Imperial Metals Corporation (the “Company”)

(TSX:III) reports financial results for the three and six months

ended June 30, 2024.

QUARTER HIGHLIGHTS

“Operationally, the second quarter was aligned

with guidance, driven largely by higher through-put and copper

grades at both Mount Polley and Red Chris,” said Brian Kynoch,

President. “With consolidated production totalling 27,854,171

pounds copper and 26,629 ounces gold through the first half of the

year, we remain on track to achieve 2024 guidance.”

“During the quarter, we also achieved strong

financial results, including adjusted EBITDA of $55.1 million and

cash earnings of $54.2 million which was derived from strong

operational results and higher metal prices.”

FINANCIAL

Adjusted EBITDA increased by $54.2 million to

$55.1 million in Q2 2024 compared to $0.9 million in Q2 2023.

Total revenue was $131.7 million in the June

2024 quarter compared to $85.8 million in the 2023 comparative

quarter.

In the June 2024 quarter, the Red Chris mine

(100% basis) had 5.0 concentrate shipments (2023-3.6 concentrate

shipments). Mount Polley mine had 2.0 concentrate shipments

(2023-1.4 concentrate shipments).

Variations in revenue are impacted by the

increased quantity of concentrate sold, timing and quantity of

concentrate shipments, metal prices and exchange rates, and period

end revaluations of revenue attributed to concentrate shipments

where copper and gold prices will settle at a future date.

The London Metals Exchange cash settlement

copper price per pound averaged US$4.42 in the June 2024 quarter

compared to US$3.85 in the 2023 comparative quarter. The LBMA

(London Bullion Market Association) gold price per troy ounce

averaged US$2,338 in the June 2024 quarter compared to US$1,978 in

the 2023 comparative quarter. The average US/CDN Dollar exchange

rate was 1.368 in the June 2024 quarter, 1.86% higher than the

exchange rate of 1.343 in the June 2023 quarter. In CDN Dollar

terms the average copper price in the June 2024 quarter was

CDN$6.05 per pound compared to CDN$5.17 per pound in the 2023

comparative quarter, and the average gold price in the June 2024

quarter was CDN$3,199 per ounce compared to CDN$2,657 per ounce in

the 2023 comparative quarter.

A negative revenue revaluation in the June 2024

quarter was $4.3 million as compared to a negative revenue

revaluation of $8.2 million in the 2023 comparative quarter.

Revenue revaluations are the result of the metal price on the

settlement date and/or the current period balance sheet date being

higher or lower than when the revenue was initially recorded or the

metal price at the last balance sheet date and finalization of

contained metal as a result of final assays and weights.

Net income for the June 2024 quarter was $20.4

million ($0.13 income per share) compared to net loss of $16.0

million ($0.10 loss per share) in the 2023 comparative quarter. The

increase in net income of $36.4 million primarily due to the

following factors:

- Income from mine

operations went from a loss of $10.5 million in the June 2023

quarter to an income of $39.0 million in June 2024, increasing net

income by $49.5 million

- Interest expense

went from $7.4 million in June 2023 to $7.8 million in June 2024,

reducing net income by $0.4 million, and

- Income and

mining tax went from a recovery of $5.1 million in June 2023 to tax

expense of $7.7 million on June 2024, reducing net income by $12.8

million.

Capital expenditures including leases were $55.9

million in the June 2024 quarter, an increase of $13.4 million from

$42.5 million in the 2023 comparative quarter. The June 2024

quarter expenditures included $21.6 million in exploration and

development, $15.4 million for tailings dam construction, $7.6

million on stripping costs, and $11.3 million of other capital.

At June 30, 2024, the Company had not hedged any

copper, gold or US/CDN Dollar exchange. Quarterly revenues will

fluctuate depending on copper and gold prices, the US/CDN Dollar

exchange rate, and the timing of concentrate sales, which is

dependent on concentrate production and the availability and

scheduling of transportation.

OPERATIONS

During the quarter ended June 30, 2024,

Imperial’s consolidated metal production was 15,500,912 pounds

copper and 13,768 ounces gold, of which 9,281,498 pounds copper and

10,009 ounces gold were produced at Mount Polley and 6,219,414

pounds copper and 3,759 ounces gold from its 30% share of Red Chris

mine production. Copper production was up 26% from the 12,353,259

million pounds copper produced in the first quarter 2024 and gold

production was up 7% from the 12,861 ounces gold produced in the

first quarter 2024.

Mount Polley Mine

Mount Polley metal production for the second

quarter of 2024 was 9,281,498 pounds copper and 10,009 ounces gold,

compared to 7,355,191 pounds copper and 10,009 ounces gold produced

during the first quarter of 2024.

Mill throughput in the second quarter was up 3%,

with 1.714 million tonnes being treated compared with 1.671 million

tonnes treated in the first quarter of 2024. Copper production in

the second quarter 2024 was up by 26% largely on higher copper

grade, 0.294 % copper versus 0.251% copper in the first quarter of

2024.

For the first six months of 2024, copper

production was up 21% compared to the same period last year with

20% increase in throughput while gold production was down 1%, with

lower gold grades and recovery offsetting the higher

throughput.

Tailings removal from the Springer Pit was

completed in May 2024. Stripping for Phase 5 pushback of the

Springer Pit continued, with most of the non-acid generating rock

from this pushback being delivered to the tailings dam for buttress

construction.

|

|

Three Months Ended June 30 |

|

Six Months Ended June 30 |

|

|

2024 |

2023 |

|

2024 |

2023 |

|

Ore milled - tonnes |

1,714,330 |

1,430,842 |

|

3,385,835 |

2,820,478 |

| Ore

milled per calendar day - tonnes |

18,839 |

15,724 |

|

18,603 |

15,583 |

|

Grade % - copper |

0.294 |

0.280 |

|

0.273 |

0.275 |

|

Grade g/t - gold |

0.263 |

0.324 |

|

0.272 |

0.318 |

|

Recovery % - copper |

83.4 |

79.9 |

|

81.6 |

80.5 |

|

Recovery % - gold |

69.2 |

68.3 |

|

67.6 |

69.8 |

|

Copper - 000’s pounds |

9,281 |

7,063 |

|

16,637 |

13,741 |

|

Gold - ounces |

10,009 |

10,185 |

|

20,018 |

20,165 |

At Mount Polley, a diamond drilling program was

completed in May, the information collected will be used to update

mine plans for the Springer Pit. The program totalled 7,377 metres

of drilling.

Exploration, development, and capital

expenditures in the second quarter of 2024 were $23.0 million

compared to $9.8 million in the 2023 comparative quarter.

Red Chris Mine

Red Chris production (100%) for the second

quarter of 2024 was 20,731,379 pounds copper and 12,531 ounces gold

compared to 16,660,225 pounds copper and 9,507 ounces gold during

the first quarter of 2024. In the second quarter of 2024, copper

production is up 24% compared to the first quarter of 2024.

The increase in copper production was a result

of an 8% increase in copper grade (0.466% vs 0.431%) and a 19%

increase in throughput. The throughput was 27,357 tonnes per day

compared to 23,081 tonnes per day. Gold production in the second

quarter 2024 was up 32% (12,531 oz vs 9,507 oz) compared to the

first quarter 2024 as result of the increased gold grades (0.30 g/t

gold vs 0.26 g/t gold) and higher throughput.

For the first six months of 2024, copper

production was up 48% compared to the same period last year on

higher copper grades and gold production was down 9% on lower gold

grades.

Imperial’s 30% portion of Red Chris mine for the

second quarter of 2024 was 6,219,414 pounds copper and 3,759 ounces

gold.

|

100% Red Chris mine production |

Three Months Ended June 30 |

|

Six Months Ended June 30 |

|

|

2024 |

2023 |

|

2024 |

2023 |

|

Ore milled - tonnes |

2,489,532 |

2,357,656 |

|

4,589,886 |

4,448,428 |

| Ore

milled per calendar day - tonnes |

27,357 |

25,908 |

|

25,219 |

24,577 |

|

Grade % - copper |

0.466 |

0.348 |

|

0.450 |

0.337 |

|

Grade g/t - gold |

0.302 |

0.343 |

|

0.284 |

0.328 |

|

Recovery % - copper |

81.1 |

75.9 |

|

82.1 |

76.6 |

|

Recovery % - gold |

51.8 |

52.6 |

|

52.6 |

51.5 |

|

Copper - 000’s pounds |

20,731 |

13,729 |

|

37,392 |

25,319 |

|

Gold - ounces |

12,531 |

13,680 |

|

22,038 |

24,176 |

Imperial’s 30% share of exploration,

development, and capital expenditures were $32.7 million in the

June 2024 quarter compared to $32.5 million in the 2023 comparative

quarter.

Several capital projects are underway to improve

safety and site efficiency; a coarse ore stockpile cover is being

installed, and a tailings thickener is being added to the circuit

to recycle water to the mill along with other improvements.

Block Cave Project Update

The Red Chris Joint Venture permitting group

continues work to advance the required permitting approvals for the

planned Block Cave mine, and continues to work collaboratively with

both Tahltan and British Columbia governments through the

process.

Red Chris Block Cave feasibility study work is

focused on permitting, capital cost estimate and schedule

refinement to ensure accuracy and execution so that a definitive

feasibility study can be delivered in advance of receiving final

permitting for the block cave.

The underground development has continued with a

total of 10,496 metres (including all vent drives) completed to the

end of June 2024. The decline to access the extraction level (Nagha

decline) had advanced 4,690 metres as of June 30, 2024, and was 84%

complete. The portal for the conveyor decline has been established,

and development work on the three conveyor declines has advanced

2,162 metres to the end of June 2024. Leg two of the conveyor

decline was 65% complete by the end of the reporting quarter.

Underground development activities will be

aligned to the permitting schedule with the Nagha decline expected

to be completed to the extraction level elevation by the end of

this year.

Huckleberry Mine

Huckleberry operations ceased in August 2016 and

the mine remains on care and maintenance status.

Site personnel continue to focus on maintaining

site access, water management (treatment and release of mine

contact water into Tahtsa Reach), snow removal, maintenance of site

infrastructure and equipment, mine permit compliance, environmental

compliance monitoring and monitoring tailings management

facilities.

For the June 2024 quarter, Huckleberry incurred

idle mine costs comprised of $1.5 million in operating costs and

$0.3 million in depreciation expense compared to $1.6 million in

operating cost and $0.2 million in depreciation expense in the

comparable quarter of 2023.

TECHNICAL INFORMATION

The technical and scientific information related

to the Company’s mineral projects has been reviewed and approved by

Brian Kynoch, P.Eng., President of Imperial Metals, and a

designated Qualified Person as defined by NI 43-101.

Jim Miller-Tait, P.Geo. Vice President

Exploration with Imperial Metals, is the designated Qualified

Person as defined by National Instrument 43-101 for the Red Chris,

Mount Polley and Huckleberry mines exploration programs.

EARNINGS AND CASH FLOW

Select Quarter Financial

Information

|

expressed in thousands of dollars, except share and per share

amounts |

Three Months Ended June 30 |

Six Months Ended June 30 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Operations: |

|

|

|

|

|

Total revenues |

$131,731 |

|

$85,761 |

|

$216,299 |

|

$178,425 |

|

|

Net income (loss) |

$19,165 |

|

$(16,049 |

) |

$10,000 |

|

$(23,302 |

) |

|

Net income (loss) per share |

$0.12 |

|

$(0.10 |

) |

$0.06 |

|

$(0.15 |

) |

|

Diluted loss per share |

$0.12 |

|

$(0.10 |

) |

$0.06 |

|

$(0.15 |

) |

|

Adjusted net income (loss) (1) |

$19,089 |

|

$(16,056 |

) |

$9,924 |

|

$(23,311 |

) |

|

Adjusted net income (loss) per share (1) |

$0.12 |

|

$(0.10 |

) |

$0.06 |

|

$(0.15 |

) |

|

Adjusted EBITDA (1) |

$55,063 |

|

$927 |

|

$65,342 |

|

$6,850 |

|

|

Cash earnings (1)(2) |

$54,153 |

|

$1,270 |

|

$64,454 |

|

$6,674 |

|

|

Cash earnings per share (1)(2) |

$0.33 |

|

$0.01 |

|

$0.40 |

|

$0.04 |

|

|

Working capital deficiency deficiency |

$(137,108 |

) |

$(103,022 |

) |

$(137,108 |

) |

$(103,022 |

) |

|

Total assets |

$1,479,174 |

|

$1,357,554 |

|

$1,479,174 |

|

$1,357,554 |

|

|

Total debt (including current portion) |

$379,257 |

|

$277,002 |

|

$379,257 |

|

$277,002 |

|

|

(1) Refer to Non-IFRS Financial Measures for further details. |

|

(2) Cash earnings is defined as the cash flow from operations

before the net change in non-cash working capital balances, income

and mining taxes, and interest paid. Cash earnings per share is

defined as cash earnings divided by the weighted average number of

common shares outstanding during the year. |

|

|

NON-IFRS FINANCIAL MEASURES

The Company reports four non-IFRS financial

measures: adjusted net income (loss), adjusted EBITDA, cash

earnings and cash cost per pound of copper produced which are

described in detail below. The Company believes these measures are

useful to investors because they are included in the measures that

are used by management in assessing the financial performance of

the Company.

Adjusted net income (loss), adjusted EBITDA,

cash earnings and cash cost per pound of copper are not

standardized financial measures under IFRS and might not be

comparable to similar financial measures disclosed by other

issuers.

Adjusted Net Income (Loss) and Adjusted

Net Income (Loss) Per Share

Adjusted net income (loss) is derived from

operating net income (loss) by removing the gains or loss,

resulting from acquisition and disposal of property, mark to market

revaluation of derivative instruments not related to the current

period, net of tax, unrealized foreign exchange gains or losses on

non-current debt, net of tax and other non-recurring items.

Adjusted net income in the June 2024 quarter was $20.3 million

($0.13 income per share) compared to an adjusted net loss of $16.1

million ($0.10 loss per share) in the 2023 comparative quarter. We

believe that the presentation of Adjusted Net Income (Loss) helps

investors better understand the results of our normal operating

activities and the ongoing cash generating potential of our

business.

Adjusted EBITDA

Adjusted EBITDA in the June 2024 quarter was

$55.1 million compared to an adjusted EBITDA of $0.9 million in the

2023 comparative quarter. We define Adjusted EBITDA as net income

before interest expense, taxes, depletion, and depreciation, and as

adjusted for certain other items.

Cash Earnings and Cash Earnings Per

Share

Cash earnings in the June 2024 quarter was $54.2

million compared to $1.3 million in the 2023 comparative quarter.

Cash earnings per share was $0.33 in the June 2024 quarter compared

to $0.01 in the 2023 comparative quarter.

Cash earnings and cash earnings per share are

measures used by the Company to evaluate its performance however

they are not terms recognized under IFRS. We believe that the

presentation of cash earnings and cash earnings per share is

appropriate to provide additional information to investors about

how well the Company can earn cash to pay its debts and manage its

operating expenses and investment. Cash earnings is defined as cash

flow from operations before the net change in non-cash working

capital balances, income and mining taxes paid, and interest paid.

Cash earnings per share is the same measure divided by the weighted

average number of common shares outstanding during the year.

Cash Cost Per Pound of Copper Produced

Management uses this non-IFRS financial measure

to monitor operating costs and profitability. The Company is

primarily a copper producer and therefore calculates this non-IFRS

financial measure individually for its three copper mines, Red

Chris (30% share), Mount Polley and Huckleberry, and on a composite

basis for these mines.

Variations from period to period in the cash

cost per pound of copper produced are the result of many factors

including: grade, metal recoveries, amount of stripping charged to

operations, mine and mill operating conditions, labour and other

cost inputs, transportation and warehousing costs, treatment and

refining costs, the amount of by-product and other revenues, the

US$ to CDN$ exchange rate and the amount of copper produced.

|

Calculation of Cash Cost Per Pound of Copper

Produced |

|

expressed in thousands, except cash cost per pound of copper

produced |

Three Months Ended June 30, 2024 |

|

|

Mount Polley |

Red Chris |

Composite |

|

Cash cost of copper produced in US$ |

$7,614 |

$17,686 |

$25,300 |

|

Copper produced – 000’s pounds |

9,281 |

6,219 |

15,500 |

|

Cash cost per lb copper produced in US$ |

$0.82 |

$2.84 |

$1.63 |

|

|

|

expressed in thousands, except cash cost per pound of copper

produced |

Three Months Ended June 30, 2023 |

|

|

Mount Polley |

Red Chris |

Composite |

|

Cash cost of copper produced in US$ |

$16,727 |

$17,623 |

$34,350 |

|

Copper produced – 000’s pounds |

7,063 |

4,119 |

11,182 |

|

Cash cost per lb copper produced in US$ |

$2.37 |

$4.28 |

$3.07 |

|

expressed in thousands, except cash cost per pound of copper

produced |

|

Six Months Ended June 30, 2024 |

|

|

Mount Polley |

Red Chris |

Composite |

|

Cash cost of copper produced in US$ |

$20,138 |

$38,607 |

$58,745 |

|

Copper produced – 000’s pounds |

16,637 |

11,217 |

27,853 |

|

Cash cost per lb copper produced in US$ |

$1.21 |

$3.44 |

$2.11 |

|

|

|

|

|

expressed in thousands, except cash cost per pound of copper

produced |

|

Six Months Ended June 30, 2023 |

|

|

Mount Polley |

Red Chris |

Composite |

|

Cash cost of copper produced in US$ |

$32,954 |

$37,313 |

$70,267 |

|

Copper produced – 000’s pounds |

13,741 |

7,596 |

21,337 |

|

Cash cost per lb copper produced in US$ |

$2.40 |

$4.91 |

$3.29 |

---

For detailed information, refer to Imperial’s

2024 Second Quarter Management’s Discussion and Analysis available

on imperialmetals.com and sedarplus.ca.

About Imperial

Imperial is a Vancouver based exploration, mine

development and operating company with holdings that include the

Mount Polley mine (100%), the Huckleberry mine (100%), and the Red

Chris mine (30%). Imperial also holds a portfolio of 23 greenfield

exploration properties in British Columbia.

Company Contacts

Brian Kynoch | President |

604.669.8959Darb S. Dhillon | Chief Financial

Officer | 604.669.8959

Cautionary Note Regarding

Forward-Looking Statements

Certain information contained in this news

release are not statements of historical fact and are

“forward-looking” statements. Forward-looking statements relate to

future events or future performance and reflect Company

management’s expectations or beliefs regarding future events and

include, but are not limited to, specific statements regarding the

Company’s expectations with respect to the update of Mount Polley’s

Springer Pit mine plans to incorporate information collected from

recent diamond drilling; installation at Mount Polley of a coarse

ore stockpile cover, and a tailings thickener in the circuit to

recycle water to the mill; the continuation of work to advance

preparation for the feasibility study and required permitting

approvals for Red Chris’ planned Block Cave mine; the alignment of

Red Chris underground development activities to the permitting

schedule and the expectation that the Red Chris Nagha decline will

be completed to the extraction level elevation by the end of 2024;

the care and maintenance activities at the Huckleberry mine; and

more general statements regarding the Company’s expectations with

respect to its business and operations; metal pricing and demand;

fluctuation of revenues; metal production guidance and estimates;

and expectations regarding the usefulness of non-IFRS financial

measures including adjusted net income (loss), adjusted EBITDA,

cash earnings and cash cost per pound of copper.

In certain cases, forward-looking statements can

be identified by the use of words such as "plans", "expects" or

"does not expect", "is expected", "outlook", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates" or "does not

anticipate", or "believes", or variations of such words and phrases

or statements that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved" or the negative of these terms or comparable terminology.

By their very nature forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements.

In making the forward-looking statements in this

news release, the Company has applied certain factors and

assumptions that are based on information currently available to

the Company as well as the Company’s current beliefs and

assumptions. These factors and assumptions and beliefs and

assumptions include, the risk factors detailed from time to time in

the Company’s interim and annual financial statements and

management’s discussion and analysis of those statements, and the

risk factors detailed in the Company’s Annual Information Form, all

of which are filed and available for review on SEDAR+ at

sedarplus.ca. Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended, many of which are beyond the Company’s ability to control

or predict. There can be no assurance that forward-looking

statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking statements and all forward-looking statements in

this news release are qualified by these cautionary statements.

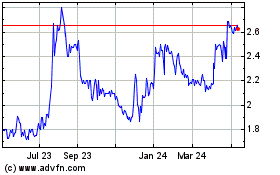

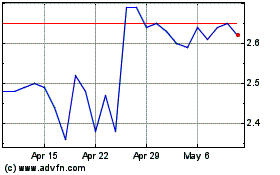

Imperial Metals (TSX:III)

Historical Stock Chart

From Feb 2025 to Mar 2025

Imperial Metals (TSX:III)

Historical Stock Chart

From Mar 2024 to Mar 2025