Q4 Inc. (TSX:QFOR) (“Q4” or the “Company”), the leading capital

markets access platform, today announced that at its special

meeting (the “Special Meeting”) of shareholders of the Company

(“Shareholders”) held today, Shareholders voted to approve the

proposed arrangement transaction (the “Arrangement”) with a newly

formed entity (the “Purchaser”) controlled by Sumeru Equity

Partners (“Sumeru”), a leading technology-focused investment firm,

whereby the Purchaser will acquire all of the issued and

outstanding common shares of the Company (“Common Shares”) for

$6.05 per Common Share, other than those held by certain

Shareholders rolling their equity interests.

The Arrangement required approval by the affirmative vote of (i)

at least 66⅔% of the votes cast by Shareholders present virtually

or represented by proxy at the Special Meeting, voting together as

a single class; and (ii) a simple majority of the votes cast by

Shareholders present virtually or represented by proxy at the

Special Meeting, voting together as a single class, excluding those

votes attached to Common Shares beneficially owned, or over which

control or direction is exercised, by certain Shareholders required

to be excluded pursuant to Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”).

A total of 38,591,773 votes were cast at the Special Meeting,

representing 95.77% of the votes attached to the issued and

outstanding Common Shares as of the record date of December 19,

2023 (the “Record Date”) and 93.33% of the votes attached to the

issued and outstanding Common Shares as of the Record Date,

excluding those votes attached to those Common Shares required to

be excluded pursuant to MI 61-101. Of the votes cast at the Special

Meeting with respect to the Arrangement, a total of 31,425,048

votes were cast in favour of the Arrangement, representing

approximately 81.48% of the votes cast on the special resolution

approving the Arrangement. In addition, a total of 17,024,701

votes, representing approximately 70.44% of the votes cast by

holders of Common Shares excluding those Common Shares required to

be excluded pursuant to MI 61-101, were cast in favour of the

special resolution approving the Arrangement. The Company’s full

report of voting results will be filed under the Company’s profile

on SEDAR+ at www.sedarplus.ca.

Darrell Heaps, Q4 Founder and CEO commented: “We are pleased

with the outcome of today’s vote and want to thank our Shareholders

for their support and understanding of the strategic rationale for

this transaction. We look forward to completing the Arrangement and

working with the Sumeru team to further expand our platform, while

continuing to deliver award winning solutions to our

customers.”

The Arrangement remains subject to certain customary closing

conditions, including the issuance of a final order by the Ontario

Superior Court of Justice (Commercial List) (the “Court”) following

the hearing expected to take place on January 30, 2024. If the

Court approval is obtained and the other conditions are satisfied

or waived, it is anticipated that the Arrangement will be completed

by the parties in February 2024.

Shareholders who have questions or require assistance submitting

their Common Shares in connection with the Arrangement may direct

their questions to Computershare Investor Services Inc., who is

acting as depositary in connection with the Arrangement, at

1-800-564-6253 (North American toll-free) or +1 514-982-7555 (calls

outside North America), or by email at

corporateactions@computershare.com.

About Q4 Inc.

Q4 Inc. (TSX: QFOR) is the leading capital markets access

platform that is transforming how issuers, investors, and the

sell-side efficiently connect, communicate, and engage with each

other.

The Q4 Platform facilitates interactions across the capital

markets through IR website products, virtual events solutions,

engagement analytics, investor relations CRM, shareholder and

market analysis, surveillance, and ESG tools. The Q4 Platform is

the only holistic capital markets access platform that digitally

drives connections, analyzes impact, and targets the right

engagement to help public companies work faster and smarter.

The company is a trusted partner to more than 2,500 public

companies globally, including many of the most respected brands in

the world, and maintains an award-winning culture where team

members grow and thrive.

Q4 is headquartered in Toronto, with offices in New York and

London. Learn more at investors.Q4inc.com.

All dollar figures in this release are in Canadian dollars

unless otherwise indicated.

About Sumeru Equity Partners

Sumeru Equity Partners provides growth capital at the

intersection of people and innovative technology. Sumeru seeks to

embolden innovative founders and management teams with capital and

scaling partnership. Sumeru has invested over US$3 billion in more

than fifty platform and add-on investments across enterprise and

vertical SaaS, data analytics, education technology, infrastructure

software and cybersecurity. The firm typically invests in companies

throughout North America and Europe. For more information, please

visit sumeruequity.com.

Cautionary Note Regarding Forward-Looking Information

This release includes “forward-looking information” and

“forward-looking statements” (collectively, “forward-looking

statements”) within the meaning of applicable securities laws.

Forward-looking statements include, but are not limited to,

statements with respect to the purchase by the Purchaser of all of

the issued and outstanding Common Shares, the anticipated timing

and the various steps to be completed in connection with the

Arrangement, including receipt of court approvals, the anticipated

timing for closing of the Arrangement and potential growth

opportunities.

In some cases, but not necessarily in all cases, forward-looking

statements can be identified by the use of forward-looking

terminology such as “plans” “targets”, “expects” or “does not

expect”, “is expected”, “an opportunity exists”, “is positioned”,

“estimates”, “intends”, “assumes”, “anticipates” or “does not

anticipate” or “believes”, or variations of such words and phrases

or state that certain actions, events or results “may”, “could”,

“would”, “might”, “will” or “will be taken”, “occur” or “be

achieved”. In addition, any statements that refer to expectations,

projections or other characterizations of future events or

circumstances contain forward-looking statements. Forward-looking

statements are not historical facts, nor guarantees or assurances

of future performance but instead represent management’s current

beliefs, expectations, estimates and projections regarding future

events and operating performance. Forward-looking statements are

necessarily based on a number of opinions, assumptions and

estimates that, while considered reasonable by the Company as of

the date of this release, are subject to inherent uncertainties,

risks and changes in circumstances that may differ materially from

those contemplated by the forward-looking statements. Important

factors that could cause actual results to differ, possibly

materially, from those indicated by the forward-looking statements

include, but are not limited to, the possibility that the proposed

Arrangement will not be completed on the terms and conditions, or

on the timing, currently contemplated, or at all, the possibility

of the Arrangement Agreement between the Company and the Purchaser

being terminated in certain circumstances, and the other risk

factors identified under “Risk Factors” in the Company’s latest

annual information form and management’s discussion and analysis

for the year ended December 31, 2022 and in the management’s

discussion and analysis for the period ended September 30, 2023,

and in other periodic filings that the Company has made and may

make in the future with the securities commissions or similar

regulatory authorities in Canada, all of which are available under

the Company’s SEDAR+ profile at www.sedarplus.ca. These factors are

not intended to represent a complete list of the factors that could

affect the Company. However, such risk factors should be considered

carefully. There can be no assurance that such estimates and

assumptions will prove to be correct. You should not place undue

reliance on forward-looking statements, which speak only as of the

date of this release.

Although the Company has attempted to identify important risk

factors that could cause actual results to differ materially from

those contained in forward-looking statements, there may be other

risk factors not currently known to us or that we currently believe

are not material that could also cause actual results or future

events to differ materially from those expressed in such

forward-looking statements. There can be no assurance that such

information will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

information. Accordingly, you should not place undue reliance on

forward-looking statements. The forward-looking statements

represent the Company’s expectations as of the date of this release

(or as the date it is otherwise stated to be made) and are subject

to change after such date. However, the Company disclaims any

intention and undertakes no obligation to update or revise any

forward-looking statements whether as a result of new information,

future events or otherwise, except as required under applicable

Canadian securities laws. All of the forward-looking statements

contained in this release are expressly qualified by the foregoing

cautionary statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240124722074/en/

Investors Edward Miller Director, Investor Relations

(437) 291-1554 ir@q4inc.com Media Longacre Square Partners

Scott Deveau sdeveau@longacresquare.com

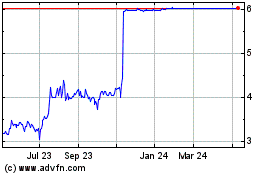

Q4 (TSX:QFOR)

Historical Stock Chart

From Dec 2024 to Jan 2025

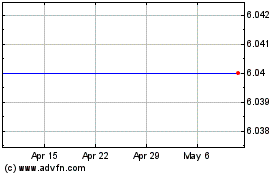

Q4 (TSX:QFOR)

Historical Stock Chart

From Jan 2024 to Jan 2025