Sierra Metals Announces Special Meeting of Shareholders for Proposed Share Consolidation

December 12 2024 - 4:00PM

Business Wire

Sierra Metals Inc. (TSX: SMT | OTCQX: SMTSF | BVL: SMT)

(“Sierra Metals” or the “Company”) announces that it will hold a

special meeting of shareholders (the “Special Meeting”) on January

31, 2025. The Company has set a record date for the Special Meeting

of December 30, 2024.

The purpose of the Special Meeting is to seek authorization from

the Company’s shareholders to enable the Board of Directors (the

“Board”) to consider a consolidation of all of the Company’s issued

and outstanding common shares (“Common Shares”) at a ratio of one

post‐consolidation share for up to every twenty pre‐consolidation

shares (the “Consolidation”). Shareholders will be requested at the

Special Meeting or any adjournment thereof, to consider and, if

thought fit, pass, with or without amendment, a special resolution

approving the Consolidation. Following the Special Meeting, the

Board expects to exercise its discretion to implement the

Consolidation on such a date and time as the Board may determine.

Additional details in respect of the proposed Consolidation will be

included in a management information circular which is being mailed

to shareholders in compliance with applicable laws and will be

available under the Company’s profile on SEDAR+

(www.sedarplus.ca).

The Board believes it is in the best interests of the Company to

be in a position to complete the Consolidation to provide the

Company with greater flexibility for future corporate activities,

enhance the marketability of the Common Shares as an investment and

lead to increased interest by a broader spectrum of potential

investors, thereby increasing the Company’s ability to secure

additional financing for operational and growth initiatives.

Over the past 24 months, Sierra Metals has successfully

stabilized, optimized and improved its operations, resulting in a

lower cost structure, increased efficiencies and profitability

across the Company. During this period, the Company, among its many

achievements, has safely delivered the following:

- Yauricocha Mine: increased throughput rates to full

capacity of 3,600 tonnes per day (30% increase) which has increased

metal production and lowered costs.

- Bolivar Mine: increased throughput rates to consistently

produce at full capacity of 5,000 tonnes per day with plans

underway to add tailing facilities to increase throughput capacity

by 50% to 7,500 tonnes per day.

- Growing mineral reserves and resources: provided an

updated NI 43-101 compliant mineral reserve and resource estimate

for Yauricocha and Bolivar which indicates both operations have

significant reserves and resources that underpin the foundation for

growth.

- Divested Cusi Mine: the divesture for cash consideration

of US$2.5 million allows the Company to focus resources on growing

its core operations, with the possibility of a steady future

revenue stream in the form of a 2% net smelter royalty from the

Cusi Mine.

- Optimized balance sheet: recapitalized its balance sheet

by refinancing its long-term debt facilities and completing an

equity private placement with broad support from insiders and

existing shareholders.

- Strengthened Leadership: to lead and execute Sierra’s

growth phase, the Company has attracted a new CEO, CFO, and senior

management team, and revitalized its board of directors.

Ernesto Balarezo, CEO of Sierra Metals, comments, “Over the past

two years, Sierra Metals has been diligently delivering strong

operating and financial results in a safe and responsible manner.

Our strong financial position has us well positioned to focus on a

period of organic growth at our two mines. The momentum we have

generated across our business is poised to continue in 2025. As we

embark on our next phase of growth, we believe the proposed share

consolidation will provide an attractive entry point for potential

new institutional investors and retail shareholders.”

The implementation of any Consolidation is subject to Sierra

Metals receiving all required approvals, including support from

shareholders at the upcoming Special Meeting, and the approval of

the Toronto Stock Exchange. If the approvals required for the

Consolidation are obtained and the Board decides to implement the

Consolidation, the Consolidation will occur at a time determined by

the Board and additional information in respect of the

Consolidation will be announced by the Company.

About Sierra Metals

Sierra Metals is a Canadian mining company focused on copper

production with additional base and precious metals by-product

credits at its Yauricocha Mine in Peru and Bolivar Mine in Mexico.

The Company is intent on safely increasing production volume and

growing mineral resources. Sierra Metals has recently had several

new key discoveries and still has many more exciting brownfield

exploration opportunities in Peru and Mexico that are within close

proximity to the existing mines. Additionally, the Company has

large land packages at each of its mines with several prospective

regional targets providing longer-term exploration upside and

mineral resource growth potential.

For further information regarding Sierra Metals, please visit

www.SierraMetals.com.

Forward-Looking Statements

This press release contains forward-looking information within

the meaning of Canadian securities legislation. Forward-looking

information relates to future events or the anticipated performance

of Sierra and reflect management's expectations or beliefs

regarding such future events and anticipated performance based on

an assumed set of economic conditions and courses of action. In

certain cases, statements that contain forward-looking information

can be identified by the use of words such as "plans", "expects",

"is expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates", "believes" or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might", or "will be taken", "occur" or

"be achieved" or the negative of these words or comparable

terminology. By its very nature forward-looking information

involves known and unknown risks, uncertainties and other factors

that may cause actual performance of Sierra to be materially

different from any anticipated performance expressed or implied by

such forward-looking information.

Forward-looking information is subject to a variety of risks and

uncertainties, which could cause actual events or results to differ

from those reflected in the forward-looking information, including,

without limitation, the risks described under the heading "Risk

Factors" in the Company's annual information form dated March 15,

2024 for its fiscal year ended December 31, 2023 and other risks

identified in the Company's filings with Canadian securities

regulators, which are available at www.sedarplus.ca.

The risk factors referred to above are not an exhaustive list of

the factors that may affect any of the Company's forward-looking

information. Forward-looking information includes statements about

the future and is inherently uncertain, and the Company's actual

achievements or other future events or conditions may differ

materially from those reflected in the forward-looking information

due to a variety of risks, uncertainties and other factors. The

Company's statements containing forward-looking information are

based on the beliefs, expectations, and opinions of management on

the date the statements are made, and the Company does not assume

any obligation to update such forward-looking information if

circumstances or management's beliefs, expectations or opinions

should change, other than as required by applicable law. For the

reasons set forth above, one should not place undue reliance on

forward-looking information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241212228164/en/

Investor Relations Sierra Metals Inc. +1 (866) 721-7437

info@sierrametals.com

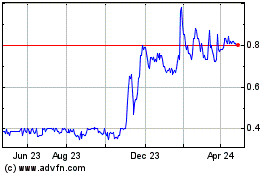

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

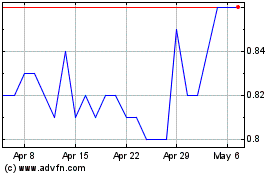

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Dec 2023 to Dec 2024