Condor Energies Inc. (“

Condor” or the

“

Company”) (TSX: CDR) is pleased to announce that,

due to strong investor demand, it has upsized its previously

announced brokered, marketed offering of common shares of Condor

(“

Common Shares”) under the Listed Issuer

Financing Exemption (the “

LIFE Offering”) by up to

$5,000,000 by way of a private placement to accredited investors

(the “

Accredited Investor Offering”). The Common

Shares placed under the Accredited Investor Offering will be issued

at a price of $1.90 per Common Share, resulting in aggregate gross

proceeds of up to $15,000,000 under the combined LIFE Offering and

Accredited Investor Offering (collectively, the

“

Offering”).

The Offering is being led by Research Capital

Corporation, as the lead agent and sole bookrunner, on behalf of a

syndicate of agents, including Auctus Advisors LLP and Canaccord

Genuity Corp. (collectively, the “Agents”).

The lead investor and largest shareholder of the

Company, EurAsia Resource Value S.E., and together with certain

insiders and other significant strategic investors of the Company

will be subscribing into the Accredited Investor Offering.

The net proceeds of the Offering will be used

for the ongoing workover program as part of Condor’s production

enhancement service activities in Uzbekistan, accelerating a

multi-well vertical and horizontal drilling program to the first

half of 2025, purchasing additional in-field flowline water

separation systems and field equipment, upgrading field facilities,

working capital and general corporate purposes. Condor is

continuing and expanding the workover program initiated in June

2024 comprised of plunger lift installations, production tubing

replacements, perforating previously non-depleted and bypassed pay

zones and other workover activities. A third service rig is planned

to commence operations in the first quarter of 2025.

In addition, the Company has granted the Agents

an option (the “Agents’ Option”) to increase the

size of the Accredited Investor Offering by up to $2,250,000 by

giving written notice of the exercise of the Agent's Option, or a

part thereof, to the Company at any time prior to closing of the

Offering.

As part of the Offering, 5,263,157 Common Shares

(“LIFE Shares”) will be offered for sale to

purchasers pursuant to the Listed Issuer Financing Exemption under

Part 5A of National Instrument 45-106 – Prospectus

Exemptions (“NI 45-106”) in all provinces of

Canada, except Quebec, and other qualifying jurisdictions,

including the United States. In addition, in relation to the

Accredited Investor Offering and assuming the exercise of the full

Agents’ Option, up to 3,815,788 Common Shares (“Accredited

Investor Shares”) will also be offered to “accredited

investors” (as defined in NI 45-106) pursuant to the accredited

investor exemption under NI 45-106 (or, in Ontario, under section

73.3 of the Ontario Securities Act) in all provinces of Canada, and

other qualifying jurisdictions, including the United States. The

LIFE Shares will not be subject a statutory hold period under

applicable Canadian securities laws, but any LIFE Shares sold in

jurisdictions outside of Canada may be subject to hold periods and

other resale restrictions. The Accredited Investor Shares will have

a statutory hold period of 4 months and a day from closing of the

Offering. There is an amended and restated offering document dated

November 25, 2024 (the “Offering

Document”) related to this Offering that can be accessed

under the Company's profile at www.sedarplus.ca and on the

Company's website at www.condorenergies.ca. Prospective investors

should read the Offering Document before making an investment

decision. The Offering Document amends and restates the offering

document of the Company dated November 20, 2024 in

respect of the Offering.

The Offering is anticipated to close on or about

December 5, 2024, or such later date as the Agents and the Company

may determine. The closing is subject to certain conditions

including, but not limited to, the receipt of all necessary

regulatory and other approvals, including the approval of the

Toronto Stock Exchange (the “TSX”).

The Company has agreed to pay to the Agents a

cash commission equal to 6% of the gross proceeds of the Offering

(including in respect of any exercise of the Agents’ Option). In

addition, the Company has agreed to issue to the Agents broker

warrants of the Company to acquire in aggregate the number of

Common Shares equal to 3% of the number of Common Shares sold under

the Offering (including in respect of any exercise of the Agents’

Option). The Agents may exercise the broker warrants for a period

of 24 months following the Offering at an exercise price of $2.20.

Notwithstanding the foregoing, the Company has agreed to pay to the

Agents a reduced cash commission equal to 2% of the gross proceeds

of certain president’s list orders.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy nor shall there be any

sale of any of securities of Condor (including the Common Shares)

in any jurisdiction in which such offer, solicitation or sale would

be unlawful, and in particular, this news release does not

constitute an offer to sell or a solicitation of an offer to buy

any Common Shares in United States of America or to U.S. Persons

(as defined below). The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “1933 Act”) or any state securities

laws and may not be offered or sold within the United States or to,

or for account or benefit of, U.S. Persons (as defined in

Regulation S under the 1933 Act) unless registered under the 1933

Act and applicable state securities laws, or an exemption from such

registration requirements is available.

About Condor

Condor is a Canadian-based, TSX-listed energy

transition company focused on European and Asian markets. The

Company produces natural gas and condensate in Uzbekistan stemming

from a production enhancement services contract for increasing the

production, ultimate recovery and overall system efficiency from an

integrated cluster of eight conventional natural gas-condensate

fields. The Company also has ongoing initiatives to construct and

operate LNG facilities in Kazakhstan and to develop and produce

lithium brine in Kazakhstan.

The TSX does not accept responsibility

for the adequacy or accuracy of this news release.

For further information, please contact:Don

Streu, President and Chief Executive OfficerSandy Quilty, Vice

President of Finance and Chief Financial OfficerTelephone: (403)

201-9694

Cautionary Note Regarding

Forward-Looking Information

This news release contains forward-looking

statements and forward-looking information as defined under

applicable Canadian and U.S. securities laws (collectively,

“forward-looking information”). Forward-looking

information includes, without limitation, forecasts, estimates,

plans, projections, targets, expectations and objectives for future

operations and financial results, and the use of words such as

“may”, “will”, “should”, “expect”, “anticipate”, “continue”,

“plan”, “ongoing”, “strive”, “expand” and similar expressions are

intended to identify forward-looking information. The

forward-looking information contained herein is provided for the

purpose of assisting readers in understanding management’s current

expectations and plans relating to the future. These

forward‐looking statements or information relate to, among other

things: Condor’s expectations as to the insiders and significant

shareholders that will subscribe to the Offering; the aggregate

gross proceeds of the Offering including the aggregate gross

proceeds from insider and significant shareholder subscriptions;

Condor’s continued energy production progress in Uzbekistan;

Condor’s plans to add a third workover rig in Uzbekistan in early

2025; the timing and ability of Condor to commence its infill

drilling campaign in Uzbekistan in the first half of 2025; the

allocation and use of proceeds of the Offering; Condor’s

expectations as to the jurisdictions in which the Offering will

take place; the anticipated closing date of the Offering and

Condor’s expectation that its project to construct and operate LNG

facilities in Kazakhstan will be ongoing.

Forward-looking information is subject to known

and unknown risks, uncertainties and other factors that may cause

the actual actions, events or results to be materially different

from those expressed or implied by such forward-looking

information, including but not limited to: general economic, market

and business conditions; volatility in market conditions including

market prices for natural gas; risks related to the exploration,

development and production of natural gas and condensate reserves;

risks inherent in the Company’s international operations; risks

related to the timing of completion of the Company’s projects and

financings; competition for capital; the availability of capital on

acceptable terms; reliance on third parties to execute the

Company’s strategy; and increasing regulations affecting the

Company’s future operations. Additional risk factors relevant to

the Company and the Common Shares are discussed under the heading

“Risk Factors” in the Company’s annual information form for the

year ended December 31, 2023 and under the heading “Forward-Looking

Statements” in the Company’s management’s discussion and analysis

for the three and nine months ended September 30, 2024, both of

which are available under the Company’s profile on SEDAR+ at

www.sedarplus.ca.

The above summary of assumptions and risks

related to forward-looking information is provided in this news

release to assist prospective investors with understanding the

risks associated with an investment in the Common Shares and may

not be appropriate for other purposes. The Company’s actual results

could differ materially from those expressed in or implied by these

forward-looking statements, and no assurance can be given that any

of the events anticipated by the forward-looking statements will

transpire or occur. Readers are therefore cautioned that they

should not unduly rely on the forward-looking statements included

in this news release.

The forward-looking statements included in this

news release are expressly qualified by this cautionary statement

and are made only as of the date of this news release. The Company

does not undertake any obligation to publicly update or revise any

forward-looking statements except as required by applicable

securities laws.

ABBREVIATIONS

The following is a summary of abbreviations used in this news

release:

|

boe/d |

Barrels of oil equivalent per day |

|

$ |

Canadian Dollars |

|

LNG |

Liquefied Natural Gas |

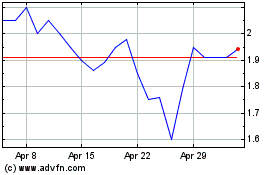

Condor Energies (TSX:CDR)

Historical Stock Chart

From Feb 2025 to Mar 2025

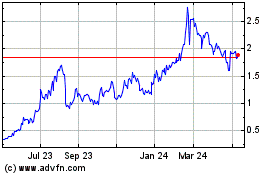

Condor Energies (TSX:CDR)

Historical Stock Chart

From Mar 2024 to Mar 2025