Forsys Closes Previously Announced Non‐Brokered Private Placement

February 21 2025 - 4:54PM

Forsys Metals Corp. (TSX: FSY) (FSE: F2T) (NSX: FSY)

(“Forsys” or the “Company”) is pleased to announce the

completion of its previously announced non-brokered private

placement (the “Private Placement”), for aggregate gross proceeds

of C$5,005,000, pursuant to which the Company issued a total of

10,010,000 Units at a subscription price of C$0.50 per Unit (see

the Company’s January 22, 2025 press release).

Each Unit consists of one Class A Common Share

(“Common Share”) and one Common Share purchase warrant (“Warrant”),

with each Warrant entitling the holder to purchase one additional

Common Share at a price of C$0.75 per Common Share for a period of

24 months from issuance.

The Private Placement remains subject to the

final approval of the Toronto Stock Exchange. All securities issued

as part of the Offering are subject to a four‐month and one‐day

hold period from the date of issuance.

The proceeds from the Private Placement will be

used to continue to fund the advancement of the Norasa Uranium

project in Namibia and general working capital purposes.

Related Party Transaction

Participation in the Private Placement was taken

up in its entirety by Forsys management and members of the Board of

Directors. The issuance of Units to insiders pursuant to the

Private Placement constitutes a “related party transaction” within

the meaning of Multilateral Instrument 61-101 - Protection of

Minority Security Holders in Special Transactions (“MI 61-101”).

The Company relies on exemptions from the formal valuation and

minority shareholder approval requirements provided under sections

5.5(a) and 5.7(1)(a) of MI 61-101 on the basis that participation

in the Private Placement by insiders will not exceed 25% of the

fair market value of the Company’s market capitalization. A

material change report disclosing the related party transaction was

filed on January 22, 2024 in connection with the Private

Placement.

Early Warning Disclosure

Immediately prior to completion of the Private

Placement, Stefano Roma beneficially owns and controls an aggregate

of 60,000,000 Common Shares, representing 29.95% of the issued and

outstanding Common Shares of the Company. Following completion of

the Private Placement, Mr. Roma now beneficially owns and controls

65,687,500 Common Shares and 5,687,500 Warrants, representing

31.23% of the issued and outstanding Common Shares of the Company

on a non-diluted basis, and 33.04% of the issued and outstanding

Common Shares of the Company on a partially diluted basis, assuming

the full exercise of the Warrants by Mr. Roma only.

This press release and Mr. Roma’s corresponding

early warning report (the "Early Warning Report") which is expected

to be filed on SEDAR+ in the near term, constitutes the required

disclosure pursuant to section 5.2 of National Instrument 62-104 -

Take-Over Bids and Issuer Bids ("NI 62- 104"). The requirement to

file an early warning report was triggered because the acquisition

by Mr. Roma of the Units in the Private Placement resulted in Mr.

Roma’s ownership of the Common Shares increasing by greater than 2%

as compared to the early warning report last filed by Mr. Roma. The

securities acquired under the Private Placement are being acquired

by Mr. Roma for investment purposes. Mr. Roma may in the future,

subject to regulatory constraints, take such actions in respect of

his holdings of securities of the Company as he may deem

appropriate in light of the circumstances then existing, including

the purchase of additional securities of the Company through open

market purchases or privately negotiated transactions or the sale

of all or a portion of his securities of the Company in the open

market or in privately negotiated transactions to one or more

purchasers. In the future, he may discuss with management and/or

the board of directors of the Company any of the transactions

listed in clauses (a) to (k) of item 5 of Form 62-103F1 of National

Instrument 62-103 – The Early Warning System and Related Take-over

Bid and Insider Reporting Issues ("NI 62-103").

The Early Warning Report that will be filed on

SEDAR+ in respect of the Private Placement will satisfy the

requirement of section 5.2 of NI 62-104 to have the Early Warning

Report filed by an acquiror, in this case by Mr. Roma, with the

securities regulatory authorities in each of the jurisdictions in

which the Company is a reporting issuer and which contains the

information required by section 3.1 of NI 62-103, which includes

the information required by Form 62-103F1.

A copy of the Early Warning Report filed by Mr.

Roma in connection with the Private Placement will be available

under the Company's profile on the SEDAR+ website at

www.sedarplus.ca.

About Forsys

Metals Corp.

Forsys Metals Corp. (TSX: FSY, FSE: F2T, NSX:

FSY) is an emerging uranium developer focused on advancing its

wholly owned Norasa Uranium Project, located in the politically and

uranium friendly jurisdiction of Namibia, Africa. The Norasa

Uranium Project is comprised of the Valencia Uranium deposit

(ML-149) and the nearby Namibplaas Uranium deposit (EPL-3638).

Further information is available at the Company website

www.forsysmetals.com

On behalf of the Board of Directors of Forsys

Metals Corp., Richard Parkhouse, Investor Relations. For additional

information please contact:

Richard Parkhouse, Investor Relationsemail:

rparkhouse@forsysmetals.comemail: info@forsysmetals.comphone: +44

7730493432

Forward Looking Statement

Certain information contained in this press

release constitutes "forward-looking information",

within the meaning of Canadian legislation. Generally, these

forward-looking statements can be identified by the use of

forward-looking terminology such as "plans", "expects" or "does not

expect", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates" or "does not anticipate", or

"believes", or variations of such words and phrases or state that

certain actions, events or results "may", "could", "would", "might"

or "will be taken", "occur", "be achieved" or "has the potential

to". Forward looking statements contained in this press release are

qualified in their entirety by the inherent risks and uncertainties

surrounding future expectations. Among those factors which could

cause actual results to differ materially are the following: market

conditions and other risk factors listed from time to time in our

reports filed with Canadian securities regulators on SEDAR+ at

www.sedarplus.ca. The forward-looking statements included in this

press release are made as of the date of this press release and

Forsys Metals Corp disclaim any intention or obligation to update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, except as expressly

required by applicable securities legislation.

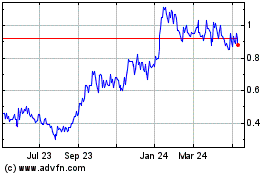

Forsys Metals (TSX:FSY)

Historical Stock Chart

From Feb 2025 to Mar 2025

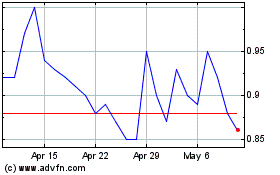

Forsys Metals (TSX:FSY)

Historical Stock Chart

From Mar 2024 to Mar 2025