Goodfellow Inc. Announces Normal Course Issuer Bid

November 07 2022 - 4:26PM

Goodfellow Inc. (TSX: GDL) (“Goodfellow” or the “Company”),

announced today that the Toronto Stock Exchange (the “TSX”) has

accepted a notice filed by the Company of its intention to make a

normal course issuer bid (“NCIB”) with respect to its common shares

(the “Shares”).

The notice provides that Goodfellow may, during

the 12-month period commencing November 10, 2022 and ending no

later than November 9, 2023, purchase up to 428,127 Shares,

representing approximately 5% of the 8,562,554 issued and

outstanding Shares of the Company as at November 1, 2022, through

the facilities of the TSX or other designated exchanges or Canadian

alternative trading systems, at times and in numbers to be

determined by the Company. All Shares purchased under the NCIB will

be acquired on the open market and in accordance with the rules and

policies of the TSX and applicable securities laws at the

prevailing market prices, plus applicable brokerage fees, and

cancelled. The Company may also seek issuer bid exemption orders

from securities regulators allowing for purchases under private

agreements, in which case purchases may also be made in accordance

with such exemptions, at a discount to the market price.

The average daily trading volume of the Shares

on the TSX for the most recently completed six calendar months is

3,465. Accordingly, pursuant to the rules and policies of the TSX,

daily purchases under the NCIB will be limited to 1,000 Shares,

except pursuant to certain prescribed exceptions, including a

weekly block purchase of Shares not owned by insiders of the

Company.

Goodfellow considers that the acquisition of

Shares for cancellation is a sound use of its funds. Decisions

regarding the actual number of Shares and timing of any purchases

or other actions in connection with the NCIB will be made by

Goodfellow based on various factors, including prevailing market

conditions and the Company’s capital and liquidity positions.

Goodfellow has entered into an automatic share

purchase plan (“ASPP”) with a designated broker in connection with

the NCIB. The ASPP will allow for the purchase for cancellation of

Shares, subject to certain trading parameters, by its designated

broker during times when Goodfellow would ordinarily not be active

in the market due to applicable regulatory restrictions or

self-imposed blackout periods. Outside these periods, Shares may be

repurchased by Goodfellow at its discretion under the NCIB.

There can be no assurances that Goodfellow will

purchase all or any of the number of Shares that are subject to the

NCIB referred to in this news release. Goodfellow may also suspend

or discontinue the NCIB at any time.

Goodfellow has not repurchased Shares under a

NCIB in the last twelve months.

About

Goodfellow

Goodfellow is a diversified manufacturer of

value-added lumber products, as well as a wholesale distributor of

building materials and floor coverings. Goodfellow has a

distribution footprint from coast-to-coast in Canada servicing

commercial and residential sectors through lumber yard retailer

networks, manufacturers, industrial and infrastructure project

partners, and floor covering specialists. Goodfellow also leverages

its value-added product capabilities to serve lumber markets

internationally. Goodfellow Inc. is a publicly traded company, and

its shares are listed on the Toronto Stock Exchange under the

symbol “GDL”.

| From: |

|

Goodfellow Inc. |

| |

|

Patrick Goodfellow |

| |

|

President and CEO |

| |

|

T: 450-635-6511 |

| |

|

F: 450-635-3730 |

| |

|

info@goodfellowinc.com |

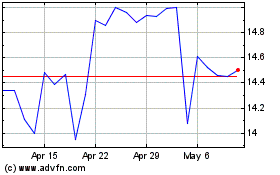

Goodfellow (TSX:GDL)

Historical Stock Chart

From Nov 2024 to Dec 2024

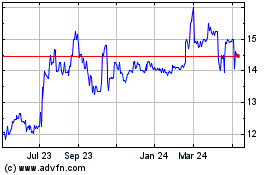

Goodfellow (TSX:GDL)

Historical Stock Chart

From Dec 2023 to Dec 2024