Exxon Mobil Corporation (NYSE:XOM):

Fourth Quarter

Twelve Months 2013

2012 % 2013

2012 %

Earnings

$ Millions

8,350 9,950 -16

32,580 44,880 -27 $ Per

Common Share Assuming Dilution

1.91 2.20 -13

7.37

9.70 -24 Capital and Exploration Expenditures - $ Millions

9,924 12,443 -20

42,489 39,799 7

EXXONMOBIL CHAIRMAN REX W. TILLERSON

COMMENTED:

“ExxonMobil delivered strong business results in 2013 while

remaining focused on improving profitability and long-term

shareholder value. Disciplined use of capital, project

execution and asset management are positioning the company to

deliver sustained superior financial performance across the

business cycle. Over the next two years, ExxonMobil will

start up numerous major projects delivering profitable new supplies

of oil and natural gas while strengthening our refining and

chemicals businesses.

“Fourth quarter 2013 earnings were $8.4 billion, down

16% from the fourth quarter of 2012. Full year 2013 earnings

were $32.6 billion, down 27% from 2012.

“Capital and exploration expenditures were $9.9 billion in

the fourth quarter and $42.5 billion for the year, including $4.3

billion for acquisitions.

“In 2013, the Corporation distributed $26 billion to

shareholders through dividends and share purchases to reduce shares

outstanding.”

FOURTH QUARTER HIGHLIGHTS

- Earnings of $8,350 million

decreased $1,600 million or 16% from the fourth quarter of

2012.

- Earnings per share (assuming dilution)

were $1.91, a decrease of 13% from the fourth quarter of 2012.

- Capital and exploration expenditures

were $9.9 billion, down 20% from the fourth quarter of

2012.

- Oil-equivalent production decreased

1.8% from the fourth quarter of 2012. Excluding the impacts of

entitlement volumes, OPEC quota effects and divestments, production

was essentially flat, with liquids volumes up 3.0%.

- Cash flow from operations and asset

sales was $12.0 billion, including proceeds associated with

asset sales of $1.8 billion.

- Share purchases to reduce shares

outstanding were $3 billion.

- Dividends per share of $0.63 increased

11% compared to the fourth quarter of 2012.

- Statoil and ExxonMobil announced the

fifth discovery in Block 2 offshore Tanzania. The discovery of an

additional 2-3 trillion cubic feet of natural gas in place in the

Mronge-1 well brings the total gas resource estimate to 17-20

trillion cubic feet.

- The Alaska LNG project announced

selection of a lead site for the liquefied natural gas plant in the

Nikiski area on the Kenai Peninsula. Together with the ongoing

multi-year summer field work, this is a key step forward for the

project and continued progress toward building Alaska’s energy

future.

- ExxonMobil commissioned a new

hydrotreater at its Singapore refinery, which increased the site’s

ultra-low sulfur diesel production capacity by 62 thousand

barrels per day. The new unit, along with the recently completed

petrochemical expansion project at our Singapore complex, positions

ExxonMobil to competitively deliver high-value products to the

growing Asia Pacific region.

Fourth Quarter 2013 vs. Fourth Quarter

2012

Upstream earnings were $6,786 million in the fourth quarter

of 2013, down $976 million from the fourth quarter of 2012.

Higher natural gas realizations, partly offset by lower liquids

realizations, increased earnings by $60 million. Production

volume and mix effects decreased earnings by $550 million. All

other items, including higher operating expenses, decreased

earnings by $490 million.

On an oil-equivalent basis, production decreased 1.8% from the

fourth quarter of 2012. Excluding the impacts of entitlement

volumes, OPEC quota effects and divestments, production was

essentially flat.

Liquids production totaled 2,235 kbd (thousands of barrels

per day), up 32 kbd from the fourth quarter of 2012. Excluding

the impacts of entitlement volumes, OPEC quota effects and

divestments, liquids production was up 3.0%, as project ramp-up,

mainly in Canada and Nigeria, and lower downtime were partially

offset by field decline.

Fourth quarter natural gas production was 11,887 mcfd

(millions of cubic feet per day), down 654 mcfd from 2012.

Excluding the impacts of entitlement volumes and divestments,

natural gas production was down 3.9%, as field decline was

partially offset by project ramp-up and increased demand.

Earnings from U.S. Upstream operations were $1,186 million,

$418 million lower than the fourth quarter of 2012. Non-U.S.

Upstream earnings were $5,600 million, down $558 million

from the prior year.

Downstream earnings were $916 million, down

$852 million from the fourth quarter of 2012. Weaker margins,

mainly in refining, decreased earnings by $680 million. Volume and

mix effects increased earnings by $110 million. All other

items, including higher operating expenses and unfavorable foreign

exchange impacts, decreased earnings by $280 million.

Petroleum product sales of 5,994 kbd were 114 kbd lower

than last year's fourth quarter.

Earnings from the U.S. Downstream were $597 million, down

$100 million from the fourth quarter of 2012. Non-U.S.

Downstream earnings of $319 million were $752 million

lower than the prior year.

Chemical earnings of $910 million were $48 million

lower than the fourth quarter of 2012. Weaker margins, mainly in

specialties, decreased earnings by $70 million, while volume

and mix effects increased earnings by $50 million. All other

items decreased earnings by $30 million. Fourth quarter prime

product sales of 6,077 kt (thousands of metric tons) were

176 kt higher than last year's fourth quarter.

Corporate and financing expenses were $262 million for the

fourth quarter of 2013, down $276 million from the fourth

quarter of 2012, reflecting favorable tax impacts.

During the fourth quarter of 2013, Exxon Mobil Corporation

purchased 36 million shares of its common stock for the

treasury at a gross cost of $3.3 billion. These purchases

included $3.0 billion to reduce the number of shares

outstanding, with the balance used to acquire shares in conjunction

with the company’s benefit plans and programs. Share purchases to

reduce shares outstanding are currently anticipated to equal

$3 billion in the first quarter of 2014. Purchases may be made

in both the open market and through negotiated transactions, and

may be increased, decreased or discontinued at any time without

prior notice.

Full Year 2013 vs. Full Year

2012

Earnings of $32,580 million decreased $12,300 million

from 2012. Earnings per share decreased 24% to $7.37.

FULL YEAR HIGHLIGHTS

- Earnings were $32,580 million,

down $12,300 million or 27% from 2012. Lower net gains from

divestments impacted earnings by $8.6 billion.

- Earnings per share decreased 24% to

$7.37. Excluding net gains from divestments, earnings per share

decreased 6%.

- Oil-equivalent production was down 1.5%

from 2012. Excluding the impacts of entitlement volumes, OPEC quota

effects and divestments, production was essentially flat.

- Cash flow from operations and asset

sales was $47.6 billion, including proceeds associated with

asset sales of $2.7 billion.

- The Corporation distributed

$26 billion to shareholders in 2013 through dividends and

share purchases to reduce shares outstanding.

- Capital and exploration expenditures

were $42.5 billion, including $4.3 billion for acquisitions,

up 7% from 2012.

Upstream earnings were $26,841 million, down

$3,054 million from 2012. Higher gas realizations, partially

offset by lower liquids realizations, increased earnings by

$390 million. Production volume and mix effects decreased

earnings by $910 million. All other items, including lower net

gains from asset sales, mainly in Angola, and higher expenses,

reduced earnings by $2.5 billion.

On an oil-equivalent basis, production was down 1.5% compared to

2012. Excluding the impacts of entitlement volumes, OPEC quota

effects and divestments, production was essentially flat.

Liquids production of 2,202 kbd increased 17 kbd

compared with 2012. Excluding the impacts of entitlement volumes,

OPEC quota effects and divestments, liquids production was up 1.6%,

as project ramp-up and lower downtime were partially offset by

field decline.

Natural gas production of 11,836 mcfd decreased

486 mcfd from 2012. Excluding the impacts of entitlement

volumes and divestments, natural gas production was down 1.5%, as

field decline was partially offset by higher demand, lower

downtime, and project ramp-up.

Earnings from U.S. Upstream operations for 2013 were

$4,191 million, up $266 million from 2012. Earnings

outside the U.S. were $22,650 million, down

$3,320 million from the prior year.

Downstream earnings of $3,449 million decreased

$9,741 million from 2012 driven by the absence of the

$5.3 billion gain associated with the Japan restructuring.

Lower margins, mainly refining, decreased earnings by

$2.9 billion. Volume and mix effects decreased earnings by

$310 million. All other items, including higher operating

expenses, unfavorable foreign exchange impacts, and lower

divestments, decreased earnings by $1.2 billion. Petroleum

product sales of 5,887 kbd decreased 287 kbd from

2012.

U.S. Downstream earnings were $2,199 million, down

$1,376 million from 2012. Non-U.S. Downstream earnings were

$1,250 million, a decrease of $8,365 million from the

prior year.

Chemical earnings of $3,828 million were $70 million

lower than 2012. The absence of the gain associated with the Japan

restructuring decreased earnings by $630 million. Higher

margins increased earnings by $480 million, while volume and

mix effects increased earnings by $80 million. Prime product

sales of 24,063 kt were down 94 kt from 2012.

Corporate and financing expenses were $1,538 million, down

$565 million from 2012, as favorable tax impacts were

partially offset by the absence of the Japan restructuring

gain.

Gross share purchases for 2013 were $16 billion, reducing

shares outstanding by 177 million shares.

Estimates of key financial and operating data follow.

ExxonMobil will discuss financial and operating results and

other matters on a webcast at 10 a.m. Central time on January 30,

2014. To listen to the event live or in archive, go to our

website at exxonmobil.com.

Cautionary statement

Statements relating to future plans, projections, events or

conditions are forward-looking statements. Actual results,

including project plans, costs, timing, and capacities; capital and

exploration expenditures; resource recoveries; and share purchase

levels, could differ materially due to factors including: changes

in oil or gas prices or other market or economic conditions

affecting the oil and gas industry, including the scope and

duration of economic recessions; the outcome of exploration and

development efforts; changes in law or government regulation,

including tax and environmental requirements; the outcome of

commercial negotiations; changes in technical or operating

conditions; and other factors discussed under the heading "Factors

Affecting Future Results" in the “Investors” section of our website

and in Item 1A of ExxonMobil's 2012 Form 10-K. We assume no duty to

update these statements as of any future date.

Frequently used terms

This press release includes cash flow from operations and asset

sales, which is a non-GAAP financial measure. Because of the

regular nature of our asset management and divestment program, we

believe it is useful for investors to consider proceeds associated

with the sales of subsidiaries, property, plant and equipment, and

sales and returns of investments together with cash provided by

operating activities when evaluating cash available for investment

in the business and financing activities. A reconciliation to net

cash provided by operating activities is shown in Attachment II.

References to quantities of oil or natural gas may include amounts

that we believe will ultimately be produced, but that are not yet

classified as “proved reserves” under SEC definitions. Further

information on ExxonMobil's frequently used financial and operating

measures and other terms is contained under the heading "Frequently

Used Terms" available through the “Investors” section of our

website at exxonmobil.com.

Reference to Earnings

References to corporate earnings mean net income attributable to

ExxonMobil (U.S. GAAP) from the consolidated income statement.

Unless otherwise indicated, references to earnings, Upstream,

Downstream, Chemical and Corporate and Financing segment earnings,

and earnings per share are ExxonMobil's share after excluding

amounts attributable to noncontrolling interests.

The term “project” as used in this release can refer to a

variety of different activities and does not necessarily have the

same meaning as in any government payment transparency reports.

Attachment I

EXXON MOBIL CORPORATION

FOURTH QUARTER

2013

(millions of dollars, unless noted)

Fourth

Quarter Twelve Months

2013 2012 2013

2012 Earnings / Earnings Per Share Total

revenues and other income

110,860 114,699

438,255

480,681 Total costs and other deductions

96,144 96,999

380,544 401,955 Income before income taxes

14,716

17,700

57,711 78,726 Income taxes

6,073 7,398

24,263 31,045 Net income including noncontrolling interests

8,643 10,302

33,448 47,681 Net income attributable to

noncontrolling interests

293 352

868 2,801 Net income

attributable to ExxonMobil (U.S. GAAP)

8,350 9,950

32,580 44,880 Earnings per common share (dollars)

1.91 2.20

7.37 9.70 Earnings per common share

- assuming dilution (dollars)

1.91 2.20

7.37 9.70

Other Financial Data Dividends on common stock

Total

2,750 2,592

10,875 10,092 Per common share

(dollars)

0.63 0.57

2.46 2.18 Millions of

common shares outstanding At December 31

4,335 4,502 Average

- assuming dilution

4,361 4,541

4,419 4,628

ExxonMobil share of equity at December 31

174,003 165,863

ExxonMobil share of capital employed at December 31

200,368

182,781 Income taxes

6,073 7,398

24,263 31,045

Sales-based taxes

7,663 7,752

30,589 32,409 All other

taxes

9,377 8,966

36,396 38,857 Total taxes

23,113 24,116

91,248 102,311 ExxonMobil share

of income taxes of equity companies

1,340 1,360

6,061

5,859

Attachment II

EXXON MOBIL CORPORATION

FOURTH QUARTER

2013

(millions of dollars)

Fourth Quarter

Twelve Months 2013

2012 2013 2012

Earnings (U.S. GAAP) Upstream United States

1,186

1,604

4,191 3,925 Non-U.S.

5,600 6,158

22,650

25,970 Downstream United States

597 697

2,199 3,575

Non-U.S.

319 1,071

1,250 9,615 Chemical United States

808 728

2,755 2,220 Non-U.S.

102 230

1,073 1,678 Corporate and financing

(262 )

(538 )

(1,538 ) (2,103 ) Net income attributable to

ExxonMobil

8,350 9,950

32,580 44,880

Cash flow from operations and asset sales (billions of

dollars) Net cash provided by operating activities (U.S.

GAAP)

10.2 13.2

44.9 56.1 Proceeds associated

with asset sales

1.8 0.8

2.7 7.7 Cash flow

from operations and asset sales

12.0 14.0

47.6 63.8

Attachment III

EXXON MOBIL CORPORATION

FOURTH QUARTER

2013

Fourth Quarter Twelve

Months 2013 2012

2013 2012 Net production of crude

oil, natural gas liquids, bitumen and synthetic oil, thousands of

barrels daily (kbd) United States

446 430

431 418

Canada/South America

320 268

280 251 Europe

194 205

190 207 Africa

455 479

469 487

Asia

775 776

784 772 Australia/Oceania

45 45

48 50 Worldwide

2,235 2,203

2,202 2,185

Natural gas production available for sale, millions of cubic feet

daily (mcfd) United States

3,455 3,747

3,545 3,822

Canada/South America

365 346

354 362 Europe

3,508 3,627

3,251 3,220 Africa

4 15

6

17 Asia

4,273 4,477

4,329 4,538 Australia/Oceania

282 329

351 363 Worldwide

11,887 12,541

11,836 12,322 Oil-equivalent production (koebd)1

4,216 4,293

4,175 4,239

1 Gas converted to oil-equivalent at 6

million cubic feet = 1 thousand barrels.

Attachment IV

EXXON MOBIL CORPORATION

FOURTH QUARTER

2013

Fourth Quarter Twelve

Months 2013 2012

2013 2012 Refinery throughput

(kbd) United States

1,823 1,856

1,819 1,816 Canada

387 468

426 435 Europe

1,310 1,499

1,400 1,504 Asia Pacific

744 823

779 998 Other

188 191

161 261 Worldwide

4,452 4,837

4,585 5,014 Petroleum product sales (kbd) United

States

2,712 2,737

2,609 2,569 Canada

472 470

464 453 Europe

1,458 1,537

1,497 1,571 Asia

Pacific

882 896

878 1,016 Other

470 468

439 565 Worldwide

5,994 6,108

5,887 6,174

Gasolines, naphthas

2,533 2,500

2,418 2,489

Heating oils, kerosene, diesel

1,881 1,881

1,838

1,947 Aviation fuels

443 487

462 473 Heavy fuels

416 499

431 515 Specialty products

721 741

738 750 Worldwide

5,994 6,108

5,887 6,174

Chemical prime product sales, thousands of metric tons (kt)

United States

2,486 2,378

9,679 9,381 Non-U.S.

3,591 3,523

14,384 14,776 Worldwide

6,077

5,901

24,063 24,157

Attachment V

EXXON MOBIL

CORPORATION

FOURTH QUARTER

2013

(millions of dollars)

Fourth Quarter

Twelve Months 2013

2012 2013 2012

Capital and Exploration Expenditures Upstream United States

2,098 4,036

9,145 11,080 Non-U.S.

6,534 7,328

29,086 25,004 Total

8,632 11,364

38,231 36,084

Downstream United States

264 192

951 634 Non-U.S.

409 479

1,462 1,628 Total

673 671

2,413

2,262 Chemical United States

369 129

963 408 Non-U.S.

248 258

869 1,010 Total

617 387

1,832

1,418 Other

2 21

13 35 Worldwide

9,924 12,443

42,489 39,799 Exploration

expenses charged to income included above Consolidated affiliates

United States

70 101

395 392 Non-U.S.

518 349

1,573 1,441 Equity companies - ExxonMobil share United

States

15 6

19 9 Non-U.S.

109 2

441 17

Worldwide

712 458

2,428 1,859

Attachment VI

EXXON MOBIL CORPORATION

EARNINGS

$ Millions $ Per Common

Share1

2009

First Quarter 4,550 0.92 Second Quarter 3,950 0.82 Third Quarter

4,730 0.98 Fourth Quarter 6,050 1.27 Year 19,280 3.99

2010

First Quarter 6,300 1.33 Second Quarter 7,560 1.61 Third Quarter

7,350 1.44 Fourth Quarter 9,250 1.86 Year 30,460 6.24

2011

First Quarter 10,650 2.14 Second Quarter 10,680 2.19 Third Quarter

10,330 2.13 Fourth Quarter 9,400 1.97 Year 41,060 8.43

2012

First Quarter 9,450 2.00 Second Quarter 15,910 3.41 Third Quarter

9,570 2.09 Fourth Quarter 9,950 2.20 Year 44,880 9.70

2013

First Quarter 9,500 2.12 Second Quarter 6,860 1.55 Third Quarter

7,870 1.79 Fourth Quarter 8,350 1.91 Year 32,580 7.37

1

Computed using the average number of

shares outstanding during each period.

The sum of the four quarters may not add to the full year

.

ExxonMobilMedia Relations, 972-444-1107

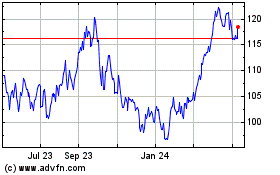

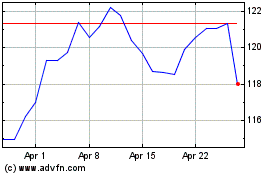

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Dec 2023 to Dec 2024