FINSIGHT Group Inc ("FINSIGHT"), a New York City based financial

technology provider that beneficially owns over 2 million or

approximately 5.6% of Q4’s outstanding shares and represents

approximately 8.9% of the non-rolling shareholders, today issued a

letter to its fellow Q4 Inc (TSE: QFOR) (“Q4” or the “Company”)

shareholders to join FINSIGHT in voting

AGAINST

the Company’s proposed plan of arrangement to be acquired by Sumeru

Equity Partners (“Sumeru”) (the “Arrangement”) at a special meeting

of Q4 shareholders ("Special Meeting") currently scheduled for

January 24, 2024. (All amounts in USD unless otherwise specified).

The full text of the letter follows:

January 17, 2024

Dear Fellow Shareholders:

By now, we hope you have reviewed our December 28, 2023 letter

to the Q4 board of directors (the “Board”) and our January 12, 2024

press release that methodically outlined the key events and details

that we believe demonstrate that the proposed Arrangement is a

conflicted, premature and opportunistic transfer of value from the

Company’s non-rolling shareholders (“Non-Rolling Shareholders”),

who collectively own 63% of the shares outstanding, to the private

equity investors, senior management, and other insiders (“Rolling

Shareholders”) who collectively own 37% of the shares

outstanding.

The Special Committee of the Board (the “Special Committee”)

subsequently responded to our press release, in a letter dated

January 15, 2024, to attempt to convince shareholders that

FINSIGHT’s concerns about the conflicted and flawed process, the

low valuation, opportunistic timing, and the lack of detail or

consideration paid to the standalone option, were misplaced.

In this letter, FINSIGHT seeks to reiterate our position and

analysis, and address some of the assertions made by the Special

Committee:I. In their January 15, 2024, letter, the Special

Committee repeated its claim that it ran a robust process.

Shareholders that have not yet read our January 12, 2024, press

release, or Q4’s Management Information Circular (the “MIC”), are

invited to review pages 30-33 of the MIC. FINSIGHT believes the

following key facts are straightforward and demonstrate that the

Special Committee’s claims are false:

- Ten Coves and senior management determined from the outset

(June 2023) that it would only entertain offers that enabled Ten

Coves to roll. We believe Ten Coves knew that this self-serving

structural impediment would significantly impair the universe of

strategics and sponsors willing to acquire the Company (many of

whom would prefer a clean capital structure or fulsome acquisition)

and it was a key motive driving the lack of buyer outreach.

- On July 4, Sumeru executed an NDA. Eight days later, on July

12, the Special Committee “determined that it would engage in a

preliminary price exploration exercise with the Potential

Counterparties… and defer any formal sale process until an

indication of interest had been received from at least one.” Here,

the Special Committee established a clear criterion to initiate a

“formal sale process.”

- On July 26, Sumeru submitted a non-binding indication of

interest. Yet, nine days later, on August 4, the Special Committee

“noted the Board’s views on the need for certainty to secure an

offer within an acceptable range and the risk of one of more

Potential Counterparties withdrawing its proposal as a result of

the Company commencing a broader sale process.”

Fellow shareholders, the above events and quotes are drawn

directly from the Company’s MIC. We believe the Special Committee

understood and more importantly, acknowledged that they were not

engaging in a “formal sale process” by relying solely on

indications of three of the four inbound sponsors and that the

process therefore cannot meet the standard of being “robust.”

Moreover, the Special Committee refused to address or explain why

Sumeru was given over 60 days after submitting its $6.05 offer to

negotiate terms acceptable specifically to Ten Coves, while the

entirety of the go-shop period was merely 35 days. If Sumeru needed

120 days to diligence and negotiate an agreement acceptable to Ten

Coves, we are skeptical that the Special Committee believed, in

good faith, that other bidders could do it in a quarter of the

time.

II. In its January 15, 2024, letter, the Special

Committee claimed: “Q4’s revenues are highly dependent on initial

public offering volume” and that “[b]efore its IPO, Q4 was able to

grow by more than 30% annually; half of this growth was through

acquisitions. Absent this M&A, Q4’s prospects of growth are

materially impaired.”

This is nonsensical and disingenuous. At what point were IPO

investors and shareholders told they were investing in an

acquisition vehicle rather than a pre-eminent software solutions

provider for public companies? The Company itself doesn’t believe

this, as evidenced by the over $35 million it spent on sales and

marketing since its IPO and by the investor presentation currently

posted to Q4’s website, that claims it has penetrated just 6% of

corporate issuers (who pay most of its fees) and estimates the

total addressable market for its services to be $20 billion1.

Further highlighting the fallacy of the Special Committee’s

statement, below are excerpts taken verbatim from page 39 of Q4’s

October 22, 2021, IPO prospectus:

- “We believe that any public company can benefit from

subscribing to the Q4 platform. We estimate that there are

approximately 41,500 public companies globally1 and, based on the

annual price point of our complete corporate platform, we believe

this represents a global market opportunity of approximately US$13

billion annually.”

- “We currently offer certain products in our platform for the

sell-side to facilitate the functions of their corporate access

teams, including virtual conferencing services, with near-term

plans to expand to deal management and research services. We

believe that there is a significant need in the global market for

these services as we estimate there are approximately 8,000

sell-side firms2, approximately 1,000 annual sell-side investor

conferences and approximately 24,000 public offerings1 annually.

Based on the cost of our solutions and what we believe the market

price is for our upcoming sell-side focused products, we believe

the global sell-side opportunity represents an annual market of

approximately US$5 billion.”

- “We also sell access to our platform to the buy-side and, in

the near-term, plan to add additional products to our platform

focused on the buy-side, including virtual meeting management and

research services. Globally, there are approximately 25,000

buy-side firms2 and, based on the average cost of our buy-side

focused solutions, we estimate a global buy-side market opportunity

of approximately US$2 billion annually.”

Fellow shareholders, the Special Committee is either purposely

misleading Non-Rolling Shareholders or lacks a fundamental

understanding of Q4’s business. Neither are acceptable positions

for the directors who purportedly represented the interests of

Non-Rolling Shareholders in these negotiations.

III. We are confident that in the event Non-Rolling

Shareholders defeat the Arrangement, the Q4 Board and management

team will heed the will of shareholders, take action on our

recommendations and execute a comprehensive repositioning of

Q4.

We have confidence that with the right priorities and

accountability in place, Q4 management can drive substantial medium

and long-term shareholder value as a standalone public company.

With the recent restructuring complete, we reiterate that Q4

management should refocus the Company on organic growth. As

articulated in our January 12, 2024, press release, FINSIGHT

believes that Q4 can take several steps to catalyze its business,

accelerate growth, and unlock immediate value for all

shareholders:

- Focus on driving free cashflow by further rationalizing

SG&A and reducing R&D, which we believe would instantly be

accretive to its valuation. Given the business is near break-even,

returning SG&A and R&D to be in line with 2020 levels could

generate over $20 million in EBITDA in 2024. Today, the Company

supports less than 12% more customers than it did in 2020, while

SG&A and R&D has increased 95%.

- Monetize the over $30 million in R&D expenditures and data

and increase prices.

- Drive initiatives to begin utilizing Q4’s vast set of

proprietary data.

- Consider establishing sales channels within the investment

banks, comparable to FINSIGHT and virtual data room providers,

where it can potentially garner multiples more average revenue per

customer (ARPC) than it does selling through budget constrained IR

departments.

- Consider moving forward with a dual-exchange listing in the US,

as originally planned, which could widen the Company’s potential

investor base, improve trading volumes, and unlock liquidity.

Moreover, senior management should:

- Immediately increase pricing of its core web hosting and

webinar services to be more representative of the value it provides

its clients. Commoditized virtual data room and b-roll video media

companies often command 5-10 times more fees than Q4 on the same

IPO despite doing a fraction of the work.

- Recognize that a strong culture is predicated on a physically

present team driven by a shared vision. As such, it should

immediately end its company-wide ‘work-from-home’ policy that we

believe is driving significant employee disengagement, attrition

and turnover.

We believe the result of adopting these steps, will be a more

focused and more operationally efficient Company that is better

positioned to capitalize on its irreplicable market share, vast

troves of proprietary data and abundance of cross-sale

opportunities.

In 12-24 months, we would welcome the exploration of strategic

alternatives provided senior management and the Board committed to

an unconflicted and comprehensive sale process, overseen by a

Special Committee that thoroughly advocates for the interests of

all shareholders.

However, and let us be clear, if following a no-vote the Board

does not immediately demonstrate that it is prepared to put the

Company on a new course – FINSIGHT will consider all its rights and

remedies as a shareholder to bring about the changes necessary to

unlock Q4’s full potential.

IV. Finally, to address the question put to us by the

Special Committee in its letter and purportedly shared by other

shareholders regarding our motivations, FINSIGHT’s interest in Q4

is purely financial. The Company can and should be sold for 2-3x

the current Arrangement price.

As the Special Committee itself observed, FINSIGHT is not a

traditional investor. We are sophisticated operators of a capital

markets technology business that is an upstream service provider –

not a competitor to Q4. We understand its business, its ecosystem

and all the stakeholders involved. We are happily prepared to forgo

a quick return on our investment because of the magnitude of the

upside opportunity available for all shareholders if the Company

conducted a proper sale process. We’ve put millions of dollars of

our own capital behind this and on principle, we will not quietly

accept a significantly impaired outcome driven entirely by the

decisions of conflicted insiders and fiduciaries, and nor should

you.

Fellow shareholders, you do not have to accept this

opportunistic transaction. Vote it down.

The time for action has arrived. FINSIGHT encourages you

to VOTE AGAINST

the Arrangement today. If you have already voted “For” the

Arrangement, you can change your vote online to “AGAINST” using the

control number and website that was printed on your proxy or voting

instruction form.

Shareholders with questions about their vote can contact

Carson Proxy Advisors at 1-800-530-5189 or at

info@carsonproxy.com

Sincerely,

Leo EfstathiouCEO, FINSIGHT Group Inc.

About FINSIGHT Group Inc.

FINSIGHT Group Inc is a privately held software service provider

that serves thousands of the world’s leading institutional

investors, investment banks and corporations. Its applications

streamline workflows that facilitate hundreds of billions of

dollars worth of capital markets activity annually to provide

unparalleled visibility and actionable insights into fixed income

and equity capital markets.

Advisors

Goodmans LLP is serving as legal counsel, and Gagnier

Communications and Carson Proxy Advisors are serving as strategic

advisors to FINSIGHT Group Inc.

Shareholder Contact

Carson Proxy Advisors1-800-530-5189(416)

751-2066info@carsonproxy.com

Media Contact

Riyaz Lalani & Dan GagnierGagnier Communications(416)

305-1459FINSIGHT@gagnierfc.com

Disclaimer for Forward-Looking Information

Certain information in this news release may constitute

“forward-looking information” within the meaning of applicable

securities legislation. Forward-looking statements and information

generally can be identified by the use of forward-looking

terminology such as “outlook,” “objective,” “may,” “will,”

“expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,”

“plans,” “continue,” or similar expressions suggesting future

outcomes or events. Forward-looking information in this news

release may include, but is not limited to, statements of FINSIGHT

regarding how FINSIGHT intends to exercise its legal rights as a

shareholder of the Company.

Although FINSIGHT believes that the expectations reflected in

any such forward-looking information are reasonable, there can be

no assurance that such expectations will prove to be correct. Such

forward-looking statements are subject to risks and uncertainties

that may cause actual results, performance or developments to

differ materially from those contained in the statements. Except as

required by law, FINSIGHT does not intend to update these

forward-looking statements.

Information in Support of Public Broadcast

Solicitation

The following information is provided in accordance with the

corporate and securities laws of the Province of Ontario and

federal laws of Canada applicable therein, applicable to public

broadcast solicitations. FINSIGHT is relying on the exemption under

section 9.2(4) of National Instrument 51-102 – Continuous

Disclosure Obligations ("NI 51-102") to make this

public broadcast solicitation. This solicitation is being made by

FINSIGHT and not by or on behalf of the management of Q4. The

registered office address of Q4 is 99 Spadina Avenue, Suite 500,

Toronto, Ontario M5V 3P8.

FINSIGHT has filed this press release containing the information

required by section 9.2(4)(c) of NI 51-102 on Q4’s company profile

on SEDAR+ at www.sedarplus.ca.

FINSIGHT and Carson Proxy Advisors may solicit proxies in

reliance upon the public broadcast exemption to the solicitation

requirements under corporate and securities laws of the Province of

Ontario and federal laws of Canada applicable therein, conveyed by

way of public broadcast, including through press releases, speeches

or publications, and by any other manner permitted under the

applicable laws. Carson Proxy Advisors has been retained by

FINSIGHT to act as proxy solicitation agent to assist with

FINSIGHT’s solicitation and to provide certain advisory and related

services. FINSIGHT will pay Carson Proxy Advisors a fee of up to

$125,000, plus related expenses. All costs incurred for the

solicitation will be borne by FINSIGHT.

A Q4 shareholder who has given a proxy has the power to revoke

it by depositing an instrument in writing signed by the Q4

shareholder or by the Q4 shareholder’s attorney, who is authorized

in writing, or if the Q4 shareholder is a corporation, by an

officer, or attorney authorized in writing, or by transmitting, by

telephonic or electronic means, a revocation signed by electronic

signature by or on behalf of the Q4 shareholder or by the Q4

shareholder’s attorney, who is authorized in writing, and deposited

with Computershare Investor Services Inc. at any time up to and

including the last business day preceding the day of the Meeting,

or in the case of any adjournment or postponement of the Meeting,

the last business day preceding the day of the adjournment or

postponement, or with the Chair of the Meeting on the day of, and

prior to the start of, the Meeting or any adjournment or

postponement thereof. A Q4 shareholder may also revoke a proxy in

any other manner permitted by law, but prior to the exercise of

such proxy in respect of any particular matter. If a Q4 shareholder

is a non-registered (or beneficial) shareholder, they can contact

their broker or nominee to find out how to change or revoke their

voting instructions and the timing requirements, or for other

voting questions. Intermediaries may set deadlines for the receipt

of revocation notices that are farther in advance of the Meeting

than those set out above and, accordingly, the Q4 shareholder must

take such steps sufficiently in advance of the date of the Meeting

for their Intermediary to act on such revocation. If a Q4

shareholder has followed the process for attending and voting at

the Meeting online, voting at the Meeting online will revoke all

previously submitted proxies. However, in such a case, the Q4

shareholder will be provided with the opportunity to vote by ballot

on the matters put forth at the Meeting. If the Q4 shareholder does

not wish to revoke all previously submitted proxies, they are

instructed to not accept the terms and conditions, in which case

such Q4 shareholder can only enter the Meeting as a guest.

FINSIGHT is a shareholder of Q4. With the exception of the

foregoing, to the knowledge of FINSIGHT, neither FINSIGHT nor any

associates or affiliates of FINSIGHT, has any material interest,

direct or indirect, by way of beneficial ownership of securities or

otherwise, in the Proposed Transaction or any other matter to be

acted upon at the Meeting.

1

https://investors.q4inc.com/events-presentations/default.aspx

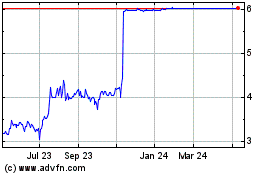

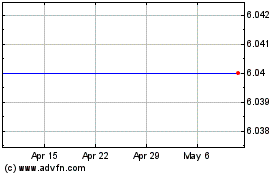

Q4 (TSX:QFOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Q4 (TSX:QFOR)

Historical Stock Chart

From Apr 2023 to Apr 2024