Currency Exchange

International, Corp.

(the “Company”)

(TSX:CXI; OTCBB:CURN), announces

its financial results and management's discussion and analysis

("

MD&A") for the three and six-months ended

April 30, 2021 (all figures are in U.S. dollars except where

otherwise indicated). The complete financial statements and

MD&A can be found on the Company's SEDAR profile at

www.sedar.com.

On March 11, 2020 the World Health Organization

(“WHO”) officially declared COVID-19, the disease caused by a novel

coronavirus, a pandemic. Measures enacted to curtail COVID-19

by various governments have significantly impacted travel and

tourism, and therefore the demand for foreign currencies. The

Company has experienced a material decline in revenue as a result.

While the Company continues to operate, it is not possible to

reliably estimate the duration and severity of these consequences

as well as their impact on the financial position and results of

future periods.

Randolph Pinna, CEO of the Company, stated, “Q2

marked a milestone in the pandemic for the Company. CXI’s trailing

twelve-month revenue was higher in Q2 than in the previous quarter

ended January 31, 2021. This inflection point also coincided in the

same quarter that saw the group’s consolidated net revenue being

higher than it was in the comparative period a year ago. While the

improvement is seemingly small relative to CXI’s pre-pandemic

revenue, it is important to note that it is mostly not as a result

of a recovery in travel and tourism based demand for foreign

currencies, but rather due to the execution of our strategic plan

and the diligent effort by our employees to diversify our revenue

base while becoming more efficient in process and cost control.

Significant progress has been made in growing our international

payments business, as well as strengthening our position in the

global banknote trade. While we continue to pursue this strategy,

we are optimistic that we are now on the precipice of a recovery in

international travel. There are tangible indicators that the

vaccines have proven effective at combatting the coronavirus,

allowing some countries to relax regulations that restrict global

mobility. The European Union is now opening up travel to vaccinated

travelers and we anticipate that the border between Canada and the

U.S. is likely to re-open sometime this summer. We are taking a

conservative approach in our expectations on the recovery as it

pertains to revenue and maintain a focus on returning to

profitability.”

Corporate and Operational

Highlights:

- Since April 30,

2020, the Company has added 768 new customer relationships

comprising 1,196 locations, of which 274 relationships representing

608 locations were added in the U.S. and 494 relationships

representing 588 locations were added in Canada. Approximately

one-half of the new customer relationships in Canada were added

pursuant to the business acquisition completed on July 29, 2020 as

announced on June 30, 2020.

- Exchange Bank of

Canada continued its growth in the international payments segment

in Canada, initiating trades with 210 new corporate clients,

enabling it to more than double its payment revenue over the same

quarter in the prior year.

- In the

three-months ending April 30, 2021, the Company has further

increased its penetration in the financial institution market in

the U.S. with the addition of 42 new clients (106 for fiscal year

2021), representing 112 (233 for fiscal year 2021) locations.

- The Company

increased its penetration in the global banknote market with the

addition of a European-based financial institution client.

- The Company had

a net negative operating cash flow, excluding the impact of working

capital changes in the quarter of approximately $0.5 million, or

$0.2 million per month, which indicates a progressive reduction in

operating cash outflow since October 31, 2020. The liquidity

position is strong with $54M in unrestricted cash.

Financial Highlights for the Three-month Period Ended

April 30, 2021 compared to the Three-month Period Ended April 30,

2020:

- Revenue

increased 4% or $0.3 million to $6.6 million for the three-month

period ended April 30, 2021. This represents an inflection point

for the Company, as the revenue in the prior year period included

revenue prior to the declaration of the COVID-19 pandemic on March

11, 2020. While revenue between the two periods is relatively

consistent, the operating expenses as a percentage of revenue has

improved, demonstrating progression towards the Company’s goal of

returning to positive operating leverage. This reflects the

positive impact from the restructuring actions taken in 2020 to

re-size the business;

- A net operating

loss of $0.6 million in the three-month period ended April 30, 2021

compared to $2.3 million in net operating income for the

three-month period ended April 30, 2020. Operating expenses

declined by 17%, in part due to previous restructuring actions and

other cost reduction efforts that have mitigated a significant

amount of the revenue decline;

- Other income

included $0.5 million from government grants for the three-month

period ended April 30, 2021;

- A net loss of

$0.9 million in the three-month period ended April 30, 2021

compared to a net loss of $2.9 million for the three-month period

ended April 30, 2020;

- A net loss per

share of ($0.14) on a basic and fully diluted basis for the

three-month period ended April 30, 2021, compared to net loss per

share of ($0.46) in the three-month period ended April 30, 2020;

and

- The Company had

$65.8 million in current assets and $56.5 million in net equity at

April 30, 2021.

Financial Highlights for the Six-month Period Ended

April 30, 2021 compared to the Six-month Period Ended April 30,

2020:

- Revenue for the

six-month period ended April 30, 2021 declined by 28% over the same

period in the prior year. The decline reflects the unprecedented

impact that COVID-19 pandemic-related travel restrictions have had

on consumer demand for banknotes. The decline in the U.S. also

reflects the reduction in retail branch locations, which decreased

by 24% to 35 locations at April 30, 2021, from 46 at April 30,

2020;

- A net operating

loss of $1.9 million in the six-month period ended April 30, 2021

compared to a net operating loss of $1.2 million for the six-month

period ended April 30, 2020. This is reflective of the reduction in

revenue from year-to-year due to the ongoing pandemic. However,

this is offset by a decline in operating expenses of 22% for the

same period;

- Other income

included $0.7 million from government grants for the six-month

period ended April 30, 2021;

- A net loss of

$2.7 million in the six-month period ended April 30, 2021 compared

to a net loss of $2.8 million for the six-month period ended April

30, 2020;

- A net loss per

share of ($0.41) on a basic and fully diluted basis for the

six-month period ended April 30, 2021, compared to net loss per

share of ($0.43) in the six-month period ended April 30, 2020.

As demonstrated in the table below, seasonality

is reflected in the timing of when foreign currencies are in

greater or lower demand. In a normal operating year, there is

seasonality to the Company's operations with higher revenues

generated from March until September and lower revenues from

October to February. This coincides with peak tourism seasons in

North America when there are generally more travelers entering and

leaving the United States and Canada. The coronavirus pandemic has

significantly impacted the ability for people to travel, and

therefore the three-month periods ending April 30, 2020, July 31,

2020, October 31, 2020, January 31, 2021, and April 30, 2021 are

not indicative of typical seasonality.

Selected

Financial Data

|

Three-monthsending |

Revenue |

Net operatingincome (loss) |

Net income(loss) |

Total assets |

Total equity |

Earnings (loss)per share(diluted) |

|

|

$ |

$ |

$ |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

| 4/30/2021 |

6,573,570 |

(558,010 |

) |

(924,691 |

) |

79,856,635 |

56,520,124 |

($0.14 |

) |

| 1/31/2021 |

5,089,429 |

(1,315,151 |

) |

(1,721,104 |

) |

82,354,069 |

57,039,436 |

(0.27 |

) |

| 10/31/2020 |

4,935,917 |

(1,852,195 |

) |

(3,465,632 |

) |

85,758,517 |

58,229,735 |

(0.54 |

) |

| 7/31/2020 |

3,879,873 |

(1,993,117 |

) |

(2,274,719 |

) |

96,105,961 |

61,462,798 |

(0.35 |

) |

| 4/30/2020 |

6,323,344 |

(1,303,410 |

) |

(2,942,948 |

) |

99,263,039 |

62,965,874 |

(0.46 |

) |

| 1/31/2020 |

9,874,289 |

1,162,930 |

|

159,274 |

|

108,319,219 |

66,323,630 |

0.02 |

|

| 10/31/2019 |

11,469,079 |

1,863,442 |

|

769,393 |

|

82,729,714 |

66,329,035 |

0.13 |

|

| 7/31/2019 |

12,402,484 |

2,935,899 |

|

1,820,768 |

|

81,719,233 |

65,447,949 |

0.28 |

|

Adoption of Advance Notice Bylaw:

The Company also announced that the Company’s

board of directors (the “Board”) has adopted an advance notice

bylaw (the “Advance Notice Bylaw”), which establishes a framework

for advance notice of shareholder proposals and nominations of

directors by shareholders of the Company. The adoption of the

Advance Notice Bylaw is intended to:

- Facilitate an

orderly and efficient annual general or special meeting

process;

- Ensure that all

shareholders receive adequate notice of shareholder proposals and

director nominations and sufficient information regarding all

proposals and director nominees; and

- Allow

shareholders to register an informed vote after having been

afforded reasonable time for appropriate deliberation.

The Advance Notice Bylaw, among other things,

fixes a deadline by which holders of record of common shares of the

Company must submit shareholder proposals and director nominations

to the Company prior to any annual meeting of shareholders and sets

out the required information that must be included in the notice to

the Company. No person will be eligible for election as a director

of the Company unless nominated in accordance with the Advance

Notice Bylaw. This same requirement applies to shareholder

proposals.

To be timely, a shareholder’s notice must be

delivered to the Secretary at the principal executive offices of

the Company not later than the close of business on the 90th day

nor earlier than the close of business on the 120th day prior to

the first anniversary of the preceding year’s annual meeting;

provided, however, that in the event that the date of the annual

meeting is more than thirty (30) days before or more than 70 days

after such anniversary date, notice by the shareholder to be timely

must be so delivered (A) no earlier than the close of business on

the 120th day prior to such annual meeting and (B) no later than

the close of business on the later of the 90th day prior to such

annual meeting or the close of business on the 10th day following

the day on which public announcement of the date of such meeting is

first made by the Company.

The Advance Notice Bylaw is now in effect and

the Company intends to seek shareholder approval to ratify the

amendment to the Company’s bylaws to include the Advance Notice

Bylaw at the Company’s next annual general meeting of shareholders

(“AGM”). A summary of the Advance Notice Bylaw will be contained in

the information circular to be prepared for the 2021 AGM and mailed

to the Company’s shareholders. A copy of the Advance Notice Bylaw

is available on SEDAR.

Conference Call

The Company plans to host a conference call on June 11,

2021 at 8:30

AM (EST). To participate in or

listen to the call, please dial the appropriate number:

- Toll Free: 1-855-336-7594

- Conference ID Number: 8388766

About Currency Exchange International,

Corp.

The Company is in the business of providing a

range of foreign exchange technology and processing services in

North America. Primary products and services include the exchange

of foreign currencies, wire transfer payments, Global EFTs,

purchase and sale of foreign bank drafts and international

travelers’ cheques, and foreign cheque clearing. Related services

include the licensing of proprietary FX software applications

delivered on its web-based interface, www.ceifx.com (“CXIFX”), and

licensing retail foreign currency operations to select companies in

agreed locations.

The Company’s wholly-owned Canadian subsidiary,

Exchange Bank of Canada, based in Toronto, Canada, provides foreign

exchange and international payment services to financial

institutions and select corporate clients in Canada through the use

of its proprietary software – www.ebcfx.com.

Contact InformationFor further information

please contact: Bill MitoulasInvestor Relations(416) 479-9547Email:

bill.mitoulas@cxifx.comWebsite: www.ceifx.com

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION

This press release includes forward-looking

information within the meaning of applicable securities laws. This

forward-looking information includes, or may be based upon,

estimates, forecasts and statements as to management’s expectations

with respect to, among other things, demand and market outlook for

wholesale and retail foreign currency exchange products and

services, proposed entry into the Canadian financial services

industry, future growth, the timing and scale of future business

plans, results of operations, performance, and business prospects

and opportunities. Forward-looking statements are identified by the

use of terms and phrases such as “anticipate”, “believe”, “could”,

“estimate”, “expect”, “intend”, “may”, “plan”, “predict”,

“preliminary”, “project”, “will”, “would”, and similar terms and

phrases, including references to assumptions.

Forward-looking information is based on the

opinions and estimates of management at the date such information

is provided, and on information available to management at such

time. Forward-looking information involves significant risks,

uncertainties and assumptions that could cause the Company’s actual

results, performance or achievements to differ materially from the

results discussed or implied in such forward-looking information.

Actual results may differ materially from results indicated in

forward-looking information due to a number of factors including,

without limitation, the competitive nature of the foreign exchange

industry, the impact of COVID-19 coronavirus on factors relevant to

the Company’s business, currency exchange risks, the need for the

Company to manage its planned growth, the effects of product

development and the need for continued technological change,

protection of the Company’s proprietary rights, the effect of

government regulation and compliance on the Company and the

industry in which it operates, network security risks, the ability

of the Company to maintain properly working systems, theft and risk

of physical harm to personnel, reliance on key management

personnel, global economic deterioration negatively impacting

tourism, volatile securities markets impacting security pricing in

a manner unrelated to operating performance and impeding access to

capital or increasing the cost of capital as well as the factors

identified throughout this press release and in the section

entitled “Risks and Uncertainties” of the Company’s Management’s

Discussion and Analysis for Year Ended October 31, 2020. The

forward-looking information contained in this press release

represents management’s expectations as of the date hereof (or as

of the date such information is otherwise stated to be presented),

and is subject to change after such date. The Company disclaims any

intention or obligation to update or revise any forward-looking

information whether as a result of new information, future events

or otherwise, except as required under applicable securities

laws.

The Toronto Stock Exchange does not accept

responsibility for the adequacy or accuracy of this press release.

No stock exchange, securities commission or other regulatory

authority has approved or disapproved the information contained in

this press release.

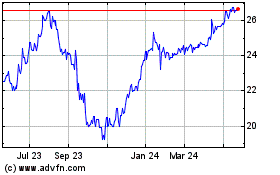

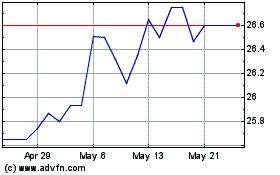

Currency Exchange (TSX:CXI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Currency Exchange (TSX:CXI)

Historical Stock Chart

From Feb 2024 to Feb 2025