Currency Exchange International, Corp. (“

CXI” or

the “

Company”) (TSX: CXI) (OTC: CURN), announced

today that a Special Committee of independent directors is actively

considering a range of strategic options for its wholly-owned

subsidiary, Exchange Bank of Canada (“

EBC”), a

federally chartered non-deposit-taking Canadian Schedule I bank.

The strategic review aims to explore opportunities to maximize

long-term value for shareholders and focus the Company’s resources

towards its profitable U.S. operations.

The formal review of the future of EBC is

expected to enhance performance and improve the return on CXI’s

capital. INFOR Financial Inc. has been retained as the Company’s

strategic advisor to assist in this process.

The Board of Directors and Management are

focused on assessing shareholder interests and evaluating the

optimal path forward for CXI on executing its strategic plan. CXI

emphasizes that there is no assurance the strategic review will

result in any specific transaction. The Company remains committed

to ensuring minimal, if any, disruption to all its stakeholders

throughout this process.

About Currency Exchange International,

Corp.

Currency Exchange International is in the

business of providing comprehensive foreign exchange technology and

processing services for banks, credit unions, businesses, and

consumers in the United States and select clients globally. Primary

products and services include the exchange of foreign currencies,

wire transfer payments, Global EFTs, and foreign cheque clearing.

Wholesale customers are served through its proprietary FX software

applications delivered on its web-based interface, www.cxifx.com

(“CXIFX”), its related APIs with core banking

platforms, and through personal relationship managers. Consumers

are served through Company-owned retail branches, agent retail

branches, and its e-commerce platform, order.ceifx.com.

The Group’s wholly-owned Canadian subsidiary,

Exchange Bank of Canada, based in Toronto, Canada, provides foreign

exchange and international payment services in Canada and select

international foreign jurisdictions. Clients are served through the

use of its proprietary software, www.ebcfx.com

(“EBCFX”), related APIs to core banking platforms,

and personal relationship managers.

Contact Information

For further information please contact: Bill

Mitoulas Investor Relations (416) 479-9547 Email:

bill.mitoulas@cxifx.com Website: www.cxifx.com

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION

This press release includes forward-looking

information within the meaning of applicable securities laws. This

forward-looking information includes, or may be based upon,

estimates, forecasts, and statements as to management’s

expectations with respect to, among other things, the merits and

impact of the evaluation of strategic alternatives for Exchange

Bank of Canada (EBC). Forward-looking statements are identified by

the use of terms and phrases such as “anticipate,” “believe,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,”

“preliminary,” “project,” “will,” “would,” and similar terms and

phrases, including references to assumptions.

Forward-looking information is based on the

opinions and estimates of management at the date such information

is provided and on information available to management at such

time. Forward-looking information involves significant risks,

uncertainties, and assumptions that could cause the Company’s

actual results, performance, or achievements to differ materially

from the results discussed or implied in such forward-looking

information. Actual results may differ materially from results

indicated in forward-looking information due to a number of factors

including, without limitation, potential disruptions to customer

relationships or operations during the review process, challenges

in developing and adopting a strategic plan, regulatory

requirements and timing related to EBC’s operations, risks

associated with any potential transition, potential disruptions to

operations during the transition period, risks associated with the

outcome and implementation of the strategic review, competition in

the foreign exchange and payments industries, fluctuations in

financial performance caused by global economic conditions,

competition in the foreign exchange and payments industries,

reliance on key personnel, and fluctuations in financial

performance caused by global economic conditions or changes in

foreign currency markets.

Additional risks include the ability of the

Company to comply with regulatory requirements, the competitive

nature of the foreign exchange industry, the impact of infectious

diseases or the evolving situation in Ukraine on factors relevant

to the Company’s business, currency exchange risks, the need for

the Company to manage its planned growth, the effects of product

development and the need for continued technological change,

protection of the Company’s proprietary rights, the effect of

government regulation and compliance on the Company and the

industry in which it operates, network security risks, the ability

of the Company to maintain properly working systems, theft and risk

of physical harm to personnel, reliance on key management

personnel, unexpected losses or challenges associated with customer

attrition during the strategic review process, global economic

deterioration negatively impacting tourism, volatile securities

markets impacting security pricing in a manner unrelated to

operating performance and impeding access to capital or increasing

the cost of capital, as well as the factors identified throughout

this press release and in the section entitled “Financial Risk

Factors” of the Company’s Management’s Discussion and Analysis for

the three and nine months ended July 31, 2024.

The forward-looking information contained in

this press release represents management’s expectations as of the

date hereof (or as of the date such information is otherwise stated

to be presented) and is subject to change after such date. The

Company disclaims any intention or obligation to update or revise

any forward-looking information whether as a result of new

information, future events, or otherwise, except as required under

applicable securities laws.

The Toronto Stock Exchange does not accept

responsibility for the adequacy or accuracy of this press release.

No stock exchange, securities commission, or other regulatory

authority has approved or disapproved the information contained in

this press release.

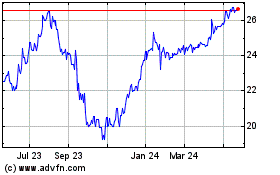

Currency Exchange (TSX:CXI)

Historical Stock Chart

From Jan 2025 to Feb 2025

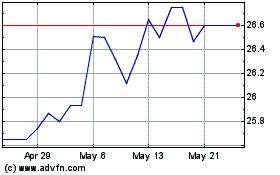

Currency Exchange (TSX:CXI)

Historical Stock Chart

From Feb 2024 to Feb 2025