Currency Exchange International, Corp. Announces Exchange Bank of Canada Appeal of FINTRAC’s Penalty

December 11 2024 - 3:00PM

Currency Exchange International, Corp. (“Currency Exchange” or the

“Company”) (TSX:CXI) (OTCPK:CURN) today announced that Exchange

Bank of Canada (“

EBC” or “

the

Bank”) , a federally chartered Canadian Schedule 1 bank

and a 100% wholly owned subsidiary of the Company, has filed a

notice of appeal with the Federal Court of Canada in relation to

the Financial Transactions and Reports Analysis Centre of Canada’s

(FINTRAC) notice of administrative monetary penalties of $2.46

million involving the Bank.

This administrative action does not assert that

EBC has been involved in money laundering or terrorist

financing.

“EBC takes its compliance, monitoring, and

reporting obligations very seriously,” said President and CEO,

Randolph Pinna. “We believe that substantial enhancements were

implemented in recent years and EBC remains committed to

maintaining the highest standards of ethical conduct and regulatory

compliance. EBC will continue to ensure our compliance regime keeps

pace with evolving standards and industry practices.”

EBC is of the opinion that the penalty is not

commensurate with the alleged violations. Given that this matter is

the subject of an appeal, EBC does not intend to comment further at

this time.

About Currency Exchange International,

Corp.

Currency Exchange International is in the

business of providing comprehensive foreign exchange technology and

processing services for banks, credit unions, businesses, and

consumers in the United States and select clients globally. Primary

products and services include the exchange of foreign currencies,

wire transfer payments, Global EFTs, and foreign cheque clearing.

Wholesale customers are served through its proprietary FX software

applications delivered on its web-based interface, www.cxifx.com

(“CXIFX”), its related APIs with core banking platforms, and

through personal relationship managers. Consumers are served

through Group-owned retail branches, agent retail branches, and its

e-commerce platform, order.ceifx.com.

The Group’s wholly-owned Canadian subsidiary

Online FX, Exchange Bank of Canada, based in Toronto, Canada,

provides foreign exchange and international payment services in

Canada and select international foreign jurisdictions. Customers

are served through the use of its proprietary software,

www.ebcfx.com (“EBCFX”), related APIs to core banking platforms,

and personal relationship managers.

Contact Information

For further information please contact: Bill

Mitoulas Investor Relations (416) 479-9547 Email:

bill.mitoulas@cxifx.com Website: www.cxifx.com

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION

This press release includes forward-looking

information within the meaning of applicable securities laws. This

forward-looking information includes, or may be based upon,

estimates, forecasts, and statements as to management’s

expectations with respect to, among other things, the nature and

terms of the FINTRAC penalty, the merits or possible outcome of the

appeal, and ongoing regulatory compliance measures and the adequacy

thereof. Forward-looking statements are identified by the use of

terms and phrases such as “anticipate”, “believe”, “could”,

“estimate”, “expect”, “intend”, “may”, “plan”, “predict”,

“preliminary”, “project”, “will”, “would”, and similar terms and

phrases, including references to assumptions.

Forward-looking information is based on the

opinions and estimates of management at the date such information

is provided, and on information available to management at such

time. Forward-looking information involves significant risks,

uncertainties and assumptions that could cause the Company’s actual

results, performance, or achievements to differ materially from the

results discussed or implied in such forward-looking information.

Actual results may differ materially from results indicated in

forward-looking information due to a number of factors including,

without limitation, the ability of the Company and EBC to comply

with regulatory requirements, the ability of the Company to manage

regulatory infractions and enforcement measures without impairing

the operation of its business or undertaking, the ability of the

Company to adopt and adhere to regulatory requirements, the

competitive nature of the foreign exchange industry, the impact of

infectious diseases or the evolving situation in Ukraine on factors

relevant to the Company’s business, currency exchange risks, the

need for the Company to manage its planned growth, the effects of

product development and the need for continued technological

change, protection of the Company’s proprietary rights, the effect

of government regulation and compliance on the Company and the

industry in which it operates, network security risks, the ability

of the Company to maintain properly working systems, theft and risk

of physical harm to personnel, reliance on key management

personnel, global economic deterioration negatively impacting

tourism, volatile securities markets impacting security pricing in

a manner unrelated to operating performance and impeding access to

capital or increasing the cost of capital as well as the factors

identified throughout this press release and in the section

entitled “Financial Risk Factors” of the Company’s Management’s

Discussion and Analysis for the three and nine-months ended July

31, 2024. The forward-looking information contained in this press

release represents management’s expectations as of the date hereof

(or as of the date such information is otherwise stated to be

presented) and is subject to change after such date. The Company

disclaims any intention or obligation to update or revise any

forward-looking information whether as a result of new information,

future events or otherwise, except as required under applicable

securities laws.

The Toronto Stock Exchange does not accept

responsibility for the adequacy or accuracy of this press release.

No stock exchange, securities commission or other regulatory

authority has approved or disapproved the information contained in

this press release.

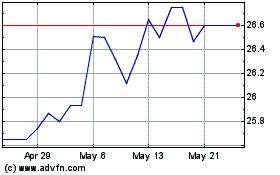

Currency Exchange (TSX:CXI)

Historical Stock Chart

From Jan 2025 to Feb 2025

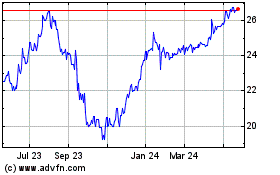

Currency Exchange (TSX:CXI)

Historical Stock Chart

From Feb 2024 to Feb 2025