Northern Graphite Corporation (TSX VENTURE:NGC)(OTCQX:NGPHF) is pleased to

announce the results of its bankable feasibility study ("FS") for its 100% owned

Bissett Creek graphite deposit. The FS was prepared by GMining Services Inc. and

included contributions from SGS Canada Inc. (Lakefield-metallurgy and

Geostat-resource modelling), Knight Piesold Ltd. (environmental, permitting,

tailings management and road infrastructure) and Met-Chem Canada Inc. (process

engineering). A conference call will be held at 9:00 am Eastern Standard Time,

on July 10, 2012 to discuss the FS results (see details below). A National

Instrument 43-101 technical report relating to the FS will be filed on SEDAR

within 45 days of this news release.

Gregory Bowes, Chief Executive Officer, commented that: "The FS confirms the

technical and financial viability of constructing and operating an open pit mine

and a 2,300tpd processing plant on the Bissett Creek property and establishes

Northern Graphite as an industry leader with a large flake, high purity,

scalable deposit that is located close to infrastructure and has very

competitive operating costs". He added that "This is a conservative and

realistic study that indicates the project has attractive economics and that

there are a number of immediate, low risk opportunities to further enhance

project returns."

Table 1

Summary of Feasibility Study Results ($CDN- 1Q 2012)

Probable reserves (tonnes) 18,977,000t

Grade (graphitic carbon) 1.89%

Waste to ore ratio 0.50

Processing rate 2,300tpd (92% availability)

Mine life 23 years

Mill recovery 94.7% (years 3 to 23)

Average annual production

(tonnes of graphite

concentrate @ 94.5% C) 18,600t (first five years)

Capital cost ($ millions) $ 102.9M (including $9.4M contingency)

Mine Cash Operating costs ($

per tonne of concentrate) $ 851/t (first five years)

Mine Cash Operating Costs ($

per tonne of concentrate) $ 968/t (mine life)

Mining costs ($ per tonne of

ore) $ 5.79/t (mine life)

Processing costs ($ per tonne

of ore) $ 9.60/t (mine life)

General and administrative

costs ($ per tonne of ore) $ 2.94/t (mine life)

CDN/US dollar exchange rate 1.00

Graphite prices (US$ per

tonne) $ 2,800 $ 2,600 $ 2,300 $ 2,100

Pre tax Net Present Value @8%

(CDN$ millions) $ 182.8 $ 151.0 $ 103.5 $ 71.7

Pre tax IRR (%) 25.9% 23.1% 18.7% 15.6%

After tax Net Present Value

@8% (CDN$ millions) $ 125.0 $ 103.2 $ 69.9 $ 46.9

After tax IRR (%) 22.4% 20.0% 16.4% 13.7%

Prices of US$2,100 and US$2,600 per tonne of concentrate represent the 24 and 12

month weighted average price for the various sizes and grades of flake graphite

that will be produced from the Bissett Creek deposit, based on prices quoted by

Industrial Minerals Magazine. Prices of US$2,300/t and US$2,800/t represent the

24 and 12 month weighted average prices with the inclusion of a conservative 10%

premium over +80 mesh large flake graphite prices for the +50 mesh (XL) and +32

mesh (XXL) flake components that will make up approximately 50% of Bissett Creek

production. The Company believes that it will realize premiums in excess of 20%

over the price of standard large flake graphite based on historical pricing for

XL and XXL flake graphite.

Project Description

The proposed development of the Bissett Creek graphite deposit includes the

construction of an open pit mine, a 2,300tpd flotation processing plant based on

92% availability, a natural gas fueled power generating plant and associated

infrastructure. The processing plant will consist of conventional crushing,

grinding and flotation circuits followed by concentrate drying and screening.

The Company plans to build a natural gas pipeline to the site from the main

Trans Canada line which is approximately 15 kms away. The natural gas will fuel

five 1.0 MW-generators to produce electrical power and waste heat from the

generators will be used to dry the concentrate. This will result in low overall

energy costs. Infrastructure includes upgrading the last 5 kms of access road,

site preparation, and building a non-acid generating tailings facility and a

very small sulphide tailings facility. The processing plant will include

sulphide flotation at the end of the circuit to remove enough sulphides to make

approximately 97% of the tailings benign. After year 12 of operation, the

sulphide tailings will be moved to the bottom of a mined out pit for permanent

storage under water. Sulphide tailings and non-sulphide tailings will

subsequently continue to be deposited in a mined out pit for the balance of the

mine life which will result in a low final closure costs.

Resources and Reserves

Probable mining reserves for the Bissett Creek deposit were established based on

indicated resources estimated as at September, 2011 by Francois Thibert, M.Sc.

P. Geo. from SGS Canada Inc. (Geostat), an independent qualified person under NI

43-101, using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM)

Standards on Mineral Resources and Reserves, Definitions and Guidelines (see

Table 2).

Table 2

Bissett Creek Flake Graphite Deposit

2011 Updated Mineral Resources (Diluted), September 2011

----------------------------------------------------------------------------

Indicated Inferred

----------------------------------------------------------------------------

In Situ In Situ

Tonnage(i) Graphite(ii) Tonnage(i) Graphite(ii)

%Cg (metric Cg(%) (metric (metric Cg(%) (metric

Cut-off tons) by LECO tons) tons) by LECO tons)

----------------------------------------------------------------------------

0.986 25,983,000 1.81 470,300 55,038,000 1.57 864,100

----------------------------------------------------------------------------

1.227 24,588,000 1.85 454,900 50,472,000 1.62 817,600

----------------------------------------------------------------------------

1.50 19,954,000 1.99 397,100 33,672,000 1.81 609,500

----------------------------------------------------------------------------

1.75 16,031,000 2.34 375,100 21,417,000 2.21 473,300

----------------------------------------------------------------------------

2.0 11,921,000 2.50 298,000 14,584,000 2.37 345,600

----------------------------------------------------------------------------

Relative density 2.63t/m3, 10% dilution, 90% mine recovery, (i)rounded to

nearest 1k, (ii)rounded to nearest .1k

Mineral resources that are not mineral reserves do not have demonstrated

economic viability

G Mining established a breakeven cut-off grade ("COG") and ran optimized Whittle

pits on the indicated resources based on a number of parameters including those

outlined in Table 1. The final mine plan resulted in a probable reserve of 19.0

million tonnes of ore grading 1.89% graphitic carbon ("Cg") based on a cut-off

grade of 1.2% Cg. In order to increase head grades in the initial years of

production while maintaining a reasonable stripping ratio, ore between 1.2% Cg

and 1.6% Cg will be partially stockpiled and added to the mill feed at a later

date. The mine plan was also designed to supply blasted rock and glacial till

for tailings dam construction during pre-production and to allow for tailings

disposal in mined out areas by year 13 for sulphide tailings and year 16 for

non-sulphide tailings. A mining recovery factor of 90% and a dilution factor of

7.8% at a grade of 0.5% Cg were applied.

Metallurgy

SGS-Lakefield has completed the full suite of metallurgical tests on the Bissett

Creek deposit including lab and bench scale work, a bulk sample/pilot plant

test, and variability testing to ensure recoveries and flake size distribution

are consistent across the deposit. A similar program was also carried out in the

1980s as part of a previous feasibility study (non NI 43-101 compliant) with

consistent results.

The FS is largely based on pilot plant results from the processing of slightly

weathered material that does not respond as well to flotation as unweathered

rock. The locked cycle tests, which were performed on fresh drill core, were

better in terms of recoveries, concentrate grades and flake size distribution

which represents potential upside in the project.

The FS assumes recoveries of 92.7% in the first year of operation, 93.7% in year

two and 94.7% over the balance of the project. Recoveries in the eight

locked-cycle test averaged 97.2% and ranged from 95.2% to 99.1%.

The FS assumes an average concentrate grade of 94.5% compared to 94.9% in the

locked-cycle tests. However, the locked cycle tests generated average grades of

98.1%, 97.0% and 95.1% for the important +32 (XXL), +50 (XL) and +80 (L) mesh

size fractions respectively.

Based on pilot plant results, the FS assumes that production will consist of 18%

+32 mesh at 95.1% C, 31% +50 mesh at 95.1% C, 28.2% +80 mesh at 94.5% C, 5% +100

mesh at 97.3% C, 7% +150 mesh at 98% C and 11% -150 mesh at 92.7% carbon.

Production

Over the first five full years of operation a total of 4.2 million tonnes of ore

will be processed at an average head grade of 2.22% Cg to produce an average of

18,600 tonnes of graphite concentrate at 94.5% C per year. Over the 23 years of

operations contemplated in the FS, the mine will produce an average of

approximately 15,900 tonnes of graphite concentrate (94.5% C) per year which

includes processing of the low grade stockpile.

Operating Costs

Over the first five years, cash mine operating costs will average CDN$851 per

tonne of concentrate. Over the life of the project operating costs are estimated

at $968 per tonne of concentrate. These estimates are based on operating costs

per tonne of ore of $9.60 for processing, $2.94 for general and administrative

costs and $5.79 for mining.

Capital Costs

The capital cost to construct the processing plant, power plant and all

associated mine infrastructure is estimated at $93.5 million before contingency.

The total capital cost, including a $9.4 million contingency, is $102.9 million

(Table 3). In some instances the Company chose options that increased the

capital cost but reduced operating costs and improved the overall project

economics. In addition, the Company is required to post a financial assurance

with the Province of Ontario to guarantee its obligations with respect to the

Mine Closure Plan ("MCP"). The amount and timing of the financial assurance is

currently being negotiated.

Table 3

Capital Costs ($CDN millions)

Power plant and pipeline $ 11.7

Infrastructure $ 9.3

Mobile equipment $ 1.7

Tailings and water management $ 6.7

Processing plant $ 39.9

EPCM and construction indirects $ 14.2

General services and other $ 5.8

Preproduction and commissioning $ 4.2

----------------

SUBTOTAL $ 93.5

Contingency $ 9.4

----------------

TOTAL $ 102.9

Sensitivities

Table 4

Project Sensitivities (Pre tax)

$2,800 $2,600 $2,300 $2,100

---------------------------------------------------------------

NPV(i) IRR NPV(i) IRR NPV(i) IRR NPV(i) IRR

---------------------------------------------------------------

Base Case $ 182.8 25.9% $ 151.0 23.1% $ 103.5 18.7% $ 71.7 15.6%

Grade +10% $ 219.0 28.2% $ 184.7 25.4% $ 133.2 21.0% $ 98.9 17.9%

Operating

costs -10% $ 198.0 27.2% $ 166.2 24.4% $ 118.7 20.1% $ 86.9 17.1%

Operating

costs +10% $ 167.6 24.6% $ 135.8 21.7% $ 88.3 17.3% $ 56.5 14.1%

Capex -10% $ 193.0 28.5% $ 161.3 25.5% $ 113.7 20.8% $ 82.0 17.5%

Capex +10% $ 172.5 23.6% $ 140.8 21.0% $ 93.2 16.9% $ 61.5 14.0%

(i)$ millions @ 8%

Project Opportunities

It is the opinion of Northern Graphite management that a number of significant,

low risk opportunities exist to improve upon the FS. A 10% increase in grade and

a 10% reduction in operating costs for example, both of which management

believes are achievable for the reasons outlined below, would increase the pre

tax IRR by up to 20% and the NPV by up to 40%.

1. The final pit includes approximately 1.5 million tonnes of inferred

resources grading 1.54% Cg which are treated as waste. The processing of

this material would reduce the stripping ratio and mining costs and

improve cash flows.

2. The mine plan does not consider inferred resources outside the pit where

significant tonnages in excess of 2% Cg exist. Upgrading these resources

to indicated and including them in a revised mine plan, instead of

processing the low grade stockpile, would reduce costs, greatly extend

the mine life, and further enhance the economics of the deposit. The

Preliminary Economic Assessment on the Bissett Creek project states

there is a relatively high probability that inferred resources can be

upgraded due to the thick, flat lying and continuous nature of the

mineralization in the Bissett Creek deposit. Mineral resources that are

not mineral reserves do not have demonstrated economic viability.

3. Actual graphite production from the pilot plant was approximately 4%

higher than indicated by the assayed head grade of the bulk sample while

graphite production from eight locked cycle tests was approximately 12%

higher than the assayed head grades. The bulk sample consisted of

partially weathered near surface material which does not respond as well

to flotation while the locked cycle tests were performed using fresh

drill core. Therefore, the reserve grade is considered conservative and

potentially understated. Further investigation of assay procedures and

mineralogy is planned to explain the understatement but sufficient

testing has been done for the Company to conclude that the performance

of the mill will likely exceed levels used in the FS.

4. The FS assumed contract mining. It is highly likely the Company will buy

and operate its own mining fleet. The incremental capital cost is

approximately $7 million but with lease financing, and 20% down payment,

the incremental financing requirement is approximately $1.4 million.

Owner mining would reduce operating costs by approximately $50 per tonne

of concentrate.

5. The Company expects to achieve 95% mill recoveries earlier than

projected in the FS and ultimately to exceed the 95% level and to do

better than the 92% mill utilization rate used in the FS.

6. The Company's business plan is to significantly expand production in the

future by incorporating inferred resources and to reduce unit costs

below $800/tonne of concentrate. Inferred resources are considered too

speculative geologically to have the economic considerations applied to

them that would enable them to be categorized as mineral reserves, and

there is therefore no certainty that the Company's business plan in this

regard will be realized. Mineral resources that are not mineral reserves

do not have demonstrated economic viability.

7. There is scope to reduce capital costs through the purchase of used

equipment, lease financing of the natural gas generators, and additional

permitting to provide access to lower cost tailings options.

8. The Company has successfully upgraded graphite concentrate from the

Bissett Creek deposit for use in Lithium ion batteries and other high

purity markets. Testing is ongoing and will assist the Company in

defining the capital and operating costs associated with constructing an

upgrading facility. No revenues or costs associated with upgrading and

selling into value added markets are included in the FS. Industrial

Minerals Magazine recently reported that spherical graphite used in

Lithium ion batteries sells for US$6,000-8,000 per tonne.

Environmental, Permitting and Local Community

The Company expects to file its Mine Closure Plan ("MCP") with the Ministry of

Northern Development and Mines ("MNDM") within three weeks. The MCP is a

comprehensive document that describes in detail the scope of the project

including the nature of mining and processing operations, buildings and

infrastructure, potential effects on the environment, mitigation measures to

protect the environment, a description of First Nation, government agency and

local community consultation, and the Company's plan to rehabilitate the site

and return it to its natural state at the end of operations including an

estimate of the cost of doing so. The Company is required to post a financial

assurance to ensure that funds are available to complete the closure plan. The

MNDM has 45 days to respond and the Company anticipates that acceptance and

approval of the MCP will be received by the end of the third quarter of this

year. Approval of the MCP will enable the Company to initiate construction and

to apply for a number of other permits that relate to operations.

Qualified Persons

The FS was prepared in accordance with NI 43-101 standards by G Mining Services

Inc. Louis Gignac, ing., Nicolas Menard, ing., Antoine Champagne, ing., Ahmed

Bouajila, ing., Robert Menard, ing., and Robert Marchand, ing. are the

independent "qualified persons" under NI 43-101 who were responsible for

preparing the FS on behalf of GMining Services Inc. The scientific and technical

information in this press release has been reviewed and approved by Louis

Gignac, ing., President of GMining Services Inc.

This press release has also been reviewed and approved by Don Baxter, P.Eng,

President of the Company and a non-independent "Qualified Person" under NI

43-101.

Readers should refer to the NI 43-101 technical report relating to the FS for

further details of the project development. The technical report will be filed

on SEDAR (www.sedar.com) within 45 days of this news release in accordance with

NI 43-101.

The Graphite Market

Graphite production and exports from China, which produces 70% of the world's

supply, are expected to decline and an export tax and a licensing system have

been instituted. As a result, both the European Union and the United States have

declared graphite a supply critical mineral and end users are actively seeking

secure, alternative sources of quality supply.

Graphite demand and prices have increased substantially over the past few years

due to the ongoing modernization of China and other emerging economies which has

resulted in strong demand from traditional steel and automotive markets. In

addition, new applications such as lithium ion batteries, vanadium redox

batteries, fuel cells and nuclear power have the potential to create significant

incremental demand growth. The manufacturing of Li ion batteries requires up to

30 times more graphite than lithium and their use in the growing EV/HEV market

is expected to require significant increases in graphite production.

Northern Graphite Corporation

Northern Graphite Corporation is a Canadian company that has a 100% interest in

the Bissett Creek graphite deposit located in eastern Ontario. Northern Graphite

is well positioned to benefit from this compelling supply/demand dynamic with a

high purity, large flake, scalable deposit that is located close to

infrastructure. Additional information on Northern Graphite can be found under

the Company's profile on SEDAR at www.sedar.com and on the Company's website at

www.northerngraphite.com.

Conference Call

The Company has scheduled a conference call to discuss the FS at 9:00 a.m.

Eastern Standard Time (EST) on Tuesday, July 10th 2012. Gregory Bowes, CEO, and

Don Baxter P.Eng, President of Northern Graphite will host the call and invite

analysts and investors to participate.

Time: 9:00 a.m. Eastern Standard Time

Dial in Number: 800 734 8507

This press release contains forward-looking statements, which can be identified

by the use of statements that include words such as "could", "potential",

"believe", "expect", "anticipate", "intend", "plan", "likely", "will" or other

similar words or phrases. These statements are only current predictions and are

subject to known and unknown risks, uncertainties and other factors that may

cause our or our industry's actual results, levels of activity, performance or

achievements to be materially different from those anticipated by the

forward-looking statements. The Company does not intend, and does not assume any

obligation, to update forward-looking statements, whether as a result of new

information, future events or otherwise, unless otherwise required by applicable

securities laws. Readers should not place undue reliance on forward-looking

statements.

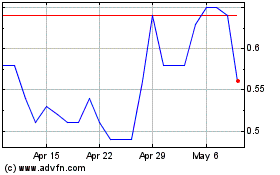

Condor Gold (TSX:COG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Condor Gold (TSX:COG)

Historical Stock Chart

From Feb 2024 to Feb 2025