“In the third quarter of 2021, Suncor generated funds from

operations of $2.6 billion, underpinned by strong results from the

Refining & Marketing business and including the significant

planned turnaround at Oil Sands Base,” said Mark Little, president

and chief executive officer. “Since the start of 2021, we have

returned $2.6 billion to our shareholders through share repurchases

and dividends and have reduced net debt by $3.1 billion,

demonstrating significant progress towards fortifying our balance

sheet and meeting our capital allocation targets for the year.”

- Funds from operations increased to $2.641 billion ($1.79 per

common share) in the third quarter of 2021, compared to $1.166

billion ($0.76 per common share) in the prior year quarter. Cash

flow provided by operating activities, which includes changes in

non-cash working capital, was $4.718 billion ($3.19 per common

share) in the third quarter of 2021, compared to $1.245 billion

($0.82 per common share) in the prior year quarter.

- The company recorded operating earnings(1) of $1.043 billion

($0.71 per common share) in the third quarter of 2021, compared to

an operating loss of $338 million ($0.22 per common share) in the

prior year quarter. The company had net earnings of $877 million

($0.59 per common share) in the third quarter of 2021, compared to

a net loss of $12 million ($0.01 per common share) in the prior

year quarter.

- Refining and Marketing (R&M) delivered $947 million in

funds from operations in the current period, marking the third

highest results for third quarter funds from operations on record.

The increase in funds from operations in the third quarter of 2021,

compared to $594 million in the prior year quarter, was a result of

the improving business environment and strong refinery utilizations

of 99%, and was achieved despite Canadian gasoline and diesel

demand estimated to be 7%(2) below the comparable period in 2019.

R&M funds from operations included a first-in, first-out (FIFO)

inventory valuation gain of $84 million after-tax in the third

quarter of 2021, compared to $164 million in the prior year

quarter.

- Suncor’s total upstream production increased to 698,600 barrels

of oil equivalent per day (boe/d) in the third quarter of 2021,

compared to 616,200 boe/d in the prior year quarter, due to

continued strong performance from the company’s In Situ assets and

increased production volumes at Syncrude, partially offset by the

impact of the significant planned turnaround at Oil Sands Base

plant Upgrader 2 and planned maintenance at Firebag, which was

completed in the quarter.

- Suncor successfully assumed the role of operator of the

Syncrude asset on September 30, 2021, a critical step towards

driving greater integration, efficiencies and competitiveness

across all Suncor- operated assets in the region.

- Suncor and the co-owners of the Terra Nova project finalized an

agreement to restructure the project ownership and move forward

with the Asset Life Extension (ALE) project, which is expected to

extend production life by approximately 10 years.

- Suncor, together with eight Indigenous communities, announced

the formation of Astisiy Limited Partnership (Astisiy), which has

signed agreements to acquire a 15% equity interest in the Northern

Courier Pipeline. The pipeline, which connects the Fort Hills asset

to Suncor’s East Tank Farm, will be operated by Suncor and is

expected to provide the eight Indigenous communities with reliable

income for decades.

- In the third quarter of 2021, the company returned $1.0 billion

to its shareholders through $704 million in share repurchases and

payment of $309 million of dividends, and reduced net debt(3) by

$2.0 billion.

- Since the beginning of 2021, Suncor has reduced net debt by

$3.1 billion and repurchased $1.7 billion of its common shares

since the start of its normal course issuer bid program (NCIB) in

February 2021, representing approximately 63 million common shares

at an average price of $26.39 per common share, or the equivalent

of 4.1% of Suncor’s issued and outstanding common shares as at

January 31, 2021. The company is on track to exceed its previously

communicated debt reduction and share repurchase targets for the

year.

- Subsequent to the third quarter of 2021, the company completed

the sale of its 26.69% working interest in the Golden Eagle Area

Development for after-tax proceeds of US$250 million net of closing

adjustments and other closing costs, and future contingent

consideration of up to US$50 million. The effective date of the

sale was January 1, 2021.

- Subsequent to the third quarter of 2021, Suncor’s Board of

Directors (the Board) approved a quarterly dividend of $0.42 per

share, which represents an increase of 100% over the prior quarter

dividend, reinstating the dividend to the 2019 level. The Board

also approved an increase to the company’s share repurchase program

to approximately 7% of Suncor’s public float as at January 31, 2021

and concurrently, the Toronto Stock Exchange (TSX) accepted a

notice to increase the maximum number of common shares the company

may repurchase pursuant to its NCIB to 7% of the company’s public

float. The acceleration of share repurchases, dividend increase and

expected net debt reductions, compared to the company’s previously

announced targets demonstrate the progress made during the year and

management’s confidence in the company’s ability to generate cash

flow and its commitment to increased shareholder returns.

Financial Results

Operating Earnings (Loss)

Suncor’s operating earnings increased to $1.043

billion ($0.71 per common share) in the third quarter of 2021, from

an operating loss of $338 million ($0.22 per common share) in the

prior year quarter. The increase in operating earnings was

primarily related to higher crude oil and refined product

realizations reflecting the improved business environment, higher

crude production and refinery crude throughput, and lower

depreciation, depletion and amortization (DD&A) and exploration

expenses. Operating earnings were partially offset by an increase

in operating expenses and royalties associated with Suncor’s

increased production in the third quarter of 2021. The prior year

quarter operating earnings were negatively impacted by the

unprecedented decline in transportation fuel demand, partially

offset by lower operating costs.

Net Earnings (Loss)

Suncor’s net earnings were $877 million ($0.59 per

common share) in the third quarter of 2021, compared to a net loss

of $12 million ($0.01 per common share) in the prior year quarter.

In addition to the factors impacting operating earnings (loss)

discussed above, net earnings for the third quarter of 2021 were

impacted by a $257 million unrealized after-tax foreign exchange

loss on the revaluation of U.S. dollar denominated debt, a non-cash

after-tax impairment reversal of $168 million against the Terra

Nova assets, a $60 million after-tax loss for early repayment of

long-term debt and a $17 million after-tax unrealized loss on risk

management activities. The net loss in the prior year quarter

included a $290 million unrealized after-tax foreign exchange gain

on the revaluation of U.S. dollar denominated debt and a $36

million after-tax unrealized gain on risk management

activities.

Funds from Operations and Cash Flow

Provided by Operating Activities

Funds from operations were $2.641 billion ($1.79

per common share) in the third quarter of 2021, compared to $1.166

billion ($0.76 per common share) in the third quarter of 2020.

Funds from operations were influenced by the same factors impacting

operating earnings (loss) noted above.

Cash flow provided by operating activities, which

includes changes in non-cash working capital, was $4.718 billion

($3.19 per common share) for the third quarter of 2021, compared to

$1.245 billion ($0.82 per common share) in the prior year quarter.

In addition to the factors noted above, cash flow provided by

operating activities was further impacted by a greater source of

cash associated with the company’s working capital balances in the

current period compared to the prior year quarter. The source of

cash in the third quarter of 2021 was primarily due to an increase

in accounts payable and accrued liabilities and the receipt of the

company’s 2020 federal income tax refund.

Operating Results

Suncor’s total upstream production increased to

698,600 boe/d in the third quarter of 2021, compared to 616,200

boe/d in the prior year quarter, reflecting continued strong

performance from the company’s In Situ assets and increased

production volumes at Syncrude, partially offset by the impact of

the significant planned turnaround at Oil Sands Base plant Upgrader

2 and planned maintenance at Firebag, which was completed in the

quarter.

The company’s net synthetic crude oil production

was 405,500 barrels per day (bbls/d) in the third quarter of 2021

compared to 410,800 bbls/d in the prior year quarter. In the third

quarter of 2021, the company completed its five-year planned

turnaround at Oil Sands Base plant Upgrader 2, and subsequent to

the quarter the asset ramped up to normal operating rates. Syncrude

upgrader utilization was 91% in the third quarter of 2021, compared

to 78% in the prior year quarter. The prior year quarter was

impacted by planned turnaround maintenance at both Oil Sands

operations and Syncrude, and an operational incident at the

secondary extraction facilities at Oil Sands Base plant.

The company’s non-upgraded bitumen production

increased to 199,600 bbls/d in the third quarter of 2021 from

108,200 bbls/d in the prior year quarter due to continued strong

performance from the company’s In Situ assets and the impact of the

significant planned turnaround at Oil Sands Base plant Upgrader 2,

resulting in less Firebag volumes being processed at the upgrader

and therefore increased non-upgraded bitumen being sold to market.

The increase in production was partially offset by planned

maintenance at Firebag in the third quarter of 2021. Production at

Fort Hills increased during the third quarter of 2021, compared to

the prior year quarter. During the third quarter of 2021,

significant progress on the mine ramp up strategy was achieved and

Fort Hills continued to manage overburden removal and build ore

inventory according to plan. Fort Hills is expected to transition

to a two-train operation and operate at full production rates by

the end of the year.

Exploration and Production (E&P) produced

93,500 boe/d during the third quarter of 2021, compared to 97,200

boe/d in the prior year quarter. The decrease was primarily due to

natural production declines, partially offset by higher production

at the Golden Eagle Area Development and liftings in Libya in the

third quarter of 2021 compared to no liftings in the prior year

quarter.

Refinery crude throughput increased to 460,300

bbls/d and refinery utilization was 99% in the third quarter of

2021, compared to refinery crude throughput of 399,700 bbls/d and

refinery utilization of 87% in the prior year quarter, reflecting

strong utilizations across all refineries comparable to the same

periods in 2018 and 2019, despite Canadian gasoline and diesel

demand estimated to be 7% below the comparable period in 2019. The

prior year quarter reflected reduced rates due to the completion of

an eight-week planned turnaround at the Edmonton refinery and lower

demand for refined products.

Refined product sales in the third quarter of 2021

increased to 551,500 bbls/d, compared to 534,000 bbls/d in the

prior year quarter. Strong utilizations during the quarter,

increased demand and secured sales channels positioned the company

to capture the improved business environment.

“We continue to execute on our commitment to

operational excellence across our assets. During the third quarter

of 2021, Suncor once again outperformed the Canadian refining

average, achieving 99% utilization at our refineries, and capturing

funds from operations that exceeded the comparable 2019 levels in

the downstream business,” said Little. “In 2021, we completed the

largest annual maintenance program in the company’s history,

including the completion of the significant turnaround at Oil Sands

Base and planned maintenance at Firebag during the quarter,

enabling us to return to normal production rates across our asset

base in the fourth quarter.”

The company’s total operating, selling and general

expenses were $2.768 billion in the third quarter of 2021, compared

to $2.235 billion in the prior year quarter. The increase was

primarily due to higher crude production and refinery crude

throughput, a significant increase in natural gas prices and lower

costs in the prior year quarter. The increase was partially offset

by cost reductions related to the company’s strategic initiatives.

Increased production in the quarter resulted in higher absolute

costs but lower cash operating costs per barrel at Oil Sands

operations and Syncrude. The prior year quarter reflected lower

costs related to specific measures taken by the company to reduce

operating costs in response to the COVID-19 pandemic.

In the first nine months of 2021, the company’s

total operating, selling and general expenses were $8.388 billion,

which included one-time costs associated with restructuring and

integration charges. While the company has made progress on its

cost reduction initiatives, it currently estimates that fourth

quarter operating, selling, and general expenses will be in line

with the year-to-date run rate due to the planned increase in

upstream production volumes in the fourth quarter and the expected

increase in natural gas input prices. The company’s exposure to

higher natural gas costs is partially mitigated by increased

revenue from power sales.

Strategy Update Suncor remains

focused on operational excellence and its capital allocation

strategy; fortifying the balance sheet through debt reductions and

increasing the return to its shareholders in the form of

accelerated share repurchases and increased dividends. In the third

quarter of 2021, the company continued to make meaningful progress

towards its debt reduction strategy by exercising the early

redemption option on its outstanding US$750 million 3.60% notes,

originally maturing in December 2024, as well as reducing

short-term debt by approximately $1.1 billion, contributing to a

reduction in net debt of approximately $2.0 billion. Since the

start of 2021, Suncor has reduced net debt by $3.1 billion and the

company expects to return to 2019 net debt levels during the fourth

quarter and be within its 2025 targeted net debt range by the end

of the year.

In the third quarter of 2021, the company

repurchased approximately 28 million common shares for $704 million

under its NCIB and paid $309 million of dividends. Share

repurchases in the quarter represent 1.8% of Suncor’s issued and

outstanding common shares as at January 31, 2021, and were

purchased at an average price of $25.05 per common share. Since the

start of its NCIB in February 2021, the company has repurchased

$1.7 billion in common shares, representing approximately 63

million common shares at an average price of $26.39 per common

share, or the equivalent of 4.1% of Suncor’s issued and outstanding

common shares as at January 31, 2021. Since the beginning of 2021,

the company has returned approximately $2.6 billion to

shareholders, including $1.7 billion in common share repurchases

and $943 million in dividends paid, demonstrating its commitment to

shareholder returns.

Subsequent to the third quarter of 2021, the Board

approved a quarterly dividend of $0.42 per share, which represents

an increase of 100% over the prior quarter dividend, as well as an

increase to the company’s share repurchase program to approximately

7% of Suncor’s public float as at January 31, 2021. Concurrently,

the TSX accepted a notice to increase the maximum number of common

shares the company may repurchase pursuant to its NCIB to 7% of the

company’s public float. The acceleration of the share repurchases,

dividend increase and expected net debt reductions, compared to the

company’s previously announced targets demonstrate the progress

made during the year and management’s confidence in the company’s

ability to generate cash flow and its commitment to increased

shareholder returns.

On September 30, 2021, Suncor successfully assumed

the role of operator of the Syncrude asset, a critical step towards

driving greater efficiencies and competitiveness across all

Suncor-operated assets in the region. Suncor assuming operatorship

reflects the company’s confidence in the Syncrude asset and Suncor

expects to improve operational performance, efficiency and

competitiveness and capture increased value by capitalizing on the

collective strength of all of the Suncor-operated assets in the

region. The change in operatorship is expected to generate annual

gross synergies for the joint venture owners of $100 million in the

first six months, with an additional $200 million through

2022-2023.

In E&P, Suncor, together with the co-owners of

the Terra Nova project, finalized an agreement to restructure the

project ownership and move forward with the ALE project. As a

result of the agreement, Suncor increased its ownership in the

project by approximately 10% to 48% in exchange for a cash payment

from the exiting owners, and the agreement includes the previously

disclosed royalty and financial support from the Government of

Newfoundland and Labrador. Proceeds from the acquisition will be

used to partially fund future capital expenditures for the ALE

project. Maintenance work on the Floating, Production, Storage and

Offloading (FPSO) facility commenced late in the quarter and the

FPSO is expected to sail to dry dock in Ferrol, Spain, later in

2021. A safe return to operations is anticipated before the end of

2022. The ALE project is expected to extend the production life by

approximately 10 years, provide an additional 70 million barrels of

resource for the partnership and provide many benefits to the

Newfoundland and Labrador and Canadian economies in the form of

taxes, royalties and employment.

Suncor also entered into a conditional agreement

to increase its interest in the White Rose asset subject to an

economic restart decision for the West White Rose project by

mid-2022. Should the decision to restart occur, Suncor has agreed

to increase its interest in the White Rose asset by 12.5% to

approximately 40% in exchange for a cash payment by the operator to

Suncor.

“We continue to deliver on capital discipline and

our strategy of optimizing our base business while focusing on

high-margin, low-capital projects that deliver significant returns,

cash flow and long-term value generation for our shareholders,”

said Little. “In the third quarter of 2021, we successfully assumed

the role of operator of the Syncrude asset, announced that we are

progressing the Terra Nova Asset Life Extension project and,

subsequent to the quarter, completed the sale of our working

interest in the Golden Eagle Area Development.”

Suncor’s strategy is underpinned by the company’s

principles of capital discipline and operational excellence. The

company’s 2021 capital expenditures have been heavily focused on

the safety and reliability of the company’s operations, which

included the completion of the significant planned turnaround at

Oil Sands Base plant Upgrader 2 and planned maintenance at Firebag

in the third quarter, and significant turnaround activities at

Syncrude, Buzzard and across all of the company’s refineries in the

second quarter. All significant planned maintenance has been safely

completed for 2021, reinforcing the decision to stagger the

company’s planned turnarounds at Oil Sands Base plant Upgrader 2

and Syncrude in response to the impacts of the COVID-19 pandemic in

the Fort McMurray region.

The company continues to advance a number of

strategic initiatives that are expected to contribute to the

company’s $2.15 billion incremental free funds flow target.

Significant initiatives contributing to the target include tailings

management, the expansion of our supply, marketing and trading

capabilities, completion of the interconnecting pipelines between

Oil Sands Base plant and Syncrude and asset debottlenecks. A

tailings management initiative implemented recently, Permanent

Aquatic Storage Structure, has lowered tailings treatment and

handling requirements resulting in decreased sustaining capital and

tailings management spend.

During the third quarter of 2021, Suncor also

announced the formation of Astisiy, a partnership with eight

Indigenous communities in the Regional Municipality of Wood

Buffalo, which has signed agreements to acquire an equity interest

in the Northern Courier Pipeline. This historic partnership

includes Suncor, three First Nations and five Métis communities

who, together, will own a 15% stake in this approximately $1.3

billion pipeline asset. Partners are expected to benefit from

revenues generated through competitive tolls from long-term

transportation and terminalling services agreements supporting the

pipeline, regardless of the price of crude. The pipeline, which

connects the Fort Hills asset to Suncor’s East Tank Farm, will be

operated by Suncor upon completion of the purchase, and adds to

Suncor’s existing pipelines and infrastructure that the company

operates in the region. The transaction is anticipated to close in

the fourth quarter of 2021.

Subsequent to the third quarter of 2021, the

company completed the sale of its 26.69% working interest in the

Golden Eagle Area Development for after-tax proceeds of US$250

million net of closing adjustments and other closing costs, and

future contingent consideration of up to US$50 million. The

effective date of the sale was January 1, 2021. The proceeds will

be used to support Suncor’s capital allocation strategy.

Operating Earnings (Loss)

Reconciliation(1)(2)

|

|

Three months ended September 30 |

|

Nine months ended September 30 |

|

($ millions) |

2021 |

|

2020 |

|

|

2021 |

|

2020 |

|

|

Net earnings (loss) |

877 |

|

(12 |

) |

|

2 566 |

|

(4 151 |

) |

|

Unrealized foreign exchange loss (gain) on U.S. dollar denominated

debt |

257 |

|

(290 |

) |

|

(80 |

) |

253 |

|

|

Unrealized loss (gain) on risk management activities(2) |

17 |

|

(36 |

) |

|

7 |

|

(4 |

) |

|

Restructuring charge(3) |

— |

|

— |

|

|

126 |

|

— |

|

|

Asset impairment (reversal)(4) |

(168 |

) |

— |

|

|

(168 |

) |

1 798 |

|

|

Loss on early repayment of long-term debt(5) |

60 |

|

— |

|

|

60 |

|

— |

|

|

Operating earnings (loss)(1)(2) |

1 043 |

|

(338 |

) |

|

2 511 |

|

(2 104 |

) |

|

(1) |

Operating earnings (loss) is a non-GAAP financial measure. All

reconciling items are presented on an after-tax basis. See the

Non-GAAP Financial Measures section of this news release. |

|

(2) |

Beginning in the first quarter of 2021, the company revised its

calculation of operating earnings, a non- GAAP financial measure,

to exclude unrealized (gains) losses on derivative financial

instruments that are recorded at fair value to better align the

earnings impact of the activity with the underlying items being

risk-managed. Prior period comparatives have been restated to

reflect this change. |

|

(3) |

Restructuring charge in the Corporate segment recorded in the first

quarter of 2021. |

|

(4) |

During the first quarter of 2020, the company recorded non-cash

after-tax impairment charges of $1.376 billion on its share of the

Fort Hills assets, in the Oil Sands segment, and $422 million

against its share of the White Rose and Terra Nova assets, in the

E&P segment, due to a decline in forecasted crude oil prices as

a result of decreased global demand due to the COVID-19 pandemic

and changes to their respective capital, operating and production

plans. During the third quarter of 2021, the company recorded a

non-cash after-tax impairment reversal of $168 million on its share

of the Terra Nova assets, in the E&P segment, as a result of

the ALE project moving forward and the benefit of royalty and

financial support from the Government of Newfoundland and

Labrador. |

|

(5) |

Charges associated with the early repayment of debt in the

Corporate segment. |

Corporate Guidance

Suncor has updated its full-year business

environment outlook assumptions for Brent Sullom Voe from

US$68.00/bbl to US$71.00/bbl, WTI at Cushing from US$65.00/bbl to

US$68.00/bbl, WCS at Hardisty from US$52.00/bbl to US$55.00/bbl and

New York Harbor 2-1-1 crack from US$18.00/bbl to US$19.00/bbl, due

to improvements in key forward curve pricing for the remainder of

the year. As a result of these updates, the full-year current

income tax expense range has increased from $1.2 billion – $1.5

billion to $1.4 billion – $1.7 billion.

In addition, Oil Sands operations Crown royalties

have been updated from 4% – 6% to 5% – 7%, Syncrude crown royalties

have been updated from 9% – 12% to 10% – 13% and East Coast Canada

crown royalties have been updated from 10% – 14% to 11% – 15%, with

the increase in royalty rates attributed to higher forecasted

benchmark prices.

For further details and advisories regarding

Suncor’s 2021 annual guidance, see www.suncor.com/guidance.

Normal Course Issuer Bid

Subsequent to the third quarter of 2021, Suncor

received approval from the TSX to amend its existing NCIB effective

as of the close of markets on October 29, 2021, to purchase common

shares through the facilities of the TSX, New York Stock Exchange

and/or alternative trading platforms. The notice provides that

Suncor may increase the maximum number of common shares that may be

repurchased in the period beginning February 8, 2021, and ending

February 7, 2022, from 76,250,000 shares, or approximately 5% of

Suncor’s issued and outstanding common shares as at January 31,

2021, to 106,700,000, or approximately 7% of Suncor’s public float

as at January 31, 2021. No other terms of the NCIB have been

amended.

Between February 8, 2021, and October 25, 2021,

and pursuant to the NCIB, Suncor has already repurchased

approximately $1.834 billion of common shares on the open market.

Pursuant to the NCIB (as amended), Suncor has agreed that it will

not purchase more than 106,700,000 common shares, of which

69,058,156 common shares have already been purchased between

February 8, 2021, and October 25, 2021.

The actual number of common shares that may be

purchased and the timing of any such purchases will be determined

by Suncor. Suncor believes that, depending on the trading price of

its common shares and other relevant factors, purchasing its own

shares represents an attractive investment opportunity and is in

the best interests of the company and its shareholders. The company

does not expect that the decision to allocate cash to repurchase

shares will affect its long-term growth strategy.

Non-GAAP Financial Measures

Certain financial measures referred to in this

news release (funds from operations, operating earnings (loss) and

free funds flow) are not prescribed by GAAP. Operating earnings

(loss) is defined in the Non‑GAAP Financial Measures Advisory

section of Suncor's management's discussion and analysis dated

October 27, 2021 (the MD&A) and reconciled to the most directly

comparable GAAP measure in the Consolidated Financial Information

and Segment Results and Analysis sections of the MD&A.

Beginning in the first quarter of 2021, the company has revised its

calculation of operating earnings to exclude unrealized (gains)

losses on derivative financial instruments that are recorded at

fair value to better align the earnings impact of the activity with

the underlying items being risk-managed. Prior period comparatives

have been restated to reflect this change. Funds from operations

and free funds flow are defined and reconciled, where applicable,

to the most directly comparable GAAP measures in the Non-GAAP

Financial Measures Advisory section of the MD&A. These non-GAAP

financial measures are included because management uses this

information to analyze business performance, leverage and liquidity

and it may be useful to investors on the same basis. These non-GAAP

measures do not have any standardized meaning and therefore are

unlikely to be comparable to similar measures presented by other

companies and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

GAAP.

Legal Advisory – Forward-Looking

Information

This news release contains certain forward-looking

information and forward-looking statements (collectively referred

to herein as “forward-looking statements”) within the meaning of

applicable Canadian and U.S. securities laws. Forward-looking

statements in this news release include references to: Suncor’s

capital allocation strategy and target, including that: it remains

on track to return to 2019 net debt levels during the fourth

quarter and be within its 2025 targeted net debt range by the end

of the year, statements surrounding Suncor’s $2.15 billion

incremental free funds flow target and the strategic initiatives

that are expected to contribute to it, Suncor’s belief that it is

on track to exceed its previously communicated debt reduction and

share repurchase targets for the year, Suncor’s estimated fourth

quarter operating, selling and general expenses and the expectation

that the proceeds of Suncor’s sale of its 26.69% working interest

in the Golden Eagle Area Development will be used to support

Suncor’s capital allocation strategy; Suncor’s expectation

regarding Fort Hills’ ramp up strategy, including its belief that

it will transition to a two-train operation and operate at full

production rates by the end of the year; Suncor’s expectations with

respect to the Terra Nova project, including with respect to the

ALE project that is expected to extend production life by

approximately 10 years and provide an additional 70 million barrels

of production, the expected use of proceeds with respect to the

acquisition of the increased project ownership interest, and the

timing of maintenance work on the Floating, Production, Storage and

Offloading facility; the expectation that, now that operatorship of

Syncrude has transferred, that there will be gross synergies of

approximately $100 million for the joint venture owners within the

first six months with an additional $200 million through 2022 –

2023 and that the assumption of operatorship will be a critical

step towards improving operational performance, driving greater

integration, efficiencies and competitiveness and capturing

increased value across all Suncor-operated assets in the region;

expectations regarding Suncor’s acquisition, together with eight

Indigenous communities, of a 15% equity interest in the Northern

Courier Pipeline, including that the transaction will close in the

fourth quarter of 2021, that Suncor will operate the pipeline

following closing and that the acquisition will provide the eight

Indigenous communities with reliable income for decades to come;

statements about the NCIB, including the amount, timing and manner

of purchases under the NCIB; and Suncor’s full-year outlook range

on Oil Sands operations crown royalties, Syncrude crown royalties,

East Coast Canada crown royalties and current income tax expenses

as well as business environment outlook assumptions for Brent

Sullom Voe, WTI at Cushing, WCS at Hardisty and New York Harbor

2-1-1 crack. In addition, all other statements and information

about Suncor’s strategy for growth, expected and future

expenditures or investment decisions, commodity prices, costs,

schedules, production volumes, operating and financial results and

the expected impact of future commitments are forward-looking

statements. Some of the forward-looking statements and information

may be identified by words like “expects”, “anticipates”, “will”,

“estimates”, “plans”, “scheduled”, “intends”, “believes”,

“projects”, “indicates”, “could”, “focus”, “vision”, “goal”,

“outlook”, “proposed”, “target”, “objective”, “continue”, “should”,

“may” and similar expressions.

Forward-looking statements are based on Suncor’s

current expectations, estimates, projections and assumptions that

were made by the company in light of its information available at

the time the statement was made and consider Suncor’s experience

and its perception of historical trends, including expectations and

assumptions concerning: the accuracy of reserves estimates; the

current and potential adverse impacts of the COVID-19 pandemic,

including the status of the pandemic and future waves and any

associated policies around current business restrictions,

shelter-in-place orders or gatherings of individuals; commodity

prices and interest and foreign exchange rates; the performance of

assets and equipment; capital efficiencies and cost savings;

applicable laws and government policies; future production rates;

the sufficiency of budgeted capital expenditures in carrying out

planned activities; the availability and cost of labour, services

and infrastructure; the satisfaction by third parties of their

obligations to Suncor; the development and execution of projects;

and the receipt, in a timely manner, of regulatory and third-party

approvals.

Forward-looking statements and information are not

guarantees of future performance and involve a number of risks and

uncertainties, some that are similar to other oil and gas companies

and some that are unique to Suncor. Suncor’s actual results may

differ materially from those expressed or implied by its

forward-looking statements, so readers are cautioned not to place

undue reliance on them.

Suncor’s Annual Information Form and Annual Report

to Shareholders, each dated February 24, 2021, Form 40-F dated

February 25, 2021, the MD&A and other documents it files from

time to time with securities regulatory authorities describe the

risks, uncertainties, material assumptions and other factors that

could influence actual results and such factors are incorporated

herein by reference. Copies of these documents are available

without charge from Suncor at 150 6th Avenue S.W., Calgary, Alberta

T2P 3E3; by email request to invest@suncor.com; by calling

1-800-558-9071; or by referring to suncor.com/FinancialReports or

to the company’s profile on SEDAR at sedar.com or EDGAR at sec.gov.

Except as required by applicable securities laws, Suncor disclaims

any intention or obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Suncor Energy is Canada's leading integrated

energy company, with a global team of over 30,000 people. Suncor's

operations include oil sands development, production and upgrading,

offshore oil and gas, petroleum refining in Canada and the US, and

our national Petro-Canada retail distribution network (now

including our Electric Highway network of fast-charging EV

stations). A member of Dow Jones Sustainability indexes, FTSE4Good

and CDP, Suncor is responsibly developing petroleum resources,

while profitably growing a renewable energy portfolio and advancing

the transition to a low-emissions future. Suncor is listed on the

UN Global Compact 100 stock index. Suncor's common shares (symbol:

SU) are listed on the Toronto and New York stock exchanges.

Legal Advisory – BOEs

Certain natural gas volumes have been converted to

barrels of oil equivalent (boe) on the basis of one barrel to six

thousand cubic feet. Any figure presented in boe may be misleading,

particularly if used in isolation. A conversion ratio of one bbl of

crude oil or natural gas liquids to six thousand cubic feet of

natural gas is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead. Given that the value ratio based

on the current price of crude oil as compared to natural gas is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.

For more information about Suncor, visit our web

site at suncor.com, follow us on Twitter @Suncor or Living our

Purpose.

A full copy of Suncor's third quarter 2021 Report

to Shareholders and the financial statements and notes (unaudited)

can be downloaded at suncor.com/financialreporting.

To listen to the conference call discussing

Suncor's third quarter results, visit suncor.com/webcasts.

Media inquiries: 1-833-296-4570

media@suncor.com

Investor inquiries: 800-558-9071

invest@suncor.com

(1) Beginning in the first quarter of 2021, the

company has revised its calculation of operating earnings, a

non-GAAP financial measure, to exclude unrealized (gains) losses on

derivative financial instruments that are recorded at fair value to

better align the earnings impact of the activity with the

underlying items being risk-managed. Prior period comparatives have

been restated to reflect this change. (2) Sources: IHS Markit and

Statistics Canada. (3) Net debt is equal to total debt less cash

and cash equivalents.

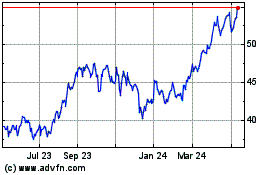

Suncor Energy (TSX:SU)

Historical Stock Chart

From Dec 2024 to Jan 2025

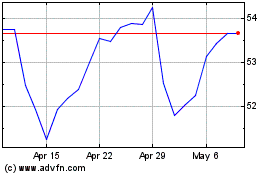

Suncor Energy (TSX:SU)

Historical Stock Chart

From Jan 2024 to Jan 2025