GURU Organic Energy Corp. (TSX: GURU) (“

GURU” or

the “

Company”), Canada’s leading organic energy

drink brand1, announced today that the Toronto Stock Exchange (the

“

TSX”) has approved the notice filed by the

Company to renew its normal course issuer bid

(“

NCIB”) with respect to its common shares (the

“

Shares”).

The notice provides that GURU may, during the

12-month period commencing July 25, 2024, and ending no later than

July 24, 2025, purchase up to 1,515,778 Shares, representing

approximately 5% of the 30,315,564 Shares outstanding as at July

15, 2024, through the facilities of the TSX or alternative Canadian

trading systems, at times and in numbers to be determined by the

Company. All shares purchased under the NCIB will be purchased on

the open market and in accordance with the rules and policies of

the TSX at the prevailing market prices and cancelled.

The average daily trading volume of the Shares

on the TSX for the most recently completed six calendar months is

7,027. Pursuant to the rules and policies of the TSX, daily

purchases under the NCIB will be limited to 1,756 Shares,

representing 25% of the average daily trading volume, except

pursuant to certain prescribed exceptions.

GURU’s expansion plans are aimed at growing

market share and generating sustainable long-term profitable growth

and the great majority of its capital and efforts are allocated to

these goals. However, GURU believes that at times, the market price

of its Shares may not reflect their full value, and their

repurchase in this context represents an appropriate and desirable

use of some of the Company’s capital. Decisions regarding the

actual number of Shares and timing of any purchases or other

actions in connection with the NCIB will be made by GURU based on

various factors, including prevailing market conditions and the

Company’s capital and liquidity positions. In addition, GURU may

from time to time repurchase Shares under an automatic share

purchase plan it may enter into with a broker in the future, which

would enable purchases during times when GURU would typically not

be permitted to purchase Shares due to regulatory or other

reasons.

There can be no assurances that GURU will

purchase all or any of the number of Shares that are subject to the

NCIB referred to in this press release. GURU may also suspend or

discontinue the NCIB at any time.

Under the Company’s current NCIB, which expires

on July 24, 2024, the Company received approval from the TSX to

purchase up to 1,593,560 Shares. GURU has repurchased 1,564,301

Shares under its current NCIB in the last twelve months at an

average weighted price of $1.9439 per Share through the facilities

of the TSX or alternative Canadian trading systems.

____________________1 Nielsen, 52-week period

ended May 21, 2024, All Channels, Canada vs. same period year

ago.

About GURU ProductsGURU energy

drinks are made from a short list of plant-based active

ingredients, including natural caffeine, with zero sucralose and

zero aspartame. These carefully sourced ingredients are crafted

into unique blends that push your body to go further and your mind

to be sharper.

About GURU Organic EnergyGURU

Organic Energy Corp. (TSX: GURU) is a dynamic,

fast-growing beverage company that launched the world’s first

natural, plant-based energy drink in 1999. The Company markets

organic energy drinks in Canada and the United States through an

estimated distribution network of about 25,000 points of sale, and

through www.guruenergy.com and Amazon. GURU has built an inspiring

brand with a clean list of organic ingredients, including natural

caffeine, with zero sucralose and zero aspartame, which offer

consumers Good Energy that never comes at the expense of their

health. The Company is committed to achieving its mission of

cleaning the energy drink industry in Canada and the United States.

For more information, go to www.guruenergy.com or follow us

@guruenergydrink on Instagram, @guruenergy on Facebook and

@guruenergydrink on TikTok.

For further information, please

contact:

|

GURU Organic EnergyInvestorsCarl

Goyette, President and CEOIngy Sarraf, Chief Financial

Officer514-845-4878investors@guruenergy.com |

MediaLyla RadmanovichPELICAN

PR514-845-8763media@rppelican.ca |

|

|

|

|

Francois Kalos |

|

|

francois.kalos@guruenergy.com |

|

Forward-Looking InformationThis

press release contains “forward-looking information” within the

meaning of applicable Canadian securities legislation. Such

forward-looking information includes, but is not limited to,

information with respect to the Company’s objectives and the

strategies to achieve these objectives, information and statements

relating to potential future purchases by GURU of Shares under the

NCIB, as well as information with respect to management’s beliefs,

plans, expectations, anticipations, estimates and intentions. This

forward-looking information is identified by the use of terms and

phrases such as “may”, “would”, “should”, “could”, “expect”,

“intend”, “estimate”, “anticipate”, “plan”, “believe”, or

“continue”, the negative of these terms and similar terminology,

including references to assumptions, although not all

forward-looking information contains these terms and phrases.

Forward-looking information is provided for the purposes of

assisting the reader in understanding the Company and its business,

operations, prospects and risks at a point in time in the context

of historical and possible future developments and therefore the

reader is cautioned that such information may not be appropriate

for other purposes. Forward-looking information is based upon a

number of assumptions and are subject to a number of risks and

uncertainties, many of which are beyond management’s control, which

could cause actual results to differ materially from those that are

disclosed in or implied by such forward-looking information. These

risks and uncertainties include, but are not limited to, the

following risk factors, which are discussed in greater detail under

the “RISK FACTORS” section of the annual information form for the

year ended October 31, 2023: management of growth; reliance on key

personnel; reliance on key customers; changes in consumer

preferences; significant changes in government regulation;

criticism of energy drink products and/or the energy drink market;

economic downturn and continued uncertainty in the financial

markets and other adverse changes in general economic or political

conditions, as well as the COVID-19 pandemic, the war in Ukraine

and geopolitical developments, global inflationary pressure or

other major macroeconomic phenomena; global or regional

catastrophic events; fluctuations in foreign currency exchange

rates; inflation; revenues derived entirely from energy drinks;

increased competition; relationships with co-packers and

distributors and/or their ability to manufacture and/or distribute

GURU’s products; seasonality; relationships with existing

customers; changing retail landscape; increases in costs and/or

shortages of raw materials and/or ingredients and/or fuel and/or

costs of co-packing; failure to accurately estimate demand for its

products; history of negative cash flow and no assurance of

continued profitability or positive EBITDA; repurchase of common

shares; intellectual property rights; maintenance of brand image or

product quality; retention of the full-time services of senior

management; climate change; litigation; information technology

systems; fluctuation of quarterly operating results; risks

associated with the PepsiCo distribution agreement; accounting

treatment of the PepsiCo Warrants; and conflicts of interest,

consolidation of retailers, wholesalers and distributors and key

players’ dominant position; compliance with data privacy and

personal data protection laws; management of new product launches;

review of regulations on advertising claims, as well as those other

risks factors identified in other public materials, including those

filed with Canadian securities regulatory authorities from time to

time and which are available on SEDAR+ at www.sedarplus.ca.

Additional risks and uncertainties not currently known to

management or that management currently deems to be immaterial

could also cause actual results to differ materially from those

that are disclosed in or implied by such forward-looking

information. Although the forward-looking information contained

herein is based upon what management believes are reasonable

assumptions as at the date they were made, investors are cautioned

against placing undue reliance on this information since actual

results may vary from the forward-looking information. Certain

assumptions were made in preparing the forward-looking information

concerning availability of capital resources, business performance,

market conditions, and customer demand. Consequently, all of the

forward-looking information contained herein is qualified by the

foregoing cautionary information, and there can be no guarantee

that the results or developments that management anticipates will

be realized or, even if substantially realized, that they will have

the expected consequences or effects on the business, financial

condition or results of operation. Unless otherwise noted or the

context otherwise indicates, the forward-looking information

contained herein is provided as of the date hereof, and management

does not undertake to update or amend such forward-looking

information whether as a result of new information, future events

or otherwise, except as may be required by applicable law.

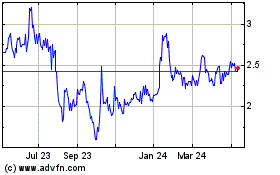

GURU Organic Energy (TSX:GURU)

Historical Stock Chart

From Dec 2024 to Jan 2025

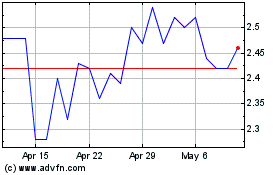

GURU Organic Energy (TSX:GURU)

Historical Stock Chart

From Jan 2024 to Jan 2025