GURU Organic Energy Corp. (TSX: GURU) (“

GURU” or

the “

Company”), Canada’s leading organic energy

drink brand1, today announced its results for the third quarter

ended July 31, 2023. All amounts are in Canadian dollars

unless otherwise indicated.

|

Financial Highlights(in thousands of dollars,

except per share data) |

Three months endedJuly 31 |

Nine months endedJuly 31 |

|

|

|

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

Net revenue |

8,878 |

|

7,730 |

|

21,602 |

|

22,299 |

|

|

Gross profit |

4,544 |

|

4,238 |

|

11,331 |

|

12,161 |

|

|

Net loss |

(3,006 |

) |

(6,530 |

) |

(8,276 |

) |

(13,694 |

) |

|

Basic and diluted loss per share |

(0.09 |

) |

(0.20 |

) |

(0.26 |

) |

(0.42 |

) |

|

Adjusted EBITDA2 |

(3,010 |

) |

(6,492 |

) |

(8,062 |

) |

(13,254 |

) |

“Q3 was GURU’s best quarter to date with record

net revenue of $8.9 million and a significant reduction in net

loss, as we continue to focus on growing our business efficiently

through targeted investments in marketing and improved in-store

execution with our exclusive distribution partner in Canada.

Increased sales velocities, mainly in major Canadian urban centres,

along with our new GURU Fruit Punch, continued to fuel our growth,”

said Carl Goyette, President and CEO of GURU Organic Energy.

“U.S. activities also showed positive results,

driven by improved online execution in the quarter and a record

performance during Amazon’s Prime Day this past July. Our

rotational program with a leading wholesale club in California went

extremely well and could lead to more opportunities in the future.

GURU Tropical Punch has become GURU’s #1 energy drink in the U.S.,

confirming the growing popularity of our punch-flavoured

innovations with consumers. With that in mind, we are excited to

launch GURU Fruit Punch in the U.S., together with a new

yet-to-be-announced innovation before the end of the year.

“Q4 has started strong with additional wins in

the grocery sector in Canada through our distribution partner,

increasing our energy drinks’ availability in grocery stores.

September will also see the start of a rotational program with a

leading wholesale club in Quebec. The fourth quarter will continue

to be active with The Amazing Race Canada sponsorship, our fall

Feel Good Energy Challenge and University Campus programs.

“Overall, we’re pleased with the growing

traction generated by our targeted strategy and marketing

activities, as well as the positive results from our latest

flavored innovations, Tropical Punch and Fruit Punch. Looking

ahead, with our past learnings and solid financial position, we

believe that we are on the right track to grow GURU’s market share,

while continuing to improve our financial performance in the

quarters ahead through efficient growth,” added Mr. Goyette.

The Company also announces that it has reached a

mutual agreement with Rajaa Grar that she will no longer be with

the Company in her role as Chief Revenue Officer. GURU wishes Rajaa

the best of luck in her new endeavours and thanks her for her

service to the Company.

Results of operationsNet

revenue for the third quarter increased by 15% to a record

$8.9 million, compared to $7.7 million for the same

quarter last year. The growth was driven by increased velocities in

Canada and the Company’s summer marketing campaign. In Canada,

sales in Q3 2023 increased by 11% to $7.5 million from

$6.7 million in Q3 2022. U.S. sales during the quarter grew by over

38% to $1.4 million from $1.0 million in Q3 2022,

mainly due to online sale optimization and stronger return on lower

promotional activities in all channels. According to SPINS3, which

measures U.S. consumer scan data of GURU energy drinks, GURU

experienced 11% sales growth in the natural food channel in the

last 52 weeks versus the previous year, showing continued

strength in GURU’s current target market in the U.S. For the

nine-month period, net revenue was $21.6 million, compared to

$22.3 million for the same period in 2022.

Gross profit totalled $4.5 million,

compared to $4.2 million in Q3 2022. Gross margin, which

is comprised of distribution, selling and merchandizing fees,

amounted to 51.2% in Q3 2023, compared to 54.8% for the same

period a year ago. The decrease in gross margin was mainly due to

higher costs of goods sold and more promotional activity. For the

nine-month period, gross profit totalled $11.3 million,

compared to $12.2 million a year ago. Gross margin for the

nine-month period was 52.5%, compared to 54.0% last year.

Selling, general and administrative expenses

(“SG&A”), which include operational, sales, marketing and

administration costs, amounted to $8.1 million in

Q3 2023, compared to $11.0 million for the same period a

year ago. Selling and marketing expenses decreased to

$5.7 million from $8.5 million in Q3 2022, as the

Company took a more targeted approach to its investment in sales

and marketing campaigns during the current fiscal year. General and

administrative expenses decreased to $2.4 million from

$2.5 million in Q3 2022, as a result of continued cost

control measures. For the nine-month period, SG&A amounted to

$20.8 million, compared to $26.3 million a year ago,

mainly due to lower sales and marketing expenses.

Net loss for the third quarter totalled

$3.0 million or $(0.09) per share, compared to a net loss

of $6.5 million or $(0.20) per share for the same

period a year ago. The decrease in net loss mainly reflects the

decrease in costs associated with brand, field and trade marketing

activities for the period. Net loss for the nine-month period

totalled $8.3 million in 2023, or $(0.26) per share,

compared to a net loss of $13.7 million or $(0.42) per

share for the same period a year ago.

Adjusted EBITDA2 amounted to a loss of

$3.0 million in Q3 2023, compared to a loss of

$6.5 million for the same quarter a year ago. The improvement

in Adjusted EBITDA loss for the quarter was mainly due to lower

selling and marketing expenses during the period. Adjusted EBITDA

for the first nine months of the year was a loss of

$8.1 million in 2023, compared to a loss of $13.3 million

in 2022.

As at July 31, 2023, the Company had

cash and cash equivalents of $38.7 million and unused

Canadian- and US-dollar denominated credit facilities totalling

$10 million.

1 Nielsen, 52-week period ended July 15, 2023,

All Channels, Canada vs. same period year ago2 Please refer to the

“Non-GAAP and Other Financial Measures” section at the end of this

release.3 SPINS IRI data, 52-week period ended July 16, 2023, Total

Natural channels vs. same period year ago.

Conference callGURU will hold a

conference call to discuss its third quarter results today,

September 14, 2023, at 10:00 a.m. ET.

Participants can access the call as follows:

- Via webcast:

https://edge.media-server.com/mmc/p/u7pn2h86

- Via telephone: 1-833-630-1956 (toll

free) or 1-412-317-1837 for international dial-in

- A webcast replay will be available on

GURU’s website until September 14, 2024.

About GURU ProductsGURU energy

drinks are made from a short list of plant-based active

ingredients, including natural caffeine, with zero sucralose and

zero aspartame. These carefully sourced ingredients are crafted

into unique blends that push your body to go further and your mind

to be sharper.

About GURU Organic EnergyGURU

Organic Energy Corp. (TSX: GURU) is a dynamic, fast-growing

beverage company that launched the world’s first natural,

plant-based energy drink in 1999. The Company markets organic

energy drinks in Canada and the United States through an estimated

distribution network of over 25,000 points of sale, and through

www.guruenergy.com and Amazon. GURU has built an inspiring brand

with a clean list of organic ingredients, including natural

caffeine, with zero sucralose and zero aspartame, which offer

consumers Feel Good Energy that never comes at the expense of their

health. The Company is committed to achieving its mission of

cleaning the energy drink industry in Canada and the United States.

For more information, go to investors.guruenergy.com or follow us

@guruenergydrink on Instagram, @guruenergy on Facebook and

@guruenergydrink on TikTok.

For further information, please

contact:

|

GURU Organic EnergyInvestorsCarl

Goyette, President and CEOIngy Sarraf, Chief Financial

Officer514-845-4878investors@guruenergy.com |

MediaLyla RadmanovichPELICAN

PR514-845-8763media@rppelican.ca |

Forward-Looking StatementsThis

press release contains “forward-looking statements” within the

meaning of applicable Canadian securities legislation. Such

forward-looking statements include, but are not limited to,

information with respect to the Company’s objectives and the

strategies to achieve these objectives, as well as information with

respect to management’s beliefs, plans, expectations,

anticipations, estimates and intentions. These forward-looking

statements are identified by the use of terms and phrases such as

“may”, “would”, “should”, “could”, “expect”, “intend”, “estimate”,

“anticipate”, “plan”, “believe”, or “continue”, the negative of

these terms and similar terminology, including references to

assumptions, although not all forward-looking statements contain

these terms and phrases. Forward-looking statements are provided

for the purposes of assisting the reader in understanding the

Company and its business, operations, prospects and risks at a

point in time in the context of historical and possible future

developments and therefore the reader is cautioned that such

statements may not be appropriate for other purposes.

Forward-looking statements are based upon a number of assumptions

and are subject to a number of risks and uncertainties, many of

which are beyond management’s control, which could cause actual

results to differ materially from those that are disclosed in or

implied by such forward-looking statements. These risks and

uncertainties include, but are not limited to, the following risk

factors, which are discussed in greater detail under the “RISK

FACTORS” section of the annual information form for the year ended

October 31, 2022: management of growth; reliance on key personnel;

reliance on key customers; changes in consumer preferences;

significant changes in government regulation; criticism of energy

drink products and/or the energy drink market; economic downturn

and continued uncertainty in the financial markets and other

adverse changes in general economic or political conditions, as

well as the COVID-19 pandemic, the war in Ukraine and geopolitical

developments, global inflationary pressure or other major

macroeconomic phenomena; global or regional catastrophic events;

fluctuations in foreign currency exchange rates; inflation;

revenues derived entirely from energy drinks; increased

competition; relationships with co-packers and distributors and/or

their ability to manufacture and/or distribute GURU’s products;

seasonality; relationships with existing customers; changing retail

landscape; increases in costs and/or shortages of raw materials

and/or ingredients and/or fuel and/or costs of co-packing; failure

to accurately estimate demand for its products; history of negative

cash flow and no assurance of continued profitability or positive

EBITDA; repurchase of common shares; intellectual property rights;

maintenance of brand image or product quality; retention of the

full-time services of senior management; climate change;

litigation; information technology systems; fluctuation of

quarterly operating results; risks associated with the PepsiCo

distribution agreement; accounting treatment of the PepsiCo

Warrants; and conflicts of interest, as well as those other risks

factors identified in other public materials, including those filed

with Canadian securities regulatory authorities from time to time

and which are available on SEDAR+ at www.sedarplus.ca. Additional

risks and uncertainties not currently known to management or that

management currently deems to be immaterial could also cause actual

results to differ materially from those that are disclosed in or

implied by such forward-looking statements. Although the

forward-looking statements contained herein are based upon what

management believes are reasonable assumptions as at the date they

were made, investors are cautioned against placing undue reliance

on these statements since actual results may vary from the

forward-looking statements. Certain assumptions were made in

preparing the forward-looking statements concerning availability of

capital resources, business performance, market conditions, and

customer demand. Consequently, all of the forward-looking

statements contained herein are qualified by the foregoing

cautionary statements, and there can be no guarantee that the

results or developments that management anticipates will be

realized or, even if substantially realized, that they will have

the expected consequences or effects on the business, financial

condition or results of operation. Unless otherwise noted or the

context otherwise indicates, the forward-looking statements

contained herein are provided as of the date hereof, and management

does not undertake to update or amend such forward-looking

statements whether as a result of new information, future events or

otherwise, except as may be required by applicable law.

Non-GAAP and Other Financial

MeasuresThis press release includes certain non-GAAP and

other supplementary financial measures to help assess GURU’s

financial performance. Those measures do not have any standardized

meaning prescribed by International Financial Reporting Standards

(“IFRS”). Management’s method of calculating these measures may

differ from the methods used by other issuers and, accordingly,

GURU’s definitions of these non-GAAP measures may not be comparable

to similar measures presented by other issuers. Investors are

cautioned that non-GAAP financial measures should not be construed

as an alternative to IFRS measures.

Adjusted EBITDAAdjusted EBITDA

is defined as net income or loss before income taxes, net financial

(income) expenses, depreciation and amortization, and stock-based

compensation expense. This measure is a non-GAAP financial measure

and is not an earnings or cash flow measure or a measure of

financial condition recognized by IFRS. As such, it should not be

construed as an alternative to “net income”, as determined in

accordance with IFRS, as an alternative to “cash flows from

operating activities” as a measure of liquidity and cash flows or

as an indicator of the Company’s performance or financial

condition.

The exclusion of net finance expense eliminates

the impact on earnings derived from non-operational activities, and

the exclusion of depreciation, amortization and share-based

compensation eliminates the non-cash impact of these items.

Management believes that adjusted EBITDA is a useful measure of

financial performance without the variation caused by the impacts

of the excluded items described above because it provides an

indication of the Company’s ability to seize growth opportunities

in a cost-effective manner and finance its ongoing operations.

Excluding these items does not imply that they are necessarily

non-recurring. Management believes this measure, in addition to

conventional measures prepared in accordance with IFRS, enable

investors to evaluate the Company’s operating results, underlying

performance and future prospects in a manner similar to management.

Although Adjusted EBITDA is frequently used by securities analysts,

lenders and others in their evaluation of companies, it has

limitations as an analytical tool and should not be considered in

isolation or as a substitute for analysis of the Company’s results

as reported under IFRS.

Reconciliation of Net Loss to Adjusted

EBITDA

| |

Three-month periods ended |

Nine-month periods ended |

|

July 31, 2023 |

|

July 31, 2022 |

|

July 31, 2023 |

|

July 31, 2022 |

|

|

(In thousands of Canadian dollars) |

$ |

|

$ |

|

$ |

|

$ |

|

| Net loss |

(3,006 |

) |

(6,530 |

) |

(8,276 |

) |

(13,694 |

) |

| Net financial income |

(512 |

) |

(294 |

) |

(1,259 |

) |

(521 |

) |

| Depreciation and

amortization |

312 |

|

234 |

|

857 |

|

643 |

|

| Income taxes |

13 |

|

17 |

|

32 |

|

57 |

|

|

Stock-based compensation expense |

183 |

|

81 |

|

584 |

|

261 |

|

|

Adjusted EBITDA |

(3,010 |

) |

(6,492 |

) |

(8,062 |

) |

(13,254 |

) |

Retail Consumer Scanned Sales

This indicator represents the total number of the Company’s

products that were “scanned” for purchase by end consumers in

retail points of sale in the respective period. Management believes

this indicator provides meaningful information as it serves as an

indicator of actual sales to end consumers and a potential

indicator of growth or potential future sales.

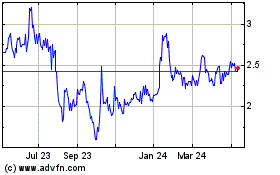

GURU Organic Energy (TSX:GURU)

Historical Stock Chart

From Dec 2024 to Jan 2025

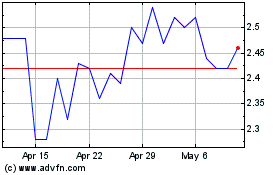

GURU Organic Energy (TSX:GURU)

Historical Stock Chart

From Jan 2024 to Jan 2025