- Bolivar’s throughput in Q2 2023 was 405,987 tonnes, an

increase of 36% from Q1 2023 and 58% from Q2 2022;

- Bolivar’s historic record copper equivalent production of

10.7 million pounds in Q2 2023;

- Yauriocha’s throughput in Q2 2023 increased 11% over Q1

2023;

- Consolidated production increased for all metals; Copper

equivalent production increased 21% and 22% over Q1 2023 and Q2

2022, respectively.

(All metal prices reported in USD)

Sierra Metals Inc. (TSX: SMT) (OTC: SMTSF) (“Sierra

Metals” or “the Company”) announces second quarter 2023

production results from its three underground mines in Latin

America: Yauricocha, a polymetallic mine in Peru and Bolivar a

copper mine and Cusi a silver mine each in Mexico.

Consolidated Q2 2023 results will be released before

market-open on Monday, August 14th followed with management hosting

a conference call and webcast the same day at 11:00 AM EDT.

Ernesto Balarezo, CEO of Sierra Metals, commented, “As we

complete our first half of 2023, we are pleased with the continued

operational recovery at Bolivar. Q2 2023 marks the fourth

sequential strong quarter for the mine, achieving production of

more than 400,000 tonnes, a landmark amount not achieved by this

mine since Q3 2020. These production numbers reinforce our

confidence in Bolivar's potential to grow further.

The Yauricocha mine operated below its full capacity of 3,600

tonnes per day ("tpd"), which was in line with our expectations. We

continue to believe that the Yauricocha mine can get back to its

full production capacity of 3,600 tonnes on receipt of the permits

to operate below the 1120 level.”

Mr. Balarezo concluded, “With two strong quarters of production

during this year, we have shown that with our focus on safe and

efficient operations combined with the various organizational

changes, we can achieve the desired results and unlock the

potential of our two core mines."

Consolidated Production

Results

Six months ended June 30, Consolidated Production

Q2 2023 Q1 2023 % Var. Q2 2022 %

Var.

2023

2022

Tonnes processed

702,052

577,284

22

%

640,181

10

%

1,279,336

1,230,911

Daily throughput

8,023

6,598

22

%

7,316

10

%

7,310

7,034

Silver production (000 oz)

740

622

19

%

608

22

%

1,362

1,342

Copper production (000 lb)

10,459

8,285

26

%

8,334

26

%

18,744

14,658

Zinc production (000 lb)

12,228

10,579

16

%

10,426

17

%

22,807

20,918

Lead production (000 lb)

4,256

3,060

39

%

3,333

28

%

7,316

7,549

Gold Production (oz)

4,442

3,910

14

%

2,622

69

%

8,352

4,545

Copper equivalent pounds (000's)(1)

21,705

18,009

21

%

17,794

22

%

39,729

33,670

(1) Copper equivalent pounds were calculated using the following

realized prices: Q2 2023: $24.17/oz Ag, $3.99/lb Cu, $1.16/lb Zn,

$0.96/lb Pb, $1,977/oz Au; Q1 2023: $22.57/oz Ag, $4.06/lb Cu,

$1.42/lb Zn, $0.97/lb Pb, $1,891/oz Au; Q2 2022: $22.65/oz Ag,

$4.30/lb Cu, $1.79/lb Zn, $1.00/lb Pb, $1,872/oz Au; 6M 2023:

$23.37/oz Ag, $4.02/lb Cu, $1.29/lb Zn, $0.96/lb Pb, $1,934/oz Au;

6M 2022: $23.30/oz Ag, $4.42/lb Cu, $1.74/lb Zn, $1.03/lb Pb,

$1,873/oz Au.

The Company achieved consolidated throughput from its three

operating mines of 702,052 tonnes during the second quarter of

2023, which was 22% higher than Q1 2023 and 10% higher than the

second quarter of 2022. The strong consolidated throughput for Q2

2023 was underpinned by the continued improvements at the Bolivar

mine, which registered an increase in throughput for the fourth

quarter in a row.

Consolidated copper equivalent production for Q2 2023 was 21.7

million pounds, an increase of 21% and 22% over Q1 2023 and Q2

2022, respectively. Consolidated production for all metals

increased during the quarter despite lower copper and gold

production from Yauricocha. Q2 2023 silver equivalent ounces

production from the non-core Cusi mine was lower by or 5% and 15%

lower than Q1 2023 and Q2 2022, respectively, and had little impact

on consolidated copper equivalent production results of the Company

in Q2 2023.

Yauricocha Mine, Peru

Throughput at the Yauricocha Mine for Q2 2023 was 244,315 tones,

11% higher than in Q1 2023, but 23% lower than in Q2 2022. This

anticipated decline was due to the continued depletion of the ore

above the 1120 level. Copper equivalent pound production for Q2

2023 was 21% lower than Q2 2022 as the reduced throughput was

partially offset by higher grades of lead, zinc and silver coming

from the high-grade small ore bodies. Copper and gold grades

declined due to the lower contribution from the Esperanza zone.

When compared to Q1 2023, there was a 6% increase in the copper

equivalent production during Q2 2023, as the higher throughput was

partially offset by the impact of lower copper grades, and

recoveries for copper and silver.

A summary of production from the Yauricocha Mine for Q2 2023 is

provided below:

Six months ended June 30, Yauricocha Production Q2

2023 Q1 2023 % Var. Q2 2022 % Var.

2023

2022

Tonnes processed

244,315

219,145

11

%

317,087

-23

%

463,460

632,337

Daily throughput

2,792

2,505

11

%

3,624

-23

%

2,648

3,613

Silver grade (g/t)

54.83

46.45

18

%

44.65

23

%

50.86

42.03

Copper grade

0.72

%

0.79

%

-9

%

0.93

%

-23

%

0.75

%

0.86

%

Lead grade

0.87

%

0.70

%

24

%

0.58

%

50

%

0.79

%

0.62

%

Zinc grade

2.65

%

2.54

%

4

%

1.88

%

41

%

2.60

%

1.86

%

Gold Grade (g/t)

0.40

0.46

-13

%

0.54

-26

%

0.43

0.53

Silver recovery

73.25

%

76.16

%

-4

%

58.64

%

25

%

74.58

%

61.30

%

Copper recovery

72.21

%

75.70

%

-5

%

78.66

%

-8

%

73.37

%

77.90

%

Lead recovery

83.88

%

81.66

%

3

%

75.81

%

11

%

82.67

%

78.28

%

Zinc recovery

85.54

%

86.18

%

-1

%

79.21

%

8

%

85.82

%

80.12

%

Gold Recovery

20.33

%

23.39

%

-13

%

21.62

%

-6

%

21.82

%

20.84

%

Silver production (000 oz)

316

249

27

%

267

18

%

565

523

Copper production (000 lb)

2,808

2,895

-3

%

5,127

-45

%

5,703

9,406

Lead production (000 lb)

3,930

2,778

41

%

3,060

28

%

6,708

6,888

Zinc production (000 lb)

12,228

10,579

16

%

10,426

17

%

22,807

20,918

Gold Production (oz)

633

754

-16

%

1,179

-46

%

1,387

2,236

Copper equivalent pounds (000's)(1)

9,525

9,003

6

%

12,105

-21

%

18,567

22,969

(1) Copper equivalent pounds were calculated using the following

realized prices: Q2 2023: $24.17/oz Ag, $3.99/lb Cu, $1.16/lb Zn,

$0.96/lb Pb, $1,977/oz Au; Q1 2023: $22.57/oz Ag, $4.06/lb Cu,

$1.42/lb Zn, $0.97/lb Pb, $1,891/oz Au; Q2 2022: $22.65/oz Ag,

$4.30/lb Cu, $1.79/lb Zn, $1.00/lb Pb, $1,872/oz Au; 6M 2023:

$23.37/oz Ag, $4.02/lb Cu, $1.29/lb Zn, $0.96/lb Pb, $1,934/oz Au;

6M 2022: $23.30/oz Ag, $4.42/lb Cu, $1.74/lb Zn, $1.03/lb Pb,

$1,873/oz Au.

Bolivar Mine, Mexico

Operating at 4,640 tpd during Q2 2023, the Bolivar Mine achieved

405,987 tonnes of throughput, an increase of 36% and 58% over Q1

2023 and Q2 2022 respectively, attributable to substantial

improvements in ventilation and drainage, which allowed for more

meters of production drilling and better access to the mining

zones. Grades were higher for all metals in comparison with Q1 2023

and Q2 2022, except for a slight decrease in gold grades as

compared to Q1 2023. The increase in grades was effectively the

direct result of mining in the Bolivar NW zone.

In Q2 2023, copper equivalent production was a record 10.7

million pounds, as the mine recorded an increased production for

all metals. Copper, silver and gold production for Q2 2023 were up

139%, 149% and 187%, respectively, as compared to Q2 2022.

A summary of production for the Bolivar Mine for Q2 2023 is

provided below:

Six months ended June 30, Bolivar Production Q2

2023 Q1 2023 % Var. Q2 2022 % Var.

2023

2022

Tonnes processed (t)

405,987

299,017

36

%

256,372

58

%

705,004

443,928

Daily throughput

4,640

3,417

36

%

2,930

58

%

4,029

2,537

Copper grade

0.92

%

0.87

%

6

%

0.63

%

46

%

0.90

%

0.61

%

Silver grade (g/t)

19.65

17.39

13

%

12.36

59

%

18.69

11.77

Gold grade (g/t)

0.42

0.45

-7

%

0.24

75

%

0.44

0.20

Copper recovery

92.92

%

94.25

%

-1

%

90.61

%

3

%

93.51

%

88.35

%

Silver recovery

80.45

%

83.99

%

-4

%

80.99

%

-1

%

82.06

%

84.11

%

Gold recovery

66.38

%

69.47

%

-4

%

65.93

%

1

%

67.72

%

65.11

%

Copper production (000 lb)

7,651

5,390

42

%

3,207

139

%

13,041

5,252

Silver production (000 oz)

207

140

48

%

83

149

%

347

141

Gold production (oz)

3,678

3,037

21

%

1,283

187

%

6,715

1,875

Copper equivalent pounds (000's)(1)

10,721

7,588

41

%

4,199

155

%

18,282

6,788

(1) Copper equivalent pounds were calculated using the following

realized prices: Q2 2023: $24.17/oz Ag, $3.99/lb Cu, $1.16/lb Zn,

$0.96/lb Pb, $1,977/oz Au; Q1 2023: $22.57/oz Ag, $4.06/lb Cu,

$1.42/lb Zn, $0.97/lb Pb, $1,891/oz Au; Q2 2022: $22.65/oz Ag,

$4.30/lb Cu, $1.79/lb Zn, $1.00/lb Pb, $1,872/oz Au; 6M 2023:

$23.37/oz Ag, $4.02/lb Cu, $1.29/lb Zn, $0.96/lb Pb, $1,934/oz Au;

6M 2022: $23.30/oz Ag, $4.42/lb Cu, $1.74/lb Zn, $1.03/lb Pb,

$1,873/oz Au.

Cusi Mine, Mexico

The non-core Cusi Mine had a lower Q2 2023 throughput and was

negatively impacted by the availability of mining equipment and

frequent flooding during the quarter. Operating at 591 tpd, the

Cusi mine processed 51,750 tonnes, which was 12% lower than Q1 2023

and 22% lower than Q2 2022. Higher silver and lead grades combined

with improved gold recoveries partially offset the impact of lower

throughput resulting in silver equivalent production of 241 koz

during Q2 2023, which was 5% and 15% below the silver equivalent

production achieved in Q1 2023 and Q2 2022 respectively.

A summary of production for the Cusi Mine for Q2 2023 is

provided below:

Six months ended June 30, Cusi Production Q2

2023 Q1 2023 % Var. Q2 2022 % Var.

2023

2022

% Var. Tonnes processed (t)

51,750

59,122

-12

%

66,722

-22

%

110,872

154,646

Daily throughput(2)

591

676

-12

%

763

-22

%

634

884

Silver grade (g/t)

160.18

141.80

13

%

146.34

9

%

150.38

162.04

Gold grade (g/t)

0.14

0.13

8

%

0.17

-18

%

0.13

0.18

Lead grade

0.33

%

0.24

%

38

%

0.23

%

43

%

0.28

%

0.24

%

Silver recovery (flotation)

81.67

%

86.30

%

-5

%

82.07

%

0

%

83.86

%

83.93

%

Gold recovery (lixiviation)

58.06

%

46.57

%

25

%

43.64

%

33

%

52.90

%

47.17

%

Lead recovery

86.54

%

88.67

%

-2

%

80.78

%

7

%

86.77

%

77.86

%

Silver production (000 oz)

217

233

-7

%

258

-16

%

450

678

Gold production (oz)

131

119

10

%

160

-18

%

250

434

Lead production (000 lb)

326

282

16

%

273

19

%

608

661

Silver equivalent ounces (000's)(1)

241

255

-5

%

283

-15

%

496

742

(1) Silver equivalent ounces were calculated using the following

realized prices: Q2 2023: $24.17/oz Ag, $3.99/lb Cu, $1.16/lb Zn,

$0.96/lb Pb, $1,977/oz Au; Q1 2023: $22.57/oz Ag, $4.06/lb Cu,

$1.42/lb Zn, $0.97/lb Pb, $1,891/oz Au; Q2 2022: $22.65/oz Ag,

$4.30/lb Cu, $1.79/lb Zn, $1.00/lb Pb, $1,872/oz Au; 6M 2023:

$23.37/oz Ag, $4.02/lb Cu, $1.29/lb Zn, $0.96/lb Pb, $1,934/oz Au;

6M 2022: $23.30/oz Ag, $4.42/lb Cu, $1.74/lb Zn, $1.03/lb Pb,

$1,873/oz Au.

Conference Call and

Webcast

Management will host a conference call and webcast to discuss Q2

2023 financial and operating results on Monday, August 14, 2023 at

11:00 AM EDT. Details are as follows:

Webcast:

https://services.choruscall.ca/links/sierrametalsq22023.html

Dial-in: Canada/USA Toll Free: 1-800-319-4610

Other: +1-416-915-3239

Participants are asked to dial in 5-10 minutes before the

scheduled start time and ask to join the Sierra Metals Second

Quarter 2023 Consolidated Financial Results call.

About Sierra Metals

Sierra Metals Inc. a diversified Canadian mining company with

green metal exposure including increasing copper production and

base metal production with precious metals byproduct credits, is

focused on the production and development of its Yauricocha Mine in

Peru, and Bolivar Mine in Mexico. The Company is focused on safely

increasing production volume and growing mineral resources. Sierra

Metals has recently had several new key discoveries and still has

many more exciting brownfield exploration opportunities at all

three mines in Peru and Mexico that are within close proximity to

the existing mines. Additionally, the Company also has large land

packages at all three mines with several prospective regional

targets providing longer-term exploration upside and mineral

resource growth potential.

Forward-Looking Statements

This press release contains forward-looking information within

the meaning of Canadian securities legislation, including

statements with respect to the timing of the Company’s Q2 2023

results and the capacity at the Yauricocha Mine Forward-looking

information relates to future events or the anticipated performance

of Sierra and reflect management's expectations or beliefs

regarding such future events and anticipated performance based on

an assumed set of economic conditions and courses of action. In

certain cases, statements that contain forward-looking information

can be identified by the use of words such as "plans", "expects",

"is expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates", "believes" or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might", or "will be taken", "occur" or

"be achieved" or the negative of these words or comparable

terminology. By its very nature forward-looking information

involves known and unknown risks, uncertainties and other factors

that may cause actual performance of Sierra to be materially

different from any anticipated performance expressed or implied by

such forward-looking information.

Forward-looking information is subject to a variety of risks and

uncertainties, which could cause actual events or results to differ

from those reflected in the forward-looking information, including,

without limitation, the risks described under the heading "Risk

Factors" in the Company's annual information form dated March 28,

2023 for its fiscal year ended December 31, 2022 and other risks

identified in the Company's filings with Canadian securities

regulators, which are available at www.sedar.com.

The risk factors referred to above are not an exhaustive list of

the factors that may affect any of the Company's forward-looking

information. Forward-looking information includes statements about

the future and is inherently uncertain, and the Company's actual

achievements or other future events or conditions may differ

materially from those reflected in the forward-looking information

due to a variety of risks, uncertainties and other factors. The

Company's statements containing forward-looking information are

based on the beliefs, expectations, and opinions of management on

the date the statements are made, and the Company does not assume

any obligation to update such forward-looking information if

circumstances or management's beliefs, expectations or opinions

should change, other than as required by applicable law. For the

reasons set forth above, one should not place undue reliance on

forward-looking information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230725651781/en/

For further information regarding Sierra Metals, please visit

www.sierrametals.com or contact: Investor Relations Sierra

Metals Inc. Tel: +1 (416) 366-7777 Email: info@sierrametals.com

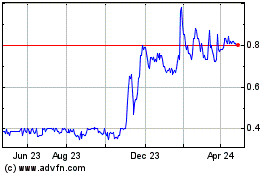

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Feb 2025 to Mar 2025

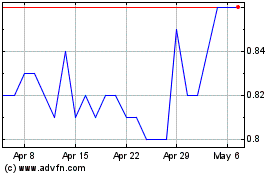

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Mar 2024 to Mar 2025