Currency Exchange International, Corp. (TSX:CXI)

(OTCBB:CURN), a full service foreign exchange technology

and services provider, is pleased to announce a new international

payments integration with WireXchange®, a wire transfer solution

from financial services technology provider Fiserv. The integration

provides financial institutions enhanced automation through an

efficient end-to-end payment process supported by an experienced,

foreign exchange specialist. The integration has officially

launched and is now available to financial institutions in the

United States.

Financial institutions are now able to

streamline their international payments process through

WireXchange, while benefiting from CXI’s world-class customer

service, pricing, and full suite of foreign exchange solutions. The

integration into WireXchange helps financial institutions deliver

the necessary competitive advantage of speed and service through

operational efficiencies during a time when the digital payments

industry is evolving to embrace such ideals.

"Several of CXI’s existing financial institution

customers for foreign banknotes and cheques are using WireXchange,

and have expressed interest in doing international wire payments

with CXI now that it has completed its integration with Fiserv.

Additionally, we understand there are many other banks dealing with

the unique challenges presented by managing their various

international payment programs. With CXI’s leading technology and

customer service, it makes it compelling for banks to switch to CXI

to benefit from its consultative and customized customer

relationship process," said Randolph Pinna, Chief Executive Officer

of CXI.

Financial institutions have traditionally

provided foreign exchange and international services through

multiple bank relationships that also compete for the same business

within their markets. CXI enables financial institutions to have

all of their international services with one provider that does not

compete with the financial institution for their clients and

creates client-focused relationships with a suite of offerings

including foreign currency banknotes, foreign cheque clearing, and

international payments. The relationship between CXI and Fiserv

facilitates a seamless and automated international payments

processing that is available to more financial institutions than

ever before.

About Currency Exchange International,

Corp.

The Company is in the business of providing a

range of foreign exchange technology and processing services in

North America. Primary products and services include the exchange

of foreign currencies, wire transfer payments, Global EFTs,

purchase and sale of foreign bank drafts and international

travelers’ cheques, and foreign cheque clearing. Related services

include the licensing of proprietary FX software applications

delivered on its web-based interface, www.ceifx.com (“CEIFX”), and

licensing retail foreign currency operations to select companies in

agreed locations.

The Company’s wholly-owned Canadian subsidiary,

Exchange Bank of Canada, based in Toronto, Canada, provides foreign

exchange and international payment services in Canada through the

use of its proprietary software – www.ebcfx.com.

About Fiserv

Fiserv, Inc. (NASDAQ: FISV) enables clients

worldwide to create and deliver financial services experiences in

step with the way people live and work today. For 35

years, Fiserv has been a trusted leader in financial

services technology, helping clients achieve best-in-class results

by driving quality and innovation in payments, processing services,

risk and compliance, customer and channel management, and insights

and optimization. Fiserv is a member of the FORTUNE®500

and has been named among the FORTUNE Magazine

World's Most Admired Companies® for six consecutive

years, recognized for strength of business model, people

management, social responsibility and innovation leadership.

Visit fiserv.com and follow on social media for

more information and the latest company news.

Contact Information

For further information please contact: Bill MitoulasInvestor

Relations(416) 479-9547Email: bill.mitoulas@cxifx.comWebsite:

www.ceifx.com

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATIONThis press release includes

forward-looking information within the meaning of applicable

securities laws. This forward-looking information includes, or may

be based upon, estimates, forecasts and statements as to

management’s expectations with respect to, among other things,

demand and market outlook for wholesale and retail foreign currency

exchange products and services, future growth, the timing and scale

of future business plans, results of operations, performance, and

business prospects and opportunities. Forward-looking statements

are identified by the use of terms and phrases such as

“anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”,

“may”, “plan”, “predict”, “preliminary”, “project”, “will”,

“would”, and similar terms and phrases, including references to

assumptions.

Forward-looking information is based on the

opinions and estimates of management at the date such information

is provided, and on information available to management at such

time. Forward-looking information involves significant risks,

uncertainties and assumptions that could cause the Company’s actual

results, performance or achievements to differ materially from the

results discussed or implied in such forward-looking information.

Actual results may differ materially from results indicated in

forward-looking information due to a number of factors including,

without limitation, the competitive nature of the foreign exchange

industry, currency exchange risks, the need for the Company to

manage its planned growth, the effects of product development and

the need for continued technological change, protection of the

Company’s proprietary rights, the effect of government regulation

and compliance on the Company and the industry in which it

operates, network security risks, the ability of the Company to

maintain properly working systems, theft and risk of physical harm

to personnel, reliance on key management personnel, global economic

deterioration negatively impacting tourism, and volatile securities

markets impacting security pricing in a manner unrelated to

operating performance and impeding access to capital or increasing

the cost of capital, as well as the factors identified throughout

this press release and in the section entitled “Risks Factors” of

the Company’s Management’s Discussion and Analysis for Year Ended

October 31, 2018. The forward-looking information contained in this

press release represents management’s expectations as of the date

hereof (or as of the date such information is otherwise stated to

be presented), and is subject to change after such date. The

Company disclaims any intention or obligation to update or revise

any forward-looking information whether as a result of new

information, future events or otherwise, except as required under

applicable securities laws.

The Toronto Stock Exchange does not accept

responsibility for the adequacy or accuracy of this press release.

No stock exchange, securities commission or other regulatory

authority has approved or disapproved the information contained in

this press release.

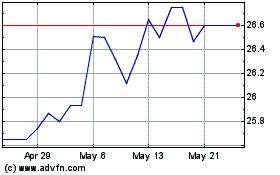

Currency Exchange (TSX:CXI)

Historical Stock Chart

From Jan 2025 to Feb 2025

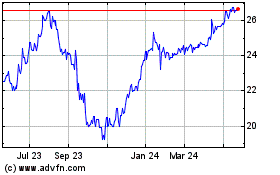

Currency Exchange (TSX:CXI)

Historical Stock Chart

From Feb 2024 to Feb 2025