Suncor Energy invests in carbon capture technology company Svante

March 18 2021 - 4:15PM

Suncor and Svante Inc. today announced an equity financing

agreement which provides Svante with the additional growth capital

to accelerate the commercialization of Svante’s novel second

generation CO2 capture technology in North America for the

decarbonization of industrial emissions and hydrogen production.

Combined, Suncor and a number of family office investors have

invested $25 million USD of equity financing, bringing the total

proceeds raised under Svante’s Series D financing to $100 million

USD, up from $75 million as announced on February 2nd, 2021, and

completing the largest single private investment into point source

carbon capture technology globally to date.

This final closing of the Series D financing includes Canadian

energy company, Suncor Energy, and Carbon Direct SPV I LLC.

Existing investors Temasek, Chart Industries, Carbon Direct, OGCI

Climate Investments, BDC Cleantech Practice, Chevron Technology

Ventures, The Roda Group, Chrysalix Venture Capital and Export

Development Canada (EDC) also participated in the Series D round,

reflecting strong on-going support for the Company, including its

market strategy and recent progress.

Svante has now attracted more than $175 million USD in total

funding since it was founded in 2007 to develop and commercialize

its breakthrough solid sorbent technology at half the capital cost

of traditional engineered solutions.

“Svante has generated a pipeline of potential new project

opportunities capturing over 40 million tonnes of CO2 per year

before 2030 from natural gas industrial boilers, cement and lime,

and blue hydrogen industrial facilities, mainly in North America

and spurred by both US and Canada federal CO2 tax credits and

prices on CO2 emissions. The net-zero pledges of major countries

and large corporations is also a key driver for the interest and

rapid growth of the carbon capture and storage new industry,” said

Claude Letourneau, President & CEO of Svante Inc. “We strive

to create world-changing solutions that address climate change

and accelerate the global transition to carbon neutrality,

reversing human impact on the climate and building a commercially

viable CO2 marketplace.”

According to Mark Little, President & CEO of Suncor, “Carbon

Capture is a strategic technology area for Suncor to reduce GHG

emissions in our base business and produce blue hydrogen as an

energy product. An investment in Svante is expected to support the

acceleration of commercial scale deployment of a technology that

has the potential to dramatically reduce the cost associated with

carbon capture. We are excited to become both an investor in and a

collaborative partner with the company.”

“We are pleased to partner with a leading Canadian player in the

energy industry, along-side existing investor Cenovus, and to

benefit not only from their financial support but also their

commitment to deliver low-carbon fuels and blue hydrogen to

transform the energy system,” said Claude Letourneau.

Supporting Svante with the transaction were financial advisors

Fort Capital Partners and Full Circle Capital, and legal counsel

Blake, Cassels & Graydon LLP.

About SvanteSvante offers companies in

emissions-intensive industries a commercially viable way to capture

large-scale CO2 emissions from existing infrastructure, either

for safe storage or to be used for further industrial use in a

closed loop. With the ability to capture CO2 directly from

industrial sources at less than half the capital cost of existing

solutions, Svante makes industrial-scale carbon capture a reality.

Svante’s Board of Directors includes Nobel Laureate and former

Secretary of Energy, Steven Chu and CEO of OGCI Climate Investments

Pratima Rangarajan. To learn more about Svante’s technology,

click here or visit Svante’s website at

www.svanteinc.com. You can also connect with us on LinkedIn or

Twitter @svantesolutions.

About Suncor EnergySuncor Energy is Canada’s

leading integrated energy company. Suncor’s operations include oil

sands development and upgrading, offshore oil and gas production,

petroleum refining, and product marketing under the Petro-Canada

brand. A member of Dow Jones Sustainability indexes, FTSE4Good and

CDP, Suncor is working to responsibly develop petroleum resources,

while also growing a renewable energy portfolio and advancing the

transition to a low-carbon future. Suncor is listed on the UN

Global Compact 100 stock index. Suncor’s common shares (symbol: SU)

are listed on the Toronto and New York stock exchanges. For more

information about Suncor, visit our web site at suncor.com,

follow us on Twitter @Suncor.

Suncor: Legal Advisory – Forward Looking

InformationThis news release contains certain

forward-looking statements within the meaning of applicable

Canadian and U.S. securities laws. Some of the forward-looking

statements may be identified by words like “expected”, “potential”

and similar expressions. Forward-looking statements are based on

information available at the time the statement was made.

Forward-looking statements are not guarantees of future performance

and involve a number of risks and uncertainties. Actual results may

differ materially from those expressed or implied by its

forward-looking statements. Suncor’s most recently filed

Management’s Discussion & Analysis and other documents Suncor

files from time to time with securities regulatory authorities

describe the risks, uncertainties, material assumptions and other

factors that could influence actual results and such factors are

incorporated herein. Except as required by applicable securities

laws, Suncor disclaims any intention or obligation to publicly

update or revise any forward-looking statements.

| Svante

Contact |

Suncor

Contacts |

| |

|

| Julia McKenna (media) |

Media inquiries |

| jmckenna@svanteinc.com |

media@suncor.com |

| + 1 (778) 985 5722 |

+1 (833) 296 4570 |

| |

|

| |

Investor inquiries |

| |

invest@suncor.com |

| |

+1 (800) 558 9071 |

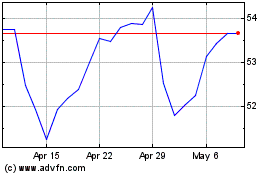

Suncor Energy (TSX:SU)

Historical Stock Chart

From Dec 2024 to Jan 2025

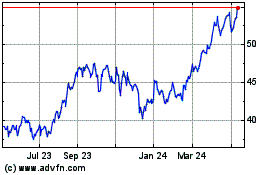

Suncor Energy (TSX:SU)

Historical Stock Chart

From Jan 2024 to Jan 2025