U.S.

Securities and Exchange Commission

Washington,

DC 20549

Notice

of Exempt Solicitation

Submitted

Pursuant to Rule 14a-6(g)

1. Name of the Registrant:

Exxon Mobil Corporation

2. Name of person relying

on exemption: The Comptroller of the City of New York, on behalf of the New York City Police Pension Fund.

3. Address of person relying

on exemption: 1 Centre Street, 8th Floor, New York, New York 10007

4. Written materials required

to be submitted pursuant to Rule 14a-6(g)(1):

| · | Letter to Exxon Mobil Corporation shareholders. |

May 21, 2024

We are calling on the world’s largest asset managers

to vote to hold ExxonMobil’s board of directors accountable for the company’s actions to undermine shareholder rights by voting

against Executive Chair and CEO Darren Woods and Lead Independent Director and Nominating and Governance Committee Chair Joseph Hooley

at the 2024 annual meeting.

ExxonMobil’s recent unprecedented attacks on

its own investors, the Rule 14a-8 shareholder proposal process, and the Securities and Exchange Commission (SEC) no action letter process

threaten the very corporate governance system that many stewardship efforts rely on. In January, ExxonMobil side-stepped the established

SEC no-action process and sued two of its own investors, Arjuna Capital and Follow This, after they filed a climate shareholder proposal.

While we take no position on the merits of the proposal, we are deeply concerned that ExxonMobil’s actions are aimed at curtailing

an important shareholder right. Most significantly, ExxonMobil is pursuing the lawsuit even though the proponents withdrew the proposal

in February, and have committed to not resubmit it in the future. In addition, the proxy statement arbitrarily discriminates between two

classes of shareowners – “our investors” and “other shareholders” – and claims that

only the former are deserving participants in shareholder democracy.

ExxonMobil’s

lawsuit threatens shareholder rights by intimidating investors who exercise their rights to submit shareholder proposals, weakening the

Rule 14(a)-8 shareholder proposal process, and undermining the role of the SEC’s no action letter process. Shareholder resolutions

allow investors to protect their interests by voicing their concerns to the board and executive leadership and requesting timely disclosure

and action on potential, emerging, or neglected risks before they become material financial liabilities.1 The SEC’s

Division of Corporation Finance – which most market participants view as a “fair arbiter,” according to the Council

of Institutional Investors – oversees an efficient and cost-effective process for helping companies determine whether to include

a particular shareholder proposal on its proxy.2 We believe that ExxonMobil’s decision to bypass the SEC’s no-action

process is being used to set the stage for other companies, who may likewise opt for litigation over actually engaging their investors.3

_________________________

1

See, for example, Ceres, US SIF, and the Interfaith Center on Corporate Responsibility, “The Business Case for the Current

SEC Shareholder Proposal Process,” April 2017,

https://www.ussif.org/files/Public_Policy/Comment_Letters/Business%20Case%20for%2014a-8.pdf,

and Ceres, Environmental Defense Fund, KKS Advisors, Meridian Institute, and the Gordon and Betty Moore Foundation, "The

Role of Investors in Supporting Better Corporate ESG Performance: Influence Strategies for Sustainable and Long-Term Value

Creation", February 2019, https://assets.ceres.org/sites/default/files/reports/2019-04/Investor_Influence_report.pdf.

2

Council of Institutional Investors, “Leading Investor Group Defends SEC as Fair Arbiter of Shareholder Proposals as ExxonMobil

Goes to Court,” April 8, 2024, https://www.cii.org/feb82024-press-release-exxon.

3

Charles Crain, vice president at the National Association of Manufacturers, told National

Public Radio that other corporations are watching the ExxonMobil case for precisely this reason.

We believe that ExxonMobil’s attempts to undermine

shareholder rights reflect a fundamental failure of board oversight and a waste of corporate assets on litigation. That’s why at

the company’s upcoming annual meeting on May 29th, shareholders must vote to hold board leadership – particularly Executive

Chair and CEO Darren Woods and Lead Independent Director and Nominating and Governance Committee Chair Joseph Hooley – accountable

by voting against them. Voting to reelect the entire board would not only endorse ExxonMobil’s actions, but also potentially

pave the way for other companies to undertake similar actions against investors seeking to voice concerns about how poor corporate governance

and risk management can erode shareholder value.

Prominent members of the institutional investor ecosystem

are speaking out and encouraging director accountability at ExxonMobil. As the world’s largest asset managers with holdings that

amount to a 38 percent stake in ExxonMobil, your votes will be critical in determining the outcome of this month’s director elections.

We call on you to vote to protect shareholder voice – a key pillar of corporate governance and public equity markets.

Signed,

Brad Lander, New York City Comptroller

Fiona Ma, California

State Treasurer

Erick Russell, Connecticut Treasurer

Zach Conine, Nevada State Treasurer

Tobias Read, Oregon State Treasurer

Mike

Pieciak, Vermont State Treasurer

Mike Pellicciotti, Washington State Treasurer*

Brooke

Lierman, Maryland State Comptroller**

David McCall, Trustee, United Steelworkers International

Union Staff Pension Plan

Brandon Rees, Trustee, AFL-CIO Staff Retirement Plan

Theresa Taylor, CalPERS Board of Administration

Ramon

Rubalcava, CalPERS Board of Administration

Yvonne Walker, CalPERS Board of Administration

Fund names and affiliations are listed for identification purposes

only.

* Washington State Treasurer Pellicciotti has signed on solely

in his official capacity as State Treasurer

**Maryland State Comptroller Lierman has signed on solely as

an elected official

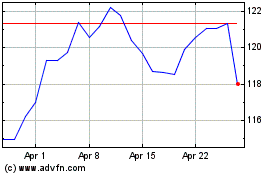

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Nov 2024 to Dec 2024

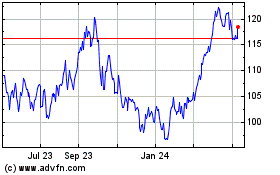

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Dec 2023 to Dec 2024