Arias Resource Capital Fund II L.P. and Arias Resource Capital Fund

II (Mexico) L.P. (the “Nominating Shareholders”), together with

other affiliates of Arias Resource Capital and its principal

(together with the Nominating Shareholders, “ARC”) holding

approximately 27% of the outstanding shares of Sierra Metals Inc.

(“Sierra” or the “Company”) (TSX: SMT), cautions Sierra

shareholders regarding the questionable tactics that Sierra’s

incumbent board of directors (the “Board”) may be resorting to in

order to entrench themselves in advance of the Company’s annual

meeting of shareholders scheduled to be held on at 2:00 p.m.

(Eastern time) on June 28, 2023 (the “Meeting”). Concerned

shareholders should attend the Meeting, to be held virtually via

live audio webcast, online at: meetnow.global/MFXH4US.

Purposely Misleading Press Release Claiming Support for

Incumbent Sierra Nominees

On the evening of June 15, 2023, a purposely misleading press

release was disseminated over Canadian newswire services and filed

under Sierra’s profile on SEDAR, purportedly on behalf of one of

Peru’s most prominent banks. (the “Bank”). The press release stated

that it was the Bank’s apparent intention to vote 3.6% of the

outstanding Sierra shares in favour of the Company’s proposed Board

slate, while parroting the allegations about ARC and its nominees

featured in the Company’s management information circular cover

letter and directing inquiries to the personal email account at

Gmail of an individual named Alberto Gubbins.

After being alerted to the purposely misleading press release by

ARC, the Bank confirmed that this press release was not issued or

authorized by the Bank. On June 16, 2023 a correction was issued by

the newswire service identifying Mr. Gubbins as the sole source of

the press release.

ARC is aware that Mr. Gubbins has been in recent contact with

Sierra’s Board member and Chief Executive Officer, Ernesto

Balarezo. It is ARC’s understanding that the two met, on or about

May 22, 2023.

As the beneficiary, Sierra should immediately publicly

confirm that it was wholly unaware of the June 15, 2023 purposely

misleading press release prior to its dissemination, disclose what

actions, if any, it took to avoid the market being misled, and to

disclose Sierra’s, and its directors’ and executives’, relationship

and dealings and with Mr. Gubbins and other supporting

shareholders.

If Sierra fails to do so, shareholders must question the lengths

to which the Company is prepared to go in order to sway the results

of the Meeting and whether shareholders’ voices will actually be

heard.

Offering Dilutive Financing Arrangements for Votes?

ARC is extremely concerned, and other Sierra shareholders should

be as well, that if re-elected, the Board may provide a minority

group of friendly shareholders that vote in favour of them at the

Meeting with the opportunity to acquire Sierra shares at prices

that are not reflective of Sierra’s fundamental value, while

substantially diluting all other shareholders. Sierra itself

effectively raised the potential for a quid pro quo arrangement

when it stated, in part:

“[Sierra] received unsolicited

communications from shareholders who collectively hold 24,728,870

Shares (approximately 15% of the outstanding Shares) advising

[Sierra] that they intend to support the nominees of [Sierra] …

certain of these shareholders have indicated that they are willing

to provide further financial support to Sierra Metals.”1

When faced with the above allegation, Sierra’s confirmed that

“the shareholders who have contacted the Company have expressed

their interest to support future financings of Sierra Metals should

the opportunities present themselves” but issued a carefully

worded, limited denial of any “financial arrangements or agreements

between the Company and the supportive shareholders respecting the

voting for the Board’s nominees.” 2

Sierra should immediately publicly disclose the nature

of the communications with these “unsolicited” shareholders and

confirm that there are absolutely no financial or non-financial

agreements, arrangements or understandings (written or oral)

between the Company and any shareholders respecting the voting for

the Board’s nominees.

If Sierra fails to do so, shareholders should be extremely wary

of dilutive financings following the Meeting should the current

Board be re-elected.

TIME IS RUNNING OUT. VOTE TODAY.

ARC is soliciting proxies for the election of five highly

qualified and competent nominees – J. Alberto Arias, Derek White,

Daniel Tellechea, Ricardo Arrarte, and Alonso Checa (collectively,

the “ARC Nominees”) – to the Board. ARC is Sierra’s largest

shareholder holding approximately 27% of the outstanding shares in

the Company and has been a committed long-term investor since 2008.

ARC understands Sierra’s assets and its long-term potential as well

as the importance of a refreshed Board to urgently turnaround the

Company.

The ARC Nominees intend to act swiftly to resolve Sierra’s

mounting losses, share price collapse and financial liquidity

challenges, and to restore the Company to its previous track record

of excellence and value creation prior to mid-2021.

The YELLOW proxy must be received prior to 5:00 p.m.

(Eastern time) on Friday, June 23, 2023 to make your vote count.

Don’t Wait, Vote Right Away.

Shareholders can call or text Kingsdale Advisors on

1.888.370.3955 (toll free in North America), email

contactus@kingsdaleadvisors.com, or chat with an advisor on

www.ProtectYourSierraInvestment.com for more information.

ADVISORS

ARC has retained Kingsdale Advisors as its strategic

shareholder, communications and proxy advisor and Stikeman Elliott

LLP as its legal advisor.

ABOUT ARC

Arias Resource Capital, founded in 2007, is a Miami-based

private equity firm in the metals sector that invests in critical

materials empowering the clean energy revolution.

CAUTIONARY NOTES AND FORWARD-LOOKING

STATEMENTS

This news release contains forward-looking information within

the meaning of applicable securities laws (“forward-looking

statements”) and are prospective in nature. These forward-looking

statements are not based on historical facts, but rather on current

expectations and may include projections about future events and

estimates and their underlying assumptions, statements regarding

plans, objectives, intentions and expectations with respect to

future financial results, events, operations, services, product

development and potential, and statements regarding future

performance. Forward-looking statements are generally identified by

the words “expects”, “anticipates”, “believes”, “intends”,

“estimates”, “plans”, “will”, “may”, “should”, “could”, “believes”,

“potential” or “continue” and similar expressions, or the negative

thereof. Forward-looking statements in this news release include,

without limitation, statements regarding the potential benefits,

contributions and development of the ARC Nominees and the expected

impact and results of Sierra’s corporate governance practices, and

Sierra’s intentions regarding dilutive financings. There are

numerous risks and uncertainties that could cause actual results

and ARC’s plans and objectives to differ materially from those

expressed in, or implied or projected by, the forward-looking

information and statements in this news release, including, without

limitation, the risks described under the headings such as

“Cautionary Statement – Forward Looking Information” and “Risk

Factors” in Sierra’s annual information form dated March 28, 2023

for its fiscal year ended December 31, 2022, and other risks

identified in Sierra’s filings with Canadian securities regulatory

authorities which are available under Sierra’s profile on SEDAR at

www.sedar.com. The forward-looking statements speak only as of the

date hereof and, other than as required by applicable law, ARC

undertakes no duty or obligation to update or revise any

forward-looking information or statements contained in this news

release as a result of new information, future events, changes in

expectation or otherwise.

ADDITIONAL INFORMATION

In connection with the Nominating Shareholders’ solicitation of

proxies in respect of the Meeting, the Nominating Shareholders have

filed and mailed its dissident proxy circular (the “ARC Circular”)

and the YELLOW form of proxy to Sierra shareholders.

Any solicitation made by ARC will be made by it and not by or on

behalf of the management of Sierra. All costs incurred for any

solicitation will be borne by ARC, provided that, subject to

applicable law, ARC may seek reimbursement from Sierra of ARC’s

out-of-pocket expenses, including proxy solicitation expenses and

legal fees, incurred in connection with any successful result at a

meeting of Sierra shareholders. Proxies may be solicited by ARC

pursuant to the ARC Circular. Solicitations may be made by or on

behalf of ARC by mail, telephone, fax, email or other electronic

means as well as by newspaper or other media advertising, and in

person by directors, officers and employees of ARC, who will not be

specifically remunerated therefor. ARC may also solicit proxies in

reliance upon the public broadcast exemption to the solicitation

requirements under applicable Canadian corporate and securities

laws, including through press releases, speeches or publications,

and by any other manner permitted under applicable Canadian laws.

ARC may engage the services of one or more agents and authorize

other persons to assist in soliciting proxies on its behalf, which

agents would receive customary fees for such services. In

particular, ARC has engaged Kingsdale Advisors (“Kingsdale”) to act

as ARC’s shareholder and communications advisor and to act as its

strategic shareholder advisor and proxy solicitation agent to

solicit proxies in the United States and Canada. Pursuant to this

engagement, Kingsdale will receive an initial fee of C$150,000,

plus a customary fee for each call to and from shareholders.

Proxies may be revoked by instrument in writing by a shareholder

giving the proxy or by its duly authorized officer or attorney, or

in any other manner permitted by law and the articles or by-laws of

Sierra. None of ARC nor, to its knowledge, any of its associates or

affiliates, has any material interest, direct or indirect: (i) in

any transaction since the beginning of Sierra’s most recently

completed financial year or in any proposed transaction that has

materially affected or would materially affect Sierra or any of its

subsidiaries; or (ii) by way of beneficial ownership of securities

or otherwise, in any matter proposed to be acted on by Sierra at

the Meeting, other than the election of directors to the board of

Sierra or as disclosed in accordance with applicable law.

See the ARC Circular for further information regarding the

Nominating Shareholders, ARC and the ARC Nominees. A copy is

available under Sierra’s profile on SEDAR at www.sedar.com.

Sierra trades on the Toronto Stock Exchange under the symbol

“SMT”. Sierra’s head office is located at 77 King Street West,

Suite 400, Toronto, Ontario M5K 0A1.

CONTACT

Aquin GeorgeDirector, Special

SituationsKingsdale Advisors647-265-4528

ageorge@kingsdaleadvisors.com

________________________1 Page 4 of the Cover

Letter to Sierra’s Management Information Circular dated May 29,

2023.2 Sierra’s press release dated June 14, 2023.

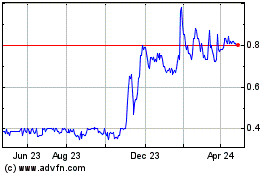

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

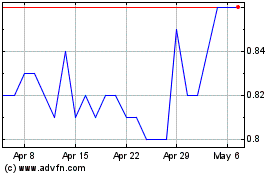

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Dec 2023 to Dec 2024