Axis Reports Q2 2024 Financial Results

February 14 2024 - 7:30AM

Business Wire

Axis Auto Finance Inc. (“Axis” or the “Company”) (TSX: AXIS), a

financial technology company changing the way Canadians purchase

and finance used vehicles, today announced financial results for

the second quarter of fiscal 2024 ending December 31, 2023.

Q2 2024 Financial

Highlights

- Total originations of $36.4 million, consisting of $8.2 million

in automotive originations and $28.2 million in equipment

originations;

- Revenues of $11.1 million in the quarter, a 4.1% increase

year-over-year;

- Adjusted loss(1) of ($0.5) million as compared to Adjusted

earnings of $0.3 million in prior year; and

- Net loss of ($1.0) million, as compared to a net loss of ($0.5)

million in the second quarter of fiscal 2023.

For the quarter ending December 31, 2023, auto loan originations

were $8.2 million, down from $35.7 million in auto loan

originations in the second quarter of 2023, as credit and

underwriting parameters were tightened. The $8.2 million in second

quarter automotive loan originations were entirely owned and on

balance sheet, as Axis did not originate any near prime volumes

managed for Westlake Financial Services (“Westlake”).

Equipment finance origination volumes in the quarter were $28.2

million, a 3.4% increase from $27.3 million in the comparable

quarter of 2023. Second quarter originations consisted of $13.4

million owned and on balance sheet, with $14.8 million being

brokered for third parties or originated for syndication

partners.

Revenues for the quarter were $11.1 million, an increase of 4.1%

from the second quarter of prior year. Automotive annualized

realized credit loss rate(2) for the quarter was 13.24%, an

increase from 8.03% during the same quarter of the prior year.

Adjusted loss(1) for the quarter was ($0.5) million, or ($0.004)

per share, as compared to Adjusted earnings of $0.3 million or

$0.003 per share for the second quarter of 2023. The Company

recorded a Net loss for the quarter of ($1.0) million or ($0.008)

per share, as compared to net loss of ($0.5) million or ($0.004)

per share in the second quarter of 2023.

Axis Reconciliation(3) of Net Income (Loss) to Adjusted Earnings (Loss) –

Second Quarter

Q2

2024

Q2

2023

Net Income (Loss), as reported in

financial statements

(970,178)

(467,949)

Adjustments:

Non-cash interest

262,031

332,860

Depreciation

162,230

200,479

Amortization

148,300

178,666

Acquisitions and integration

18,289

-

Stock-based compensation

(10,541)

184,883

IFRS-16 lease expense

(72,947)

(88,946)

Adjusted Earnings (Loss)

(462,816)

339,993

Axis Reconciliation(3) of Net Income (Loss) to Adjusted Earnings (Loss) –

Year to Date

YTD 31-Dec-2023

YTD 31-Dec-2022

Net Income (Loss), as reported in

financial statements

(3,297,179)

(1,376,296)

Adjustments:

Non-cash interest

501,086

589,349

Depreciation

342,878

400,334

Amortization

298,089

356,326

Acquisitions and integration

280,673

22,874

Stock-based compensation

58,186

275,767

IFRS-16 lease expense

(148,997)

(178,034)

Adjusted Earnings (Loss)

(1,965,264)

90,320

About Axis Auto Finance

Axis is a fintech lender providing alternative used vehicle

financing options to non-prime borrowers. Axis loans are offered

through over 3,000 automotive dealers nationwide. Approximately 30%

of Canadians (Source: Equifax) that have credit scores in the

non-prime range. All Axis auto loans report to the credit bureau,

resulting in over 70% of customers seeing a significant improvement

of their credit scores. Further information on the Company can be

found at

https://www.axisfinancegroup.com/investors-press-releases/.

(1) Adjusted loss is a non-IFRS measure as defined in the

Company’s MD&A, which is published on Sedar. Refer to pages 5

and 6 of the MD&A, that is incorporated by reference.

(2) Annualized realized credit loss rate is a non-IFRS measure

as defined in the Company’s MD&A which is published on Sedar.

Refer to pages 5 and 6 of the MD&A, that is incorporated by

reference.

(3) The reconciliation from Net Income (Loss) to Adjusted

Earnings (Loss) for the current quarter and for the full fiscal

year is shown on page 15 of the Company’s MD&A, which includes

the basis for adjustments.

Non-IFRS Measures

The Company’s audited consolidated financial statements have

been prepared in accordance with International Financial Reporting

Standards (“IFRS”) as issued by the International Accounting

Standards Board (“IASB”) and the accounting policies we adopted in

accordance with IFRS. Non-IFRS measures are not standardized

financial measures under the financial reporting framework used to

prepare the financial statements of the Company to which the

non-IFRS measures relate and might not be comparable to similar

financial measures disclosed by other issuers.

The Company believes that certain Non-IFRS Measures can be

useful to investors because they provide a means by which investors

can evaluate the Company’s underlying key drivers and operating

performance of the business, exclusive of certain adjustments and

activities that investors may consider to be unrelated to the

underlying economic performance of the business of a given period.

A full description of these measures can be found in the Management

Discussion & Analysis that accompanies the financial statements

for the corresponding period, which is published on Sedar.

The TSX Exchange has neither approved nor disapproved the

contents of this press release. Neither the Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the Exchange) accepts responsibility for the adequacy

or accuracy of this release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240214681408/en/

Axis Auto Finance Inc. Todd Hudson CEO (416) 633-5626

ir@axisautofinance.com

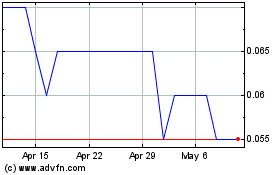

Axis Auto Finance (TSX:AXIS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Axis Auto Finance (TSX:AXIS)

Historical Stock Chart

From Feb 2024 to Feb 2025