Cardinal Energy Ltd. ("Cardinal" or the "Company") (TSX: CJ) is

pleased to announce that it has entered into an agreement with a

syndicate of underwriters (the “

Underwriters”) led

by CIBC Capital Markets pursuant to which the Underwriters have

agreed to purchase for resale to the public, on a bought deal

basis, 50,000 units (the “

Units”) of Cardinal for

gross proceeds of approximately $50 million (the

“

Offering”). Each Unit will comprise of one senior

subordinated unsecured debenture due March 31, 2030 with a par

value of $1,000 each (the “

Debentures”) and 65

common share purchase warrants (the “

Warrants”).

The Company has granted the Underwriters an option to purchase up

to an additional $10 million of Units, such option to be exercised

in whole or in part at the sole discretion of the Underwriters, at

any time until two business days prior to the Closing Date, as

defined below. The Offering is expected to close on or about

January 3, 2025 (the “

Closing Date”).

Each Warrant will entitle the holder to acquire

one common share of the Company from the Company at a price of

$7.00 per Common Share, representing a premium of approximately

12.4% to the last trade on the Toronto Stock Exchange (the

“TSX”) on December 17, 2024, for a period of three

years following the Closing Date.

The Company intends to use the net proceeds of

the Offering to repay outstanding indebtedness on its senior credit

facility, further the completion of its Reford thermal project,

accelerate the development of future thermal projects and for

general corporate purposes.

The Debentures will bear interest at a rate of

7.75% per annum, payable semi-annually in arrears on the last

business day of March and September of each year commencing on

March 31, 2025. The first payment will include accrued and unpaid

interest for the period from the Closing Date to, but excluding,

March 31, 2025. The Debentures will mature on March 31, 2030 (the

“Maturity Date”).

The Debentures will not be redeemable by the

Company before March 31, 2028 (the “First Call

Date”). On and after the First Call Date and prior to

March 31, 2029, the Debentures will be redeemable, in whole or in

part, from time to time at the Company’s option at a redemption

price equal to 103.875% of the principal amount of the Debentures

redeemed plus accrued and unpaid interest, if any, up to but

excluding the date set for redemption. On and after March 31, 2029

and prior to the Maturity Date, the Debentures will be redeemable,

in whole or in part, from time to time at the Company’s option at

par plus accrued and unpaid interest, if any, up to but excluding

the date set for redemption. The Company shall provide not more

than 60 nor less than 30 days’ prior notice of redemption of the

Debentures. The Company has the option to satisfy its obligations

to repay the principal amount of and premium (if any) on the

Debentures due at redemption or on maturity of the Debentures by

issuing and delivering that number of freely tradeable common

shares of the Company to Debenture holders in accordance with the

terms of the debenture indenture that will govern the terms of the

Debentures.

The Units will be distributed in all provinces

of Canada (other than the province of Quebec) by way of a

prospectus supplement to the Company’s base shelf prospectus dated

March 28, 2024 and by private placement in the United States to

“qualified institutional buyers” pursuant to Rule 144A of the U.S.

Securities Act of 1933.

Access to the Base Shelf Prospectus, the

Prospectus Supplement, and any amendments to the documents are

provided in accordance with securities legislation relating to

procedures for providing access to a base shelf prospectus, a

prospectus supplement and any amendment to the documents. The Base

Shelf Prospectus, the Prospectus Supplement (when filed) and any

amendments to these documents may be accessed for free on the

System for Electronic Document Analysis and Retrieval (“SEDAR+”) at

www.sedarplus.ca. Alternatively, electronic or paper copies of the

foregoing documents may be obtained, without charge, from: CIBC

Capital Markets, 161 Bay Street, 5th Floor, Toronto, ON M5J 2S8 or

by telephone at 1-416-956-6378 or by email at

mailbox.canadianprospectus@cibc.com, by providing the contact with

an email address or address, as applicable. The Offering is subject

to customary regulatory approvals, including the approval of the

TSX.

This new release is not an offer of securities

of Cardinal for sale in the United States. The securities have not

been and will not be registered under the U.S. Securities Act of

1933, as amended, and the securities may not be offered or sold in

the United States except pursuant to an applicable exemption from

such registration. No public offering of securities is being made

in the United States. This news release shall not constitute an

offer to sell or the solicitation of an offer to buy nor shall

there be any sale of the securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful.

Note Regarding Forward-Looking

Statements

This press release contains forward-looking

statements and forward-looking information (collectively

"forward-looking information") within the meaning of applicable

securities laws relating to Cardinal's plans and other aspects of

Cardinal's anticipated future operations, management focus,

objectives, strategies, financial, operating and production

results. Forward-looking information typically uses words such as

"anticipate", "believe", "project", "expect", "goal", "plan",

"intend", "may", "would", "could" or "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement. Specifically, this press release contains

forward-looking statements relating to the anticipated closing date

of the Offering and the use of proceeds of the Offering.

Although Cardinal believes that the expectations

reflected in these forward-looking statements are reasonable, undue

reliance should not be placed on them because Cardinal can give no

assurance that they will prove to be correct. Since forward looking

statements address future events and conditions, by their very

nature they involve inherent risks and uncertainties. The intended

use of the net proceeds of the Offering may change if the board of

directors of Cardinal determines that it would be in the best

interests of Cardinal to deploy the proceeds for some other purpose

and the closing date for the Offering may be changed. The forward

looking statements contained in this press release are made as of

the date hereof and Cardinal undertakes no obligations to update

publicly or revise any forward looking statements or information,

whether as a result of new information, future events or otherwise,

unless so required by applicable securities laws

About Cardinal Energy Ltd.

Cardinal is a Canadian oil and natural gas

company with operations focused on low decline oil in Western

Canada. Cardinal differentiates itself from its peers by having the

lowest decline conventional asset base in Western Canada. Cardinal

is approximately 40% complete on its first thermal SAGD oil

development project (the "Project") which will further increase the

long-term sustainability of the Company. The Project is expected to

add 6,000 bbl/d of oil production to Cardinal by the end of

2025.

For further information:

M. Scott Ratushny, CEO or Shawn Van Spankeren,

CFO or Laurence Broos, VP Finance Email: info@cardinalenergy.ca

Phone: (403) 234-8681

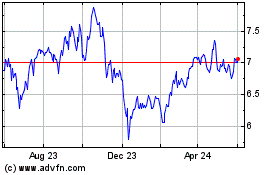

Cardinal Energy (TSX:CJ)

Historical Stock Chart

From Mar 2025 to Apr 2025

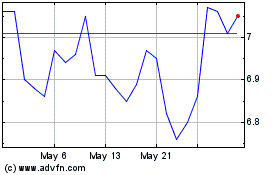

Cardinal Energy (TSX:CJ)

Historical Stock Chart

From Apr 2024 to Apr 2025