Enterprise Group, Inc. Announces 2013 Year End Financial Results

March 31 2014 - 4:46PM

Marketwired Canada

Enterprise Group, Inc. ("Enterprise," or "the Company") (TSX:E) is pleased to

announce its financial results for the year ended December 31, 2013.

2013 HIGHLIGHTS

-- Revenue of $34.8 million, an increase of $16.3 million when compared to

prior year, primarily due to strong contributions from the Company's

Utilities/Infrastructure Division.

-- EBITDAS of $10.0 million, an increase of $5.6 million when compared to

prior year.

-- Earnings per share of $0.08, an increase of $0.04 when compared to prior

year.

-- Subsequent to the conclusion of the year end, on January 3, 2014, the

Company completed its acquisition of Hart Oilfield Rentals ("Hart") for

a purchase price of approximately $22.6 million.

-- Also subsequent to the conclusion of the year end, on March 25, 2014,

the Company completed a bought deal equity financing of 27,600,000 of

its Common Shares at a price of $1.00 per Common Share for aggregate

gross proceeds of $27,600,000.

----------------------------------------------------------------------------

SUMMARY FINANCIAL OVERVIEW

----------------------------------------------------------------------------

For the year ended

In millions except for EPS December 31

----------------------------------------------------------------------------

2013 2012 % chg % of Revenue

----------------------------------------------------------------------------

Revenue $ 34.8 $ 18.5 88%

----------------------------------------------------------------------------

EBITDAS(1) 10.0 4.3 130% 29%

----------------------------------------------------------------------------

Net Income 5.8 2.5 132% 17%

----------------------------------------------------------------------------

EPS 0.08 0.04 -

----------------------------------------------------------------------------

% change are representative of whole un-rounded numbers

----------------------------------------------------------------------------

(1) EBITDAS = Earnings Before Interest, Tax, Depreciation, Amortization, and

Stock Based Compensation

Enterprise's year end results are highlighted by a material increase in revenue

when compared to the prior year. This improvement was primarily due to the

strong performance of the Company's Utilities/Infrastructure Division, which

generated year end revenues of $26.6 million, an increase of $11.4 million when

compared to the prior year. This increase can be attributed to the acquisition

Calgary Tunnelling & Horizontal Augering Ltd. ("CTHA") in June 2013, as well as

expansion of Enterprise's service equipment fleet, which has allowed the Company

to both increase its capacity and attract projects from major customers.

Over the year ahead, Enterprise expects that the performance of its

Utilities/Infrastructure Division will continue to improve. During 2013, this

Division renewed a three year, multi-million dollar service contract with one of

Canada's premier power suppliers and, due to the high level of service and

quality of work, was also awarded a second contract from the same customer that

is similar in size and scope. Enterprise also expects significant growth from

T.C. Backhoe and Directional Drilling ("TC"). In January 2014, TC entered into a

Master Service Agreement to provide hydro-vac services for a joint venture

project between a major oil company and one of North America's largest energy

companies. TC also increased the scope of its Master Service Agreement with one

of North America's largest pipeline and natural gas companies, which was

previously announced on October 25, 2013. In total, these agreements are

expected to generate $5.5 million in revenue over the next 24 months. In order

to service these agreements, the Company has deployed new personnel and

equipment, in addition to ordering a further three hydro-vacs. Management's

capital plan allocates the funds necessary to double the hydro-vac fleet during

2014 to 20 units from ten units at the end of 2013.

These contracts are evidence of the growing demand for quality work within

Enterprise's markets, and the backlog of projects that has developed as a

result. In order to satisfy this demand, Enterprise intends to significantly

expand its service and rental fleet over the course of 2014. The Company's

capital budget for the year is approximately $20.0 million, and includes:

i. approximately $3.0 million towards the expansion of underground utility

and tunnelling equipment;

ii. approximately $2.0 million towards the expansion of the utility hydro-

vac fleet; and

iii.approximately $15.0 million towards acquiring additional oilfield

service rental equipment and flameless heaters.

"Enterprise's impressive year end results clearly illustrate the benefit of our

selective acquisition strategy," stated Leonard Jaroszuk, the Company's Chief

Executive Officer. "CTHA continued to play a major role in improving our

revenues, and its contributions are testament to both the quality of its service

offerings and the effective manner in which it has been integrated into our

overall business. Integration has emerged as a core competency for Enterprise,

and we have already begun to apply ourselves to the inclusion of Hart Oilfield

Services. We expect that this acquisition will be immediately accretive, expose

Enterprise to new strategic markets, and create the opportunity for efficiencies

within our existing businesses."

"We fully expect that Enterprise will continue its trend of improvement during

2014," concluded Mr. Jaroszuk. "Our markets continue to display economic growth,

and we are eager to increase our capacity in order to satisfy the growing demand

for our high-quality services. In particular, we intend to devote the majority

of our capital towards the acquisition of additional oilfield service rental

equipment and flameless heaters, an area that we believe presents outsized

potential. We believe the expansion of our service and rental fleets will allow

Enterprise to not only continue its revenue momentum over the course of the year

ahead, but also allow a greater portion of this revenue to translate into

EBITDAS. I look forward to communicating our progress throughout the year."

SUBSEQUENT EVENTS

On January 3, 2014, Enterprise completed its acquisition of Hart, a private

oilfield equipment service provider, for a purchase price of $22.6 million,

subject to closing adjustments. Hart is a full service oilfield site

infrastructure company that provides both site services and equipment rentals to

its oil and gas customers within the Western Canadian Sedimentary Basin. Hart's

equipment fleet consists of approximately 1,500 owned pieces and an additional

500 pieces that have been rented in order to fulfill demand. During December

2013, in order to fund this acquisition, the Company completed an overnight

market public offering of subscription receipts at a price of $0.72 per

subscription receipt for gross proceeds of approximately $15.0 million. The

purchase price for the acquisition was satisfied through a combination of the

net proceeds from this public offering, the issuance of 1,388,890 common shares

of the Company at a price of $0.72 per share, and funds available from the

Company's credit facility.

Also on January 3, 2014, in conjunction with the close of the Hart acquisition,

the Company accepted a term sheet presented by the Canadian branch of PNC Bank.

This term sheet allowed the Company to increase its current senior secured

finance facility from $20.0 million to a maximum of $35.0 million, subject to

certain borrowing base restrictions, at the existing interest rate of prime plus

2%.

On March 25, 2014, the Company completed a bought deal equity financing of

27,600,000 common shares of the Company, which included 3,600,000 Common Shares

issued pursuant to the exercise in full of the financing's over-allotment

option, at a price of $1.00 per common share for aggregate gross proceeds of

$27.6 million. The Company has issued 1,380,000 broker warrants to the

Underwriters. Each broker warrant will entitle the holder to acquire one common

share at an exercise price of $1.00 per share for a period of 24 months from the

date of closing. The net proceeds will be used to accelerate the Company's

capital expenditure program, as articulated above, as well as for general

working capital purposes.

About Enterprise Group, Inc.

Enterprise Group, Inc. is a consolidator of construction services companies

operating in the energy, utility and transportation infrastructure industries.

The Company's focus is primarily construction services and specialized equipment

rental. The Company's strategy is to acquire complementary service companies in

Western Canada, consolidating capital, management, and human resources to

support continued growth. Enterprise acquired of Artic Therm International Ltd.

in September 2012, Calgary Tunnelling & Horizontal Augering Ltd. in June 2013,

and Hart Oilfield Rentals in January 2014.

Forward Looking Information

Certain statements contained in this news release constitute forward-looking

information. These statements relate to future events or the Company's future

performance. The use of any of the words "could", "expect", "believe", "will",

"projected", "estimated" and similar expressions and statements relating to

matters that are not historical facts are intended to identify forward-looking

information and are based on the Company's current belief or assumptions as to

the outcome and timing of such future events. Actual future results may differ

materially. The Company's Annual Information Form and other documents filed with

securities regulatory authorities (accessible through the SEDAR website

www.sedar.com) describe the risks, material assumptions and other factors that

could influence actual results and which are incorporated herein by reference.

The Company disclaims any intention or obligation to publicly update or revise

any forward-looking information, whether as a result of new information, future

events or otherwise, except as may be expressly required by applicable

securities laws.

Non-IFRS Measures

The Company uses International Financial Reporting Standards ("IFRS"). EBITDAS

is not a measure that has any standardized meaning prescribed by IFRS and is

therefore referred to as a non-IFRS measure. This news release contains

references to EBITDAS. This non-IFRS measure used by the Company may not be

comparable to a similar measure used by other companies. Management believes

that in addition to net income, EBITDAS is a useful supplemental measure as it

provides an indication of the results generated by the Company's principal

business activities prior to consideration of how those activities are financed

or how the results are taxed. EBITDAS is calculated as net income excluding

depreciation, amortization, interest, taxes and stock based compensation.

FOR FURTHER INFORMATION PLEASE CONTACT:

Assembly Stakeholder Relations

Candace Williams or Christy Strashek

780-328-3863

Enterprise Group, Inc.

Leonard D. Jaroszuk

President & CEO

780-418-4400

Enterprise Group, Inc.

Desmond O'Kell

Senior Vice President

780-418-4400

contact@EnterpriseGRP.ca

www.EnterpriseGRP.ca

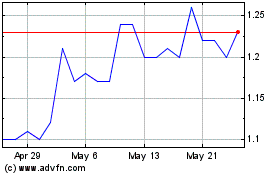

Enterprise (TSX:E)

Historical Stock Chart

From Oct 2024 to Nov 2024

Enterprise (TSX:E)

Historical Stock Chart

From Nov 2023 to Nov 2024