Guardian Capital Group Limited (TSX: GCG; GCG.A) -

All per share figures disclosed below are stated on a diluted

basis.

|

For the periods ended September 30, |

Three months |

|

Nine months |

|

|

($ in thousands, except per share amounts) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

restated |

|

restated |

|

|

|

|

|

|

| Net

revenue |

$ |

62,611 |

|

$ |

48,434 |

|

$ |

178,937 |

|

$ |

150,314 |

|

|

Operating earnings |

|

18,474 |

|

|

10,419 |

|

|

46,752 |

|

|

35,330 |

|

| Net

losses |

|

(17,358 |

) |

|

(21,148 |

) |

|

(2,960 |

) |

|

(122,442 |

) |

| Net

earnings (loss) from continuing operations |

|

(2,270 |

) |

|

(11,582 |

) |

|

35,704 |

|

|

(84,821 |

) |

| Net

earnings (loss) from discontinued operations |

|

-- |

|

|

5,034 |

|

|

553,743 |

|

|

15,864 |

|

| Net

earnings (loss) |

|

(2,270 |

) |

|

(6,548 |

) |

|

589,447 |

|

|

(68,957 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA

(1) |

$ |

24,611 |

|

$ |

15,590 |

|

$ |

65,181 |

|

$ |

49,356 |

|

| Adjusted

cash flow from operations (1) |

|

21,568 |

|

|

17,034 |

|

|

55,568 |

|

|

43,511 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable to shareholders: |

|

|

|

|

| Net

earnings (loss) from continuing operations |

$ |

(2,506 |

) |

$ |

(11,780 |

) |

$ |

34,753 |

|

$ |

(86,187 |

) |

| Net

earnings (loss) |

|

(2,506 |

) |

|

(7,608 |

) |

|

496,242 |

|

|

(73,044 |

) |

| EBITDA

(1) |

|

23,985 |

|

|

14,801 |

|

|

62,683 |

|

|

46,362 |

|

| Adjusted

cash flow from operations (1) |

|

20,971 |

|

|

16,203 |

|

|

53,051 |

|

|

40,415 |

|

| Per

share amounts (diluted): |

|

|

|

|

| Net

earnings (loss) from continuing operations |

$ |

(0.11 |

) |

$ |

(0.49 |

) |

$ |

1.40 |

|

$ |

(3.53 |

) |

| Net

earnings (loss) |

|

(0.11 |

) |

|

(2.85 |

) |

|

19.40 |

|

|

(2.68 |

) |

| EBITDA

(1) |

|

1.02 |

|

|

0.61 |

|

|

2.49 |

|

|

1.90 |

|

| Adjusted

cash flow from operations (1) |

|

0.89 |

|

|

0.67 |

|

|

2.12 |

|

|

1.65 |

|

|

|

|

|

|

|

|

As at |

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

| ($ in millions, except per

share amounts) |

|

September 30 |

September 30 |

|

|

|

|

|

Restated |

|

|

|

|

|

|

| Assets under management |

|

$ |

52,310 |

|

$ |

49,587 |

|

$ |

47,814 |

|

| Assets

under advisement |

|

|

3,905 |

|

|

3,716 |

|

|

3,787 |

|

|

|

|

|

|

|

| Total client assets |

|

|

56,215 |

|

|

53,303 |

|

|

51,601 |

|

|

|

|

|

|

|

| |

|

|

|

|

| Shareholders' equity |

|

$ |

1,201 |

|

$ |

768 |

|

$ |

743 |

|

| Securities |

|

|

1,276 |

|

|

660 |

|

|

651 |

|

| Per share amounts

(diluted): |

|

|

|

|

| Shareholders' equity (1) |

|

$ |

47.54 |

|

$ |

29.43 |

|

$ |

28.74 |

|

| Securities (1) |

|

|

50.49 |

|

|

25.31 |

|

|

25.16 |

|

|

|

|

|

|

|

The Company is reporting total clients assets of

$56.2 billion as at September 30, 2023, which include assets under

management and assets under advisement. This is a 5% increase from

$53.3 billion as at December 31, 2022, and a 9% increase from $51.6

billion reported as at September 30, 2022.

The Operating earnings were $18.5 million for

the quarter ended September 30, 2023, a 77% increase from $10.4

million in the same quarter in the prior year. The increase in

Operating earnings includes over $8.4 million in interest income

earned largely on the proceeds of disposition of the Worldsource

Business. EBITDA(1) was $24.6 million for the current

quarter, compared to $15.6 million in the same quarter in the prior

year.

As a reminder to the readers, with the Company’s

decision to sell the Worldsource Businesses, a financial measure

Net earnings from discontinued operations was introduced in the

fourth quarter of 2022. All revenues and expenses associated with

those businesses were netted into this one line. The Net earnings

from the remaining businesses is presented as Net earnings from

continuing operations. As a result, the comparative periods have

been restated to reflect this presentation format.

Net revenue for the current quarter was $62.6

million, a 29% increase from $48.4 million in the same quarter in

the prior year. Increase was driven by the higher interest income

earned, as stated above, along with an increase in net management

and advisory fee revenue, consistent with the rise in total client

assets, including a full quarter’s net revenue contribution from

Rae & Lipskie in the current quarter compared to only one

month’s revenue in the comparative period. Operating expenses were

16% higher in the current quarter at $44.1 million, compared to

$38.0 million in the same period in the prior year. The increases

were largely the result of the full quarter’s inclusion of expenses

associated with Rae & Lipskie, increased interest expense due

to rise in interest rates, increased strategic investments into our

additional anticipated growth sources for the future, including

increased technology expenditures to support these businesses, and

the effects of bearing certain costs which were recovered from

Worldsource in prior periods.

Net losses in the current quarter were $17.4

million, compared to Net losses of $21.1 million in the same

quarter in the prior year, which largely reflect the changes in

fair values of the Company’s Securities portfolio, consistent with

performance of the global financial markets.

Net loss attributable to shareholders was $2.5

million in the current quarter, compared to $7.6 million in the

comparative period.

Adjusted cash flow from operations(1) for the

current quarter was $21.6 million, compared to $17.0 million in the

comparative period. During the current quarter, the Company

returned to shareholders $8.5 million in dividends and $8.3 million

in share buybacks.

The Company’s Shareholders’ equity as at

September 30, 2023 was $1,201 million, or $47.54 per share(1),

compared to $768 million, or $29.43 per share(1) as at December 31,

2022.

The Board of Directors is pleased to have

declared a quarterly eligible dividend of $0.34 per share, payable

on January 18, 2024, to shareholders of record on January 11,

2024.

The Company's financial results for the past eight quarters are

summarized in the following table.

|

|

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

Dec 31, 2022 |

Sep 30, 2022 |

Jun 30, 2022 |

Mar 31, 2022 |

Dec 31, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restated |

Restated |

Restated |

Restated |

Restated |

|

|

|

|

|

|

|

|

|

|

| As at ($

in millions) |

|

|

|

|

|

|

|

|

|

Assets under management |

$ |

52,310 |

|

$ |

52,754 |

|

$ |

52,261 |

|

$ |

49,587 |

|

$ |

47,814 |

|

$ |

46,931 |

|

$ |

53,123 |

|

$ |

56,341 |

|

| Assets

under advisement |

|

3,905 |

|

|

3,773 |

|

|

4,065 |

|

|

3,716 |

|

|

3,787 |

|

|

3,944 |

|

|

4,272 |

|

|

4,338 |

|

|

Total client assets |

|

56,215 |

|

|

56,527 |

|

|

56,326 |

|

|

53,303 |

|

|

51,601 |

|

|

50,875 |

|

|

57,395 |

|

|

60,679 |

|

|

|

|

|

|

|

|

|

|

|

| For the three

months ended ($ in thousands) |

|

|

|

|

|

|

| Net

revenue |

$ |

62,611 |

|

$ |

61,833 |

|

$ |

54,493 |

|

$ |

50,681 |

|

$ |

48,434 |

|

$ |

50,056 |

|

$ |

51,824 |

|

$ |

52,961 |

|

|

Operating earnings |

|

18,474 |

|

|

17,038 |

|

|

11,240 |

|

|

8,790 |

|

|

10,419 |

|

|

11,404 |

|

|

13,507 |

|

|

14,086 |

|

| Net

gains (losses) |

|

(17,358 |

) |

|

(3,736 |

) |

|

18,134 |

|

|

18,225 |

|

|

(21,148 |

) |

|

(91,545 |

) |

|

(9,749 |

) |

|

51,408 |

|

| Net

earnings (losses) from continuing operations |

|

(2,270 |

) |

|

11,532 |

|

|

26,442 |

|

|

25,249 |

|

|

(11,582 |

) |

|

(73,463 |

) |

|

224 |

|

|

57,909 |

|

| Net

earnings from discontinued operations |

|

-- |

|

|

-- |

|

|

553,743 |

|

|

6,386 |

|

|

5,034 |

|

|

5,239 |

|

|

5,591 |

|

|

6,542 |

|

| Net

earnings (losses) |

|

(2,270 |

) |

|

11,532 |

|

|

580,185 |

|

|

31,635 |

|

|

(6,548 |

) |

|

(68,224 |

) |

|

5,815 |

|

|

64,451 |

|

| Net

earnings (loss) from continuing operations attributable to

shareholders |

|

(2,506 |

) |

|

11,145 |

|

|

26,114 |

|

|

24,679 |

|

|

(11,780 |

) |

|

(74,053 |

) |

|

(353 |

) |

|

56,999 |

|

| Net

earnings (loss) attributable to shareholders |

|

(2,506 |

) |

|

11,145 |

|

|

487,603 |

|

|

29,961 |

|

|

(7,608 |

) |

|

(69,698 |

) |

|

4,262 |

|

|

62,422 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per

share amounts (in $) |

|

|

|

|

|

|

|

|

| Net earnings

(loss) from continuing operations attributable to shareholders |

|

|

|

Basic |

$ |

(0.11 |

) |

$ |

0.47 |

|

$ |

1.09 |

|

$ |

1.02 |

|

$ |

(0.49 |

) |

$ |

(3.03 |

) |

$ |

(0.01 |

) |

$ |

2.30 |

|

|

Diluted |

|

(0.11 |

) |

|

0.45 |

|

|

1.02 |

|

|

0.96 |

|

|

(0.49 |

) |

|

(3.03 |

) |

|

(0.01 |

) |

|

2.15 |

|

| Net earnings

(loss) attributable to shareholders: |

|

|

|

|

|

|

|

Basic |

$ |

(0.11 |

) |

$ |

0.47 |

|

$ |

20.27 |

|

$ |

1.24 |

|

$ |

(0.31 |

) |

$ |

(2.85 |

) |

$ |

0.17 |

|

$ |

2.52 |

|

|

Diluted |

|

(0.11 |

) |

|

0.45 |

|

|

18.79 |

|

|

1.16 |

|

|

(0.31 |

) |

|

(2.85 |

) |

|

0.16 |

|

|

2.35 |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends paid |

$ |

0.34 |

|

$ |

0.34 |

|

$ |

0.24 |

|

$ |

0.24 |

|

$ |

0.24 |

|

$ |

0.24 |

|

$ |

0.18 |

|

$ |

0.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As

at |

|

|

|

|

|

|

|

|

|

Shareholders' equity ($ in millions) |

$ |

1,201 |

|

$ |

1,213 |

|

$ |

1,242 |

|

$ |

768 |

|

$ |

743 |

|

$ |

743 |

|

$ |

828 |

|

$ |

839 |

|

| Per

share amounts (in $) |

|

|

|

|

|

|

|

|

|

Basic |

$ |

50.90 |

|

$ |

51.11 |

|

$ |

52.42 |

|

$ |

31.84 |

|

$ |

30.82 |

|

$ |

30.68 |

|

$ |

33.67 |

|

$ |

33.89 |

|

|

Diluted |

|

47.54 |

|

|

47.63 |

|

|

48.73 |

|

|

29.43 |

|

|

28.88 |

|

|

28.74 |

|

|

31.27 |

|

|

31.53 |

|

|

|

|

|

|

|

|

|

|

|

|

Total Class A and Common shares outstanding (shares in

thousands) |

|

25,408 |

|

|

25,609 |

|

|

26,113 |

|

|

26,246 |

|

|

26,246 |

|

|

26,342 |

|

|

26,892 |

|

|

26,954 |

|

|

|

|

|

|

|

|

|

|

|

Guardian Capital Group Limited (Guardian) is a

global investment management company servicing institutional,

retail and private clients through its subsidiaries. It also

manages a proprietary portfolio of securities. Founded in 1962,

Guardian’s reputation for steady growth, long-term relationships

and its core values of trustworthiness, integrity and stability

have been key to its success over six decades. Its Common and Class

A shares are listed on the Toronto Stock Exchange as GCG and GCG.A,

respectively. To learn more about Guardian, visit

www.guardiancapital.com.

For further information, contact:

| Donald YiChief Financial Officer(416) 350-3136 |

|

George MavroudisPresident and Chief Executive Officer(416)

364-8341 |

| |

|

|

Investor Relations: investorrelations@guardiancapital.com.

Caution

Concerning Forward-Looking Information

Certain information

included in this press release constitutes forward-looking

information within the meaning of applicable Canadian securities

laws. All information other than statements of historical fact may

be forward-looking information. Forward-looking information is

often, but not always, identified by the use of forward-looking

terminology such as “outlook”, “objective”, “may”, “will”, “would”,

“expect”, “intend”, “estimate”, “anticipate”, “believe”, “should”,

“plan”, “continue”, or similar expressions suggesting future

outcomes or events or the negative thereof. Forward-looking

information in this press release includes, but is not limited to,

statements with respect to management’s beliefs, plans, estimates,

and intentions, and similar statements concerning anticipated

future events, results, circumstances, performance or expectations.

Such forward-looking information reflects management’s beliefs and

is based on information currently available. All forward-looking

information in this press release is qualified by the following

cautionary statements.

Although the Company

believes that the expectations reflected in such forward-looking

information are reasonable, such information involves known and

unknown risks and uncertainties which may cause the Company’s

actual performance and results in future periods to differ

materially from any estimates or projections of future performance

or results expressed or implied by such forward-looking

information. Important factors that could cause actual results to

differ materially include but are not limited to: general economic

and market conditions, including interest rates, business

competition, changes in government regulations or in tax laws, the

outbreak and severity of pandemics, such as COVID 19, military

conflicts in various parts of the world, as well as those risk

factors discussed or referred to in the disclosure documents filed

by the Company with the securities regulatory authorities in

certain provinces of Canada and available at www.sedar.com. The

reader is cautioned to consider these factors, uncertainties and

potential events carefully and not to put undue reliance on

forward-looking information, as there can be no assurance that

actual results will be consistent with such forward-looking

information.

The forward-looking

information included in this press release is made as of the date

of this press release and should not be relied upon as representing

the Company’s views as of any date subsequent to the date of this

press release.

(1) Non IFRS MeasuresThe Company's management

uses EBITDA, EBITDA attributable to shareholders, including the per

share amount, Adjusted cash flows from operations, Adjusted cash

flow from operations attributable to shareholders, including the

per share amount, Shareholders' equity per share and Securities per

share to evaluate and assess the performance of its business. These

measures do not have standardized measures under International

Financial Reporting Standards ("IFRS"), and are therefore unlikely

to be comparable to similar measures presented by other companies.

However, management believes that most shareholders, creditors,

other stakeholders and investment analysts prefer to include the

use of these measures in analyzing the Company's results. The

Company defines EBITDA as net earnings before interest, income

taxes, amortization, and stock-based compensation expenses, net

gains or losses and net earnings from discontinued operations.

EBITDA attributable shareholders as EBITDA less the amounts

attributable to non-controlling interests. The Company defines

Adjusted cash flow from operations as net cash from operating

activities, net of changes in non-cash working capital items and

cash flows from discontinued operations. Adjusted cash flow from

operations attributable to shareholders as Adjusted cash flow from

operations less the amounts attributable to non-controlling

interests. A reconciliation between these measures and the most

comparable IFRS measures are as follows:

|

For the periods ended September 30, |

Three months |

|

|

($ in thousands) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

restated |

|

restated |

|

|

|

|

|

|

| Net

earnings (loss) |

$ |

(2,270 |

) |

$ |

(6,548 |

) |

$ |

589,447 |

|

$ |

(68,957 |

) |

| Add

(deduct): |

|

|

|

|

| Net

earnings from discontinued operations |

|

-- |

|

|

(5,034 |

) |

|

(553,743 |

) |

|

(15,864 |

) |

| Income

tax expense (recovery) |

|

3,386 |

|

|

853 |

|

|

8,088 |

|

|

(2,291 |

) |

| Net

(gains) losses |

|

17,358 |

|

|

21,148 |

|

|

2,960 |

|

|

122,442 |

|

|

Stock-based compensation |

|

875 |

|

|

1,007 |

|

|

2,712 |

|

|

2,695 |

|

| Interest

expense |

|

1,918 |

|

|

1,212 |

|

|

5,900 |

|

|

2,517 |

|

|

Amortization |

|

3,344 |

|

|

2,952 |

|

|

9,817 |

|

|

8,814 |

|

|

EBITDA |

|

24,611 |

|

|

15,590 |

|

|

65,181 |

|

|

49,356 |

|

| Less

attributable to non-controlling interests in continuing

operations |

|

(626 |

) |

|

(789 |

) |

|

(2,498 |

) |

|

(2,994 |

) |

|

EBITDA attributable to shareholders |

$ |

23,985 |

|

$ |

14,801 |

|

$ |

62,683 |

|

$ |

46,362 |

|

|

|

|

|

|

|

|

For the periods ended September 30, |

Three months |

|

|

($ in thousands) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

restated |

|

restated |

|

|

|

|

|

|

| Net cash

from operating activities |

$ |

29,072 |

|

$ |

25,954 |

|

$ |

54,141 |

|

$ |

52,935 |

|

| Add

(deduct): |

|

|

|

|

| Net cash

from operating activities, discontinued operations |

|

-- |

|

|

(12,192 |

) |

|

(10,087 |

) |

|

(13,055 |

) |

| Net

change in non-cash working capital items |

|

(7,504 |

) |

|

(8,211 |

) |

|

1,801 |

|

|

3,242 |

|

| Net

change in non-cash working capital items, discontinued

operations |

|

-- |

|

|

11,483 |

|

|

9,713 |

|

|

389 |

|

|

Adjusted cash flow from operations |

|

21,568 |

|

|

17,034 |

|

|

55,568 |

|

|

43,511 |

|

| Less

attributable to non-controlling interests, continuing

operations |

|

(597 |

) |

|

(831 |

) |

|

(2,517 |

) |

|

(3,096 |

) |

|

Adjusted cash flow from operations attributable to

shareholders |

$ |

20,971 |

|

$ |

16,203 |

|

$ |

53,051 |

|

$ |

40,415 |

|

|

|

|

|

|

|

The per share amounts for EBITDA attributable to

shareholders, Adjusted cash flow from operations attributable to

shareholders, Shareholders' equity and Securities are calculated by

dividing the amounts by diluted shares, which Is calculated in a

manner similar to net earnings attributable to shareholders per

share. More detailed descriptions of these non-IFRS measures are

provided in the Company's Management's Discussion and Analysis,

including a reconciliation of these measures to their most

comparable IFRS measures.

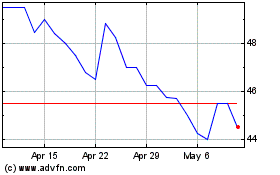

Guardian Capital (TSX:GCG)

Historical Stock Chart

From Feb 2025 to Mar 2025

Guardian Capital (TSX:GCG)

Historical Stock Chart

From Mar 2024 to Mar 2025