Bird Construction Announces 50% Dividend Increase and Releases 2025-2027 Financial Targets

October 09 2024 - 6:00AM

Bird Construction Inc. (TSX: BDT) will host its 2024 Investor Day

in Toronto today, October 9, 2024, starting at 9:00 a.m. ET. The

event, inclusive of formal presentations and a Q&A session with

the senior leadership team, is expected to conclude at

approximately 12:00 p.m. ET.

Building on the significant growth and enhanced

diversification achieved through the Company’s 2022-2024 Strategic

Plan, Teri McKibbon, President and Chief Executive Officer, and

Wayne Gingrich, Chief Financial Officer, along with other members

of the senior leadership team will present an in-depth overview of

Bird’s 2025-2027 Strategic Plan, including market outlook, a deeper

dive into its operations, capital allocation strategy, and

long-term financial targets.

In conjunction with Bird’s 2024 Investor Day,

the Company is releasing certain financial targets for the

2025-2027 period, including:

- Organic revenue growth compound

annual growth rate (CAGR) range of 10% +/- 2%, with 2025 receiving

an additional 5% growth from the full year of Jacob Bros. revenue

when compared to 2024

- Target Adjusted EBITDA Margin of 8%

for full-year 2027

- Dividend Payout Ratio of Net Income

target of 33%

In addition to these targets, Bird’s Board of

Directors has approved a $0.0233 increase in its monthly dividend

effective for the November 29, 2024 dividend, payable on December

20, 2024. The dividend increase follows the Board’s approval of the

2025-2027 Strategic Plan, which anticipates continued accretion in

earnings per share and Adjusted EBITDA through 2027.

The increased monthly dividend will be $0.07 per

share, corresponding to an annual dividend rate of $0.84 per

share.

These financial targets and the dividend

increase will be discussed in further detail during the event.

“The strategic changes we’ve made over the past

several years have diversified our business, expanded our

capabilities and geographical reach, and risk-balanced our work

program with more collaborative contracting structures. This has

allowed Bird to participate in larger portions of multi-year large

capital investment projects,” said Teri McKibbon, President and CEO

of Bird. “Looking ahead, the business has considerable momentum and

is expected to benefit from significant tailwinds stemming from our

strategic focus on higher margin and economically resilient

sectors. Our 2025-2027 financial targets reflect our continued

focus on margin accretion, disciplined project selection, and safe,

collaborative operational excellence.”

Registration for the live webcast for Bird’s

2024 Investor Day is required and can be completed here. Following

the event, the webcast replay, transcript, and presentation

materials will be available on Bird’s 2024 Investor Day

webpage.

This news release contains forward-looking

statements and information ("forward-looking statements") within

the meaning of applicable Canadian securities laws. The use of any

of the words "believe", "expect", "anticipate", "contemplate",

"target", "plan", "intend", "continue", "may", "will", "should",

“potential”, “projected”, “estimated”, and similar expressions are

intended to identify forward-looking statements and information.

More particularly and without limitation, this news release

contains forward-looking statements concerning: anticipated

financial performance; the outlook for 2024-2027; expectations for

Adjusted EBITDA Margins in 2024-2027; dividend rates, their

sustainability, and expected dividend payout ratios; expectations

with respect to anticipated revenue growth, growth in earnings,

cash flow, earnings per share and Adjusted EBITDA in 2024-2027, and

margin improvements; the ability of the Company to further leverage

its cost structure; the Company’s ability to capitalize on

opportunities and grow profitably; the robustness of near to medium

term demand in core markets; future opportunities related to the

acquisition of Jacob Bros; anticipated financial performance of

Jacob Bros and its impact to the Company’s operations and financial

performance, including the anticipated accretive value to Bird; the

sufficiency of working capital and liquidity to support growth and

finance future capital expenditures; and with respect to Bird’s

ability to convert Pending Backlog to Backlog and the timing of

conversions.

Since forward-looking statements address future

events and conditions, by their very nature they involve inherent

risks and uncertainties. Investors are cautioned that

forward-looking statements are based on the opinions, assumptions

and estimates of management considered reasonable at the date the

statements are made, and actual results could differ materially

from those currently anticipated due to a number of factors and

risks. Additional information on risks and other factors that could

affect the operations or financial results of the Company are

included in reports on file with applicable securities regulatory

authorities, including but not limited to the Company's MD&A

and Annual Information Form for the year ended December 31,

2023, which may be accessed on Bird's SEDAR+ profile at

www.sedarplus.ca.

The Toronto Stock Exchange does not accept responsibility for

the adequacy or accuracy of this release.

For further information, contact:T.L. McKibbon,

President & CEO orW.R. Gingrich, CFOBird Construction Inc.5700

Explorer Drive, Suite 400Mississauga, ON L4W 0C6Phone: (905)

602-4122

About Bird Construction

Bird (TSX: BDT) is a leading Canadian

construction and maintenance company operating from

coast-to-coast-to-coast. Servicing all of Canada's major markets

through a collaborative, safety-first approach, Bird provides a

comprehensive range of construction services, self-perform

capabilities, and innovative solutions to the industrial,

buildings, and infrastructure markets. For over 100 years, Bird has

been a people-focused company with an unwavering commitment to

safety and a high level of service that provides long-term value

for all stakeholders. www.bird.ca

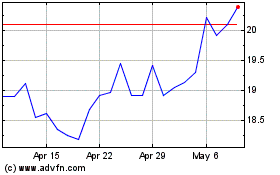

Bird Construction (TSX:BDT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Bird Construction (TSX:BDT)

Historical Stock Chart

From Jan 2024 to Jan 2025