Northern Graphite Announces Results of Expansion Case PEA

October 23 2013 - 7:45AM

Marketwired Canada

Northern Graphite Corporation (TSX VENTURE:NGC)(OTCQX:NGPHF) announces the

results of a Preliminary Economic Assessment (the "PEA") on an expansion case

for its 100% owned Bissett Creek graphite project. The PEA was undertaken to

demonstrate the ability to meet expected future growth in graphite demand by

substantially increasing production from the Bissett Creek deposit based on

measured and indicated resources only. The PEA builds on the Feasibility Study

(the "FS") completed by G Mining in August, 2012 and the expanded resource model

and updated FS economics (the "FS Update") subsequently completed by AGP Mining

Consultants ("AGP"). The PEA was authored by Marc Leduc P. Eng. AGP completed

the resource and reserve estimates and mine plan. A NI 43-101 Technical Report

will be filed on www.sedar.com within 45 days hereof.

The PEA estimates the economics of doubling mill throughput after three years of

operation and demonstrates that Bissett Creek has very attractive economics even

at or below current depressed graphite price levels. The pre-tax internal rate

of return ("IRR") is 26.3% (22.0% after tax) and the pre-tax net present value

("NPV") is $231.1 million ($150.0 million after tax) in the base case which uses

an 8% discount rate and a weighted average price of US$1,800/tonne of

concentrate. The PEA notes that the deposit was extensively investigated in the

1980s and this work was essentially redone over the last three years with

consistent results and brought up to NI 43-101 standards. In addition, resources

have been infill drilled and significantly expanded. Consequently, the project

has been substantially de-risked in terms of resources, metallurgy and

engineering.

Gregory Bowes, CEO, commented that: "The current graphite supply chain is

heavily dependent on China and is characterized by many inefficient producers

with poor environmental and labor practices and inconsistent product quality,

delivery and reliability. Bissett Creek will produce the highest quality

concentrates in the industry and will provide a stable, secure source of supply

at very competitive costs and prices."

Summary of PEA Results

PEA FS Update

Reserves/resources (million tonnes)(i) 39.4Mt(i) 28.3Mt(i)

Feed Grade (% graphitic carbon) 1.85%(i) 2.06%(i)

Waste to ore ratio 0.24 0.79

Processing rate (tonnes per day - 92% availability) 2,670-5,340 2,670

Mine life 22 years 28 years

Mill recovery 94.7% 94.7%

Average annual production 33,183t 20,800t

Initial capital cost ($ millions - including 10%

contingency) $101.6M $101.6M

Expansion capital $45.2M NA

Sustaining capital $58.7M $43.0

Cash operating costs ($/tonne of concentrate) $695/t $795/t

Mining costs ($/tonne of ore) $4.05 $5.63

Processing costs ($/tonne of ore) $7.35 $8.44

General and administrative costs ($/tonne of ore) $1.45 $2.50

CDN/US dollar exchange rate 0.95 0.95

(i) The probable reserve in the FS update consists of 24 million tonnes

("Mt") grading 2.20% Cg and 4.0 Mt of low grade stockpile ("LGS")

grading 1.26% Cg. The PEA accelerates the processing of the probable

reserve and processes an additional 11.1 million tonnes of measured and

indicated resources from the LGS at the end of the mine life. All

grades are diluted.

FS Update PEA Expansion Case

----------------------

(base

case)

Graphite prices (US$ per tonne) $1,800 $2,100 $1,800 $1,500

Pre-tax Net Present Value @8% (CDN$

millions) $129.9 $335.6 $231.0 $126.6

Pre-tax IRR (%) 19.8% 33.0% 26.3% 18.8%

After tax Net Present Value @8% (CDN$

millions) $89.3 $221.9 $150.0 $77.3

After tax IRR (%) 17.3% 27.7% 22.0% 15.7%

The proposed development of the Bissett Creek graphite deposit consists of an

open pit mine and a processing plant with conventional crushing, grinding and

flotation circuits followed by concentrate drying and screening. The PEA assumes

that the processing plant is twinned after three years of operation, except for

the crusher which has excess capacity, and that the capacity of the plant is

effectively doubled. Corresponding adjustments were made to the power plant,

mine fleet and tailings storage facilities and other infrastructure to account

for the increased throughput.

Measured and indicated resources for the Bissett Creek deposit consist of 69.8

million tonnes ("Mt") grading 1.74% graphitic carbon ("Cg") based on a 1.02% Cg

cutoff grade ("COG"). The final mine plan in the FS update only contemplated a

25 to 30 year operation and resulted in probable reserves of 28.3 Mt of ore

grading 2.06% graphitic carbon based on a COG of 0.96% Cg. Probable reserves

include 24.3 Mt grading 2.20% Cg that will be processed first and 4.0 Mt grading

1.26% Cg from a low grade stockpile ("LGS") that will be processed at the end of

the mine life. In order to increase head grades in the initial years of

production while maintaining a reasonable stripping ratio, measured and

indicated resources grading between 0.96% Cg and 1.5% Cg were stockpiled,

largely within mined out areas of the pit. The total LGS will be 16.5 Mt grading

1.26% Cg.

The PEA uses the same mine plan but accelerates the mining of the high grade ore

and processes all of the LGS thereafter. There are an additional 27.3 million

tonnes of measured and indicated resources grading 1.62% Cg which are not

included in the mine plan and 24 million tonnes of inferred resources grading

1.65% Cg which are treated as waste. Also, resources have not yet been closed

off by drilling and therefore further expansions are possible. Over the first

ten years of operation almost 38,000 tonnes of graphite concentrate will be

produced yearly and an average of 33,100 tonnes will be produced over the

project life.

Cash mine operating costs will average CDN$695 per tonne of concentrate over the

mine life. Due to the flat lying nature of the deposit, production can be

expanded without any capital investment required for additional stripping or

pushbacks of the pit walls. The waste to ore ratio actually declines in the PEA

expansion scenario and contributes to lower operating costs. The initial capital

cost estimate to construct the processing plant, power plant and all associated

mine infrastructure remains at $101.6 million including a $9.3 million

contingency. Under the PEA, an additional $45.2 million in expansion capital has

been added in year three for the parallel mill circuits and sustaining capital

over the mine life was increased by $15.7M for additional mining equipment,

tailings facilities and other infrastructure.

Sensitivities (pre-tax)

$2,100 $1,800 $1,500

NPV(i) IRR NPV(i) IRR NPV(i) IRR

Base Case $335.6 33.0% $231.1 26.3% $126.6 18.8%

Grade +10% $408.3 37.4% $293.3 30.4% $178.3 22.6%

Grade -10% $263.0 28.4% $168.9 21.9% $74.9 14.8%

Operating costs -10% $358.7 34.5% $254.2 27.8% $149.7 20.6%

Operating costs +10% $312.6 31.5% $208.1 24.7% $103.6 17.1%

Capex -10% $351.2 36.2% $246.7 29.0% $142.2 21.1%

Capex +10% $320.1 30.3% $215.6 23.9% $111.1 16.9%

(i) $ millions @ 8%

Graphite Markets and Pricing

After more than tripling from 2005 to 2012, graphite prices have fallen back 50%

or more due to the slowdown in China and a lack of growth in the US, Europe and

Japan. Recently it has been reported that Chinese flake production has fallen

27% and that the only North American producer has suspended operations which

indicates that current prices are close to the marginal cost of production for

many producers. These shutdowns have helped stabilize prices for the last six

months and should limit further price declines. The weighted average price that

would be realized by Bissett Creek concentrates in the current market is

estimated at US$1,800/t based on +50 mesh prices of approximately $2,100/t,

$1,350 for +80 mesh, $1,100 for -100 to +80 mesh and $900 for -100 mesh, all at

94% C or better. Sensitivities are presented at US$2,100/t and at US$1,500/t.

Qualified Persons

Pierre Desautels, P.Geo., Principal Resource Geologist, and Gordon Zurowski,

P.Eng., Principal Mining Engineer, both of AGP Mining Consultants and Qualified

Persons under NI 43-101 who are independent of the Company, prepared the mineral

resource estimates in the PEA. Gordon Zurowski, P.Eng., prepared the reserve

estimate and the updated Feasibility Study economics. Marc Leduc, P.Eng., who is

independent of the Company, prepared the PEA and approved and authorized the

release of the information contained herein.

Northern Graphite Corporation

Northern Graphite Corporation is a Canadian company that has a 100% interest in

the Bissett Creek graphite deposit located in eastern Ontario. Graphite demand

is expected to rapidly increase in the future due to strengthening economies and

the growth in new technologies such as lithium ion batteries, particularly due

to their use in hybrid and all electric vehicles. Northern Graphite is well

positioned to benefit from this compelling supply/demand dynamic with a high

purity, large flake, scalable deposit that is located close to infrastructure.

Additional information on Northern can be found at www.sedar.com and

www.northerngraphite.com.

This press release contains forward-looking statements, which can be identified

by the use of statements that include words such as "could", "potential",

"believe", "expect", "anticipate", "intend", "plan", "likely", "will" or other

similar words or phrases. These statements are only current predictions and are

subject to known and unknown risks, uncertainties and other factors that may

cause our or our industry's actual results, levels of activity, performance or

achievements to be materially different from those anticipated by the

forward-looking statements. The Company does not intend, and does not assume any

obligation, to update forward-looking statements, whether as a result of new

information, future events or otherwise, unless otherwise required by applicable

securities laws. Readers should not place undue reliance on forward-looking

statements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Northern Graphite Corporation

Gregory Bowes

CEO

(613) 241-9959

Northern Graphite Corporation

Stephen Thompson

CFO

(613) 241-9959

www.northerngraphite.com

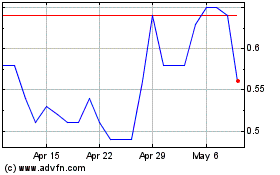

Condor Gold (TSX:COG)

Historical Stock Chart

From Apr 2024 to May 2024

Condor Gold (TSX:COG)

Historical Stock Chart

From May 2023 to May 2024