ISE Stock Exchange Announces Pricing Changes

April 23 2008 - 8:30AM

Business Wire

The International Securities Exchange (ISE) today announced that

the ISE Stock Exchange will introduce two new fee changes. The

first is a tiered rebate structure for its displayed market and the

second is a simplified pricing structure with a lower initial fee

for MidPoint Match�, its non-displayed liquidity pool. Effective

May 1, 2008, liquidity providers on the ISE Stock Exchange�s

displayed market will receive an increased rebate of $0.0035 per

share across all tapes when the monthly average daily volume (ADV)

of executed maker shares is over 5 million. The first 5 million

shares per day will continue to receive a rebate of $0.0032 per

share. The taker price per share will remain at $0.0030 for all

volume levels. As part of the pricing changes, the ISE Stock

Exchange will also simplify the fees for MidPoint Match by

introducing a 3-tiered structure with a lower starting level of

$0.0015 per share for its initial pricing tier, which applies to

members trading an ADV of up to 1 million shares. The second tier,

for ADV between 1 million and 3 million shares, is $0.0010 per

share. Once volume exceeds the 3 million share ADV threshold of the

third tier, fees are adjusted retroactively so that a $0.0010 per

share fees applies to all volume. �Our goal is to continue to

attract liquidity to our marketplace,� said Andrew Brenner, head of

the ISE Stock Exchange, �We are pleased to offer our members the

industry�s highest rebate that is consistent across all three tapes

as well as even more competitive fees for orders in MidPoint Match.

We believe this new pricing structure will provide an added

incentive for traders to send their orders to the ISE Stock

Exchange, enabling them to receive the benefits of price

improvement.� The ISE Stock Exchange members received more than $14

million in price improvement during the first quarter of 2008.

These fee changes are subject to filing with the SEC. ISE�s

complete fee schedule is available at www.ise.com/fees. Note: The

maker rebate excludes order delivery orders and executions on

securities priced below $1.00. ISE Background The International

Securities Exchange operates a family of fully electronic trading

platforms, creating efficient markets through innovative technology

and market structure. ISE�s markets portfolio consists of an

options exchange and a stock exchange. As the world�s largest

equity options trading venue, ISE offers options on equities, ETFs,

indexes, and FX. The ISE Stock Exchange trades approximately 6,000

products, and is the only fully electronic equities platform that

provides the opportunity for continuous price improvement through

the interaction of its non-displayed liquidity pool, MidPoint

Match, and its displayed stock market. ISE Alternative Markets is

scheduled to launch in 2008 and will offer a parimutuel trading

platform for derivatives auctions. To complement its markets and

enable investors to trade smarter, ISE creates innovative new

products including a portfolio of proprietary indexes and enhanced

market data for sophisticated investors. ISE is a wholly owned

subsidiary of Eurex, a leading global derivatives exchange. Eurex

itself is jointly owned by Deutsche B�rse AG (Ticker: DB1) and SWX

Swiss Exchange. Together, Eurex and ISE are the global market

leader in individual equity and equity index derivatives.

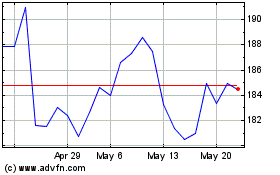

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Feb 2025 to Mar 2025

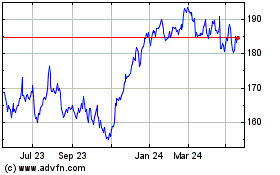

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Mar 2024 to Mar 2025

Real-Time news about Deutsche Boerse AG (Tradegate (DE)): 0 recent articles

More The International Securities Exchange News Articles