Conifex Timber Inc. (“Conifex”, “we” or “us”) (TSX: CFF) today

reported results for the third quarter ended September 30,

2024. EBITDA* was negative $3.9 million for the quarter

compared to EBITDA of negative $7.1 million in the second quarter

of 2024 and negative $6.7 million in the third quarter of

2023. Net loss was $3.8 million or $0.09 per share for the

quarter versus net loss of $9.7 million or $0.24 per share in the

previous quarter and negative $8.0 million or $0.20 per share for

the year-earlier quarter.

Selected Financial

Highlights

The following table summarizes our selected

financial information for the comparative periods. The financial

information reflects results of operations from our Mackenzie

sawmill and power plant.

|

Selected Financial Information |

|

|

|

|

|

|

|

(unaudited, in millions of dollars, except share andexchange rate

information) |

Q32024 |

Q22024 |

Q32023 |

|

Revenue |

|

|

|

|

|

Lumber – Conifex produced |

19.1 |

|

25.0 |

|

26.6 |

|

|

Lumber – wholesale |

0.0 |

|

0.0 |

|

0.8 |

|

|

By-products and other |

2.9 |

|

2.3 |

|

4.3 |

|

|

Bioenergy |

3.2 |

|

4.5 |

|

7.1 |

|

|

|

|

25.2 |

|

31.8 |

|

38.7 |

|

| Operating income

(loss) |

(6.1 |

) |

(9.6 |

) |

(10.1 |

) |

| EBITDA

(1) |

(3.9 |

) |

(7.1 |

) |

(6.7 |

) |

|

Net income (loss) |

(3.8 |

) |

(9.7 |

) |

(8.0 |

) |

| Basic

earnings (loss) per share |

(0.09 |

) |

(0.24 |

) |

(0.20 |

) |

| Diluted

earnings (loss) per share |

(0.09 |

) |

(0.22 |

) |

(0.20 |

) |

| Shares

outstanding – weighted average (millions) |

40.6 |

|

40.4 |

|

40.2 |

|

| |

|

|

|

|

|

Reconciliation of EBITDA to net income (loss) |

|

|

|

| Net income

(loss) |

(3.8 |

) |

(9.7 |

) |

(8.0 |

) |

| Add: |

Finance costs |

1.8 |

|

2.8 |

|

1.2 |

|

| |

Amortization |

2.4 |

|

2.5 |

|

3.8 |

|

|

|

Deferred income tax expense (recovery) |

(4.3 |

) |

(2.7 |

) |

(3.7 |

) |

|

EBITDA (1) |

(3.9 |

) |

(7.1 |

) |

(6.7 |

) |

* In this release, reference is

made to "EBITDA". EBITDA represents earnings before finance costs,

taxes, depreciation and amortization. We disclose EBITDA as it is a

measure used by analysts and by our management to evaluate our

performance. As EBITDA is not a generally accepted earnings measure

under IFRS and does not have a standardized meaning prescribed by

IFRS, it may not be comparable to EBITDA calculated by other

companies. In addition, EBITDA is not a substitute for net earnings

or cash flow, as determined in accordance with IFRS, and therefore

readers should consider those measures in evaluating our

performance.

Selected Operating

Information

|

|

Q32024 |

|

Q22024 |

|

Q32023 |

|

| Production – WSPF lumber

(MMfbm)(2) |

31.5 |

|

34.0 |

|

48.9 |

|

| Shipments – WSPF lumber

(MMfbm)(2) |

29.3 |

|

38.5 |

|

41.9 |

|

| Shipments – wholesale lumber

(MMfbm)(2) |

0.0 |

|

0.0 |

|

0.9 |

|

| Electricity production

(GWh) |

25.9 |

|

38.0 |

|

56.0 |

|

| Average exchange rate –

$/US$(3) |

0.733 |

|

0.731 |

|

0.746 |

|

| Average WSPF 2x4 #2 & Btr

lumber price (US$)(4) |

$366 |

|

$386 |

|

$419 |

|

| Average

WSPF 2x4 #2 & Btr lumber price ($)(5) |

$499 |

|

$528 |

|

$561 |

|

(1) Conifex's EBITDA

calculation represents earnings before finance costs, taxes,

depreciation and amortization.(2) MMfbm represents

million board feet.(3) Bank of Canada,

www.bankofcanada.ca.(4) Random Lengths Publications

Inc.(5) Average SPF 2x4 #2 & Btr lumber prices

(US$) divided by average exchange rate.

Summary of Third Quarter 2024

Results

Consolidated Net EarningsDuring the third

quarter of 2024, we incurred a net loss of $3.8 million or $0.09

per share compared to a net loss of $9.7 million or $0.22 per share

in the previous quarter and net loss of $8.0 million or $0.20 per

share in the third quarter of 2023.

Lumber OperationsOur lumber production in the

third quarter of 2024 totalled approximately 31.5 million board

feet, representing operating rates of approximately 53% of

annualized capacity. Third quarter production was negatively

impacted by a scheduled three-week curtailment at the beginning of

the quarter, as well as intermittent periods of reduced shifting

capacity, reflecting the softening of lumber prices quarter over

quarter. Lumber production of 34 million board feet in the previous

quarter reflected slightly more operating days due to our ability

to draw down on the more robust log inventories accumulated through

the first quarter of 2024 to support the logging breakup season

during the majority of the second quarter of 2024. Lumber

production in the third quarter of 2023 was 48.9 million board feet

or approximately 82% of annualized capacity, primarily due to more

operating hours.

Shipments of Conifex-produced lumber totaled

29.3 million board feet in the third quarter of 2024, representing

a decrease of 24% from the 38.5 million board feet shipped in the

previous quarter due to reduced operating days and a decrease of

30% from the 41.9 million board feet of lumber shipped in the third

quarter of 2023 also due to reduced operating days.

Our wholesale lumber shipments were nil in the

first, second, and third quarters of 2024, compared to

approximately 0.9 million board feet in the third quarter of 2023,

as we have not engaged in wholesale lumber sales since the fourth

quarter of 2023.

Revenues from lumber products were $19.1 million

in the third quarter of 2024, representing a decrease of 24% from

the previous quarter and a decrease of 28% from the third quarter

of 2023. Compared to the previous quarter, lower shipment volumes

due to a reduced operating configuration and lower mill net

realizations on lower lumber market prices contributed to the lower

revenue. The revenue decrease in the current quarter over the same

period in the prior year was largely a result of lower shipment

volumes and lower mill net realizations.

Cost of goods sold in the third quarter of 2024

decreased by 21% from the previous quarter and decreased by 42%

from the third quarter of 2023. The decrease in cost of goods sold

from the prior quarter and third quarter of 2023, were primarily

due to decreased shipment volumes. Unit manufacturing costs in the

third quarter of 2024 decreased in comparison to the previous

quarter as a result lower conversion costs, slightly offset by

higher log costs. Unit manufacturing costs decreased in comparison

to the third quarter of 2023 as a result of significantly lower log

costs, slightly offset by higher conversion costs. We recorded

inventory valuation reserves of $0.7 million in the third quarter

of 2024 compared to $0.7 million in the second quarter of 2024 and

$2.4 million in the third quarter of 2023. Inventory valuation

reserves stayed flat in comparison to the previous quarter

primarily due to a slight decrease in total inventory volume,

partially offset by higher anticipated future sales prices, and

decreased in comparison to the third quarter of 2023 due to reduced

inventory offset by lower lumber prices.

We expensed countervailing

("CV") and anti-dumping ("AD")

duty deposits of $0.2 million in the third quarter of 2024, $1.1

million in the previous quarter and recognized a favourable duty

adjustment of $0.4 million in the third quarter of 2023 for the

recognition of duty overpayments and interest accrued on duty

overpayments. In August, the duty rate increased from a combined

rate of 8.05% to a combined rate of 14.4%. Export taxes during the

third quarter of 2024 were lower than the previous quarter due to a

decrease in overall shipped volume and lumber prices, combined with

reversing a portion of the duty expense related to the final rates

associated with the fifth administrative review and the interest

accrued on the overpayments as was done in the same quarter of the

previous year. In total we have deposited US$37.1 million net of

duty sales.

Bioenergy OperationsOur Power Plant sold 25.9

GWh of electricity under our EPA with BC Hydro in the third quarter

of 2024 representing approximately 48% of targeted operating rates.

Our Power Plant sold 38.0 GWh in the second quarter of 2024 and 56

GWh of electricity in the third quarter of 2023. Production in the

third quarter of 2024 was lower than in the second quarter of 2024

because of a two-week extension to the planned annual shutdown that

extended into mid July, combined with a five-week curtailment to

end the quarter related to the threat of a transportation

disruption from t v4he CN labour strike and the corresponding

impact to the sawmill side of the business. The reduction in

generation relative to the same quarter in previous years was a

result of fewer operating days.

Electricity production contributed revenues of

$3.2 million in the third quarter of 2024, $4.5 million in the

previous quarter and $7.1 million in the third quarter of 2023.

Lower operating days were the driver of the reduced revenues.

Selling, General and Administrative

CostsSelling, general and administrative

("SG&A") costs decreased between the third

quarter and second quarter of 2024 and decreased between the third

quarter of 2024 and the third quarter of 2023. SG&A costs were

$1.3 million in the third quarter of 2024, $1.9 million in the

previous quarter and $3.3 million in the third quarter of 2023. The

decrease in SG&A costs relative to the previous quarter and the

third quarter of 2023 were largely due to a decrease in outstanding

share-based compensation and a reduction in overhead costs.

Finance Costs and AccretionFinance costs and

accretion totaled $1.8 million in the third quarter of 2024, $2.8

million in the previous quarter and $1.2 million in the third

quarter of 2023. The decrease in finance costs quarter over quarter

was primarily related to the retirement of our then-existing lumber

segment credit facility with Wells Fargo Capital Finance

Corporation Canada in the second quarter of 2024. The year over

year increase was primarily due to interest costs associated with

$25 million secured term loan (the "PenderFund Term

Loan") with Pender Corporate Bond Fund.

Other IncomeWe recognized minimal other income

in the second and third quarter of 2024 and in the comparative

quarter of 2023. In the first quarter of 2024, we recognized $3.0

million in other income for insurance proceeds from the loss of our

Osilinka logging camp. Insurance proceeds were received in the

second quarter of 2024.

Foreign Exchange Translation Gain or LossThe

foreign exchange translation gain or loss recorded for each period

on our statement of net income results from the revaluation of US

dollar-denominated cash and working capital balances to reflect the

change in the value of the Canadian dollar relative to the value of

the US dollar. US dollar-denominated monetary assets and

liabilities are translated using the period end rate.

The US dollar averaged US$0.733 for each

Canadian dollar during the third quarter of 2024, a level which

represented a modest strengthening of the Canadian dollar over the

previous quarter1.

The foreign exchange translation impacts arising

from the variability in exchange rates at each measurement period

on cash and working capital balances resulted in a foreign exchange

translation gain of $0.2 million in the third quarter of 2024,

compared to a nominal foreign exchange translation gain in the

previous quarter and a loss of $0.2 million in the third quarter of

2023.

Income TaxWe recorded income tax recovery of

$4.3 million in the third quarter of 2024, $2.7 million in the

previous quarter and $3.7 million in the third quarter of 2023. The

increase in recovery in the third quarter of 2024 relative to the

second quarter of 2024 is due to an adjustment from the prior

quarters, and the recovery in the third quarter of 2024 was

comparative relative to the third quarter of 2023 even though the

net loss in 2023 was much higher.

Deferred income taxes reflect the net tax

effects of temporary differences between the carrying amounts of

assets and liabilities on our balance sheet and the amounts used

for income tax purposes. As at September 30, 2024, we have

recognized deferred income tax assets of $10.5 million, compared to

$6.7 million in the previous quarter and $3.0 million in the third

quarter of 2023.

________________________1 Source: Bank of

Canada, www.bankofcanada.ca

Financial Position and

Liquidity

Overall debt was $77.6 million at September 30,

2024, compared to $74.1 million at June 30, 2024, and $65.6 million

at September 30, 2023. The increase in overall debt between the

third and second quarter was driven by an additional $2.5 million

in the final draw against the PenderFund Term Loan, offset by

payments against operating leases. The term loan supporting our

bioenergy operations (the "Power Term Loan"),

which is largely non-recourse to our lumber operations, represents

a substantial portion of our outstanding long-term debt. At

September 30, 2024, we had $48.7 million outstanding on our Power

Term Loan, while our remaining long-term debt consisting of leases,

was $3.1 million.

At September 30, 2024, we had available

liquidity of $2.4 million comprised of unrestricted cash. This is a

decrease from our available liquidity of $13.4 million as at June

30, 2024 and a decrease from our available liquidity of $16.0

million as at September 30, 2023. The change in liquidity in the

third quarter of 2024 compared to the second quarter of 2024 is due

to increased inventories and trade receivables and our $2.5 million

draw against the PenderFund Term Loan. The change in liquidity in

the third quarter of 2024 compared to the third quarter of 2023 is

due to lower lumber prices and increasing inventories as well as

fewer operating days.

Like other Canadian lumber producers, we were

required to begin depositing cash on account of softwood lumber

duties imposed by the US government in April 2017. Cumulative

duties of US$37.1 million paid by us, net of sales of the right to

certain refunds, since the inception of the trade dispute remain

held in trust by the US pending administrative reviews and the

conclusion of all appeals of US decisions. Future cash flows could

be adversely impacted by the CV and AD duty deposits to the extent

additional costs on US destined shipments are not mitigated by

higher lumber prices.

Outlook

We continue to believe that the bottom in SPF

lumber prices is behind us given the production curtailments

implemented by other lumber producers. Looking ahead to the final

quarter of 2024, our average mill net selling price through the

first six weeks of the quarter was 17.5% higher than the average

achieved for the third quarter of 2024. With a continuation of

these prices, we would expect a significant positive impact to our

fourth quarter EBITDA.

Conference Call

We have scheduled a conference call on

Wednesday, November 13, 2024 at 8:00 AM Pacific time / 11:00 AM

Eastern time to discuss the third quarter 2024 financial and

operating results. To participate in the call, please dial toll

free 1-800-806-5484 and enter the participant passcode

2330380#.

Our management's discussion and analysis and

financial statements for the quarter ended September 30, 2024, are

available under our profile on SEDAR+.

For further information, please contact:

Trevor Pruden Chief Financial Officer (604)

216-2949

About Conifex Timber Inc.

Conifex and its subsidiaries' primary business

currently includes timber harvesting, reforestation, forest

management, sawmilling logs into lumber and wood chips, and value

added lumber finishing and distribution. Conifex's lumber products

are sold in the United States, Canadian and Japanese markets.

Conifex also produces bioenergy at its power generation facility at

Mackenzie, B.C.

Forward-Looking Statements

Certain statements in this news release may

constitute “forward-looking statements”. Forward-looking statements

are statements that address or discuss activities, events or

developments that Conifex expects or anticipates may occur in the

future. When used in this news release, words such as “estimates”,

“expects”, “plans”, “anticipates”, “projects”, “will”, “believes”,

“intends” “should”, “could”, “may” and other similar terminology

are intended to identify such forward-looking statements.

Forward-looking statements reflect the current expectations and

beliefs of Conifex’s management. Because forward-looking statements

involve known and unknown risks, uncertainties and other factors,

actual results, performance or achievements of Conifex or the

industry may be materially different from those implied by such

forward-looking statements. Examples of such forward-looking

information that may be contained in this news release include

statements regarding: the availability and use of credit facilities

or proceeds therefrom; our level of liquidity and our ability to

service our debt; the realization of expected benefits of

completed, current and any contemplated capital projects and the

expected timing and budgets for such projects, including the

build-out of any high-performance computing or data center

operations; the growth and future prospects of our business; our

expectations regarding our results of operations and performance;

our planned operating format and expected operating rates; our

perception of the industries or markets in which we operate and

anticipated trends in such markets and in the countries in which we

do business; fluctuations in stumpage rates; our ability to supply

our manufacturing operations with wood fibre and our expected cost

of wood fibre; our expectation for market volatility associated

with, among other things, the softwood lumber dispute with the US;

potential negative impacts of duties or other protective measures

on our products, such as antidumping duties or countervailing

duties on softwood lumber; continued positive relations with

Indigenous groups; the development of a longer-term capital plan

and the expected benefits therefrom; demand and prices for our

products; our ability to develop new revenue streams; our

expectations about discussions with United Steelworkers concerning

renewal of the collective labour agreement in respect of our Power

Plant employees; the outcome of any actual or potential litigation;

future capital expenditures; and our expectations for US dollar

benchmark prices. Material factors or assumptions that were applied

in drawing a conclusion or making an estimate set out in the

forward-looking statements may include, but are not limited to, our

future debt levels; that we will complete our projects in the

expected timeframes and as budgeted; that we will effectively

market our products; that capital expenditure levels will be

consistent with those estimated by our management; our ability to

obtain and maintain required governmental and community approvals;

the impact of changing government regulations and shifting

political climates; that the US housing market will continue to

improve; that transportation services by third party providers will

continue uninterrupted; our ability to ship our products in a

timely manner; that there will be no additional unforeseen

disruptions affecting the operation of our Mackenzie power plant

and that we will be able to continue to deliver power therefrom;

our ability to obtain financing on acceptable terms, or at all;

that interest and foreign exchange rates will not vary materially

from current levels; the general health of the capital markets and

the lumber industry; and the general stability of the economic

environments within the countries in which we operate or do

business. Forward-looking statements involve significant

uncertainties, should not be read as a guarantee of future

performance or results, and will not necessarily be an accurate

indication of whether or not such results will be achieved. A

number of factors could cause actual results to differ materially

from the results discussed in the forward-looking statements,

including, without limitation: those relating to potential

disruptions to production and delivery, including as a result of

equipment failures, labour issues, the complex integration of

processes and equipment and other similar factors; labour

relations; failure to meet regulatory requirements; changes in the

market; potential downturns in economic conditions; fluctuations in

the price and supply of required materials, including log costs;

fluctuations in the market price for products sold; foreign

exchange fluctuations; trade restrictions or import duties imposed

by foreign governments; availability of financing (as necessary);

and other risk factors detailed in our 2023 annual information form

dated March 31, 2024 and our management's discussion and analysis

for the year ended December 31, 2023 and the quarter ended

September 30, 2024 available on SEDAR+ at www.sedarplus.com and

other filings with the Canadian securities regulatory authorities.

These risks, as well as others, could cause actual results and

events to vary significantly. Accordingly, readers should exercise

caution in relying upon forward-looking statements and Conifex

undertakes no obligation to publicly revise them to reflect

subsequent events or circumstances, except as required by

applicable securities laws.

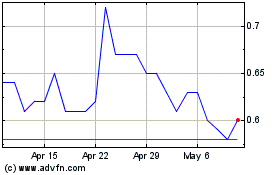

Conifex Timber (TSX:CFF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Conifex Timber (TSX:CFF)

Historical Stock Chart

From Feb 2024 to Feb 2025