Conference Call and Webcast will be held on

March 29, 2023 at 11:00am ET

Sierra Metals Inc. (TSX: SMT) (“Sierra Metals” or

the “Company”) announces fourth quarter and year-end 2022

consolidated financial results. All amounts are in US dollars,

unless otherwise noted.

Fourth Quarter and Year-End 2022 Operating and Financial

Highlights

- Revenue from metals payable of $46.2 million in Q4 2022 and

$192.1 million in 2022.

- Adjusted EBITDA(1) of ($0.5) million in Q4 2022 and $13.0

million in 2022.

- Net loss attributable to shareholders for Q4 2022 of $26.5

million, or $0.16 per share and $87.5 million, or $0.53 per share

in 2022.

- Net loss of $88.3 million, or $0.54 in 2022, which includes

impairment charges of $25.0 million for the Bolivar mine and $25.0

million for the Cusi mine; and $5.3 million non-cash

depletion.

- Cash and cash equivalents as at December 31, 2022 was $5.1

million; negative working capital of $84.4 million.

- The focus in 2023 is to improve safety practices, reduce costs,

improve productivity through increased equipment availability.

On March 13, 2023, the Company improved short-term liquidity

through refinancing $6,250,000 of debt repayments due March 2023,

with negotiations ongoing to refinance a total of $18,750,000 of

term loan amortization payments due in 2023.

Ernesto Balarezo Valdez, Sierra Metals’ Interim CEO comments,

“Sierra Metals enters 2023 with positive momentum. Since the start

of 2023, we have stabilized our operations and begun to implement a

program to optimize our operating performance, all with safety as

the top priority. The expected operational improvements, alongside

the corporate initiatives to improve our balance sheet, which

includes the recently announced debt refinancing initiatives, has

set the stage for Sierra Metals to increase production, lower costs

and improve our financial position.”

(1) This is a non-IFRS performance measure, see Non-IFRS

Performance Measures section of the MD&A.

Strategic Update

As first announced on October 18, 2022, a special committee

comprised of the Company’s independent directors (the “Special

Committee”) is undertaking a strategic review process. The

mandate of the Special Committee includes exploring, reviewing and

considering options to optimize the operations of the Company and

possible financing, restructuring and strategic options in the best

interests of the Company. The Company has engaged CIBC Capital

Markets as a financial advisor in this process.

The Special Committee continues to evaluate certain strategic

alternatives. The Company will report to shareholders upon

completion of the Special Committee’s review. Concurrently, over

the course of the strategic review process the Special Committee

and the management team have identified and have implemented a

number of opportunities to improve the Company’s operational and

financial position.

Progress made to-date includes the following:

- Successfully implementing a transition of executive level

management.

- Organizational changes designed to create a shift in the

corporate culture and instill a more “hands-on” approach to

operations.

- Placing a renewed emphasis on safety and employee engagement.

The Company has hired a VP of Health and Safety, instituted new

safety protocols across all of its operations, increased training

and communication efforts, and invested in remote-controlled

equipment which is designed to reduce risk of injury.

- Streamlining operations to reduce costs, and refinancing debt

obligations in order to preserve working capital as production

levels improve.

- Advancing discussions with secured lenders on refinancing of

material short-term obligations, and steps to improve short-term

liquidity through ancillary financing arrangements.

- Initiatives to increase productivity at the mines, including

increasing asset utilization, focused underground development of

mine sequencing, and improvements to ventilation and pumping

systems.

- Prioritizing spending to focus resources on the Company’s core

assets at Yauricocha and Bolivar.

- Initiating activities designed to identify additional mineral

resources at the Yauricocha and Bolivar mines to sustain long-term

production increases.

- Enhancements to internal financial forecasting, reporting and

integration of information across functions to ensure timely

decision making.

2023 Guidance

Production Guidance

The Bolivar mine exited fourth quarter 2022 with improved

operations and expectations of continued improved performance

throughout 2023. The Yauricocha mine is expected to gradually and

safely ramp up production throughout 2023 at the current depth.

Meanwhile, Yauricocha’s focus will remain on obtaining the

necessary permits to access the deeper, high-grade ore bodies.

The table summarizing 2023 production guidance from the

Yauricocha and the Bolivar mines is provided below. Management

considers the Cusi mine as 'non-core' and it has been excluded from

the guidance.

2023 Guidance

2022

Low High Actual Silver (000 oz)

1,500

1,700

1,218

Copper (000 lbs)

13,500

15,400

27,127

Lead (000 lbs)

46,000

50,500

12,216

Zinc (000 lbs)

14,000

15,400

38,100

Gold (oz)

37,300

42,400

9,361

Copper equivalent pounds (000's) (1)

74,300

83,300

56,108

(1) 2023 metal equivalent guidance was calculated using the

following prices: $21.03/oz Ag, $3.55/lb Cu, $1.35/lb Zn, $0.93/lb

Pb and $1,741/oz Au.

Cost Guidance

A breakdown of 2023 production guidance, cash costs and all-in

sustaining costs (“AISC”) are included in the table below.

Actual for 2022 Equivalent Production Cash costs

range AISC(2) range Cash costs AISC(2)

Mine Range (1) per CuEqLb per CuEqLb

per CuEqLb per CuEqLb Yauricocha Copper Eq Lbs

('000) 40,000 - 44,000 $1.81 - $1.88 $3.09 - $3.19

$2.23

$3.69

Bolivar Copper Eq Lbs ('000) 34,500 - 39,500 $1.92 - $2.05 $3.02 -

$3.25

$2.99

$5.07

(1) 2023 metal equivalent guidance was calculated using the

following prices: $21.03/oz Ag, $3.55/lb Cu, $1.35/lb Zn, $0.93/lb

Pb and $1,741/oz Au. (2) AISC includes treatment and refining

charges, selling costs, G&A costs and sustaining capital

expenditure

Capital Expenditures

A breakdown by mine of the throughput and planned capital

investments is shown in the following table:

Amounts in $M Sustaining Growth Total

Yauricocha

10

11

21

Bolivar

22

4

26

Total Capital Expenditure

32

15

47

Total sustaining capital for 2023, excluding Cusi, is expected

to be $32.0 million, mainly comprised of mine development ($3.0

million) and drainage ($2.3 million) in Yauricocha, and mine

development ($11.3 million), infill drilling ($5.3 million) and

equipment replacement ($3.9 million) at the Bolivar mine.

Growth capital for 2023, projected at $15.0 million, includes

costs of tailings dam expansion ($5.6 million) and Yauricocha shaft

($3.2 million) in Peru. Growth capital at Bolivar includes costs of

the tailings dam and the starter dam.

Management will continue to review performance throughout the

year, while exploring value enhancing opportunities.

Conference Call & Webcast

The Company will host a conference call on Wednesday, March 29,

2023, at 11:00 AM EDT to discuss the results. Details of the

conference call and webcast are as follows:

Date:

March 29, 2023

Time:

11:00 am ET

Webcast:

https://events.q4inc.com/attendee/111210337

Telephone:

Access code: 077974

Canada: 1 833 950 0062 (toll free)

USA: 1 844 200 6205 (toll free)

Other: 1 929 526 1599

The webcast, presentation slides and 2022 Financial Statements

and Management Discussion and Analysis will be available at

www.sierrametals.com, with an archive of the webcast available for

180 days.

Summary of Operating and Financial Results

The information provided below are excerpts from the Company’s

Annual Financial Statements and Management’s Discussion and

Analysis, which are available on the Company's website

(www.sierrametals.com) and on SEDAR (www.sedar.com) under the

Company’s profile.

(In thousands of dollars, except per share and cash cost amounts,

consolidated figures unless noted otherwise)

Q4 2022 Q3

2022 Q4 2021

2022

2021

Var% Operating Ore Processed / Tonnes Milled

494,980

561,906

590,057

2,287,797

2,902,220

-21

%

Silver Ounces Produced (000's)

570

669

805

2,581

3,527

-27

%

Copper Pounds Produced (000's)

6,170

6,299

6,071

27,127

31,757

-15

%

Lead Pounds Produced (000's)

2,071

3,878

6,011

13,498

30,816

-56

%

Zinc Pounds Produced (000's)

6,367

10,815

14,913

38,100

79,281

-52

%

Gold Ounces Produced

3,411

2,199

1,863

10,155

9,572

6

%

Copper Equivalent Pounds Produced (000's)1

14,073

16,637

17,841

64,218

89,926

-29

%

Cash Cost per Tonne Processed

$

63.30

$

65.60

$

58.21

$

63.89

$

48.69

31

%

Cash Cost per CuEqLb2

$

2.44

$

2.41

$

2.29

$

2.55

$

1.81

41

%

AISC per CuEqLb2

$

4.19

$

3.82

$

4.13

$

4.15

$

3.40

22

%

Cash Cost per CuEqLb (Yauricocha)2

$

3.16

$

2.01

$

1.61

$

2.23

$

1.46

53

%

AISC per CuEqLb (Yauricocha)2

$

5.02

$

3.36

$

3.09

$

3.69

$

2.77

33

%

Cash Cost per CuEqLb (Bolivar)2, 3

$

1.76

$

3.38

$

5.29

$

2.99

$

2.18

37

%

AISC per CuEqLb (Bolivar)2, 3

$

3.69

$

5.12

$

8.58

$

5.07

$

4.22

20

%

Cash Cost per AgEqOz (Cusi)2

$

16.35

$

14.58

$

11.80

$

16.77

$

16.71

0

%

AISC per AgEqOz (Cusi)2

$

22.14

$

19.23

$

21.09

$

23.17

$

28.15

-18

%

Financial Revenues

$

46,150

$

38,787

$

62,240

$

192,119

$

272,014

-29

%

Adjusted EBITDA2

$

(537

)

$

(3,867

)

$

18,843

$

12,997

$

104,732

-88

%

Operating cash flows before movements in working capital

$

2,860

$

(6,768

)

$

15,126

$

5,163

$

91,114

-94

%

Adjusted net income (loss) attributable to shareholders2

$

(6,758

)

$

(10,705

)

$

5,443

$

(23,149

)

$

21,571

-207

%

Net income (loss) attributable to shareholders

$

(26,456

)

$

(46,150

)

$

(34,716

)

$

(87,503

)

$

(27,363

)

220

%

Cash and cash equivalents

$

5,074

$

13,690

$

34,929

$

5,074

$

34,949

-85

%

Working capital 3

$

(84,401

)

$

(52,345

)

$

17,321

$

(84,401

)

$

17,321

-587

%

(1) Copper equivalent pounds and Silver equivalent ounces were

calculated using the following realized prices: Q4 2022 - $21.21/oz

Ag, $3.63/lb Cu, $1.37/lb Zn, $0.95/lb Pb, $1,730/oz Au. Q3 2022 -

$19.26/oz Ag, $3.51/lb Cu, $1.49/lb Zn, $0.90/lb Pb, $1,730/oz Au.

Q4 2021 - $23.41/oz Ag, $4.40/lb Cu, $1.55/lb Zn, $1.06/lb Pb,

$1,795/oz Au. FY 2022 - $21.77/oz Ag, $3.99/lb Cu, $1.59/lb Zn,

$0.98/lb Pb, $1,802/oz Au. FY 2021 - $25.21/oz Ag, $4.23/lb Cu,

$1.37/lb Zn, $1.00/lb Pb, $1,796/oz Au."

(2) This is a non-IFRS performance measure, see Non-IFRS

Performance Measures section of the MD&A.

(3) The negative working capital is largely the result of the

reclassification of the long-term portion of the corporate facility

and term loan to current, as the Company defaulted on its debt

covenants. The Company has received accommodation from the banks

for non- compliance of the corporate facility as at December 31,

2022.

2022 Operational

Highlights

At the Bolivar mine, throughput increased by 19% year-over-year

in Q4 2022, due primarily to investments in pumping and ventilation

systems. For the full year, however, throughput was 30% lower due

to delays in installation of critical infrastructure during the

first half of the year and unexpected flooding during Q3 2022.

Throughput from the Yauricocha mine was severely impacted in Q4

2022 by the mudslide incident that occurred at the end of Q3 2022

followed by a road blockade by the local communities. As compared

to Q4 2021, Yauricocha throughput was 45% lower, while on an annual

basis, throughput was 16% lower as compared to 2021.

Consolidated annual ore throughput was 2,287,797 tonnes, a

decrease of 21% from 2021. Consolidated annual copper equivalent

production dropped 29% compared to 2021, largely due to lower

throughput and lower grades. For Q4 2022, consolidated copper

equivalent production decreased 21% year-over-year due primarily to

the issues experienced at Yauricocha.

2022 Consolidated Financial

Summary

- Revenue from metals payable of $192.1 million in 2022, a

decrease of 29% from 2021 annual revenue of $272.0 million. Lower

revenue resulted from the decrease in throughput and grades at the

Yauricocha and Bolivar mines;

- Yauricocha’s cash cost per copper equivalent payable pound(1)

was $2.23 (2021 - $1.46), and AISC per copper equivalent payable

pound(1) of $3.69 (2021 - $2.77);

- Bolivar’s cash cost per copper equivalent payable pound(1) was

$2.99 (2021 - $2.18), and AISC per copper equivalent payable

pound(1) was $5.07 (2021 - $4.22);

- Cusi’s cash cost per silver equivalent payable ounce(1) was

$16.77 (2021 - $16.71), and AISC per silver equivalent payable

ounce(1) was $23.17 (2021 - $28.15);

- Adjusted EBITDA(1) of $13.0 million for 2022, a decrease from

the adjusted EBITDA(1) of $104.7 million for 2021;

- Net loss attributable to shareholders for 2022 was $87.5

million or $0.53 per share (2021: net loss of $27.4 million, $0.17

per share). Net loss for the year ended 2022 includes an impairment

charge of $25.0 million on the Bolivar mine and $25.0 million on

the Cusi mine (2021: impairment of $35.0 million on the Cusi

mine);

- Adjusted net loss attributable to shareholders(1) of $23.1

million, or $0.14 per share, for 2022 compared to the adjusted net

income(1) of $21.6 million, or $0.13 per share for 2021;

- A large component of the net income (loss) for every period is

the non-cash depletion charge in Peru, which was $5.3 million for

2022 (2021: $9.3 million). The non-cash depletion charge is based

on the aggregate fair value of the Yauricocha mineral property at

the date of acquisition of Sociedad Minera Corona S.A. de C.V.

(“Corona”) of $371.0 million amortized over the life of the

mine;

- Cash flow generated from operations before movements in working

capital of $5.2 million for 2022 was lower than the $91.1 million

in 2021, mainly due to lower revenues and higher operating costs;

and

- Cash and cash equivalents of $5.1 million and working capital

of $(84.4) million as at December 31, 2022 compared to $34.9

million and $17.3 million, respectively, at the end of 2021. Cash

and cash equivalents decreased during 2022 as the $38.3 million

used in investing activities exceeded the $1.1 million generated

from financing activities and $7.3 million generated from operating

activities.

(1) This is a non-IFRS performance measure, see Non-IFRS

Performance Measures section of the MD&A.

Non-IFRS Performance Measures

The non-IFRS performance measures presented do not have any

standardized meaning prescribed by IFRS and are therefore unlikely

to be directly comparable to similar measures presented by other

issuers.

Non-IFRS reconciliation of adjusted EBITDA

EBITDA is a non-IFRS measure that represents an indication of

the Company’s continuing capacity to generate earnings from

operations before taking into account management’s financing

decisions and costs of consuming capital assets, which vary

according to their vintage, technological currency, and

management’s estimate of their useful life. EBITDA comprises

revenue less operating expenses before interest expense (income),

property, plant and equipment amortization and depletion, and

income taxes. Adjusted EBITDA has been included in this document.

Under IFRS, entities must reflect in compensation expense the cost

of share-based payments. In the Company’s circumstances,

share-based payments involve a significant accrual of amounts that

will not be settled in cash but are settled by the issuance of

shares in exchange for cash. As such, the Company has made an

entity specific adjustment to EBITDA for these expenses. The

Company has also made an entity-specific adjustment to the foreign

currency exchange (gain)/loss. The Company considers cash flow

before movements in working capital to be the IFRS performance

measure that is most closely comparable to adjusted EBITDA.

The following table provides a reconciliation of adjusted EBITDA

to the consolidated financial statements for the three months and

years ended December 31, 2022 and 2021:

Three Months Ended December 31, Years Ended December

31,

2022

2021

2022

2021

Net income (loss)

$ (27,582)

$ (33,220)

$ (88,306)

$ (22,108)

Adjusted for: Depletion and depreciation

7,068

10,526

35,449

46,074

Interest expense and other finance costs

1,865

886

4,963

3,645

NRV adjustments on inventory

366

3,619

7,879

5,746

Share-based payments

(112)

20

467

1,059

Derivative gains

-

-

-

(451)

Costs related to COVID

-

1,590

1,693

9,582

Foreign currency exchange and other provisions

907

(280)

2,322

(583)

Impairment charges

18,000

35,000

50,000

35,000

Legal settlement and related charges

-

-

-

1,665

Income taxes

(1,049)

702

(1,470)

25,103

Adjusted EBITDA

$ (537)

$ 18,843

$ 12,997

$ 104,732

Non-IFRS Reconciliation of Adjusted Net Income (Loss)

Adjusted net income (loss) attributable to shareholders

represents net income (loss) attributable to shareholders excluding

certain impacts, net of taxes, such as non-cash depletion charge

due to the acquisition of Corona, impairment charges and reversal

of impairment charges, write-down of assets, and certain non-cash

and non-recurring items including but not limited to share-based

compensation and foreign exchange (gain) loss.The Company believes

that, in addition to conventional measures prepared in accordance

with IFRS, certain investors may want to use this information to

evaluate the Company’s performance and ability to generate cash

flows. Accordingly, it is intended to provide additional

information and should not be considered in isolation or as a

substitute for measures of performance in accordance with IFRS.

The following table provides a reconciliation of adjusted net

income (loss) to the consolidated financial statements for the

three months and years ended December 31, 2022 and 2021:

Three Months Ended December 31, Years Ended December

31, (In thousands of United States dollars)

2022

2021

2022

2021

Net income (loss) attributable to shareholders

$

(26,456

)

$

(34,716

)

$

(87,503

)

$

(27,363

)

Non-cash depletion charge on Corona's acquisition

772

2,084

5,300

9,329

Deferred tax recovery on Corona's acquisition depletion charge

(235

)

(284

)

(1,614

)

(2,831

)

NRV adjustments on inventory

366

3,619

7,879

5,746

Share-based compensation

(112

)

20

467

1,059

Legal settlement and related charges

-

-

-

1,665

Derivative gains

-

-

-

(451

)

Foreign currency exchange loss (gain)

907

(280

)

2,322

(583

)

Asset impairment

18,000

35,000

50,000

35,000

Adjusted net income (loss) attributable to shareholders

$

(6,758

)

$

5,443

$

(23,149

)

$

21,571

Cash Cost per Silver Equivalent Payable Ounce and Copper

Equivalent Payable Pound

The Company uses the non-IFRS measure of cash cost per silver

equivalent ounce and copper equivalent payable pound to manage and

evaluate operating performance. The Company believes that, in

addition to conventional measures prepared in accordance with IFRS,

certain investors use this information to evaluate the Company’s

performance and ability to generate cash flows. Accordingly, it is

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. The Company considers

cost of sales per silver equivalent payable ounce and copper

equivalent payable pound to be the most comparable IFRS measure to

cash cost per silver equivalent payable ounce, copper equivalent

payable pound, and zinc equivalent payable pound, and has included

calculations of this metric in the reconciliations within the

applicable tables to follow.

All-in Sustaining Cost per Silver Equivalent Payable Ounce

and Copper Equivalent Payable Pound

All‐In Sustaining Cost (“AISC”) is a non‐IFRS measure and was

calculated based on guidance provided by the World Gold Council

(“WGC”) in June 2013. WGC is not a regulatory industry organization

and does not have the authority to develop accounting standards for

disclosure requirements. Other mining companies may calculate AISC

differently as a result of differences in underlying accounting

principles and policies applied, as well as differences in

definitions of sustaining versus development capital

expenditures.

AISC is a more comprehensive measure than cash cost per

ounce/pound for the Company’s consolidated operating performance by

providing greater visibility, comparability and representation of

the total costs associated with producing silver and copper from

its current operations.

The Company defines sustaining capital expenditures as, “costs

incurred to sustain and maintain existing assets at current

productive capacity and constant planned levels of productive

output without resulting in an increase in the life of assets,

future earnings, or improvements in recovery or grade. Sustaining

capital includes costs required to improve/enhance assets to

minimum standards for reliability, environmental or safety

requirements. Sustaining capital expenditures excludes all

expenditures at the Company’s new projects and certain expenditures

at current operations which are deemed expansionary in nature.”

Consolidated AISC includes total production cash costs incurred

at the Company’s mining operations, including treatment and

refining charges and selling costs, which forms the basis of the

Company’s total cash costs. Additionally, the Company includes

sustaining capital expenditures and corporate general and

administrative expenses. AISC by mine does not include certain

corporate and non‐cash items such as general and administrative

expense and share-based payments. The Company believes that this

measure represents the total sustainable costs of producing silver

and copper from current operations and provides the Company and

other stakeholders of the Company with additional information of

the Company’s operational performance and ability to generate cash

flows. As the measure seeks to reflect the full cost of silver and

copper production from current operations, new project capital and

expansionary capital at current operations are not included.

Certain other cash expenditures, including tax payments, dividends

and financing costs are also not included.

The following table provides a reconciliation of cash costs to

cost of sales, as reported in the Company’s consolidated statement

of income for the three months and years ended December 31, 2022

and 2021:

Three months ended Three months ended (In

thousand of US dollars, unless stated)

December 31, 2022

December 31, 2021 Yauricocha Bolivar

Cusi Consolidated Yauricocha Bolivar

Cusi Consolidated Cash Cost per Tonne of Processed Ore Cost of

Sales

18,670

13,981

6,973

39,624

24,695

15,393

6,465

46,553

Reverse: Workers Profit Sharing

514

-

-

514

(748)

-

-

(748)

Reverse: D&A/Other adjustments

(3,946)

(2,854)

(1,033)

(7,833)

(5,564)

(3,790)

(1,549)

(10,903)

Reverse: Variation in Finished Inventory

(29)

(31)

(914)

(974)

(471)

(151)

68

(554)

Total Cash Cost

15,209

11,096

5,026

31,331

17,912

11,452

4,984

34,348

Tonnes Processed

152,586

270,313

72,081

494,980

277,531

227,722

84,804

590,057

Cash Cost per Tonne Processed $

99.67

41.05

69.74

63.30

64.54

50.29

58.77

58.21

Twelve months ended Twelve months ended (In

thousand of US dollars, unless stated)

December 31, 2022

December 31, 2021 Yauricocha Bolivar

Cusi Consolidated Yauricocha Bolivar

Cusi Consolidated Cash Cost per Tonne of Processed Ore Cost of

Sales

97,463

63,331

25,853

186,647

105,665

57,415

27,715

190,795

Reverse: Workers Profit Sharing

-

-

-

-

(4,266)

-

-

(4,266)

Reverse: D&A/Other adjustments

(19,738)

(13,339)

(4,175)

(37,252)

(24,899)

(15,963)

(7,110)

(47,972)

Reverse: Variation in Finished Inventory

(1,771)

(910)

(553)

(3,234)

814

1,736

190

2,740

Total Cash Cost

75,954

49,082

21,125

146,161

77,314

43,188

20,795

141,297

Tonnes Processed

1,053,980

941,910

291,907

2,287,797

1,256,847

1,349,602

295,771

2,902,220

Cash Cost per Tonne Processed $

72.06

52.11

72.36

63.89

61.51

32.00

70.31

48.69

The following table provides detailed information on

Yauricocha’s cash cost, and all-in sustaining cost per copper

equivalent payable pound for the three months and years ended

December 31, 2022 and 2021:

YAURICOCHA Three months ended Years ended (In

thousand of US dollars, unless stated)

December 31, 2022

December 31, 2021 December 31, 2022 December 31,

2021 Cash Cost per zinc

equivalent payable pound Total Cash Cost

15,209

17,912

75,954

77,314

Variation in Finished inventory

29

471

1,771

(814)

Total Cash Cost of Sales

15,238

18,383

77,725

76,500

Treatment and Refining Charges

2,868

8,534

23,892

35,634

Selling Costs

438

1,026

2,909

4,670

G&A Costs

2,949

2,166

9,967

9,344

Sustaining Capital Expenditures

2,709

5,235

13,903

18,843

All-In Sustaining Cash Costs

24,202

35,344

128,396

144,991

Copper Equivalent Payable Pounds (000's)

4,819

11,427

34,782

52,251

Cash Cost per Copper Equivalent Payable Pound (US$)

3.16

1.61

2.23

1.46

All-In Sustaining Cash Cost per Copper Equivalent Payable

Pound (US$)

5.02

3.09

3.69

2.77

The following table provides detailed information on Bolivar’s

cash cost, and all-in sustaining cost per copper equivalent payable

pound for the three months and years ended December 31, 2022 and

2021:

BOLIVAR Three months ended Years ended (In

thousand of US dollars, unless stated)

December 31, 2022

December 31, 2021 December 31, 2022 December 31,

2021 Cash Cost per copper

equivalent payable pound Total Cash Cost

11,096

11,452

49,082

43,188

Variation in Finished inventory

31

151

910

(1,736)

Total Cash Cost of Sales

11,127

11,603

49,992

41,452

Treatment and Refining Charges

2,977

2,435

8,865

14,240

Selling Costs

1,596

728

4,443

3,986

G&A Costs

1,994

1,181

4,780

5,997

Sustaining Capital Expenditures

5,601

2,870

16,783

14,551

All-In Sustaining Cash Costs

23,295

18,817

84,863

80,226

Copper Equivalent Payable Pounds (000's)

6,321

2,194

16,745

19,033

Cash Cost per Copper Equivalent Payable Pound (US$)

1.76

5.29

2.99

2.18

All-In Sustaining Cash Cost per Copper Equivalent Payable

Pound (US$)

3.69

8.58

5.07

4.22

The following table provides detailed information on Cusi’s cash

cost, and all-in sustaining cost per silver equivalent payable

ounce for the three months and years ended December 31, 2022 and

2021:

CUSI Three months ended Years ended (In

thousand of US dollars, unless stated)

December 31, 2022

December 31, 2021 December 31, 2022 December 31,

2021 Cash Cost per silver

equivalent payable ounce Total Cash Cost

5,026

4,984

21,125

20,795

Variation in Finished inventory

914

(68)

553

(190)

Total Cash Cost of Sales

5,940

4,916

21,678

20,605

Treatment and Refining Charges

466

1,061

1,643

3,899

Selling Costs

358

342

1,128

1,227

G&A Costs

710

928

2,267

2,449

Sustaining Capital Expenditures

564

1,536

3,248

6,537

All-In Sustaining Cash Costs

8,038

8,783

29,964

34,717

Silver Equivalent Payable Ounces (000's)

363

416

1,293

1,233

Cash Cost per Silver Equivalent Payable Ounce (US$)

16.35

11.80

16.77

16.71

All-In Sustaining Cash Cost per Silver Equivalent Payable

Ounce (US$)

22.14

21.09

23.17

28.15

CONSOLIDATED Three months ended Years

ended (In thousand of US dollars, unless stated)

December

31, 2022 December 31, 2021 December 31, 2022

December 31, 2021 Total Cash Cost of Sales

32,305

34,902

149,395

138,557

All-In Sustaining Cash Costs

55,534

62,944

243,223

259,934

Copper Equivalent Payable Pounds (000's)

13,260

15,240

58,581

76,355

Cash Cost per Copper Equivalent Payable Pound (US$)

2.44

2.29

2.55

1.81

All-In Sustaining Cash Cost per Copper Equivalent Payable

Pound (US$)

4.19

4.13

4.15

3.40

Additional Non-IFRS Measures

The Company uses other financial measures, the presentation of

which is not meant to be a substitute for other subtotals or totals

presented in accordance with IFRS, but rather should be evaluated

in conjunction with such IFRS measures. The following other

financial measures are used:

- Operating cash flows before movements in working capital -

excludes the movement from period-to-period in working capital

items including trade and other receivables, prepaid expenses,

deposits, inventories, trade and other payables and the effects of

foreign exchange rates on these items.

The terms described above do not have a standardized meaning

prescribed by IFRS, and therefore the Company’s definitions are

unlikely to be comparable to similar measures presented by other

companies. The Company’s management believes that their

presentation provides useful information to investors because cash

flows generated from operations before changes in working capital

excludes the movement in working capital items. This, in

management’s view, provides useful information of the Company’s

cash flows from operations and are considered to be meaningful in

evaluating the Company’s past financial performance or its future

prospects. The most comparable IFRS measure is cash flows from

operating activities.

About Sierra Metals

Sierra Metals is a diversified Canadian mining company with

green metal exposure including copper, zinc and lead production

with precious metals byproduct credits, focused on the production

and development of its Yauricocha Mine in Peru and its Bolivar Mine

in Mexico. The Company is focused on the safety and productivity of

its producing mines. The Company also has large land packages with

several prospective regional targets providing longer-term

exploration upside and mineral resource growth potential.

For further information regarding Sierra Metals, please visit

www.sierrametals.com.

Continue to Follow, Like and Watch our progress:

Web: www.sierrametals.com

| Twitter: sierrametals | Facebook: SierraMetalsInc |

LinkedIn: Sierra Metals Inc | Instagram:

sierrametals

Forward-Looking Statements

This press release contains forward-looking information within

the meaning of Canadian securities legislation. Forward-looking

information relates to future events or the anticipated performance

of Sierra and reflect management's expectations or beliefs

regarding such future events and anticipated performance based on

an assumed set of economic conditions and courses of action,

including the accuracy of the Company’s current mineral resource

estimates; that the Company’s activities will be conducted in

accordance with the Company’s public statements and stated goals;

that there will be no material adverse change affecting the

Company, its properties or its production estimates (which assume

accuracy of projected ore grade, mining rates, recovery timing, and

recovery rate estimates and may be impacted by unscheduled

maintenance, labour and contractor availability and other operating

or geo-political uncertainties on the Company’s production,

workforce, business, operations and financial condition); the

expected trends in mineral prices, inflation and currency exchange

rates; that all required approvals will be obtained for the

Company’s business and operations on acceptable terms; that there

will be no significant disruptions affecting the Company's

operations. In certain cases, statements that contain

forward-looking information can be identified by the use of words

such as "plans", "expects", "is expected", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates", "believes" or

variations of such words and phrases or statements that certain

actions, events or results "may", "could", "would", "might", or

"will be taken", "occur" or "be achieved" or the negative of these

words or comparable terminology. Forward-looking statements include

those relating to the Company’s guidance on the timing and amount

of future production and its expectations regarding the results of

operations; expected costs; permitting requirements and timelines;

anticipated market prices of metals; the Company’s ability to

comply with contractual and permitting or other regulatory

requirements; formalizing the refinancing contract and the timeline

related thereto and the timing of senior management’s conference

call to discuss the Company’s financial and operating results for

the year ended December 31, 2022. By its very nature

forward-looking information involves known and unknown risks,

uncertainties and other factors that may cause actual performance

of Sierra to be materially different from any anticipated

performance expressed or implied by such forward-looking

information.

Forward-looking information is subject to a variety of risks and

uncertainties, which could cause actual events or results to differ

from those reflected in the forward-looking information, including,

without limitation, the risks of not meeting the expectations

contemplated herein and the risks described under the heading "Risk

Factors" in the Company's annual information form dated March 28,

2023 for its fiscal year ended December 31, 2022 and other risks

identified in the Company's filings with Canadian securities

regulators, which filings are available at www.sedar.com.

The risk factors referred to above are not an exhaustive list of

the factors that may affect any of the Company's forward-looking

information. Forward-looking information includes statements about

the future and is inherently uncertain, and the Company's actual

achievements or other future events or conditions may differ

materially from those reflected in the forward-looking information

due to a variety of risks, uncertainties and other factors. The

Company's statements containing forward-looking information are

based on the beliefs, expectations, and opinions of management on

the date the statements are made, and the Company does not assume

any obligation to update such forward-looking information if

circumstances or management's beliefs, expectations or opinions

should change, other than as required by applicable law. For the

reasons set forth above, one should not place undue reliance on

forward-looking information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230328005891/en/

Investor Relations Sierra Metals Inc. Tel: +1 (416)

366-7777 Email: info@sierrametals.com

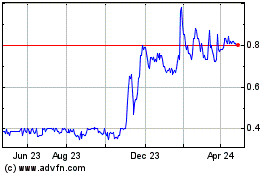

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

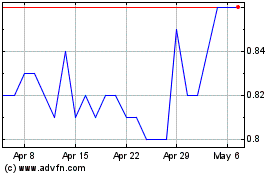

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Dec 2023 to Dec 2024