“Bird’s continued momentum through the second quarter, with over

27% revenue growth and further margin accretion, is a direct result

of the Company’s strategy, strong team and the quality of our

collaborative work programs and Backlog. Our strategic focus on key

sectors, coupled with strong execution and disciplined project

selection is driving performance, and supports our expectations for

continued growth and margin expansion through the remainder of 2024

and beyond,” stated Teri McKibbon, President and CEO of Bird

Construction. “Bird’s recently announced acquisition of Jacob Bros

Construction adds another catalyst for growth and profitability.

With top tier leadership, a strong team and deep relationships in

the British Columbia infrastructure market, we are excited by the

new opportunities this partnership will bring.”

FINANCIAL HIGHLIGHTS

Bird's second quarter continued to deliver

substantial revenue and earnings growth, with the Company executing

record-high volumes of work in the quarter, and delivering earnings

growth that continued to significantly outpace revenue growth. The

Company maintained near-record Backlog levels at quarter end,

securing over $822 million of new work during the quarter, and

added over $304 million to Pending Backlog, which continues to

include almost $0.9 billion of recurring revenue contracts. The

record levels of combined backlog reflect Bird's reputation as a

go-to partner for collaborative delivery of sophisticated, complex

projects, and support the Company's outlook for significant revenue

and earnings growth for the remainder of 2024 and beyond.

Second Quarter 2024 compared to Second

Quarter 2023

- Construction revenue of $873.5 million earned in the quarter

compared to $686.4 million earned in the prior year quarter,

representing a 27% increase year-over-year.

- Net income and earnings per share were $21.4 million and $0.40

in Q2 2024, compared to $13.7 million and $0.26 in Q2 2023,

representing increases of 56%.

- Adjusted Earnings1 and Adjusted Earnings Per Share were $22.7

million and $0.42 in Q2 2024, compared to $15.7 million and $0.29

in Q2 2023, representing increases of 45%.

- Adjusted EBITDA1 of $46.6 million, or 5.3% of revenues,

compared to $29.5 million, or 4.3% of revenues in Q2 2023,

representing an increase of 58%.

Year-to-Date 2024 compared to

Year-to-Date 2023

- Construction revenue of $1,561.7 million was earned in 2024,

compared to $1,222.9 million in 2023, representing a 28% increase

year-over-year.

- Net income and earnings per share for the year were $31.4

million and $0.58, compared to $18.9 million and $0.35 in 2023,

representing increases of 66%.

- Adjusted Earnings1 and Adjusted Earnings Per Share were $33.3

million and $0.62 in 2024, compared to $21.0 million and $0.39 in

the prior year, representing increases of 59%.

- Adjusted EBITDA1 for 2024 was $70.7 million, or 4.5% of

revenues, compared to $45.5 million, or 3.7% of revenues in 2023,

representing an increase of 55%.

1 This News Release contains terminology and financial

measures that do not have standard meanings under IFRS and may not

be comparable with similar measures presented by other companies.

Further information regarding these measures can be found in the

“Terminology and Non-GAAP & Other Financial Measures” section

of this News Release.

| Financial

Results |

|

|

|

|

|

| (in thousands

of Canadian dollars, except per share amounts) |

|

|

|

|

| |

Three months endedJune 30, |

|

Six months endedJune 30, |

|

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

| |

|

|

|

|

|

| Construction revenue |

$ |

873,541 |

$ |

686,415 |

|

$ |

1,561,741 |

$ |

1,222,874 |

| |

|

|

|

|

|

| Net income |

|

21,399 |

|

13,714 |

|

|

31,383 |

|

18,863 |

| |

|

|

|

|

|

| Basic and diluted earnings per

share |

|

0.40 |

|

0.26 |

|

|

0.58 |

|

0.35 |

| |

|

|

|

|

|

| Adjusted Earnings Per Share |

|

0.42 |

|

0.29 |

|

|

0.62 |

|

0.39 |

| |

|

|

|

|

|

| Adjusted EBITDA1 |

|

46,562 |

|

29,457 |

|

|

70,746 |

|

45,539 |

| |

|

|

|

|

|

| Cash flows from operations

before changes in non-cash working capital |

$ |

47,477 |

$ |

28,831 |

|

$ |

78,665 |

$ |

46,459 |

| |

|

|

|

|

|

|

(1)Adjusted EBITDA is a non-GAAP financial measure. See

“Terminology and Non-GAAP & Other Financial Measures.” |

HIGHLIGHTS

- Bird continued to deliver significant revenue growth in the

second quarter of 2024, with over 90% of the 27% growth from

organic sources. Year over year revenue growth also benefited from

NorCan, acquired on January 18, 2024.

- The Company's margin profiles in the second quarter of 2024

continued to improve compared to the prior year, with Gross Profit

Percentage increasing to 8.6% compared to 7.9%, and Adjusted EBITDA

Margin increasing to 5.3% from 4.3%.

- Bird added over $822 million in securements to its Backlog in

the second quarter ($1.5 billion year-to-date), maintaining

near-record Backlog levels of $3.4 billion at June 30, 2024.

Pending Backlog of work awarded but not yet contracted grew 10% in

the second quarter (22% year-to-date) to $3.7 billion, and

continues to include almost $900 million of MSA and other recurring

revenue to be earned over the next six years.

- Operational cash flow generation was strong in the quarter,

generating $47.5 million before investments in non-cash working

capital, a 65% increase over the $28.8 million generated in the

second quarter of 2023. Increased investment in non-cash working

capital was driven by the Company's significant growth in the

quarter, a higher proportion of self perform work executed and

timing differences.

- On June 10, 2024 Bird announced that it had entered into an

agreement to acquire British Columbia based Jacob Bros Construction

(“Jacob Bros”) for estimated aggregate consideration of $135

million consisting of the issuance of 1.49 million Bird common

shares, $97.2 million in cash, and the assumption of approximately

$4.0 million of equipment debt. Jacob Bros is a privately-owned

civil infrastructure construction business with significant

self-perform capability serving both public and private clients,

and has a strong, people-first culture that aligns with Bird's own.

Jacob Bros specializes in civil infrastructure construction across

a wide array of projects, such as airports, seaports, rail, bridges

and structures, earthworks, energy projects, and utilities.

Additionally, Jacob Bros delivers expertise in specialized projects

that require innovative, purpose-built, custom solutions that

leverage their suite of comprehensive services. The acquisition was

completed on August 1, 2024.

- In connection with the announcement of the Jacob Bros

acquisition, the Company amended its Syndicated Credit Facility,

extending the maturity to December 15, 2027, expanding the size of

the revolving facility to $300.0 million, and adding the

availability of a new $125.0 million term loan facility which was

used to repay existing term loan facilities and fund a portion of

the Jacob Bros cash consideration. In addition, the Company

expanded the non-committed accordion feature to $100.0

million.

- During the second quarter of 2024, the Company announced that

it was awarded five projects with a total combined value of over

$625 million. These projects include multi-year mine infrastructure

work in Eastern Canada and three long term care projects and a

multi-building institutional project in Western Canada.

- The Board has declared eligible dividends of $0.0467 per common

share for each of August 2024, September 2024 and October

2024.

CONFERENCE CALL AND WEBCAST

Bird will host an investor webcast to discuss

the quarterly results on Thursday, August 8, 2024 at 10:00 a.m. ET,

to discuss the Company’s results. Analysts and investors may

connect to the webcast at

https://event.choruscall.com/mediaframe/webcast.html?webcastid=Gw1wc4g5.

They may also dial 1-844-763-8274 for audio only

or to enter the question queue; attendees are asked to be on the

line 10 minutes prior to the start of the call. The presentation

can also be found on our website at

https://www.bird.ca/investors.

The Company’s financial statements and

Management’s Discussion & Analysis (“MD&A”) will be filed

and available on the System for Electronic Document Analysis and

Retrieval (“SEDAR+”) at www.sedarplus.ca and on the Company’s

website at www.bird.ca.

TERMINOLOGY AND NON-GAAP & OTHER

FINANCIAL MEASURES

Throughout this News Release, certain

terminology and financial measures are used that do not have

standard meanings under IFRS and are considered specified financial

measures. These include non-GAAP financial measures, non-GAAP

financial ratios, and supplementary financial measures. These

measures may not be comparable with similar measures presented by

other companies. Further information on these financial measures

can be found in the “Terminology and Non-GAAP & Other Financial

Measures” section in Bird’s most recently filed Management’s

Discussion & Analysis for the period ended June 30, 2024,

prepared as of August 7, 2024. This document is available on

Bird’s SEDAR+ profile, at www.sedarplus.ca and on the Company’s

website at www.bird.ca.

“Backlog” is the total value of all contracts

awarded to the Company, less the total value of work completed on

these contracts as of the date of the most recently completed

quarter. The Company’s Backlog equates to the Company’s remaining

performance obligations as at June 30, 2024 and

December 31, 2023.

“Adjusted Earnings” and “Adjusted EBITDA” are

non-GAAP financial measures. “Adjusted Earnings Per Share” and

“Adjusted EBITDA margin” are non-GAAP financial ratios. “Pending

Backlog” is a supplementary financial measure.

Adjusted Earnings and Adjusted EBITDA are

reconciled as follows:

Adjusted Earnings:

| |

Three months endedJune 30, |

|

Six months endedJune 30, |

|

(in thousands of Canadian dollars, except per share amounts) |

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

| Net income |

$ |

21,399 |

|

$ |

13,714 |

|

|

$ |

31,383 |

|

$ |

18,863 |

|

| Add: Acquisition and integration

costs |

|

1,759 |

|

|

1,161 |

|

|

|

2,543 |

|

|

1,323 |

|

| Add: Impairment of assets |

|

— |

|

|

1,430 |

|

|

|

— |

|

|

1,430 |

|

| Income tax effect of the above

costs |

|

(430 |

) |

|

(625 |

) |

|

|

(622 |

) |

|

(664 |

) |

| |

|

|

|

|

|

| Adjusted

Earnings |

$ |

22,728 |

|

$ |

15,680 |

|

|

$ |

33,304 |

|

$ |

20,952 |

|

| |

|

|

|

|

|

| Adjusted Earnings Per

Share(1) |

$ |

0.42 |

|

$ |

0.29 |

|

|

$ |

0.62 |

|

$ |

0.39 |

|

| |

|

|

|

|

|

| Notes: |

|

|

|

|

|

|

(1)Restructuring costs as defined in accordance with IFRS. |

|

(1)Calculated as Adjusted Earnings divided by basic weighted

average shares outstanding. |

Adjusted EBITDA:

| |

Three months endedJune 30, |

|

Six months endedJune 30, |

|

(in thousands of Canadian dollars, except percentage amounts) |

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

| Net income |

$ |

21,399 |

|

$ |

13,714 |

|

|

$ |

31,383 |

|

$ |

18,863 |

|

| Add: Income tax expense |

|

7,104 |

|

|

4,087 |

|

|

|

10,458 |

|

|

5,671 |

|

| Add: Depreciation and

amortization |

|

12,919 |

|

|

8,112 |

|

|

|

22,253 |

|

|

15,947 |

|

| Add: Finance and other costs |

|

5,303 |

|

|

3,187 |

|

|

|

8,691 |

|

|

5,979 |

|

| Less: Finance and other

income |

|

(1,778 |

) |

|

(1,516 |

) |

|

|

(3,457 |

) |

|

(2,687 |

) |

| Add: (Gain)/loss on sale of

property and equipment |

|

(144 |

) |

|

(718 |

) |

|

|

(1,125 |

) |

|

(987 |

) |

| Add: Acquisition and integration

costs |

|

1,759 |

|

|

1,161 |

|

|

|

2,543 |

|

|

1,323 |

|

| Add: Impairment of assets |

|

— |

|

|

1,430 |

|

|

|

— |

|

|

1,430 |

|

| |

|

|

|

|

|

| Adjusted

EBITDA |

$ |

46,562 |

|

$ |

29,457 |

|

|

$ |

70,746 |

|

$ |

45,539 |

|

| |

|

|

|

|

|

| Adjusted EBITDA

Margin(1) |

|

5.3 |

% |

|

4.3 |

% |

|

|

4.5 |

% |

|

3.7 |

% |

| |

|

|

|

|

|

| (1)Calculated as

Adjusted EBITDA divided by revenue. |

FORWARD-LOOKING INFORMATION

This news release contains forward-looking

statements and information ("forward-looking statements") within

the meaning of applicable Canadian securities laws. The

forward-looking statements contained in this news release are based

on the expectations, estimates and projections of management of

Bird as of the date of this news release unless otherwise stated.

The use of any of the words "believe", "expect", "anticipate",

"contemplate", "target", "plan", "intend", "continue", "may",

"will", "should" and similar expressions are intended to identify

forward-looking statements and information. More particularly and

without limitation, this news release contains forward-looking

statements concerning: anticipated financial performance; the

outlook for 2024; expectations for Adjusted EBITDA Margins in 2024

and beyond; dividend rates, their sustainability, and expected

dividend payout ratios; expectations with respect to anticipated

revenue growth and seasonality, growth in earnings, cash flow,

earnings per share and adjusted EBITDA in 2024 and beyond, and

margin improvements; the ability of the Company to further leverage

its cost structure; the Company’s ability to capitalize on

opportunities and grow profitably; the robustness of near to medium

term demand in core markets; future opportunities related to the

acquisition of Jacob Bros; expectations regarding the Jacob Bros

acquisition impact to Bird’s business, anticipated financial

performance of Jacob Bros and its impact to the Company’s

operations and financial performance, including the anticipated

accretive value to Bird, the sufficiency of working capital and

liquidity to support growth and finance future capital

expenditures; and with respect to Bird’s ability to convert Pending

Backlog to Backlog and the timing of conversions.

Since forward-looking statements address future

events and conditions, by their very nature they involve inherent

risks and uncertainties. Investors are cautioned that

forward-looking statements are based on the opinions, assumptions

and estimates of management considered reasonable at the date the

statements are made, and actual results could differ materially

from those currently anticipated due to a number of factors and

risks. These include, but are not limited to the risks associated

with the industries in which the Company operates in general such

as: the ability to hire and retain qualified and capable personnel,

maintaining safe work sites, economy and cyclicality, ability to

secure work, performance of subcontractors, accuracy of cost to

complete estimates, estimating costs and schedules/assessing

contract risks, adjustments and cancellations of Backlog, global

pandemics, joint venture risk, information systems and

cyber-security risk, litigation/potential litigation, work

stoppages, strikes and lockouts, acquisition and integration risk,

competitive factors, potential for non-payment, climate change

risks and opportunities, access to capital, quality assurance and

quality control, design risks, insurance risk, access to surety

support and other contract security, completion and performance

guarantees, ethics and reputational risk, compliance with

environmental laws, and internal and disclosure controls.

Readers are cautioned that the foregoing list of

factors is not exhaustive. Additional information on other factors

that could affect the operations or financial results of the

parties, and the combined company are included in reports on file

with applicable securities regulatory authorities, including but

not limited to; Bird's Annual Information Form and Management’s

Discussion and Analysis for the year ended December 31, 2023, each

of which may be accessed on Bird’s SEDAR+ profile, at

www.sedarplus.ca and on the Company’s website at www.bird.ca.

The forward-looking statements contained in this

news release are made as of the date hereof and the Company

undertakes no obligation to update publicly or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as, and to the extent required

by applicable securities laws.

The Toronto Stock Exchange does not accept

responsibility for the adequacy or accuracy of this release.

For further information, please

contact:

T.L. McKibbon, President & CEO or W.R.

Gingrich, CFO Bird Construction Inc. 5700 Explorer Drive, Suite 400

Mississauga, ON L4W 0C6 Phone: (905) 602-4122

ABOUT BIRD CONSTRUCTION

Bird (TSX: BDT) is a leading Canadian

construction and maintenance company operating from

coast-to-coast-to-coast. Servicing all of Canada's major markets

through a collaborative, safety-first approach, Bird provides a

comprehensive range of construction services, self-perform

capabilities, and innovative solutions to the industrial,

buildings, and infrastructure markets. For over 100 years, Bird has

been a people-focused company with an unwavering commitment to

safety and a high level of service that provides long-term value

for all stakeholders. www.bird.ca

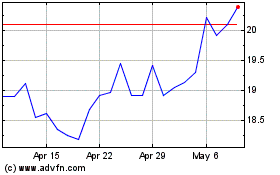

Bird Construction (TSX:BDT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bird Construction (TSX:BDT)

Historical Stock Chart

From Nov 2023 to Nov 2024