Athabasca Oil Corporation (TSX: ATH) (“Athabasca” or the “Company”)

is pleased to report its audited 2024 year-end results and

reserves. Athabasca provides investors unique positioning to top

tier liquids weighted assets (Thermal Oil and Duvernay) with a

focus on maximizing cash flow per share growth by investing in

competitive projects alongside a return of capital framework that

will continue to direct 100% of Free Cash Flow to share buybacks in

2025.

Year-end 2024 Consolidated Corporate

Results

-

Production: Annual production of 36,815 boe/d (98%

Liquids), representing 7% (14% per share) growth year over year.

Strong production performance across all assets supported the

Company achieving its upwardly revised annual guidance of 36,000 –

37,000 boe/d (July 2024).

-

Record Cash Flow: Adjusted Funds Flow of $561

million ($1.02 per share), representing 102% per share growth year

over year. Cash Flow from Operating Activities of $558 million.

Free Cash Flow of $322 million from Athabasca (Thermal Oil).

-

Capital Program: $268 million, within annual

guidance of $270 million, highlighted by $164 million invested at

Leismer for completing the 28,000 bbl/d expansion and advancing the

40,000 bbl/d expansion project and $73 million in Duvernay

development.

-

Pristine Balance Sheet: Net Cash position of $123

million; Liquidity of $481 million ($345 million of cash).

Athabasca has $2.3 billion of tax pools (~80% high-value and

immediately deductible).

Return of Capital Strategy

-

Achieved Return of Capital Commitment in 2024:

Athabasca (Thermal Oil) allocated ~100% of its Free Cash Flow

(“FCF”) to return of capital in 2024 completing $317 million in

share repurchases.

-

Cumulative Return of Capital of ~$900 million:

Since 2021, the Company has delivered a deliberate return of

capital strategy, prioritizing ~$400 million of debt reduction

followed by share buybacks of ~$500 million to date. The Company

has reduced its fully diluted share count by ~18% since Q1

2023.

-

Continued 100% of Free Cash Flow (Thermal Oil) Return to

Shareholders through buybacks in 2025: The Company expects

to utilize ~100% of its Normal Course Issuer Bid (“NCIB”) for the

second straight year. Following the expiry of its current NCIB on

March 17, 2025 the Company will renew a third annual NCIB with the

Toronto Stock Exchange.

2024 Year-end Consolidated

Reserves1

-

Differentiated Long-life Reserves: Athabasca holds

1.3 billion boe of Proved Plus Probable (“2P”) reserves and ~1

billion barrels of Contingent Resource (Best Estimate). This

represents $6.4 billion2 NPV10 of 2P reserves ($12.44 per share),

an increase of 35% per share from 2023, and includes $3.8 billion2

of Total Proved (“1P”) reserves ($7.28 per share), an increase of

34% per share from 2023.

-

Thermal Oil Underpins Deep Value: An $813 million

increase in 2P NPV102 to $5.8 billion is supported by well design

driving improved capital efficiencies, lower operating costs at

both producing projects and constructive heavy oil pricing. These

reserves represent a ~30 year 1P and ~90 year 2P reserve life.

-

Duvernay Value Capture: Duvernay Energy

Corporation (“DEC”) 2P reserves increased by 170% to 73 mmboe,

representing a NPV102 value of $614 million. Strong growth is

attributed to establishing development on the newly operated lands

and accelerated development on previous land positions. DEC has an

estimated 444 gross drilling locations (204 net) across its

~200,000 acre (gross) land base.

2025 Guidance Maintained

-

Athabasca (Thermal Oil): The Thermal Oil division

underpins the Company’s strong Free Cash Flow outlook, with

unchanged production guidance of 33,500 – 35,500 bbl/d and an

unchanged ~$250 million capital budget. The program at Leismer

includes the tie-in of six redrills and four new sustaining well

pairs on Pad 10 early in 2025, along with continued pad and

facility expansion work for the progressive expansion to 40,000

bbl/d. At Hangingstone two extended reach sustaining well pairs

(~1,400 meter average laterals) that were drilled in 2024 will be

placed on production in March.

-

Duvernay Energy Corporation: The 2025 capital

program of ~$85 million includes the completion of a 100% working

interest (“WI”) three-well pad that was drilled in 2024 and the

drilling and completion of a 30% WI four-well pad. Activity will

also include spudding two additional multi-well pads in H2 2025

(one operated 100% WI pad and one 30% WI pad) with completions to

follow in 2026. DEC is constructing gathering system infrastructure

on its operated assets that will support exit production of ~5,500

boe/d this year and momentum into 2026.

-

Significant Free Cash Flow: The Company forecasts

consolidated Adjusted Funds Flow between $525 – $550 million3,

including $475 - $500 million from its Thermal Oil assets. Every

+US$1/bbl move in West Texas Intermediate (“WTI”) and Western

Canadian Select (“WCS”) heavy oil impacts annual Adjusted Funds

Flow by ~$10 million and ~$17 million, respectively. Athabasca

forecasts generating ~$1.8 billion of Free Cash Flow3 from its

Thermal Oil assets over five years (2025-29), representing ~70% of

its current equity market capitalization.

-

Competitive and Resilient Break-evens. Thermal Oil

is competitively positioned with sustaining capital to hold

production flat funded within cash flow at ~US$50/bbl WTI1 and

growth initiatives fully funded within cash flow below US$60/bbl

WTI1. The Company’s operating break-even is estimated at ~US$40/bbl

WTI3. Every $0.01 change in the Canada/US exchange rate is ~$10

million in annual Adjusted Funds Flow, and a weakened Canadian

dollar would help cushion the impact that any potential US tariffs

may have on commodity pricing.

-

Steadfast Focus on Cash Flow Per Share Growth: The

Company forecasts ~20% compounded annual cash flow per share3

growth between 2025 – 2029 driven by investing in attractive

capital projects and prioritizing share buybacks with Free Cash

Flow.

Footnote: Refer to the “Reader Advisory” section within this news release for additional information on

Non‐GAAP Financial Measures (e.g. Adjusted Funds

Flow, Free Cash Flow, Net Cash,

Liquidity) and production disclosure.

1 Consolidated reserves reflect gross reserves

and financial metrics before taking into account Athabasca’s 70%

equity interest in Duvernay Energy.2 Net present value of future

net revenue before tax at a 10% discount rate (NPV 10 before tax)

for 2024 is based on an average of McDaniel, Sproule and GLJ

pricing as at January 1, 2025.3 Pricing Assumptions: 2025 US$70

WTI, US$12.50 WCS heavy differential, C$2 AECO, and 0.725 C$/US$

FX; 2026-29 US$70 WTI, US$12.50 WCS heavy differential, C$3 AECO,

and 0.725 C$/US$ FX.

Financial and Operational Highlights

|

|

Three months ended December

31, |

|

Year endedDecember 31, |

|

|

($ Thousands, unless otherwise noted) |

2024 |

|

2023 |

|

2024 |

|

|

2023 |

|

|

CORPORATE CONSOLIDATED(1) |

|

|

|

|

|

|

|

|

|

|

Petroleum and natural gas production (boe/d)(2) |

|

37,236 |

|

|

|

33,127 |

|

|

|

36,815 |

|

|

|

34,490 |

|

|

Petroleum, natural gas and midstream sales |

$ |

352,456 |

|

|

$ |

315,929 |

|

|

$ |

1,442,091 |

|

|

$ |

1,268,525 |

|

|

Operating Income(2) |

$ |

155,022 |

|

|

$ |

96,960 |

|

|

$ |

620,092 |

|

|

$ |

417,023 |

|

|

Operating Income Net of Realized Hedging(2)(3) |

$ |

153,119 |

|

|

$ |

91,443 |

|

|

$ |

613,630 |

|

|

$ |

381,088 |

|

|

Operating Netback ($/boe)(2) |

$ |

45.53 |

|

|

$ |

30.44 |

|

|

$ |

46.14 |

|

|

$ |

32.57 |

|

|

Operating Netback Net of Realized Hedging ($/boe)(2)(3) |

$ |

44.97 |

|

|

$ |

28.71 |

|

|

$ |

45.66 |

|

|

$ |

29.76 |

|

|

Capital expenditures |

$ |

92,944 |

|

|

$ |

38,752 |

|

|

$ |

268,042 |

|

|

$ |

139,832 |

|

|

Cash flow from operating activities |

$ |

158,677 |

|

|

$ |

103,196 |

|

|

$ |

557,541 |

|

|

$ |

305,526 |

|

|

per share - basic |

$ |

0.30 |

|

|

$ |

0.18 |

|

|

$ |

1.02 |

|

|

$ |

0.52 |

|

|

Adjusted Funds Flow(2) |

$ |

143,737 |

|

|

$ |

81,830 |

|

|

$ |

560,935 |

|

|

$ |

295,236 |

|

|

per share - basic |

$ |

0.27 |

|

|

$ |

0.14 |

|

|

$ |

1.02 |

|

|

$ |

0.51 |

|

|

ATHABASCA (THERMAL OIL) |

|

|

|

|

|

|

|

|

|

|

Bitumen production (bbl/d)(2) |

|

33,849 |

|

|

|

31,059 |

|

|

|

33,505 |

|

|

|

30,246 |

|

|

Petroleum, natural gas and midstream sales |

$ |

346,716 |

|

|

$ |

309,078 |

|

|

$ |

1,419,670 |

|

|

$ |

1,204,245 |

|

|

Operating Income(2) |

$ |

143,246 |

|

|

$ |

92,199 |

|

|

$ |

569,083 |

|

|

$ |

370,732 |

|

|

Operating Netback ($/bbl)(2) |

$ |

46.30 |

|

|

$ |

30.78 |

|

|

$ |

46.54 |

|

|

$ |

32.93 |

|

|

Capital expenditures |

$ |

74,268 |

|

|

$ |

29,371 |

|

|

$ |

194,902 |

|

|

$ |

118,975 |

|

|

Adjusted Funds Flow(2) |

$ |

133,398 |

|

|

|

|

$ |

516,612 |

|

|

|

|

|

Free Cash Flow(2) |

$ |

59,130 |

|

|

|

|

$ |

321,710 |

|

|

|

|

|

DUVERNAY ENERGY(1) |

|

|

|

|

|

|

|

|

|

|

Petroleum and natural gas production (boe/d)(2) |

|

3,387 |

|

|

|

2,068 |

|

|

|

3,310 |

|

|

|

4,244 |

|

|

Percentage Liquids (%)(2) |

75 |

% |

|

71 |

% |

|

76 |

% |

|

58 |

% |

|

Petroleum, natural gas and midstream sales |

$ |

20,179 |

|

|

$ |

12,659 |

|

|

$ |

83,194 |

|

|

$ |

91,062 |

|

|

Operating Income(2) |

$ |

11,776 |

|

|

$ |

4,761 |

|

|

$ |

51,009 |

|

|

$ |

46,291 |

|

|

Operating Netback ($/boe)(2) |

$ |

37.79 |

|

|

$ |

25.02 |

|

|

$ |

42.10 |

|

|

$ |

29.89 |

|

|

Capital expenditures |

$ |

18,676 |

|

|

$ |

9,381 |

|

|

$ |

73,140 |

|

|

$ |

20,857 |

|

|

Adjusted Funds Flow(2) |

$ |

10,339 |

|

|

|

|

$ |

44,323 |

|

|

|

|

|

Free Cash Flow(2) |

$ |

(8,337 |

) |

|

|

|

$ |

(28,817 |

) |

|

|

|

|

NET INCOME (LOSS) AND COMPREHENSIVE INCOME (LOSS) |

|

|

|

|

|

|

|

|

|

|

Net income (loss) and comprehensive income (loss)(4) |

$ |

264,336 |

|

|

$ |

27,506 |

|

|

$ |

467,743 |

|

|

$ |

(51,220 |

) |

|

per share - basic(4) |

$ |

0.50 |

|

|

$ |

0.05 |

|

|

$ |

0.85 |

|

|

$ |

(0.09 |

) |

|

per share - diluted(4) |

$ |

0.50 |

|

|

$ |

0.03 |

|

|

$ |

0.85 |

|

|

$ |

(0.09 |

) |

|

COMMON SHARES OUTSTANDING |

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

526,233,362 |

|

|

|

574,412,564 |

|

|

|

547,795,407 |

|

|

|

583,757,575 |

|

|

Weighted average shares outstanding - diluted |

|

530,796,068 |

|

|

|

588,498,448 |

|

|

|

553,382,675 |

|

|

|

583,757,575 |

|

|

|

|

|

December 31, |

|

December 31, |

|

|

As at ($ Thousands) |

|

|

2024 |

|

2023 |

|

|

LIQUIDITY AND BALANCE SHEET |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

$ |

344,836 |

|

|

$ |

343,309 |

|

|

Available credit facilities(5) |

|

|

$ |

136,324 |

|

|

$ |

85,488 |

|

|

Face value of term debt(6) |

|

|

$ |

200,000 |

|

|

$ |

207,648 |

|

(1) Corporate

Consolidated and Duvernay Energy reflect gross production and

financial metrics before taking into consideration Athabasca's 70%

equity interest in Duvernay Energy.(2) Refer

to the “Advisories and Other Guidance” section within this News

Release for additional information on Non-GAAP Financial Measures

and production disclosure.(3) Includes realized

commodity risk management loss of $1.9 million and $6.5 million for

the three months and year ended December 31, 2024 (three months and

year ended December 31, 2023 – loss of $5.5 million and $35.9

million).(4) Net income (loss) and

comprehensive income (loss) per share amounts are based on net

income (loss) and comprehensive income (loss) attributable to

shareholders of the Parent Company. In the calculation of diluted

earnings per share for the three months ended December 31, 2023

earnings were reduced by $11.3 million to account for the impact to

net income had the outstanding warrants been converted to

equity.(5) Includes available credit under

Athabasca's and Duvernay Energy's Credit Facilities and Athabasca's

Unsecured Letter of Credit Facility.(6) The

face value of the term debt at December 31, 2023 was US$157.0

million translated into Canadian dollars at the December 31, 2023

exchange rate of US$1.00 = C$1.3226.

Athabasca (Thermal Oil) Year-end 2024

Highlights and Operations Update

-

Production: Bitumen production averaged 33,505

bbl/d in 2024 representing 11% growth year over year (18% per

share) supported by the Leismer facility expansion mid-year and

Hangingstone’s resilient production base.

-

Record Cash Flow: Adjusted Funds Flow of $517

million with an Operating Netback of $46.54/bbl. Operating Income

of $569 million.

-

Capital Program: $195 million of capital

expenditures in 2024 focused on expansion projects at Leismer and

sustaining operations at Hangingstone.

-

Free Cash Flow: $322 million of Free Cash Flow

supporting 100% return of capital commitment.

Leismer

Bitumen production for 2024 averaged 26,103

bbl/d, up 16% year over year (18% per share).

In Q4 2024, the Company completed drilling six

extended redrills on Pad L1 and four well pairs at Pad L10. The

redrills were placed onstream in February and support production of

~28,000 bbl/d. Steaming of the Pad L10 well pairs is expected to

start in April with first production mid-year. Another six well

pairs will be drilled in H2 2025.

Activity at Leismer continues to be focused on

advancing progressive growth to 40,000 bbl/d by the end of 2027.

The project cost is estimated at $300 million generating a capital

efficiency of approximately $25,000/bbl/d. The $300 million

includes an estimated $190 million for facility capital (majority

spread over 2025 and 2026) and an estimated $110 million for growth

wells. To date the Company has procured ~80% of the project and

remains on budget and on schedule with the original sanction plans

announced in July 2024. This winter the Company completed regional

infrastructure to Pad L10 and L11 including lease site

construction, delineation drilling and pipeline looping. Major

facility equipment has been purchased and the Company is preparing

to install two previously acquired steam generators in 2027.

Leismer is forecasted to remain pre-payout from

a crown royalty perspective until late 20273.

Hangingstone

Bitumen production for 2024 averaged 7,402 bbl/d

and experienced no decline during the year. Non-condensable gas

co-injection has aided in pressure support and reduced energy

usage. Hangingstone’s steam oil ratio averaged 3.4 for 2024.

At Hangingstone two extended reach sustaining

well pairs (~1,400 meter average laterals) were drilled in 2024.

These wells commenced steaming in December and will be placed on

production in March. These well pairs are expected to enhance the

current production level and support base production long term.

Hangingstone continues to deliver meaningful

cash flow contributions with minimal capital to the Company and

also has a pre-payout crown royalty structure to beyond 20303.

Corner

The Company’s Corner asset is a large de-risked

top-tier oil sands asset adjacent to Leismer with 351 million

barrels of 2P reserves and 520 million barrels of Contingent

Resource (Best Estimate Unrisked). There are over 300 delineation

wells and ~80% seismic coverage with reservoir qualities similar or

better than Leismer. The asset has a 40,000 bbl/d regulatory

approval for development with the existing pipeline corridor

passing through the Corner lease. The Company is updating its

development plans and is finalizing facility cost estimates,

including modular optionality. Athabasca intends to explore

external funding options and does not plan to fund an expansion

utilizing existing cash flow or balance sheet resources.

Duvernay Energy Corporation Year-end

2024 Highlights and Operations Update

-

Production: Production averaged 3,310 boe/d (76%

Liquids) in 2024, supported by two pads (5 gross, 2.9 net wells)

placed on production.

-

Cash Flow: Adjusted Funds Flow of $44 million in

2024 with an Operating Netback of $42.10/boe. Operating Income was

$51 million in 2024. DEC has no long-term debt and ended the year

with a cash position of $26 million.

-

Capital Program: $73 million of capital, fully

funded within cash flow and cash on hand in DEC.

Production from wells drilled in 2024 continue

to validate DEC’s type curve expectations. The five new wells

placed on production have average IP30’s of ~1,200 boe/d per well

(86% liquids) and IP90s of ~940 boe/d (86% Liquids) per well.

DEC drilled a three-well 100% working interest

pad at 4-18-64-16W5 in Q4 2024. The wells were cased with average

laterals of ~4,100 meters per well. This operated pad of wells is

expected to be completed post-breakup in 2025. Winter activity has

been focused on strategic gathering system investments connecting

its newly operated assets with its existing operated infrastructure

on the joint venture acreage supporting near-term development

plans. DEC has secured a regional term water license and is

commencing water sourcing in advance of the completion activities

this summer.

Marketing Access Strategy and Resilience to United

States (“US”) Trade Tariffs

-

Long Term Market Access: Athabasca has diversified

its long term end market access which includes ~7,200 bbl/d of

capacity on the Keystone pipeline by 2028, providing direct

exposure to the US Gulf Coast. The Company has recently contracted,

through an intermediary, 10,000 bbl/d of capacity on the Enbridge

Express system, providing capacity to PADD II with no associated

balance sheet commitments. The start-up of the Trans Mountain

pipeline expansion has provided excess egress capacity out of

Canada, driving tighter and less volatile WCS heavy differentials.

Industry market access is expected to be further supported by

expansions on the Enbridge and Trans Mountain Pipeline systems

along with the possible revival of new pipeline projects.

-

Athabasca is Resilient: The Company is well

positioned to withstand macro volatility including proposed US

Trade Tariffs with operational flexibility, financial durability

and a robust cash flow outlook. Athabasca’s capital program is

designed to provide flexible growth at Leismer and DEC has no

near-term land expiries with flexible development plans. The

Company’s balance sheet is in a $123 million Net Cash position with

tenure on Canadian denominated term debt until 2029. Every $0.01

change in the Canada/US exchange rate is ~$10 million in annual

Adjusted Funds Flow, and a weakened Canadian dollar would help

cushion the impact that any potential US tariffs may have on

commodity pricing.

Differentiated Long-life

Reserves1

-

Strong Reserve Growth: 22% increase year over year

in 2P reserve value to $6.4 billion NPV102 ($12.44 per share, 35%

increase) and 21% increase in 1P reserves to $3.8 billion2 ($7.28

per share, 34% increase). Athabasca maintains a deep inventory with

a ~30 year 1P and ~90 year 2P reserve life.

-

Massive Resource Base: 1.3 billion boe of 2P

reserves, anchored by 1.2 billion barrels of 2P Thermal Reserves,

plus an additional ~1 billion barrels of Contingent Resources (best

estimate).

-

Duvernay Energy: Significant reserve additions

from ~46,000 acres of 100% working interest land, driving a 128%

year over year increase in 2P reserve value to $614 million

NPV102.

Athabasca’s independent reserves evaluator,

McDaniel & Associates Consultants Ltd. (“McDaniel”), prepared

the year-end reserves evaluation effective December 31, 2024.

Reserves are reported on a consolidated basis and reflecting gross

reserves and financial metrics before taking into account

Athabasca’s 70% equity interest in Duvernay Energy.

| |

Duvernay Energy1 |

Thermal Oil |

Corporate |

| |

2023 |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

| Reserves

(mmboe) |

|

|

|

|

|

|

|

Proved Developed Producing |

|

4 |

|

|

|

6 |

|

|

|

77 |

|

|

|

74 |

|

|

|

82 |

|

|

|

80 |

|

| Total Proved |

|

11 |

|

|

|

41 |

|

|

|

404 |

|

|

|

404 |

|

|

|

415 |

|

|

|

445 |

|

| Proved Plus Probable |

|

27 |

|

|

|

73 |

|

|

|

1,216 |

|

|

|

1,209 |

|

|

|

1,243 |

|

|

|

1,282 |

|

|

|

|

|

|

|

|

|

|

|

| NPV10 BT

($million)2 |

|

|

|

|

|

|

|

|

| Proved Developed

Producing |

$58 |

|

|

$81 |

|

|

$1,713 |

|

|

$1,749 |

|

|

$1,771 |

|

|

$1,830 |

|

| Total Proved |

$142 |

|

|

$345 |

|

|

$2,969 |

|

|

$3,421 |

|

|

$3,111 |

|

|

$3,766 |

|

| Proved Plus Probable |

$269 |

|

|

$614 |

|

|

$5,011 |

|

|

$5,824 |

|

|

$5,280 |

|

|

$6,438 |

|

|

|

|

|

|

|

|

|

|

Numbers in the table may not add precisely due

to rounding.

For additional information regarding Athabasca’s

reserves and resources estimates, please see “Independent Reserve

and Resource Evaluations” in the Company’s 2024 Annual Information

Form which is available on the Company’s website or on SEDAR at

www.sedarplus.ca.

1 Consolidated reserves reflect gross reserves

and financial metrics before taking into account Athabasca’s 70%

equity interest in Duvernay Energy.2 Net present value of future

net revenue before tax at a 10% discount rate (NPV 10 before tax)

for 2024 is based on an average of McDaniel, Sproule and GLJ

pricing as at January 1, 2025.

About Athabasca Oil Corporation

Athabasca Oil Corporation is a Canadian energy

company with a focused strategy on the development of thermal and

light oil assets. Situated in Alberta’s Western Canadian

Sedimentary Basin, the Company has amassed a significant land base

of extensive, high quality resources. Athabasca’s light oil assets

are held in a private subsidiary (Duvernay Energy Corporation) in

which Athabasca owns a 70% equity interest. Athabasca’s common

shares trade on the TSX under the symbol “ATH”. For more

information, visit www.atha.com.

For more information, please contact:

|

Matthew Taylor |

Robert Broen |

| Chief Financial Officer |

President and CEO |

| 1-403-817-9104 |

1-403-817-9190 |

| mtaylor@atha.com |

rbroen@atha.com |

| |

|

Reader Advisory:

This News Release contains forward-looking

information that involves various risks, uncertainties and other

factors. All information other than statements of historical fact

is forward-looking information. The use of any of the words

“anticipate”, “plan”, “project”, “continue”, “maintain”, “may”,

“estimate”, “expect”, “will”, “target”, “forecast”, “could”,

“intend”, “potential”, “guidance”, “outlook” and similar

expressions suggesting future outcome are intended to identify

forward-looking information. The forward-looking information is not

historical fact, but rather is based on the Company’s current

plans, objectives, goals, strategies, estimates, assumptions and

projections about the Company’s industry, business and future

operating and financial results. This information involves known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking information. No assurance can

be given that these expectations will prove to be correct and such

forward-looking information included in this News Release should

not be unduly relied upon. This information speaks only as of the

date of this News Release. In particular, this News Release

contains forward-looking information pertaining to, but not limited

to, the following: our strategic plans; the allocation of future

capital; timing and quantum for shareholder returns including share

buybacks; the terms of our NCIB program; our drilling plans and

capital efficiencies; production growth to expected production

rates and estimated sustaining capital amounts; timing of Leismer’s

and Hangingstone’s pre-payout royalty status; applicability of tax

pools and the timing of tax payments; Adjusted Funds Flow and Free

Cash Flow over various periods; type well economic metrics; number

of drilling locations; forecasted daily production and the

composition of production; our outlook in respect of the Company’s

business environment, including in respect of commodity pricing;

and other matters.

In addition, information and statements in this

News Release relating to "Reserves" and “Resources” are deemed to

be forward-looking information, as they involve the implied

assessment, based on certain estimates and assumptions, that the

reserves and resources described exist in the quantities predicted

or estimated, and that the reserves and resources described can be

profitably produced in the future. With respect to forward-looking

information contained in this News Release, assumptions have been

made regarding, among other things: commodity prices; the

regulatory framework governing royalties, taxes and environmental

matters in the jurisdictions in which the Company conducts and will

conduct business and the effects that such regulatory framework

will have on the Company, including on the Company’s financial

condition and results of operations; the Company’s financial and

operational flexibility; the Company’s financial sustainability;

Athabasca's cash flow break-even commodity price; the Company’s

ability to obtain qualified staff and equipment in a timely and

cost-efficient manner; the applicability of technologies for the

recovery and production of the Company’s reserves and resources;

future capital expenditures to be made by the Company; future

sources of funding for the Company’s capital programs; the

Company’s future debt levels; future production levels; the

Company’s ability to obtain financing and/or enter into joint

venture arrangements, on acceptable terms; operating costs;

compliance of counterparties with the terms of contractual

arrangements; impact of increasing competition globally; collection

risk of outstanding accounts receivable from third parties;

geological and engineering estimates in respect of the Company’s

reserves and resources; recoverability of reserves and resources;

the geography of the areas in which the Company is conducting

exploration and development activities and the quality of its

assets. Certain other assumptions related to the Company’s Reserves

and Resources are contained in the report of McDaniel &

Associates Consultants Ltd. (“McDaniel”) evaluating Athabasca’s

Proved Reserves, Probable Reserves and Contingent Resources as at

December 31, 2024 (which is respectively referred to herein as the

"McDaniel Report”).

Actual results could differ materially from

those anticipated in this forward-looking information as a result

of the risk factors set forth in the Company’s Annual Information

Form (“AIF”) dated March 5, 2025 available on SEDAR at

www.sedarplus.ca, including, but not limited to: weakness in the

oil and gas industry; exploration, development and production

risks; prices, markets and marketing; market conditions; trade

relations and tariffs; climate change and carbon pricing risk;

statutes and regulations regarding the environment including

deceptive marketing provisions; regulatory environment and changes

in applicable law; gathering and processing facilities, pipeline

systems and rail; reputation and public perception of the oil and

gas sector; environment, social and governance goals; political

uncertainty; state of capital markets; ability to finance capital

requirements; access to capital and insurance; abandonment and

reclamation costs; changing demand for oil and natural gas

products; anticipated benefits of acquisitions and dispositions;

royalty regimes; foreign exchange rates and interest rates;

reserves; hedging; operational dependence; operating costs; project

risks; supply chain disruption; financial assurances; diluent

supply; third party credit risk; indigenous claims; reliance on key

personnel and operators; income tax; cybersecurity; advanced

technologies; hydraulic fracturing; liability management;

seasonality and weather conditions; unexpected events; internal

controls; limitations and insurance; litigation; natural gas

overlying bitumen resources; competition; chain of title and

expiration of licenses and leases; breaches of confidentiality; new

industry related activities or new geographical areas; water use

restrictions and/or limited access to water; relationship with

Duvernay Energy Corporation; management estimates and assumptions;

third-party claims; conflicts of interest; inflation and cost

management; credit ratings; growth management; impact of pandemics;

ability of investors resident in the United States to enforce civil

remedies in Canada; and risks related to our debt and securities.

All subsequent forward-looking information, whether written or

oral, attributable to the Company or persons acting on its behalf

are expressly qualified in their entirety by these cautionary

statements.

Also included in this News Release are estimates

of Athabasca's 2025 outlook which are based on the various

assumptions as to production levels, commodity prices, currency

exchange rates and other assumptions disclosed in this News

Release. To the extent any such estimate constitutes a financial

outlook, it was approved by management and the Board of Directors

of Athabasca and is included to provide readers with an

understanding of the Company’s outlook. Management does not have

firm commitments for all of the costs, expenditures, prices or

other financial assumptions used to prepare the financial outlook

or assurance that such operating results will be achieved and,

accordingly, the complete financial effects of all of those costs,

expenditures, prices and operating results are not objectively

determinable. The actual results of operations of the Company and

the resulting financial results may vary from the amounts set forth

herein, and such variations may be material. The outlook and

forward-looking information contained in this New Release was made

as of the date of this News release and the Company disclaims any

intention or obligations to update or revise such outlook and/or

forward-looking information, whether as a result of new

information, future events or otherwise, unless required pursuant

to applicable law.

Oil and Gas Information

“BOEs" may be misleading, particularly if used

in isolation. A BOE conversion ratio of six thousand cubic feet of

natural gas to one barrel of oil equivalent (6 Mcf: 1 bbl) is based

on an energy equivalency conversion method primarily applicable at

the burner tip and does not represent a value equivalency at the

wellhead. As the value ratio between natural gas and crude oil

based on the current prices of natural gas and crude oil is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.

Initial Production Rates

Test Results and Initial Production Rates: The

well test results and initial production rates provided herein

should be considered to be preliminary, except as otherwise

indicated. Test results and initial production rates disclosed

herein may not necessarily be indicative of long-term performance

or of ultimate recovery.

Reserves Information

The McDaniel Report was prepared using the

assumptions and methodology guidelines outlined in the COGE

Handbook and in accordance with National Instrument 51-101

Standards of Disclosure for Oil and Gas Activities, effective

December 31, 2024. There are numerous uncertainties inherent in

estimating quantities of bitumen, light crude oil and medium crude

oil, tight oil, conventional natural gas, shale gas and natural gas

liquids reserves and the future cash flows attributed to such

reserves. The reserve and associated cash flow information set

forth above are estimates only. In general, estimates of

economically recoverable reserves and the future net cash flows

therefrom are based upon a number of variable factors and

assumptions, such as historical production from the properties,

production rates, ultimate reserve recovery, timing and amount of

capital expenditures, marketability of oil and natural gas, royalty

rates, the assumed effects of regulation by governmental agencies

and future operating costs, all of which may vary materially. For

those reasons, estimates of the economically recoverable reserves

attributable to any particular group of properties, classification

of such reserves based on risk of recovery and estimates of future

net revenues associated with reserves prepared by different

engineers, or by the same engineers at different times, may vary.

The Company's actual production, revenues, taxes and development

and operating expenditures with respect to its reserves will vary

from estimates thereof and such variations could be material.

Reserves figures described herein have been rounded to the nearest

MMbbl or MMboe. For additional information regarding the

consolidated reserves and information concerning the resources of

the Company as evaluated by McDaniel in the McDaniel Report, please

refer to the Company’s AIF.

Reserve Values (i.e. Net Asset Value) is

calculated using the estimated net present value of all future net

revenue from our reserves, before income taxes discounted at 10%,

as estimated by McDaniel effective December 31, 2024 and based on

average pricing of McDaniel, Sproule and GLJ as of January 1,

2025.

The 444 gross Duvernay drilling locations

referenced include: 87 proved undeveloped locations and 85 probable

undeveloped locations for a total of 172 booked locations with the

balance being unbooked locations. Proved undeveloped locations and

probable undeveloped locations are booked and derived from the

Company's most recent independent reserves evaluation as prepared

by McDaniel as of December 31, 2024 and account for drilling

locations that have associated proved and/or probable reserves, as

applicable. Unbooked locations are internal management estimates.

Unbooked locations do not have attributed reserves or resources

(including contingent or prospective). Unbooked locations have been

identified by management as an estimation of Athabasca’s multi-year

drilling activities expected to occur over the next two decades

based on evaluation of applicable geologic, seismic, engineering,

production and reserves information. There is no certainty that the

Company will drill all unbooked drilling locations and if drilled

there is no certainty that such locations will result in additional

oil and gas reserves, resources or production. The drilling

locations on which the Company will actually drill wells, including

the number and timing thereof is ultimately dependent upon the

availability of funding, commodity prices, provincial fiscal and

royalty policies, costs, actual drilling results, additional

reservoir information that is obtained and other factors.

Non-GAAP and Other Financial Measures,

and Production Disclosure

The "Corporate Consolidated Adjusted Funds

Flow", “Corporate Consolidated Adjusted Funds Flow per Share”,

"Athabasca (Thermal Oil) Adjusted Funds Flow", "Duvernay Energy

Adjusted Funds Flow", “Corporate Consolidated Free Cash Flow”,

"Athabasca (Thermal Oil) Free Cash Flow", "Duvernay Energy Free

Cash Flow", “Corporate Consolidated Operating Income", "Corporate

Consolidated Operating Income Net of Realized Hedging", "Athabasca

(Thermal Oil) Operating Income", "Duvernay Energy Operating

Income", "Corporate Consolidated Operating Netback", "Corporate

Consolidated Operating Netback Net of Realized Hedging", "Athabasca

(Thermal Oil) Operating Netback", "Duvernay Energy Operating

Netback" and “Cash Transportation and Marketing Expense” financial

measures contained in this News Release do not have standardized

meanings which are prescribed by IFRS and they are considered to be

non-GAAP financial measures or ratios. These measures may not be

comparable to similar measures presented by other issuers and

should not be considered in isolation with measures that are

prepared in accordance with IFRS. Net Cash and Liquidity are

supplementary financial measures. The Leismer and

Hangingstone operating results are supplementary financial measures

that when aggregated, combine to the Athabasca (Thermal Oil)

segment results.

Adjusted Funds Flow, Adjusted Funds Flow Per

Share and Free Cash Flow

Adjusted Funds Flow and Free Cash Flow are

non-GAAP financial measures and are not intended to represent cash

flow from operating activities, net earnings or other measures of

financial performance calculated in accordance with IFRS. The

Adjusted Funds Flow and Free Cash Flow measures allow management

and others to evaluate the Company’s ability to fund its capital

programs and meet its ongoing financial obligations using cash flow

internally generated from ongoing operating related activities.

Adjusted Funds Flow per share is a non-GAAP financial ratio

calculated as Adjusted Funds Flow divided by the applicable number

of weighted average shares outstanding. Adjusted Funds Flow and

Free Cash Flow are calculated as follows:

|

|

Three months ended December 31,

2024 |

|

Three months ended December 31,

2023 |

|

|

($ Thousands) |

Athabasca (Thermal Oil) |

|

Duvernay Energy(1) |

|

Corporate Consolidated(1) |

|

Corporate Consolidated |

|

|

Cash flow from operating activities |

$ |

144,810 |

|

|

$ |

13,867 |

|

|

$ |

158,677 |

|

|

$ |

103,196 |

|

|

Changes in non-cash working capital |

|

(11,504 |

) |

|

|

(3,675 |

) |

|

|

(15,179 |

) |

|

|

(21,973 |

) |

|

Settlement of provisions |

|

92 |

|

|

|

147 |

|

|

|

239 |

|

|

|

607 |

|

| ADJUSTED FUNDS FLOW |

|

133,398 |

|

|

|

10,339 |

|

|

|

143,737 |

|

|

|

81,830 |

|

|

Capital expenditures |

|

(74,268 |

) |

|

|

(18,676 |

) |

|

|

(92,944 |

) |

|

|

(38,752 |

) |

|

FREE CASH FLOW |

$ |

59,130 |

|

|

$ |

(8,337 |

) |

|

$ |

50,793 |

|

|

$ |

43,078 |

|

(1) Duvernay Energy and Corporate

Consolidated reflect gross financial metrics before taking into

consideration Athabasca's 70% equity interest in Duvernay

Energy.

|

|

Year endedDecember 31, 2024 |

|

Year endedDecember 31, 2023 |

|

|

($ Thousands) |

Athabasca (Thermal Oil) |

|

Duvernay Energy(1) |

|

Corporate Consolidated(1) |

|

Corporate Consolidated |

|

|

Cash flow from operating activities |

$ |

511,828 |

|

|

$ |

45,713 |

|

|

$ |

557,541 |

|

|

$ |

305,526 |

|

|

Changes in non-cash working capital |

|

3,056 |

|

|

|

(1,541 |

) |

|

|

1,515 |

|

|

|

525 |

|

|

Settlement of provisions |

|

1,728 |

|

|

|

151 |

|

|

|

1,879 |

|

|

|

1,762 |

|

|

Long-term deposit |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(12,577 |

) |

|

ADJUSTED FUNDS FLOW |

|

516,612 |

|

|

|

44,323 |

|

|

|

560,935 |

|

|

|

295,236 |

|

|

Capital expenditures |

|

(194,902 |

) |

|

|

(73,140 |

) |

|

|

(268,042 |

) |

|

|

(139,832 |

) |

|

FREE CASH FLOW |

$ |

321,710 |

|

|

$ |

(28,817 |

) |

|

$ |

292,893 |

|

|

$ |

155,404 |

|

(1) Duvernay Energy and Corporate

Consolidated reflect gross financial metrics before taking into

consideration Athabasca's 70% equity interest in Duvernay

Energy.

Duvernay Energy Operating Income and Operating

Netback

The non-GAAP measure Duvernay Energy Operating

Income in this News Release is calculated by subtracting the

Duvernay Energy royalties, operating expenses and transportation

& marketing expenses from petroleum and natural gas sales which

is the most directly comparable GAAP measure. The Duvernay Energy

Operating Netback per boe is a non-GAAP financial ratio calculated

by dividing the Duvernay Energy Operating Income by the Duvernay

Energy production. The Duvernay Energy Operating Income and the

Duvernay Energy Operating Netback measures allow management and

others to evaluate the production results from the Company’s

Duvernay Energy assets.

The Duvernay Energy Operating Income is

calculated using the Duvernay Energy Segments GAAP results, as

follows:

|

|

Three months ended December

31, |

|

|

Year endedDecember 31, |

|

|

($ Thousands, unless otherwise noted) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Petroleum and natural gas sales |

$ |

20,179 |

|

|

$ |

12,659 |

|

|

$ |

83,194 |

|

|

$ |

91,062 |

|

|

Royalties |

|

(2,753 |

) |

|

|

(2,180 |

) |

|

|

(11,035 |

) |

|

|

(12,583 |

) |

|

Operating expenses |

|

(4,729 |

) |

|

|

(5,009 |

) |

|

|

(17,116 |

) |

|

|

(24,997 |

) |

|

Transportation and marketing |

|

(921 |

) |

|

|

(709 |

) |

|

|

(4,034 |

) |

|

|

(7,191 |

) |

|

DUVERNAY ENERGY OPERATING INCOME |

$ |

11,776 |

|

|

$ |

4,761 |

|

|

$ |

51,009 |

|

|

$ |

46,291 |

|

Athabasca (Thermal Oil) Operating Income and Operating

Netback

The non-GAAP measure Athabasca (Thermal Oil)

Operating Income in this News Release is calculated by subtracting

the Athabasca (Thermal Oil) segments cost of diluent blending,

royalties, operating expenses and cash transportation &

marketing expenses from heavy oil (blended bitumen) and midstream

sales which is the most directly comparable GAAP measure. The

Athabasca (Thermal Oil) Operating Netback per bbl is a non-GAAP

financial ratio calculated by dividing the respective projects

Operating Income by its respective bitumen sales volumes. The

Athabasca (Thermal Oil) Operating Income and the Athabasca (Thermal

Oil) Operating Netback measures allow management and others to

evaluate the production results from the Athabasca (Thermal Oil)

assets. The Athabasca (Thermal Oil) Operating Income is calculated

using the Athabasca (Thermal Oil) Segments GAAP results, as

follows:

|

|

Three months ended December

31, |

|

|

Year endedDecember 31, |

|

|

($ Thousands, unless otherwise noted) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Heavy oil (blended bitumen) and midstream sales |

$ |

346,716 |

|

|

$ |

309,078 |

|

|

$ |

1,419,670 |

|

|

$ |

1,204,245 |

|

|

Cost of diluent |

|

(137,817 |

) |

|

|

(137,438 |

) |

|

|

(549,808 |

) |

|

|

(518,219 |

) |

|

Total bitumen and midstream sales |

|

208,899 |

|

|

|

171,640 |

|

|

|

869,862 |

|

|

|

686,026 |

|

|

Royalties |

|

(12,413 |

) |

|

|

(15,695 |

) |

|

|

(75,064 |

) |

|

|

(60,865 |

) |

|

Operating expenses - non-energy |

|

(20,699 |

) |

|

|

(23,767 |

) |

|

|

(93,144 |

) |

|

|

(87,116 |

) |

|

Operating expenses - energy |

|

(11,526 |

) |

|

|

(17,651 |

) |

|

|

(49,713 |

) |

|

|

(81,769 |

) |

|

Transportation and marketing(1) |

|

(21,015 |

) |

|

|

(22,328 |

) |

|

|

(82,858 |

) |

|

|

(85,544 |

) |

|

ATHABASCA (THERMAL OIL) OPERATING INCOME |

$ |

143,246 |

|

|

$ |

92,199 |

|

|

$ |

569,083 |

|

|

$ |

370,732 |

|

(1) Transportation and

marketing excludes non-cash costs of $0.6 million and $2.2 million

for the three months and year ended December 31, 2024 (three months

and year ended December 31, 2023 - $0.6 million and $2.2

million).

Corporate Consolidated Operating Income and

Corporate Consolidated Operating Income Net of Realized Hedging and

Operating Netbacks

The non-GAAP measures of Corporate Consolidated

Operating Income including or excluding realized hedging in this

News Release are calculated by adding or subtracting realized gains

(losses) on commodity risk management contracts (as applicable),

royalties, the cost of diluent blending, operating expenses and

cash transportation & marketing expenses from petroleum,

natural gas and midstream sales which is the most directly

comparable GAAP measure. The Corporate Consolidated Operating

Netbacks including or excluding realized hedging per boe are

non-GAAP ratios calculated by dividing Corporate Consolidated

Operating Income including or excluding hedging by the total sales

volumes and are presented on a per boe basis. The Corporate

Consolidated Operating Income and Corporate Consolidated Operating

Netbacks including or excluding realized hedging measures allow

management and others to evaluate the production results from the

Company’s Duvernay Energy and Athabasca (Thermal Oil) assets

combined together including the impact of realized commodity risk

management gains or losses (as applicable).

|

|

Three months ended December

31, |

|

|

Year endedDecember 31, |

|

|

($ Thousands, unless otherwise noted) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Petroleum, natural gas and midstream sales(1) |

$ |

366,895 |

|

|

$ |

321,737 |

|

|

$ |

1,502,864 |

|

|

$ |

1,295,307 |

|

|

Royalties |

|

(15,166 |

) |

|

|

(17,875 |

) |

|

|

(86,099 |

) |

|

|

(73,448 |

) |

|

Cost of diluent(1) |

|

(137,817 |

) |

|

|

(137,438 |

) |

|

|

(549,808 |

) |

|

|

(518,219 |

) |

|

Operating expenses |

|

(36,954 |

) |

|

|

(46,427 |

) |

|

|

(159,973 |

) |

|

|

(193,882 |

) |

|

Transportation and marketing(2) |

|

(21,936 |

) |

|

|

(23,037 |

) |

|

|

(86,892 |

) |

|

|

(92,735 |

) |

|

Operating Income |

|

155,022 |

|

|

|

96,960 |

|

|

|

620,092 |

|

|

|

417,023 |

|

|

Realized loss on commodity risk mgmt. contracts |

|

(1,903 |

) |

|

|

(5,517 |

) |

|

|

(6,462 |

) |

|

|

(35,935 |

) |

|

OPERATING INCOME NET OF REALIZED HEDGING |

$ |

153,119 |

|

|

$ |

91,443 |

|

|

$ |

613,630 |

|

|

$ |

381,088 |

|

(1) Non-GAAP measure includes

intercompany NGLs (i.e. condensate) sold by the Duvernay Energy

segment to the Athabasca (Thermal Oil) segment for use as diluent

that is eliminated on

consolidation.(2) Transportation and marketing

excludes non-cash costs of $0.6 million and $2.2 million for the

three months and year ended December 31, 2024 (three months and

year ended December 31, 2023 - $0.6 million and $2.2 million).

Cash Transportation and Marketing Expense

The Cash Transportation and Marketing Expense

financial measures contained in this News Release are calculated by

subtracting the non-cash transportation and marketing expense as

reported in the Consolidated Statement of Cash Flows from the

transportation and marketing expense as reported in the

Consolidated Statement of Income (Loss) and are considered to be

non-GAAP financial measures.

Net Cash

Net Cash is defined as the face value of term

debt, plus accounts payable and accrued liabilities, plus current

portion of provisions and other liabilities plus income tax payable

less current assets, excluding risk management contracts.

Liquidity

Liquidity is defined as cash and cash equivalents plus available credit capacity.

Production volumes details

|

|

|

Three months ended December

31, |

|

|

Year endedDecember 31, |

|

|

Production |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Duvernay Energy: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil(1) |

bbl/d |

|

2,103 |

|

|

|

1,208 |

|

|

|

2,202 |

|

|

|

1,396 |

|

|

Condensate NGLs |

bbl/d |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

528 |

|

|

Oil and condensate NGLs |

bbl/d |

|

2,103 |

|

|

|

1,208 |

|

|

|

2,202 |

|

|

|

1,924 |

|

| Other NGLs |

bbl/d |

|

422 |

|

|

|

258 |

|

|

|

329 |

|

|

|

525 |

|

| Natural

gas(2) |

mcf/d |

|

5,172 |

|

|

|

3,612 |

|

|

|

4,677 |

|

|

|

10,769 |

|

|

Total Duvernay Energy |

boe/d |

|

3,387 |

|

|

|

2,068 |

|

|

|

3,310 |

|

|

|

4,244 |

|

| Total

Thermal Oil bitumen |

bbl/d |

|

33,849 |

|

|

|

31,059 |

|

|

|

33,505 |

|

|

|

30,246 |

|

|

Total Company production |

boe/d |

|

37,236 |

|

|

|

33,127 |

|

|

|

36,815 |

|

|

|

34,490 |

|

(1) Comprised of 99% or greater

of tight oil, with the remaining being light and medium crude

oil.(2) Comprised of 99% or greater of shale gas,

with the remaining being conventional natural gas.

This News Release also makes reference to Athabasca's

forecasted average daily Thermal Oil production of 33,500

‐ 35,500 bbl/d for 2025. Athabasca

expects that 100% of that production will be comprised of bitumen. Duvernay Energy’s forecasted total average daily production of ~4,000 boe/d for

2025

is expected to be comprised of approximately 68% tight oil, 23% shale gas and 9% NGLs.

Liquids is defined as bitumen, light crude oil,

medium crude oil and natural gas liquids.

Reserve Life Index is calculated as year-end

reserves divided by Q4 2024 production.

Break Even is an operating metric that

calculates the US$WTI oil price required to fund operating costs

(Operating Break-even), sustaining capital (Sustaining Break-even),

or growth capital (Total Capital) within Adjusted Funds Flow.

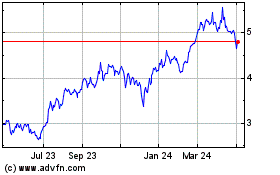

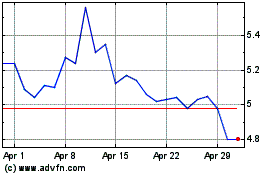

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Feb 2025 to Mar 2025

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Mar 2024 to Mar 2025