D-BOX Technologies Inc. (“D-BOX” or the "Corporation") (TSX: DBO) a

world leader in haptic and immersive experiences, today reported

financial results for the fourth quarter and fiscal year ended

March 31, 2024. All dollar amounts are expressed in Canadian

currency.

Q4 FISCAL 2024

HIGHLIGHTS(Compared to Q4 fiscal 2023)

- Total revenues of $10.1 million

contributed to full year record highs for rights for use, rental

and maintenance revenue, system sales revenue, and total

revenues

- 31 net new screens installed,

bringing the total number of active D-BOX cinema screens to 929 as

at March 31, 2024

- Adjusted EBITDA decreased slightly

from $648 thousand to $619 thousand

- Net profit of $620 thousand

contributed to record net profit of $1.1 million for the fiscal

year

“Fiscal 2024 was our best year ever, with record

highs for rights for use, rental and maintenance revenue, system

sales revenue, total revenues, and net profit,” said Sébastien

Mailhot, President and Chief Executive Officer of D-BOX. “We

attribute this success to our decision to focus primarily on

commercial markets, particularly the theatrical, simulation and

training, and sim racing segments. In fact, most of our record

revenues and profitability in fiscal 2024 came from these three key

market segments. For the fourth quarter, our revenues and

profitability rebounded strongly following a softer third quarter a

few months ago. However, our system sales, total revenues and

adjusted EBITDA were down compared to the very strong fourth

quarter we had the prior year.”

“Even though we are proud of our strong and

growing financial results in both fiscal 2023 and fiscal 2024, we

are looking to accelerate profitable growth as we have reached a

pivotal point on revenue growth conversion to higher profitability.

We are now more focused on fewer markets where we see more market

readiness, and on building a more dominant position in those

markets to materialize strategic value accordingly. And while the

Hollywood guild strikes ended last year, some lingering effects are

expected to persist in calendar 2024 as the industry undergoes a

transition-year ahead of an expected rebound, pointing to a

potentially softer H1 in fiscal 2025 for D-BOX.”

(Amounts are in thousands of Canadian dollars)

|

|

Three-month periodsended March

31 |

Twelve-month periodsended March

31 |

|

|

2024 |

2023 |

2024 |

2023 |

|

Total revenues |

10,179 |

10,412 |

|

39,597 |

34,122 |

|

|

Rights for use, rental and maintenance revenues |

2,126 |

1,930 |

|

8,699 |

8,502 |

|

|

System sales revenues |

8,053 |

8,482 |

|

30,898 |

25,620 |

|

|

Gross profit excluding amortization* |

4,993 |

5,164 |

|

19,814 |

17,732 |

|

|

Net profit (loss) |

620 |

(115 |

) |

1,093 |

(937 |

) |

|

Adjusted EBITDA* |

619 |

648 |

|

3,056 |

1,782 |

|

*See the Non-IFRS Financial Performance Measures

section in this news release for more information.

|

Balance sheet |

|

|

As at March 31,

2024 |

As at March 31, 2023 |

|

Cash and cash equivalents |

2,916 |

3,116 |

|

Working capital |

9,987 |

8,417 |

FOURTH QUARTER OVERVIEW

Fourth quarter revenues decreased 2% to $10.2

million compared to the same period in the previous year, due to a

5% decrease in overall system sales, attributable to lower system

sales in the simulation and training market.

Systems sales for the entertainment market

increased 4% to $6.4 million driven by a $1.9 million increase in

system sales to theatrical customers. There were 31 net new screen

installations in the quarter, bringing the total number of active

D-BOX screens to 929 at quarter end. The increase in system sales

among theatrical customers was offset by decreases among sim racing

customers ($0.5 million) and other entertainment market customers

($1.2 million).

Rights for use, rental and maintenance revenues

increased 10% to $2.1 million with strong performances from highly

anticipated films like Dune II and Kung Fu Panda 4 during the month

of March.

Gross profit excluding amortization decreased to

$5.0 million from $5.2 million for the same period in the previous

year. Gross margin excluding amortization decreased to 49% from 50%

due to a higher proportion (market mix) of system sales to

theatrical customers. Generally, system sales to theatrical

customers have a slightly lower margin due to rights for use,

rental, and maintenance revenues in subsequent periods.

Operating expenses excluding selling and

marketing expenses decreased 3% to $10.2 million, representing 45%

of total revenues. Selling and marketing expenses decreased 5% to

$1.7 million; administration expenses were down 3% to $1.8 million;

and research and development expenses were essentially flat at $1.1

million.

Net profit was $620 thousand compared to a loss

of $115 thousand a year earlier. Adjusted EBITDA was $619 thousand,

down from $648 thousand a year ago.

At quarter-end, D-BOX had a cash position and

undrawn credit facilities totaling $8.4 million.

NOTICE OF VIDEO INVESTOR

PRESENTATION

Management of D-BOX will be publishing a video

presentation to investors on the Corporation’s website at

https://www.d-box.com/en/investor-relations on Monday, June 3,

2024, at 9:00 am ET. During the presentation, management will

discuss the Corporation’s fourth quarter and year end results and

outlook. Investors are invited to submit relevant questions in

advance by email to investors@d-box.com before 12 pm ET on Friday,

May 31, 2024.

ADDITIONAL INFORMATION REGARDING THE

FOURTH QUARTER AND YEAR ENDED MARCH 31, 2024

The financial information relating to the fourth

quarter and fiscal year ended March 31, 2024, should be read in

conjunction with the Corporation’s audited consolidated financial

statements and the Management’s Discussion and Analysis dated May

30, 2024. These documents are available at www.sedarplus.ca.

NON-IFRS FINANCIAL PERFORMANCE

MEASURES*

D-BOX uses three non-IFRS financial performance

measures in its MD&A and other communications. The non-IFRS

measures do not have any standardized meaning prescribed by IFRS

and are unlikely to be comparable to similarly titled measures

reported by other companies. Investors are cautioned that the

disclosure of these metrics is meant to add to, and not to replace,

the discussion of financial results determined in accordance with

IFRS. Management uses both IFRS and non-IFRS measures when

planning, monitoring and evaluating the Corporation’s performance.

The non-IFRS performance measures are described as follows:

|

1) |

|

EBITDA represents earnings before interest and financing, income

taxes and depreciation and amortization. Adjustments to EBITDA are

for items that are not necessarily reflective of the Corporation’s

underlying operating performance. As there is no generally accepted

method of calculating EBITDA, this measure is not necessarily

comparable to similarly titled measures reported by other issuers.

Adjusted EBITDA provides useful and complementary information,

which can be used, in particular, to assess profitability and cash

flows from operations. The following table reconciles adjusted

EBITDA to profit (loss): |

(Amounts are in thousands of Canadian

dollars)

|

|

Three-month periods ended March 31 |

Fiscal years ended March 31 |

|

2024 |

2023 |

2024 |

2023 |

|

Net income (loss) |

620 |

|

(115 |

) |

1,093 |

|

(937 |

) |

|

Amortization of property and equipment |

176 |

|

351 |

|

1,024 |

|

1,226 |

|

|

Amortization of intangible assets |

149 |

|

249 |

|

720 |

|

1,000 |

|

|

Impairment (reversal) |

— |

|

— |

|

— |

|

(223 |

) |

|

Gain on disposal of assets |

(478 |

) |

— |

|

(478 |

) |

(5 |

) |

|

Financial expenses |

79 |

|

103 |

|

570 |

|

504 |

|

|

Income taxes |

— |

|

— |

|

7 |

|

19 |

|

|

Share-based payments |

28 |

|

20 |

|

63 |

|

228 |

|

|

Foreign exchange loss (gain) |

45 |

|

40 |

|

57 |

|

(30 |

) |

|

Adjusted EBITDA |

619 |

|

648 |

|

3,056 |

|

1,782 |

|

|

2) |

|

During fiscal 2024, D-BOX sold an investment, recorded in other

assets, for gross proceeds of $500, resulted in a realized gain on

sale of investment of $478. |

ABOUT D-BOX

D-BOX creates and redefines realistic, immersive

entertainment experiences by moving the body and sparking the

imagination through effects: motion, vibration and texture. D-BOX

has collaborated with some of the best companies in the world to

deliver new ways to enhance great stories. Whether it’s movies,

video games, music, relaxation, virtual reality applications,

metaverse experience, themed entertainment or professional

simulation, D-BOX creates a feeling of presence that makes life

resonate like never before. D-BOX Technologies Inc. (TSX: DBO) is

headquartered in Montreal with offices in Los Angeles, USA and

Beijing, China. Visit D BOX.com.

DISCLAIMER REGARDING FORWARD-LOOKING

STATEMENTS

Certain information included in this press

release may constitute “forward-looking information” within the

meaning of applicable Canadian securities legislation.

Forward-looking information may include, among others, statements

regarding the future plans, activities, objectives, operations,

strategy, business outlook, and financial performance and condition

of the Corporation, or the assumptions underlying any of the

foregoing. In this document, words such as “may”, “would”, “could”,

“will”, “likely”, “believe”, “expect”, “anticipate”, “intend”,

“plan”, “estimate” and similar words and the negative form thereof

are used to identify forward-looking statements. Forward-looking

statements should not be read as guarantees of future performance

or results, and will not necessarily be accurate indications of

whether, or the times at or by which, such future performance will

be achieved. Forward-looking information, by its very nature, is

subject to numerous risks and uncertainties and is based on several

assumptions which give rise to the possibility that actual results

could differ materially from the Corporation’s expectations

expressed in or implied by such forward-looking information and no

assurance can be given that any events anticipated by the

forward-looking information will transpire or occur, including but

not limited to the future plans, activities, objectives,

operations, strategy, business outlook and financial performance

and condition of the Corporation.

Forward-looking information is provided in this

press release for the purpose of giving information about

Management’s current expectations and plans and allowing investors

and others to get a better understanding of the Corporation’s

operating environment. However, readers are cautioned that it may

not be appropriate to use such forward-looking information for any

other purpose.

Forward-looking information provided in this

document is based on information available at the date hereof

and/or management’s good-faith belief with respect to future events

and are subject to known or unknown risks, uncertainties,

assumptions and other unpredictable factors, many of which are

beyond the Corporation’s control.

The risks, uncertainties and assumptions that

could cause actual results to differ materially from the

Corporation’s expectations expressed in or implied by the

forward-looking information include, but are not limited to, the

ability to increase royalty-based revenue and generate profitable

growth. These and other risk factors that could cause actual

results to differ materially from expectations expressed in or

implied by the forward-looking information are discussed under

“Risk Factors” in the Corporation’s annual information form for the

fiscal year ended March 31, 2024, a copy of which is available on

SEDAR+ at www.sedarplus.ca.

Except as may be required by Canadian securities

laws, the Corporation does not intend nor does it undertake any

obligation to update or revise any forward-looking information

contained in this press release to reflect subsequent information,

events, circumstances or otherwise.

The Corporation cautions readers that the risks

described above are not the only ones that could have an impact on

it. Additional risks and uncertainties not currently known to the

Corporation or that the Corporation currently deems to be

immaterial may also have a material adverse effect on the

Corporation’s business, financial condition or results of

operations.

CONTACT INFORMATION

| Josh Chandler Chief Financial

OfficerD-BOX Technologies Inc.514-928-8043jchandler@d-box.com |

Trevor Heisler Vice President

Investor Relations MBC Capital Markets

Advisors416-500-8061investors@d-box.com

|

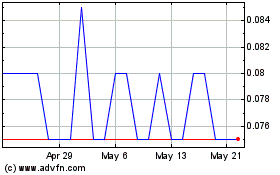

D Box Technologies (TSX:DBO)

Historical Stock Chart

From Nov 2024 to Dec 2024

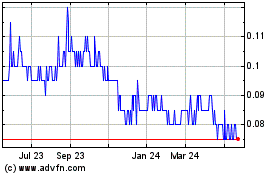

D Box Technologies (TSX:DBO)

Historical Stock Chart

From Dec 2023 to Dec 2024