Currency Exchange International Closes Transaction with U.S. Exchange House

March 28 2014 - 3:52PM

Marketwired

Currency Exchange International Closes Transaction with U.S.

Exchange House

TORONTO, ONTARIO--(Marketwired - Mar 28, 2014) - Currency

Exchange International, Corp. (the "Company")

(TSX:CXI)(OTCBB:CURN), further to its press release dated March 20,

2014, announces today that its subsidiaries, Currency Exchange

International America Corp. and Currency Exchange International of

Canada Corp., have closed the acquisition of certain assets of U.S.

Exchange House, Inc. ("USEH") pertaining to the wholesale banknote

operations located in the United States of America and Canada. CXI

paid USD$2.35 million in cash on closing along with two additional

contingent payments of up to USD$1.325 million payable on the first

and second anniversary after closing. These additional payments

will be based on the amount of revenue generated from the customers

acquired. The assets acquired from USEH will be merged and

integrated into the Company's current banknote business and will

continue to use the Currency Exchange International, Corp. brand

name. Operational efficiencies are expected by the Company's

management due to the very similar business operations and overlap

of back office functions and the hiring of some USEH currency

trading staff. CXI expects to continue to grow its banknote

business due to the increased customer base.

About U.S. Exchange

House, Inc.

USEH operated its wholesale banknote and related businesses in

Los Angeles and Toronto. Its quality service led to a portfolio of

many loyal clients. USEH traders include a team of professionals

with complementary skills and strength.

About Currency Exchange

International, Corp.

The Company is in the business of providing a range of foreign

currency exchange and related products and services in North

America, including the Hawaiian Islands. Primary products and

services include the exchange of foreign currencies, wire transfer

payments, purchase and sale of foreign bank drafts and

international traveler cheques, and foreign cheque clearing.

Related services include the licensing of proprietary FX software

applications delivered on its web-based interface, www.ceifx.com

("CEIFX"), and licensing retail foreign currency operations to

select companies in agreed locations.

The Company's services are provided in Canada by its wholly

owned subsidiary, CXIC, based in Toronto, Canada through the use of

CEIFX.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This press release includes forward-looking information

within the meaning of applicable securities laws. This

forward-looking information includes, or may be based upon,

estimates, forecasts and statements as to management's expectations

with respect to, among other things, successful completion of the

asset acquisition, continued growth of the Company's banknote

business, increase in net revenues based on the acquisition, demand

and market outlook for wholesale and retail foreign currency

exchange products and services, proposed entry into the Canadian

financial services industry, future growth, the timing and scale of

future business plans, results of operations, performance, and

business prospects and opportunities. Forward-looking statements

are identified by the use of terms and phrases such as

"anticipate", "believe", "could", "estimate", "expect", "intend",

"may", "plan", "predict", "preliminary", "project", "will",

"would", and similar terms and phrases, including references to

assumptions.

Forward-looking information is based on the opinions and

estimates of management at the date such information is provided,

and on information available to management at such time.

Forward-looking information involves significant risks,

uncertainties and assumptions that could cause the Company's actual

results, performance or achievements to differ materially from the

results discussed or implied in such forward-looking information.

Actual results may differ materially from results indicated in

forward-looking information due to a number of factors including,

without limitation, the competitive nature of the foreign exchange

industry, currency exchange risks, the need for the Company to

manage its planned growth, the effects of product development and

the need for continued technological change, protection of the

Company's proprietary rights, the effect of government regulation

and compliance on the Company and the industry in which it

operates, network security risks, the ability of the Company to

maintain properly working systems, theft and risk of physical harm

to personnel, reliance on key management personnel, global economic

deterioration negatively impacting tourism, volatile securities

markets impacting security pricing in a manner unrelated to

operating performance and impeding access to capital or increasing

the cost of capital, and the regulatory approval process for a new

Canadian Schedule I bank, as well as the factors identified

throughout this press release and in the section entitled "Risks

and Uncertainties" of the Company's Management's Discussion and

Analysis for Three-Month Period Ended January 31, 2014. The

forward-looking information contained in this press release

represents management's expectations as of the date hereof (or as

of the date such information is otherwise stated to be presented),

and is subject to change after such date. The Company disclaims any

intention or obligation to update or revise any forward-looking

information whether as a result of new information, future events

or otherwise, except as required under applicable securities

laws.

The Toronto Stock Exchange does not accept responsibility for

the adequacy or accuracy of this press release. No stock exchange,

securities commission or other regulatory authority has approved or

disapproved the information contained in this press release.

Currency Exchange International, Corp.Randolph W. PinnaPresident

and Chief Executive

Officer407.240.0224Randolph@ceifx.comwww.ceifx.com

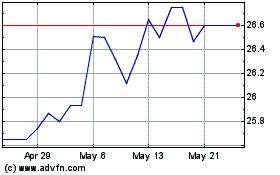

Currency Exchange (TSX:CXI)

Historical Stock Chart

From Jan 2025 to Feb 2025

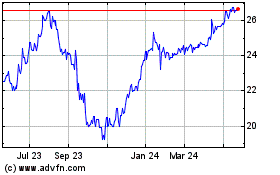

Currency Exchange (TSX:CXI)

Historical Stock Chart

From Feb 2024 to Feb 2025