

Via Email

David K. Holeman, Chief Executive Officer

Whitestone REIT

2600 S. Gessner Rd, Suite 500

Houston, TX 77063

Dear Mr. Holeman:

We have appreciated the time spent together with

you, Ms. Mastandrea and the Whitestone REIT (“Whitestone” or the “Company”) management team and

believe you have assembled a high quality portfolio in attractive markets. To that end, on behalf of MCB Acquisition Company, LLC (through

one or more controlled affiliates “MCB” or “we”), we are pleased to provide you with an all cash

offer to acquire all of the outstanding common shares of Whitestone, including all of the outstanding common partnership interests (“OP

Units”) in Whitestone REIT Operating Partnership, L.P. (the “OP”), at a price of $14.00 per share, subject

to negotiation of satisfactory definitive transaction agreements and the other matters described below. We have spent considerable time

evaluating the Company based on public information, which included accumulating a substantial ownership position in the Company’s

common shares, and we have continued to gain a better understanding of the Company’s operating and investment strategy through the

time and dialogue you have afforded us.

We believe that the non-binding offer set forth

in this letter presents the Company’s shareholders with a highly attractive valuation for the business. The speed and certainty

with which we are prepared to move forward to consummate the transaction would allow the Company’s shareholders to de-risk their

investment and obtain immediate liquidity at a compelling valuation. We are keenly aware of the challenges facing the Company, such as

access to growth capital, and believe that these challenges can best be addressed as a private company with a well-capitalized sponsor.

MCB currently owns 4,690,000 of the Company’s

common shares, representing approximately 9.4% of the Company’s outstanding common shares (based on the number of outstanding common

shares reported by the Company in its Quarterly Report on Form 10-Q filed with the SEC on May 2, 2024).

Why MCB?

MCB has a proven track record of high-performance

investments throughout the continental United States and is a trusted leader in commercial real estate investment. Our company, founded

in 2007, has grown to manage over $3 billion in assets, including over 14.5 million square feet of operating real estate and an additional

4 million square feet of development real estate. We operate across four primary asset classes: retail, industrial, multifamily and healthcare.

MCB leverages our industry relationships and proficiency in acquisitions, development, finance, management, operations, and legal acumen

to deliver strong returns for our investors.

As you are aware, MCB and its principals bring

deep expertise in investing in open air shopping centers. Our retail portfolio today consists of almost 6 million square feet and continues

to expand. MCB actively provides property and asset management services to our own portfolio with our team of over 100 people. The team

has a history of unlocking unique value in retail real estate through active management and leveraging our deep tenant and industry relationships.

We believe our team will complement the Whitestone team to drive further value, with patient and long-term focused private investors.

As a result of this experience, we believe we are well positioned to help Whitestone navigate its next phase of growth.

Our Proposal

With this as background for our interest, and

based on our review of the Company’s public filings, our non-binding proposal includes the following elements:

1. Valuation:

Our proposal represents a premium of 17% to the Company’s 60-day VWAP of $12.01 through May 31, 2024. In addition, the proposal

represents a premium of 7% to the Company’s 52-week high of $13.08, which includes a period that is partially affected by speculation

around proposals that may have been previously made. Our valuation is not only based on our analysis of the Company’s most recent

financial results and acquisition activity, but is also rooted in our extensive familiarity with similar retail assets and with the prior

knowledge and comfort gained from visiting the Company’s assets.

2. Financing:

MCB focuses on creating a capital structure that provides the necessary flexibility to implement our strategic objectives and growth initiatives,

and to execute against both organic and inorganic drivers of growth. We expect to fund the acquisition with a combination of equity and

debt. Our contemplated equity for this transaction is fully committed from discretionary capital managed by MCB. With respect to the debt

portion of the acquisition, we have received a Highly Confident Letter from Wells Fargo with respect to the debt financing needed to complete

the transaction, to be converted to a full commitment at execution of the definitive transaction agreements. The Highly Confident Letter

is attached to this proposal as Appendix A. Any definitive transaction agreement between us and the Company would not be subject to a

financing contingency. Representatives of Wells Fargo are available to address any questions you may have on the proposed debt financing.

3. Internal

Approvals & Conditions: We have reviewed in detail this potential transaction with our Investment Committee and have received

full support to submit this proposal. Any binding offer for the Company on behalf of MCB would require the final approval of our Investment

Committee.

4.

Transaction Documents and Closing Conditions: We expect the transaction’s definitive agreements to contain terms customary

for a public REIT go-private transaction, including a customary condition to closing related to obtaining the approval of the Company’s

shareholders.

5.

Remaining Due Diligence:

This proposal is subject to the completion of our remaining due diligence which would cover certain customary topics, including, but

not limited to the following.

| a. | Historical and projected financial information at both the corporate and property-level |

| b. | Balance sheet and other details covering the existing capital structure of the company |

| c. | Property-level information for the operating portfolio and detail on land sites held for development |

| d. | Existing tenant information and leases, including detail on any pending leases or leasing discussions |

| e. | Customary corporate information including organizational, tax, accounting, employment and other material

items |

| f. | Review of pending litigation and other legal matters |

| g. | Such other information that we and our counsel may request under separate cover |

6. Advisors:

MCB has engaged Vinson & Elkins L.L.P. as lead counsel in connection with this transaction, and we would expect to employ their

services in conducting legal due diligence and negotiating transaction agreements at the appropriate time. We have also retained Wells

Fargo as financial advisor to assist us in analyzing, structuring, and negotiating the financial aspects of the proposed transaction.

We are prepared to enter into a mutually acceptable confidentiality agreement with the Company to facilitate the exchange of information.

As mentioned, we have already spent significant

time underwriting the Company and its portfolio. This will enable us to conduct a streamlined and efficient due diligence process in coordination

with our advisors. We expect to complete our remaining due diligence and to be in a position to execute definitive documents and publicly

announce a transaction in 30 to 45 days assuming the Company is appropriately responsive to our requests.

6.

Disclosures: We expect to file a Schedule 13D, as required under applicable securities laws, disclosing our ownership position

and this proposal promptly after we deliver this proposal to you.

7.

Contacts: Should you have any questions regarding our proposal, we have provided our executive acquisition and investment team’s

contact information in the table below.

| Name |

Title |

Phone |

Email |

| P. David Bramble |

Managing Partner, Co-founder |

(410) 662-005 |

dbramble@mcbrealestate.com |

| Mike Trail |

Principal & CIO |

(410) 662-0107 |

mtrail@mcbrealestate.com |

| Brian Mendell |

Managing Director |

(646) 942-6980 |

bmendell@mcbrealestate.com |

While we would like to move forward as quickly

as possible to sign definitive transaction agreements, as we are sure you understand, our proposal does not constitute a binding offer

to purchase the Company and we may terminate negotiations at any time for any reason, and thus no legal obligation to purchase the Company

will exist until definitive transaction agreements have been executed and delivered.

We are enthusiastic about this opportunity and

are eager to continue our due diligence. MCB has established its reputation for successfully managing and maximizing the value of commercial

real estate. Given our investment philosophy and experience base, we believe that MCB would be an outstanding partner for the Whitestone

management team as it works to increase the long-term value of the Company.

We would welcome the opportunity to present our

proposal in more detail to the Company’s board of trustees and its advisors.

We look forward to hearing from you soon.

Sincerely,

/s/ P. David Bramble

P. David Bramble, Managing Partner

cc:

Via email, under separate cover:

Peter Pinkard, Managing Partner

Gina Baker Chambers, President

Drew Gorman, Principal

Mike Trail, Chief Investment Officer

Brian Mendell, Managing Director

Appendix

A: Highly Confident Letter

STRICTLY PRIVATE & CONFIDENTIAL

June 3, 2024

David Bramble

MCB Acquisition Company, LLC

2002 Clipper Park Rd, Suite 105

Baltimore, MD 21211

Dear Mr. Bramble,

You have informed Wells Fargo Securities, LLC

(“Wells Fargo”) that MCB Acquisition Company, LLC (“MCB” or the “Company”) intends to submit an indicative

bid for the proposed acquisition (the “Acquisition”) of Whitestone REIT (“Whitestone” or the “Target”).

In connection with our evaluation of the proposed

Transactions (as defined below), we have reviewed the preliminary information provided to us by the Company. Based on the above referenced

information and taking into account current market conditions, we are pleased to inform you that, as of the date hereof, we are highly

confident that funded debt financing of up to $800MM, can be arranged by us via the capital markets to consummate the Acquisition and

refinance existing debt of the Company (the “Financing” and together with the Acquisition, the “Transactions”).

It should be noted that Wells Fargo’s comments

about the feasibility of the Financing does not constitute or give rise to (i) any legal obligation on the part of Wells Fargo, or any

of its affiliates, to arrange, underwrite or provide, or commit to arrange, underwrite or provide, the Financing or any other financing

for the Transactions or otherwise; or (ii) any representations or warranties in respect of any of the foregoing. Any such obligations

or liabilities would arise only under separate written agreements in form and substance satisfactory to Wells Fargo.

This letter is confidential and is delivered to

you on the understanding that neither this letter nor any of its terms or substance has been or shall be disclosed, directly or indirectly,

by you to any other person without our prior written consent except you may disclose this letter: (i) to your directly involved officers,

financial advisors, accountants and lawyers, (ii) subject to their acknowledgment that they may not rely on this letter, to the Target’s

Board of Directors, the senior managers of the Target, and the Target’s financial advisors and lawyers and (iii) as may be compelled

in a judicial or administrative proceeding or as otherwise required by law (in which case you agree to inform us promptly in advance of

disclosure thereof); provided that in the case of clause (i) and clause (ii) such disclosure shall be on a confidential and need-to-know

basis only.

This letter shall be governed by and construed

in accordance with New York law.

Based upon the information we have been provided,

we are prepared to continue our diligence efforts in parallel with your process in connection with the Acquisition.

We appreciate the opportunity to work with you

on this important transaction. Should you have any questions or require any clarification, please do not hesitate to contact any of the

Wells Fargo team.

Sincerely,

Wells Fargo Securities, LLC

/s/ Brendan M. Poe

Brendan M. Poe

Managing Director

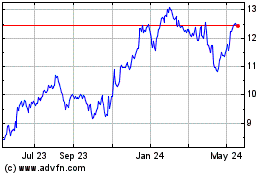

Whitestone REIT (NYSE:WSR)

Historical Stock Chart

From May 2024 to Jun 2024

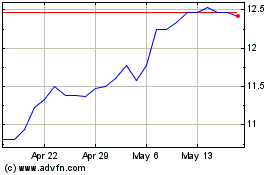

Whitestone REIT (NYSE:WSR)

Historical Stock Chart

From Jun 2023 to Jun 2024