(TSX: NWC): The North West

Company Inc. (the “

Company” or

“

North West”) announced today

that the Toronto Stock Exchange (the “

TSX”) has

accepted notice of the Company’s intention to make a normal course

issuer bid (“

NCIB”) for a portion of its common

voting shares and variable voting shares (the

“

Shares”) as appropriate opportunities arise from

time to time. The board of directors of the Company believes that

the purchase by the Company of a portion of its outstanding Shares

may from time to time be an appropriate use of available resources

and in the best interests of the Company.

Pursuant to the NCIB notice filed with the TSX,

the Company may acquire up to a maximum of 4,765,289 of its Shares,

or approximately 10% of its public float as of the date of November

19, 2024, for cancellation over the next 12 months. As of November

19, 2024, the Company has 47,847,504 issued and outstanding Shares.

The actual number of Shares that may be purchased pursuant to the

NCIB will be determined by management of the Company, subject to

applicable law and the rules of the TSX.

Purchases under the NCIB will be made through

the facilities of the TSX or through Canadian alternative trading

systems and in accordance with applicable regulatory requirements

at a price per Share equal to the market price at the time of

acquisition. The number of Shares that can be purchased pursuant to

the NCIB is subject to a current daily maximum of 18,909 (which is

equal to approximately 25% of 75,637, being the average daily

trading volume of the Shares during the last six calendar months),

subject to the Company’s ability to make one block purchase of

Shares per calendar week that exceeds such limits.

In connection with the NCIB, the Company has

established an automatic securities purchase plan (the

“Plan”) with its designated broker to facilitate

the purchase of Shares under the NCIB at times when the Company

would ordinarily not be permitted to purchase its Shares due to

regulatory restrictions or self-imposed blackout periods. Under the

Plan, before entering a self-imposed blackout period, North West

may, but is not required to, ask the designated broker to make

purchases under the NCIB within specified parameters. Outside of

the pre-determined blackout periods, Shares may be purchased under

the NCIB based on the discretion of the Company’s management, in

compliance with TSX rules and applicable securities laws. The

Company may elect to suspend or discontinue its NCIB at any time.

The automatic securities purchase plan will be effective as of

November 21, 2024.

All Shares purchased under the NCIB will be

cancelled upon their purchase. The Company intends to fund the

purchases out of its available resources. The Company may begin to

purchase Shares on November 21, 2024 and the NCIB will terminate on

November 20, 2025, or such earlier date as the Company completes

its purchases pursuant to the NCIB or provides notice of

termination.

The NCIB follows the Company’s normal course

issuer bid for the 12 months ended November 17, 2024 (the

“2024 NCIB”). Under the 2024 NCIB, the Company had

obtained approval to purchase up to 4,733,380 Shares. The 2024 NCIB

began on November 17, 2023 and ended on November 16, 2024. Within

the past 12 months, under the 2024 NCIB the Company did not

repurchase and cancel any Shares through the facilities of the TSX

and alternative Canadian trading systems as at October 31,

2024.

Notice to

Readers

Certain forward-looking statements are made in

this news release, within the meaning of applicable securities

laws. These statements reflect North West’s current expectations

and are based on information currently available to management.

Forward looking statements about the Company, including its

business operations, strategy and expected financial performance

and condition that are predictive in nature, depend upon or refer

to future events or conditions, or include words such as “expects”,

“anticipates”, “plans”, “believes”, “estimates”, “intends”,

“targets”, “projects”, “forecasts” or negative versions thereof and

other similar expressions, or future or conditional future

financial performance (including sales, earnings, growth rates,

capital expenditures, dividends, debt levels, financial capacity,

access to capital, and liquidity), ongoing business strategies or

prospects, the Company's intentions regarding a normal course

issuer bid, the number of Shares purchased under the NCIB, the

potential impact of a pandemic on the Company's operations, supply

chain and the Company's related business continuity plans, the

realization of cost savings from cost reduction plans, the

anticipated impact of The Next 100 strategic priorities and

possible future action by the Company.

Forward-looking statements are based on current

expectations and projections about future events and are inherently

subject to, among other things, risks, uncertainties and

assumptions about the Company, economic factors and the retail

industry in general. They are not guarantees of future performance,

and actual events and results could differ materially from those

expressed or implied by forward-looking statements made by the

Company due to changes in economic conditions, political and market

factors in North America and internationally. These factors

include, but are not limited to, changes in inflation, interest and

foreign exchange rates, the Company's ability to maintain an

effective supply chain, changes in accounting policies and methods

used to report financial condition, including uncertainties

associated with critical accounting assumptions and estimates, the

effect of applying future accounting changes, business competition,

technological change, changes in government regulations and

legislation, changes in tax laws, unexpected judicial or regulatory

proceedings, catastrophic events, the Company's ability to complete

and realize benefits from capital projects, E-Commerce investments,

strategic transactions and the integration of acquisitions, the

Company's ability to realize benefits from investments in

information technology ("IT") and systems, including IT system

implementations, or unanticipated results from these initiatives

and the Company's success in anticipating and managing the

foregoing risks.

The reader is cautioned that the foregoing list

of important factors is not exhaustive. Other risks are outlined in

the Risk Management section of the 2023 Annual Report and in the

Risk Factors sections of the Annual Information Form and Management

Information Circular, material change reports and news releases.

The reader is also cautioned to consider these and other factors

carefully and not place undue reliance on forward-looking

statements. Other than as specifically required by applicable law,

the Company does not intend to update any forward-looking

statements whether as a result of new information, future events or

otherwise.

Additional information on the Company, including

our Annual Information Form, can be found on SEDAR+ at

www.sedarplus.com or on the Company's website at

www.northwest.ca.

Company

Profile

The North West Company Inc., through its

subsidiaries, is a leading retailer of food and everyday products

and services to rural communities and urban neighbourhoods in

Canada, Alaska, the South Pacific and the Caribbean. North West

operates 229 stores under the trading names Northern, NorthMart,

Giant Tiger, Alaska Commercial Company, Cost-U-Less and RiteWay

Food Markets and has annualized sales of approximately CDN$2.5

billion.

The common shares of North West

trade on the Toronto Stock Exchange under the symbol

NWC.

For more information

contact:

Dan McConnell, President and Chief Executive

Officer, The North West Company Inc.Phone 204-934-1482; fax

204-934-1317; email dmcconnell@northwest.ca

John King, Executive Vice-President and Chief

Financial Officer, The North West Company Inc.Phone 204-934-1397;

fax 204-934-1317; email jking@northwest.ca

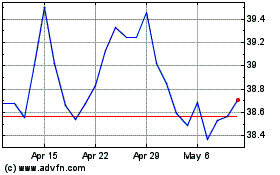

The North West (TSX:NWC)

Historical Stock Chart

From Jan 2025 to Feb 2025

The North West (TSX:NWC)

Historical Stock Chart

From Feb 2024 to Feb 2025