AGF Capital Partners, AGF Management Limited’s multi-boutique

alternatives business with Affiliate Managers across both private

assets and alternative strategies, today announced the launch of

the AGF NHC Tactical Alpha Fund (“The Fund”). The Fund is an

absolute return-oriented strategy that aims to generate attractive

risk-adjusted returns across market regimes while maintaining low

beta to traditional asset classes.

Managed by AGF Investments Inc., the Fund will invest

substantially all of its assets in the New Holland Tactical Alpha

Offshore Fund Ltd., a Cayman Islands exempted company, which in

turn will invest substantially all of its assets in the New Holland

Tactical Alpha Master Fund LP, a Cayman Islands exempted limited

partnership, managed by New Holland Capital (“NHC”).

“The launch of this fund is the next step in our partnership

with NHC as we continue to build and grow our alternatives business

and diversify our capabilities,” said Ash Lawrence, Head of AGF

Capital Partners. “NHC possesses decades of experience in absolute

return investing, and we are excited to bring a product to

accredited Canadian investors that provides access and exposure to

their institutional caliber fund.”

The AGF NHC Tactical Alpha Fund allocates to a fund with a

diverse range of alternative investment strategies within a

risk-managed framework. The fund’s structure allows for more

efficient use of capital and oversight of total portfolio positions

and risk exposures.

“Absolute return strategies can serve as an effective

counterbalance to traditional asset classes in portfolios, helping

to mitigate downside risk while maintaining participation in rising

markets,” said Scott Radke, CEO and Co-CIO of New Holland Capital.

“We look forward to leveraging our specialized focus in absolute

return investing to deliver these potential benefits to accredited

Canadian investors, whose portfolios we believe can benefit from

greater access to diversification and uncorrelated investment

strategies.”

“Alternative investments are poised to play an increasingly

important role in investor portfolios given a volatile and

potentially more muted outlook for public markets,” said Lawrence.

“Bringing together AGF Capital Partners’ experience and resources

with NHC’s expertise, we’re excited for the launch of this

alternative investment product.”

In February 2024, AGF Management Limited announced a strategic

investment in NHC as part of their strategy to continue growing AGF

Capital Partners, AGF’s diversified alternatives business.

Learn more about the AGF NHC Tactical Alpha Fund.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent

and globally diverse asset management firm. Our companies deliver

excellence in investing in the public and private markets through

three business lines: AGF Investments, AGF Capital Partners and AGF

Private Wealth.

AGF brings a disciplined approach, focused on incorporating

sound, responsible and sustainable corporate practices. The firm’s

collective investment expertise, driven by its fundamental,

quantitative and private investing capabilities, extends globally

to a wide range of clients, from financial advisors and their

clients to high-net worth and institutional investors including

pension plans, corporate plans, sovereign wealth funds, endowments

and foundations.

Headquartered in Toronto, Canada, AGF has investment operations

and client servicing teams on the ground in North America and

Europe. With nearly C$53 billion in total assets under

management and fee-earning assets, AGF serves more than 800,000

investors. AGF trades on the Toronto Stock Exchange under the

symbol AGF.B.

About AGF Investments

AGF Investments is a group of wholly owned subsidiaries of AGF

Management Limited, a Canadian reporting issuer. The subsidiaries

included in AGF Investments are AGF Investments Inc. (AGFI), AGF

Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and

AGF International Advisors Company Limited (AGFIA). The term AGF

Investments may refer to one or more of these subsidiaries or to

all of them jointly. This term is used for convenience and does not

precisely describe any of the separate companies, each of which

manages its own affairs.

AGF Investments entities only provide investment advisory

services or offers investment funds in the jurisdiction where such

firm and/or product is registered or authorized to provide such

services.

AGF Investments Inc. is a wholly-owned subsidiary of AGF

Management Limited and conducts the management and advisory of

mutual funds in Canada.

About AGF Capital Partners

AGF Capital Partners is AGF’s multi-boutique alternatives

business with diverse capabilities across both private assets and

alternative strategies. Clients benefit from the specialized

investment expertise of Affiliate Managers combined with the

organizational support and breadth of resources of AGF Management

Limited (AGF). With over 18 years average experience, AGF Capital

Partners Affiliate Managers’ Kensington Capital Partners Limited,

New Holland Capital, LLC and SAF Group manage approximately C$13.5

billion in alternative AUM and fee earning assets on behalf of

institutional and retail clients. Affiliate Manager AUM may not be

consolidated into AGF Management Limited's reported AUM. US AUM

converted FX rate at December 31, 2024 (1.44).

The term ‘Affiliate Manager’ refers to any partner regardless of

relationship structures or revenue sharing agreements. The form of

AGF’s structured partnership interests in Affiliate Managers

differs from Affiliate Manager to Affiliate Manager. The structure

of the relationship with a particular Affiliate Manager, or the

revenue that AGF agrees to share in, may change. Affiliate Managers

only provide investment advisory services or offer products in the

jurisdiction where such firm, individuals and/or product is

registered or authorized to provide such services.

About New Holland Capital, LLC

New Holland Capital, LLC is an alternative investment manager

that manages over US$6B in absolute return strategies for

institutional clients. The firm seeks to generate alpha across a

wide set of diversifying strategies, with a preference for niche,

capacity constrained opportunities often with emerging portfolio

managers. For more information

visit https://newhollandcapital.com/.

Disclosures

This press release is solely for information purposes and does

not constitute an offer or solicitation of an offer or any advice

or recommendation to purchase any securities or other financial

instruments and may not be construed as such.

Any securities referenced in this news release will only be

offered and sold pursuant to a confidential offering memorandum in

such Canadian jurisdictions where they may be lawfully offered for

sale to eligible investors who qualify as “accredited investors”

under applicable Canadian securities laws. In addition, any offer

or sale of, or advice related to, any securities referenced in this

news release will be made only by a dealer registered in the

appropriate category or relying on an exemption from registration.

No Canadian securities regulatory authority has reviewed or in any

way passed upon the information contained in this news release or

the merits of any securities referenced in this news release

This communication is not an offering of securities for sale in

the United States. The Fund is being offered only to prospective

Canadian accredited investors that are not "U.S. Persons" as such

term is defined in Regulation S under the U.S. Securities Act of

1933.

® The “AGF” logo is a registered trademark of AGF Management

Limited and used under licence.

Media Contact

AGF Management Limited

Amanda MarchmentDirector, Corporate

Communications416-865-4160amanda.marchment@agf.com

AGF Management (TSX:AGF.B)

Historical Stock Chart

From Jan 2025 to Feb 2025

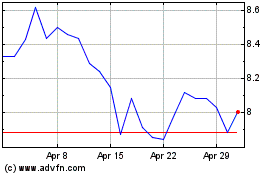

AGF Management (TSX:AGF.B)

Historical Stock Chart

From Feb 2024 to Feb 2025