(all numbers in this release are in US dollars (US$) unless

otherwise noted) Alaris Equity Partners Income Trust (the

"

Trust") (TSX: AD.UN) is pleased to announce that

its subsidiary, Alaris Equity Partners USA Inc. (collectively, with

the Trust and its other subsidiaries, "

Alaris")

has made an investment of $21.0 million into Berg Demo Holdings,

LLC ("

Berg") (the “

Berg

Investment”) and $61.1 million into Professional Electric

Contractors of Connecticut, Inc. ("

PEC") (the

"

PEC Investment"). Alaris is also

pleased to announce the redemption of Alaris' investment in Unify

Consulting LLC ("

Unify"), which closed in

December, and resulted in gross proceeds of $12.3 million to Alaris

(the "

Unify Redemption").

“A productive start to 2025 with the closing of

two new partnerships and the successful exit of another. Berg and

PEC both signify the forming of partnerships with very strong

entrepreneurs. David Berg and Jim Bisson from Berg and PEC

respectively are exactly what we look for in partners. Long track

records of success and a strong passion to continue to grow their

businesses. Both partners have the capacity and desire to grow

through acquisitions in addition to continued organic growth.

I’d like to thank Darren Alger and his team at

Unify for a wonderful eight years as our partner. Alaris originally

funded a management buyout for Darren and we are proud of how well

he has done as majority owner. Crystallizing another investment

with an IRR of 20% is also an excellent result for our management

team,” said Steve King, Chief Executive Officer, Alaris.

Berg Investment

The Berg Investment consists of: (i) $17.15

million (the "Berg Preferred Contribution")

of preferred equity, entitling Alaris to an initial annualized

distribution of $2.40 million (the "Berg

Distribution"); and (ii) $3.85 million

(the "Berg Common Equity") for a minority

common equity ownership in Berg. The Berg Distribution will reset

annually based on the percentage change in gross profit, subject to

a collar of +/- 7%.

Berg has an earnings coverage ratio between 1.5x

and 2.0x based on Berg's trailing twelve-month financial results

and giving effect to certain other changes to Berg's capital

structure. The Berg Investment will be used for capital investment

and to provide partial liquidity to equity holders.

"We are thrilled to partner with Alaris, a

partnership that strengthens our leadership team’s ability to drive

future growth. As a third-generation demolition, scrap, and

hazardous materials company, Berg has built a legacy of excellence.

With Alaris’s strategic support and expertise, we are confident

that Berg will continue to thrive as an industry leader for

generations to come," said David Berg, Founder, Berg.

Berg is a leading demolition solutions provider

serving public, commercial and industrial end markets in the

Baltimore and DC, Maryland & Virginia (“DMV”) metropolitan area

in the United States. Founded in 1998 by David Berg and

headquartered in Baltimore, MD, Berg has become the preeminent

hazardous material abatement, selective structural and building

razing operation in the region.

PEC Investment

The PEC Investment of $61.1 million consists of

a $37.0 million investment in debt and preferred equity (the

"PEC Contribution") as well as an investment of

$24.1 million in exchange for a minority common equity ownership in

PEC (the "PEC Common Equity"). Included within the

$37.0 million PEC Contribution is $10.0 million of preferred equity

redeemable at par. The PEC Contribution will result in an

annualized cash distribution to Alaris of $5.18 million (the

"PEC Distribution"), an initial combined annual

yield of 14% and will reset annually +/- 7% based on changes in

PEC’s revenue. The proceeds from the PEC Investment were used for

partial liquidity to existing PEC shareholders.

PEC has an earnings coverage ratio between 1.5x

and 2.0x, based on PEC’s trailing twelve-month financial results

and giving effect to changes to PEC’s capital structure following

the Alaris investment.

“When we first met Alaris, we liked their people

and their unique model immediately; Alaris' combination of

financial strength and M&A acumen will allow us to focus on

growth, while their approach recognizes our desire to protect and

preserve PEC's culture, which has always been a competitive

advantage and our defining attribute,” said Jim Bisson, Jr.,

President and Chief Executive Officer, PEC.

PEC is a full-service electrical contracting

firm with a broad range of capabilities ranging from commercial

installations, historical structural retrofits and large scale

Photovoltaic (PV) projects. In addition, through its subsidiary

North American Renewables, Inc, PEC is a leading solar engineering,

procurement and construction (“EPC”) contractor. PEC serves the

Greater New England and New York area.

Unify Redemption

Alaris successfully exited its partnership with

Unify after eight years resulting in total gross proceeds over the

life of the investment of CAD$51.6 million. Alaris’ total return on

the Unify investment is CAD$38.6 million, equating to an unlevered

IRR of 20% and MOIC of 1.9x.

Following the Berg and PEC Investment, and the

Unify Redemption, Alaris will have approximately CA$412.9 million

drawn on its senior credit facility (the

"Facility") and $87.1 million available for

investment purposes while the total senior debt to EBITDA on a

proforma basis is approximately 2.43x. Alaris estimates its run

rate payout ratio to be approximately 57.6% following today’s

announcement.

About Alaris:

The Trust, through its subsidiaries, invests in

a diversified group of private businesses ("Private Company

Partners") primarily through structured equity. The

primary goal of our structured equity investments is to deliver

stable and predictable returns to our unitholders through both cash

distributions and capital appreciation. This strategy is enhanced

by common equity positions, which allow us to generate returns in

alignment with the founders of our Private Company Partners.

NON-IFRS MEASURES:

Earnings Coverage Ratio refers

to the Normalized EBITDA of a Partner divided by such Partner’s sum

of debt servicing (interest and principal), unfunded capital

expenditures and distributions to Alaris. Management believes the

earnings coverage ratio is a useful metric in assessing our

partners continued ability to make their contracted

distributions.

Normalized EBITDA refers to

EBITDA excluding items that are non-recurring in nature and is

calculated by adjusting for non-recurring expenses and gains to

EBITDA. Management deems non-recurring charges to be unusual and/or

infrequent charges that our Partners incur outside of its common

day-to-day operations.

EBITDA refers to earnings

determined in accordance with IFRS, before depreciation and

amortization, net of gain or loss on disposal of capital assets,

interest expense and income tax expense. EBITDA is used by

management and many investors to determine the ability of an issuer

to generate cash from operations.

IRR is a supplementary

financial measure and refers to internal rate of return, which is a

metric used to determine the discount rate that derives a net

present value of cash flows to zero. Management uses IRR to analyze

partner returns. The Trust’s method of calculating this

supplementary financial measure may differ from the methods used by

other issuers. Therefore, it may not be comparable to similar

measures by other issuers.

MOIC is a supplementary

financial measure and refers to multiple of capital invested, which

is a financial metric used to evaluate the value of an

investment relative to the initial capital. Management uses MOIC to

analyze partner returns. The Trust’s method of calculating this

supplementary financial measure may differ from the methods used by

other issuers. Therefore, it may not be comparable to similar

measures by other issuers.

The terms Earnings Coverage Ratio, Normalized

EBITDA, EBITDA, IRR and MOIC (the "Non-IFRS

Measures") are not standard measures under IFRS. Alaris'

calculation of the Non-IFRS Measures may differ from those of other

issuers and, therefore, should only be used in conjunction with the

Trust’s annual audited and unaudited interim financial statements,

which are available under the Trust's (and its predecessor's)

profile on SEDAR+ at www.sedarplus.ca.

FORWARD LOOKING STATEMENTS

This news release contains forward-looking

statements, including forward-looking statements within the meaning

of "safe harbor" provisions under applicable securities laws

("forward-looking statements"). Statements other than statements of

historical fact contained in this news release may be

forward-looking statements, including, without limitation,

management's expectations, intentions and beliefs concerning the

Berg and PEC Investments and the Unify redemption. Many of these

statements can be identified by words such as "believe", "expects",

"will", "intends", "projects", "anticipates", "estimates",

"continues" or similar words or the negative thereof. Forward

looking statements in this news release include, without

limitation, statements regarding: the annualized distributions for

the Berg and PEC Investments; the earnings coverage ratios for Berg

and PEC; and Alaris’ outstanding indebtedness and use of the

balance of the Facility. Any forward-looking statements herein

which constitute a financial outlook or future-oriented financial

information (including the impact on Run Rate Payout Ratio) were

approved by management as of the date hereof and have been included

to provide an understanding of Alaris' financial performance and

are subject to the same risks and assumptions disclosed herein.

There can be no assurance that the plans, intentions or

expectations upon which these forward-looking statements are based

will occur.

By their nature, forward-looking statements

require Alaris to make assumptions and are subject to inherent

risks and uncertainties. Assumptions about the performance of the

Canadian and U.S. economies over the next 24 months and how that

will affect Alaris’ business and that of its Partners are material

factors considered by Alaris management when setting the outlook

for Alaris. Key assumptions include, but are not limited to,

assumptions that: interest rates will not rise in a matter

materially different from the prevailing market expectations over

the next 12 to 24 months; no widespread global health crisis will

impact the economy or any Partners’ operations in a material way in

the next 12 months; the businesses of the majority of our Partners

will continue to grow; the businesses of new Partners and those of

existing partners will perform in line with Alaris’ expectations

and diligence; more private companies will require access to

alternative sources of capital and that Alaris will have the

ability to raise required equity and/or debt financing on

acceptable terms. Management of Alaris has also assumed that the

Canadian and U.S. dollar trading pair will remain in a range of

approximately plus or minus 15% of the current rate expectations

over the next 6 months. In determining expectations for economic

growth, management of Alaris primarily considers historical

economic data provided by the Canadian and U.S. governments and

their agencies as well as prevailing economic conditions at the

time of such determinations.

Forward-looking statements are subject to risks,

uncertainties and assumptions and should not be read as guarantees

or assurances of future performance. The actual results of the

Trust and the Partners could materially differ from those

anticipated in the forward-looking statements contained herein as a

result of certain risk factors, including, but not limited to: the

ability of our Partners and, correspondingly, Alaris to meet

performance expectations for 2025 and beyond; any change in the

senior lenders’ outlook for Alaris’ business; management's ability

to assess and mitigate the impacts of any local, regional, national

or international health crises like COVID-19 or its variants; the

dependence of Alaris on the Partners; reliance on key personnel;

general economic conditions in Canada, North America and globally;

failure to complete or realize the anticipated benefit of Alaris’

financing arrangements with the Partners; a failure of the Trust or

any Partners to obtain required regulatory approvals on a timely

basis or at all; changes in legislation and regulations and the

interpretations thereof; risks relating to the Partners and their

businesses, including, without limitation, a material change in the

operations of a Partner or the industries they operate in;

inability to close additional Partner contributions in a timely

fashion, or at all; a change in the ability of the Partners to

continue to pay Alaris’ distributions; a material change in the

unaudited information provided to Alaris by the Partners; a failure

of a Partner (or Partners) to realize on their anticipated growth

strategies; a failure to achieve the expected benefits of the

third-party asset management strategy or similar new investment

structures and strategies; conflicts of interest that may arise

under the asset management strategy or otherwise; a failure to

achieve resolutions for outstanding issues with Partners on terms

materially in line with management’s expectations or at all; and a

failure to realize the benefits of any concessions or relief

measures provided by Alaris to any Partner or to successfully

execute an exit strategy for a Partner where desired. Additional

risks that may cause actual results to vary from those indicated

are discussed under the heading "Risk Factors" and "Forward Looking

Statements" in the Trust’s Management Discussion and Analysis for

the year ended December 31, 2023, which is filed under the Trust’s

profile at www.sedar.com and on its website at

www.alarisequitypartners.com.

This news release contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about increases to the Trust's net operating

cash from activities and revenues, each of which are subject to the

same assumptions, risk factors, limitations, and qualifications as

set forth above. Readers are cautioned that the assumptions used in

the preparation of such information, although considered reasonable

at the time of preparation, may prove to be imprecise and, as such,

undue reliance should not be placed on FOFI and forward-looking

statements. Alaris' actual results, performance or achievement

could differ materially from those expressed in, or implied by,

these forward-looking statements and FOFI, or if any of them do so,

what benefits the Trust will derive therefrom. The Trust has

included the forward-looking statements and FOFI in order to

provide readers with a more complete perspective on Alaris’ future

operations and such information may not be appropriate for other

purposes. Alaris disclaims any intention or obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

law.

Readers are cautioned not to place undue

reliance on any forward-looking information contained in this news

release as a number of factors could cause actual future results,

conditions, actions or events to differ materially from the

targets, expectations, estimates or intentions expressed in the

forward-looking statements. Statements containing forward-looking

information reflect management’s current beliefs and assumptions

based on information in its possession on the date of this news

release. Although management believes that the assumptions

reflected in the forward-looking statements contained herein are

reasonable, there can be no assurance that such expectations will

prove to be correct.

The forward-looking statements contained herein

are expressly qualified in their entirety by this cautionary

statement. The forward-looking statements included in this news

release are made as of the date of this news release and Alaris

does not undertake or assume any obligation to update or revise

such statements to reflect new events or circumstances except as

expressly required by applicable securities legislation.

Neither the TSX nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX) accepts responsibility for the adequacy or accuracy of this

release.

For further information please

contact:

ir@alarisequity.comP: (403) 260-1457Alaris Equity

Partners Income TrustSuite 250, 333 24th Avenue S.W.Calgary,

Alberta T2S 3E6

www.alarisequitypartners.com

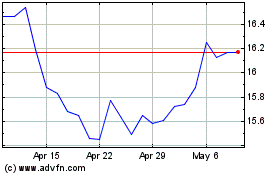

Alaris Equity Partners I... (TSX:AD.UN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Alaris Equity Partners I... (TSX:AD.UN)

Historical Stock Chart

From Mar 2024 to Mar 2025