Tricon Residential Inc. (NYSE: TCN, TSX: TCN) ("Tricon" or the

"Company"), an owner and operator of single-family rental homes and

multi-family rental apartments in the United States and Canada,

announced today its consolidated financial results for the year

ended December 31, 2021.

All financial information is presented in U.S. dollars unless

otherwise indicated.

The Company reported strong operational and financial results in

the fourth quarter, including the following highlights:

- Net income from continuing operations increased by 67%

year-over-year to $127.0 million compared to $75.8 million in Q4

2020; diluted earnings per share from continuing operations

increased by 28% year-over-year to $0.46 compared to $0.36 per

share in Q4 2020;

- Core funds from operations ("Core FFO") increased by 10%

year-over-year to $45.6 million driven by solid operating

performance in the single-family rental portfolio and higher fees

generated from new Investment Vehicles created during the year.

Core FFO per share decreased by $0.02 to $0.15 due to an increase

in the diluted weighted average shares outstanding resulting

primarily from the U.S. public offering and private placement

completed on October 12, 2021;1

- Same home Net Operating Income ("NOI") for the single-family

rental business grew by 10.3% year-over-year and same home NOI

margin increased by 0.8% to 68.3%. Same home occupancy increased by

0.3% year-over-year to 97.6%, and blended rent growth was 8.8%

(comprised of new lease rent growth of 19.1% and renewal rent

growth of 5.7%). In addition, Tricon's continued focus on resident

retention led to a record-low annualized same home turnover rate of

16.3%;1

- The Company continued to grow its single-family rental

portfolio through the organic acquisition of 2,016 homes during the

quarter at an average price of $335,000 per home (including

up-front renovations) for a total acquisition cost of $675 million,

of which Tricon's proportionate share was equal to $203

million;

- Positive trends continued into the new year, with same home

rent growth of 8.3% in January 2022, including 19.1% growth on new

leases and 6.3% growth on renewals, while the same home occupancy

increased to 97.9%. The steady pace of acquisitions is expected to

continue into 2022, with management forecasting approximately 1,800

to 2,000 home acquisitions in Q1 2022; and

- On October 7, 2021, the Company’s common shares were listed for

trading on the New York Stock Exchange. On October 12, 2021, the

Company closed a public offering and concurrent private placement

of common shares resulting in a total issuance of 46,248,746 common

shares for aggregate gross proceeds of approximately $570

million.

In addition to strong quarterly operational and financial

results, Tricon achieved several significant strategic milestones

in 2021:

- During the year, the Company entered into two strategic

single-family rental joint venture partnerships with institutional

investors: (i) SFR JV-HD, which was upsized in Q4 2021 from $300

million to $450 million of total equity commitments, is expected to

acquire up to 5,000 newly built single-family rental homes from

national and regional homebuilders with approximately $1.5 billion

of purchasing potential (including associated leverage), and (ii)

SFR JV-2, which is expected to acquire approximately 18,000

single-family homes through resale channels in its U.S. Sun Belt

target markets with approximately $5.0 billion of purchasing

potential (including associated leverage);

- In March 2021, the Company entered into a new joint venture

with Canada Pension Plan Investment Board to invest up to C$500

million of equity capital in build-to-core multi-family rental

projects in the Greater Toronto Area;

- In the same month, the Company sold an 80% interest in its U.S.

multi-family rental portfolio to two institutional investors. The

transaction generated gross sales proceeds of approximately $432

million to Tricon, which strengthened the Company's balance sheet

and reduced its leverage;

- With these new joint ventures completed during 2021, the

Company increased its third-party Assets Under Management ("AUM")

by $4.0 billion or 139% year-over-year to $6.8 billion, and

increased its total AUM by $4.9 billion or 55% year-over-year to

$13.7 billion;

- On September 9, 2021, the Company completed the redemption of

its outstanding 5.75% extendible convertible unsecured subordinated

debentures due March 31, 2022 and issued a total of 16,449,980

common shares in connection with the conversion and redemption of

the aggregate principal amount of $172.4 million, further reducing

its leverage; and

- On an annual basis, Core FFO per share increased by 12%

year-over-year from $0.51 to $0.57, meeting the Company's Core FFO

per share target of $0.52 to $0.57 one year ahead of schedule.

“Tricon’s fourth quarter marked yet another period of

exceptional growth and operational milestones, with our

single-family rental portfolio growing by 28.3% year-over-year,

proportionate NOI increasing 17.6%, and same home NOI growing by

10.3% year-over-year. We successfully surpassed our three-year Core

FFO per share target set in 2019 one year ahead of schedule, while

at the same time reducing our balance sheet leverage ratio over the

past two years by nearly half, to 7.8x net debt to Adjusted

EBITDAre.2 I’m extremely proud of our team’s accomplishments and

thankful for the support of our shareholders along the way,” said

Gary Berman, President and CEO of Tricon. “As we look ahead to

another year of growth, Tricon is well positioned with the

operational team, technology, capital and market opportunity in

place to take our business to 50,000 homes and beyond. But we also

have an incredible opportunity to build a platform for doing good –

by providing new homes through our build-to-rent business to

alleviate America’s housing shortage, and by assisting our

residents in their pursuit of home ownership and financial

well-being through our recently announced Tricon Vantage program.

We strongly believe that our holistic and sustainable approach to

growth will benefit all of our stakeholders and create an enduring

legacy for our company by inspiring others to follow.”

Financial

Highlights

For the periods ended December 31

Three months

Twelve months

(in thousands of U.S. dollars, except per

share amounts which are in U.S. dollars, unless otherwise

indicated)

2021

2020

2021

2020

Financial highlights on a consolidated

basis

Net income from continuing operations,

including:

$

126,977

$

75,808

$

517,089

$

112,637

Fair value gain on rental properties

261,676

106,995

990,575

220,849

Income (loss) from investments in U.S.

residential developments

10,530

10,191

31,726

(61,776

)

Basic earnings per share attributable

to shareholders of Tricon from continuing operations

0.47

0.38

2.34

0.56

Diluted earnings per share attributable

to shareholders of Tricon from continuing operations

0.46

0.36

2.31

0.56

Net income (loss) from discontinued

operations

—

5,670

(67,562

)

3,776

Basic earnings (loss) per share

attributable to shareholders of Tricon from discontinued

operations

—

0.03

(0.31

)

0.02

Diluted earnings (loss) per share

attributable to shareholders of Tricon from discontinued

operations

—

0.03

(0.31

)

0.02

Dividends per share (1)

$

0.058

$

0.055

$

0.225

$

0.207

Weighted average shares outstanding -

basic

268,428,784

194,679,682

219,834,130

194,627,127

Weighted average shares outstanding -

diluted

270,953,420

212,445,547

222,118,737

195,795,473

Non-IFRS(2) measures on a proportionate

basis

Core funds from operations ("Core FFO")

(3)

$

45,630

$

41,430

$

152,021

$

113,217

Adjusted funds from operations ("AFFO")

(3)

36,548

33,985

121,594

85,342

Core FFO per share (4)

0.15

0.17

0.57

0.51

AFFO per share (4)

0.12

0.14

0.45

0.38

(1) Dividends are issued and paid in U.S.

dollars. Prior to November 8, 2021, dividends were declared and

paid in Canadian dollars; for reporting purposes, amounts recorded

in equity were translated to U.S. dollars using the daily exchange

rate on the applicable dividend record date.

(2) Non-IFRS measures are presented to

illustrate alternative relevant measures to assess the Company's

performance. For the basis of presentation of the Company’s

Non-IFRS measures and reconciliations, refer to the “Non-IFRS

Measures” and Appendix A. For definitions of the Company’s Non-IFRS

measures, refer to Section 6 of Tricon's MD&A.

(3) Performance share unit (PSU) expense

of $1,520 and $3,633 for the three and twelve months ended December

31, 2020, respectively, have been removed from Core FFO to conform

with the current period presentation. This change resulted in a

$1,520 and $3,633 increase in Core FFO and AFFO for the three and

twelve months ended December 31, 2020, respectively.

(4) Core FFO per share and AFFO per share

are calculated using the total number of weighted average potential

dilutive shares outstanding, including the assumed conversion of

convertible debentures and exchange of preferred units issued by

Tricon PIPE LLC, which was 306,247,538 and 268,562,442 for the

three and twelve months ended December 31, 2021, respectively, and

247,739,665 and 223,849,152 for the three and twelve months ended

December 31, 2020, respectively.

Net income from continuing operations in the fourth quarter of

2021 was $127.0 million compared to $75.8 million in the fourth

quarter of 2020, and included:

- Revenue from single-family rental properties of $123.4 million

compared to $94.4 million in the fourth quarter of 2020, driven by

28.0% growth in the number of rental homes to 29,149 and an 8.7%

increase in average effective monthly rent, partially offset by a

2.4% decrease in occupancy driven by an accelerated pace of

acquisition of vacant homes.

- Direct operating expenses of $40.0 million compared to $30.7

million in the fourth quarter of 2020, reflecting the growth in

size of the single-family rental portfolio, higher property tax

expenses associated with increasing property values, and

incremental repairs and maintenance expenses as a result of a

tighter labor market and supply chain delays.

- Revenue from private funds and advisory services of $17.7

million compared to $10.3 million in the fourth quarter of 2020

largely as a result of the syndication and internalization of

property management functions of the U.S. multi-family portfolio,

an increase in performance fees earned in the quarter, and higher

development fees generated from Johnson communities.

- Fair value gain on rental properties of $261.7 million compared

to $107.0 million in the fourth quarter of 2020 as a result of

significantly higher home values for the single-family rental

portfolio. The appreciation in home prices is attributable to a

number of factors, including strong population and job growth in

the U.S. Sun Belt markets, low mortgage interest rates, and a

relatively low supply of new construction.

Net income from continuing operations for the year ended

December 31, 2021 was $517.1 million compared to $112.6 million for

the year ended December 31, 2020, and included:

- Revenue from single-family rental properties of $441.7 million

and direct operating expenses of $145.8 million compared to $367.0

million and $121.2 million in the prior year, respectively, which

translated to a net operating income ("NOI") increase of $50.2

million attributable to the organic expansion of the single-family

rental portfolio as well as strong rent growth.

- Income from investments in U.S. residential developments of

$31.7 million compared to a loss of $61.8 million in 2020; results

in the current year reflect healthy project performance in the

for-sale housing market and contrast with the comparative period

when a major fair value adjustment was taken at the onset of the

COVID-19 pandemic due to rapidly deteriorating business

fundamentals.

- Fair value gain on rental properties of $990.6 million compared

to $220.8 million in the prior year, for the reasons discussed

above.

Core funds from operations ("Core FFO") for the fourth quarter

of 2021 was $45.6 million, an increase of $4.2 million or 10%

compared to $41.4 million in the fourth quarter of 2020. This

growth in Core FFO reflects greater fees earned by the Company's

Private Funds and Advisory business from new Investment Vehicles

formed during the year and NOI growth from the single-family rental

business as discussed above. The fourth quarter of 2020 also

benefited from a $7.1 million current tax recovery, which did not

occur in the current year.

Core FFO increased by $38.8 million or 34% to $152.0 million for

the twelve months ended December 31, 2021, compared to $113.2

million in the prior year, for the same reasons discussed above.

The full-year Core FFO also includes higher income from investments

in U.S. residential developments, driven by improved project

performance during the year.

Adjusted funds from operations ("AFFO") for the three and twelve

months ended December 31, 2021 was $36.5 million and $121.6

million, respectively, an increase of $2.6 million (8%) and $36.3

million (42%) from the same periods in the prior year. This growth

in AFFO was driven by the increase in Core FFO discussed above,

partially offset by higher recurring capital expenditures

associated with a larger single-family rental portfolio as well as

inflationary cost pressures.

Single-Family Rental Operating

Highlights

The measures presented in the table below and throughout this

press release are on a proportionate basis, reflecting only the

portion attributable to Tricon's shareholders based on the

Company's ownership percentage of the underlying entities and

excludes the percentage associated with non-controlling and limited

partners' interests, unless otherwise stated. A list of these

measures, together with a description of the information each

measure reflects and the reasons why management believes the

measure to be useful or relevant in evaluating the underlying

performance of the Company’s businesses, is set out in Section 6 of

Tricon's MD&A.

For the periods ended December 31

Three months

Twelve months

(in thousands of U.S. dollars, except

percentages)

2021

2020

2021

2020

Total rental homes managed

29,237

22,794

Net operating income (NOI)(1)

$

59,354

$

50,476

$

221,655

$

197,528

Same home net operating income (NOI)

margin(1)

68.3

%

67.5

%

67.8

%

66.9

%

Same home net operating income (NOI)

growth

10.3

%

N/A

7.2

%

N/A

Same home occupancy

97.6

%

97.3

%

97.6

%

97.2

%

Same home annualized turnover

16.3

%

22.6

%

19.7

%

23.3

%

Same home average quarterly rent growth -

renewal

5.7

%

3.0

%

4.9

%

3.4

%

Same home average quarterly rent growth -

new move-in

19.1

%

11.2

%

17.1

%

9.6

%

Same home average quarterly rent growth -

blended

8.8

%

5.5

%

8.2

%

5.2

%

(1) Non-IFRS measures are presented to

illustrate alternative relevant measures to assess the Company's

performance. For the basis of presentation of the Company’s

Non-IFRS measures and reconciliations, refer to the “Non-IFRS

measures” and Appendix A. For definitions of the Company’s Non-IFRS

measures, refer to Section 6 of Tricon's MD&A.

Single-family rental NOI was $59.4 million for the three months

ended December 31, 2021, an increase of $8.9 million or 17.6 %

compared to the same period in 2020. The favorable variance in NOI

was primarily driven by an $11.6 million or 15.9% increase in

rental revenues reflecting the growth in portfolio size (Tricon's

proportionate share of rental homes was 19,707 in Q4 2021 compared

to 17,698 in Q4 2020) as well as higher average monthly rent

($1,591 in Q4 2021 compared to $1,464 in Q4 2020). Other revenue

also increased by $1.5 million or 61.4% as ancillary services such

as smart-home technology and renters insurance were provided to

more residents. This favorable change in revenue was partially

offset by direct operating expenses which increased by $4.2 million

or 16.8% driven by higher costs incurred on a larger portfolio of

homes, including increased material and labor costs associated with

supply chain delays and a tighter labor market, respectively.

Single-family rental same home NOI growth was 10.3% in the

fourth quarter of 2021, driven by revenue growth of 8.9% reflecting

a 6.7% higher average monthly rent ($1,562 in Q4 2021 compared to

$1,464 in Q4 2020) coupled with a 30 basis point improvement in

occupancy to 97.6% and ancillary revenue growth of 42.3%. This

positive variance was partially offset by a 6.1% increase in

operating expenses primarily driven by higher property taxes,

incremental material and labor costs as explained above, and

additional costs incurred to provide ancillary services to more

residents.

Single-Family Rental Investment

Activity

The Company continued to grow its single-family rental portfolio

through the acquisition of an additional 2,016 homes during the

quarter, bringing its total managed portfolio to 29,149 rental

homes. The homes were purchased at an average cost per home of

$335,000, including up-front renovations for a total acquisition

cost of $675 million, of which Tricon's share was approximately

$203 million. For the first quarter of 2022, Tricon anticipates

acquiring approximately 1,800 to 2,000 homes.

On November 23, 2021, the Company announced its plans to deliver

over 3,000 rental units in 23 new home communities across the U.S.

Sun Belt through the Company's existing single-family rental

investment vehicles, THPAS-JV1 and SFR JV-HD. The 23 communities

are located across ten metropolitan areas and the Company is

currently on track to deliver 600 new homes in these communities by

the end of 2022. The full pipeline is expected to be delivered by

the end of 2024.

Adjacent Residential Businesses

Highlights

Quarterly highlights of the Company's adjacent residential

businesses include:

- Tricon's share of U.S. multi-family rental NOI was $3.9 million

compared to $3.2 million for the same period in 2020, a $0.7

million or 20.6% increase on a same-property basis. The growth in

NOI is mainly driven by a $0.7 million or 13.0% year-over-year

increase in revenue buoyed by a 3.0% year-over-year rise in

occupancy to 96.6%, a 7.1% year-over-year improvement in average

monthly rent and a decline in concessions associated with improved

leasing demand. Total operating expenses remained stable at $2.3

million as higher property management costs incurred from a

competitive labor market and rising material prices were fully

offset by recoveries from property tax appeals during the

quarter;

- In the Canadian multi-family business, The Selby achieved

occupancy of 97.8% (a 10.8% year-over-year increase) owing to

management's successful execution of targeted marketing and

resident retention strategies, and the stabilization of overall

market conditions in downtown Toronto;

- Across Tricon's Canadian residential developments portfolio,

construction continues to progress on schedule, with the majority

of projects under construction being funded by construction loans.

Of note, The Taylor in downtown Toronto is on track to secure its

first occupancy in Q2 2022;

- In addition, the Company successfully completed the sale of the

7 Labatt development project in downtown Toronto, generating total

distributions to Tricon of $15.1 million (including $0.3 million of

performance fees) or a ~15% internal rate of return; and

- Tricon's investments in U.S. residential developments generated

$18.1 million of distributions to the Company in the fourth quarter

of 2021, including $3.3 million in performance fees.

Change in Net Assets

Tricon's net assets were $3.1 billion at December 31, 2021,

increasing significantly both sequentially as well as on a

year-over-year basis. Tricon’s net assets grew by $0.7 billion and

$1.4 billion when compared to $2.4 billion and $1.7 billion as at

September 30, 2021 and December 31, 2020, respectively. These

increases were primarily attributable to fair value gains of $0.3

billion and $1.0 billion for the three and twelve months ended

December 31, 2021. Accordingly, Tricon's book value (net assets)

per common share outstanding also increased by 6% sequentially to

$11.22 (C$14.22) as at December 31, 2021 compared to $10.61

(C$13.52) as at September 30, 2021, or 25% on a year-over-year

basis compared to $8.98 (C$11.44) as at December 31, 2020.

Balance Sheet and

Liquidity

Tricon's liquidity consists of a $500 million corporate credit

facility which was undrawn and available to the Company as at

December 31, 2021. The Company also had approximately $177 million

of unrestricted cash on hand, resulting in total liquidity of $677

million compared to $637 million as at September 30, 2021.

As at December 31, 2021, Tricon’s pro-rata net debt (excluding

exchangeable instruments) was $2.3 billion, reflecting a pro-rata

net debt to assets ratio of 34.9%.3 For the three months ended

December 31, 2021, Tricon's pro-rata net debt to Adjusted EBITDAre

ratio was 7.8x.

Full-Year 2022 Guidance

The following table highlights guidance for the Company's Core

FFO per share and same home metrics for the upcoming fiscal

year:

For the years ended December 31

2021 Actual

2022 Guidance

Core FFO per share

$

0.57

$

0.60

-

$

0.64

Same home revenue growth

5.9

%

7.0

%

-

9.0

%

Same home expense growth

3.2

%

6.5

%

-

8.5

%

Same home NOI growth

7.2

%

7.0

%

-

9.0

%

Single-family rental home acquisitions

6,574

8,000+

Note: Non-IFRS measures are presented to

illustrate alternative relevant measures to assess the Company's

performance. Refer to the “Non-IFRS Measures” and Section 6 of the

Company's MD&A for definitions. See also the “Forward-Looking

Information” section, as the figures presented above are considered

to be “financial outlook” for purposes of applicable Canadian

securities laws and may not be appropriate for purposes other than

to understand management’s current expectations relating to the

future of the Company. The reader is cautioned that this

information is forward-looking and actual results may vary

materially from those reported. Although the Company believes that

its anticipated future results, performance or achievements

expressed or implied by the forward-looking statements and

information are based upon reasonable assumptions and expectations,

the reader should not place undue reliance on forward-looking

statements and information. The Company reviews its key assumptions

regularly and may change its outlook on a going-forward basis if

necessary.

Quarterly Dividend

On March 1, 2022, the Board of Directors of the Company declared

a dividend of $0.058 (USD) per common share payable on or after

April 15, 2022 to shareholders of record on March 31, 2022.

Tricon’s dividends are designated as eligible dividends for

Canadian tax purposes in accordance with subsection 89(14) of the

Income Tax Act (Canada), and any applicable corresponding

provincial and territorial legislation. Tricon has a Dividend

Reinvestment Plan (“DRIP”) which allows eligible shareholders of

the Company to reinvest their cash dividends in additional common

shares of the Company. Common shares issued pursuant to the DRIP in

connection with the announced dividend will be issued from treasury

at a 1% discount from the market price, as defined in the DRIP.

Participation in the DRIP is optional and shareholders who do not

participate in the plan will continue to receive cash dividends. A

complete copy of the DRIP is available in the Investors section of

Tricon’s website at www.triconresidential.com.

Conference Call and

Webcast

Management will host a conference call at 10 a.m. ET on

Thursday, March 3, 2022 to discuss the Company’s results. Please

call (888) 550-5422 or (646) 960-0676 (Conference ID # 3699415).

The conference call will also be accessible via webcast at

www.triconresidential.com (Investors - News & Events). A replay

of the call will be available from 1 p.m. ET on March 3, 2022,

until midnight ET on April 2, 2022. To access the replay, call

(800) 770-2030 or (647) 362-9199, followed by Conference ID

#3699415.

This press release should be read in conjunction with the

Company’s Financial Statements and Management’s Discussion and

Analysis (the "MD&A") for the year ended December 31, 2021,

which are available on Tricon’s website at

www.triconresidential.com and have been filed on SEDAR

(www.sedar.com) as well as with the SEC as part of the Company’s

annual report filed on Form 40-F. The financial information therein

is presented in U.S. dollars. Shareholders have the ability to

receive a hard copy of the complete audited Financial Statements

free of charge upon request.

The Company has also made available on its website supplemental

information for the three and twelve months ended December 31,

2021. For more information visit www.triconresidential.com.

About Tricon Residential

Inc.

Tricon Residential Inc. is an owner and operator of a growing

portfolio of approximately 37,000 single-family rental homes and

multi-family rental apartments in the United States and Canada with

a primary focus on the U.S. Sun Belt. Our commitment to enriching

the lives of our residents and local communities underpins Tricon’s

culture and business philosophy. We strive to continuously improve

the resident experience through our technology-enabled operating

platform and innovative approach to rental housing. At Tricon

Residential, we imagine a world where housing unlocks life’s

potential. For more information visit

www.triconresidential.com.

Forward-Looking Information

This news release contains forward-looking statements pertaining

to expected future events, financial and operating results, and

projections of the Company, including statements related to

targeted financial performance and leverage, anticipated home

acquisitions, the single-family rental unit acquisition and

development pipeline and the benefits to the Company of such

factors. Such forward-looking information and statements involve

risks and uncertainties and are based on management’s current

expectations, intentions and assumptions in light of its

understanding of relevant current market conditions, its business

plans, and its prospects. If unknown risks arise, or if any of the

assumptions underlying the forward-looking statements prove

incorrect, actual results may differ materially from management

expectations as projected in such forward-looking statements.

Examples of such risks include, but are not limited to the

Company's inability to execute its growth strategies; the impact of

changing economic and market conditions, increasing competition and

the effect of fluctuations and cycles in the Canadian and U.S. real

estate markets; changes in the attitudes, financial condition and

demand of the Company's demographic markets; fluctuation in

interest rates and volatility in financial markets; developments

and changes in applicable laws and regulations; and the impact of

COVID-19 on the operations, business and financial results of the

Company, as well as the risks described in the Company’s Annual

Information Form in respect of the year ended December 31, 2021,

available on SEDAR at www.sedar.com. Accordingly, although the

Company believes that its anticipated future results, performance

or achievements expressed or implied by the forward-looking

statements and information are based upon reasonable assumptions

and expectations, the reader should not place undue reliance on

forward-looking statements and information. The Company disclaims

any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, unless required by applicable law.

Certain statements included in this press release, including

with respect to 2022 guidance for Core FFO per share and same home

metrics, are considered to be financial outlook for purposes of

applicable Canadian securities laws, and as such, the financial

outlook may not be appropriate for purposes other than to

understand management’s current expectations relating to the future

of the Company, as disclosed in this press release. These

forward-looking statements have been approved by management to be

made as at the date of this press release. Although the

forward-looking statements contained in this press release are

based upon what management currently believes to be reasonable

assumptions, (including in particular the revenue growth, expense

growth and portfolio growth assumptions set out herein which

themselves are based on, respectively: assumed ancillary revenue

growth and continuing favorable market rent growth; increased

internalization of maintenance activities and improved management

efficiencies accompanying portfolio growth; and the availability of

single-family homes meeting the Company’s acquisition objectives),

there can be no assurance that actual results, performance or

achievements will be consistent with these forward-looking

statements. The forward-looking statements contained in this

document are expressly qualified in their entirety by this

cautionary statement.

Non-IFRS Measures

The Company has included herein certain non-IFRS financial

measures and non-IFRS ratios, including, but not limited to, net

operating income ("NOI"), NOI margin, funds from operations

("FFO"), core funds from operations ("Core FFO"), adjusted funds

from operations ("AFFO"), Core FFO per share, AFFO per share,

Adjusted EBITDAre as well as certain key indicators of the

performance of our businesses which are supplementary financial

measures. These measures are commonly used by entities in the real

estate industry as useful metrics for measuring performance. We

utilize these measures in managing our business, including

performance measurement and capital allocation. In addition,

certain of these measures are used in measuring compliance with our

debt covenants. We believe that providing these performance

measures on a supplemental basis is helpful to investors and

shareholders in assessing the overall performance of the Company’s

business. However, these measures are not recognized under and do

not have any standardized meaning prescribed by IFRS as issued by

the IASB, and are not necessarily comparable to similar measures

presented by other publicly traded entities. These measures should

be considered as supplemental in nature and not as a substitute for

related financial information prepared in accordance with IFRS.

Because non-IFRS financial measures, non-IFRS ratios and

supplementary financial measures do not have standardized meanings

prescribed under IFRS, securities regulations require that such

measures be clearly defined, identified, and reconciled to their

nearest IFRS measure. The calculation and reconciliation of the

non-IFRS financial measures and the requisite disclosure for

non-IFRS ratios used herein are provided in Appendix A below. The

definitions of the Company’s Non-IFRS measures are provided in the

"Glossary and Defined Terms" section as well as Section 6 of

Tricon's MD&A.

The non-IFRS financial measures, non-IFRS ratios and

supplementary financial measures presented herein should not be

construed as alternatives to net income (loss) or cash flow from

the Company’s activities, determined in accordance with IFRS, as

indicators of Tricon’s financial performance. Tricon’s method of

calculating these measures may differ from other issuers’ methods

and, accordingly, these measures may not be comparable to similar

measures presented by other publicly-traded entities.

Appendix A - Reconciliations

RECONCILIATION OF NET INCOME TO FFO,

CORE FFO AND AFFO

For the periods ended December 31

Three months

Twelve months

(in thousands of U.S. dollars)

2021

2020

Variance

2021

2020

Variance

Net income from continuing operations

attributable to Tricon's shareholders

$

125,122

$

74,008

$

51,114

$

512,817

$

109,546

$

403,271

Fair value gain on rental properties

(261,676

)

(106,995

)

(154,681

)

(990,575

)

(220,849

)

(769,726

)

Fair value gain on Canadian development

properties

(10,098

)

—

(10,098

)

(10,098

)

—

(10,098

)

Fair value loss on derivative financial

instruments and other liabilities

72,783

16,418

56,365

220,177

7,461

212,716

Loss from investments in U.S. residential

developments

—

—

—

—

79,579

(79,579

)

Limited partners' share of FFO

adjustments

41,720

12,204

29,516

171,498

30,388

141,110

FFO attributable to Tricon's

shareholders

$

(32,149

)

$

(4,365

)

$

(27,784

)

$

(96,181

)

$

6,125

$

(102,306

)

Core FFO from U.S. and Canadian

multi-family rental

2,318

7,199

(4,881

)

13,805

27,977

(14,172

)

Income from equity-accounted investments

in multi-family rental properties

(33,961

)

(427

)

(33,534

)

(75,333

)

(746

)

(74,587

)

Income from equity-accounted investments

in Canadian residential developments

(10,085

)

(8,293

)

(1,792

)

(8,200

)

(13,378

)

5,178

Deferred tax expense

53,507

32,188

21,319

234,483

41,824

192,659

Current tax impact on sale of U.S.

multi-family rental portfolio

—

—

—

(44,502

)

—

(44,502

)

Interest on convertible debentures

—

2,506

(2,506

)

6,732

9,927

(3,195

)

Interest on Due to Affiliate

4,312

4,312

—

17,250

5,654

11,596

Amortization of deferred financing costs,

discounts and lease obligations

3,917

3,730

187

16,571

10,922

5,649

Equity-based, non-cash and non-recurring

compensation (1),(2)

56,050

2,222

53,828

66,262

8,719

57,543

Other adjustments

1,721

2,358

(637

)

21,134

16,193

4,941

Core FFO attributable to Tricon's

shareholders

$

45,630

$

41,430

$

4,200

$

152,021

$

113,217

$

38,804

Recurring capital expenditures (3)

(9,082

)

(7,445

)

(1,637

)

(30,427

)

(27,875

)

(2,552

)

AFFO attributable to Tricon's

shareholders

$

36,548

$

33,985

$

2,563

$

121,594

$

85,342

$

36,252

(1) Includes performance fees expense,

which is accrued based on changes in the unrealized carried

interest of the underlying Investment Vehicles and hence is added

back to Core FFO as a non-cash expense. Performance fees are paid

and deducted in arriving at Core FFO only when the associated fee

revenue has been realized. For the three and twelve months ended

December 31, 2021, the Company paid $196 of performance fees (2020

- nil), which is netted from the adjustment for equity-based,

non-cash and non-recurring compensation.

(2) Performance share unit (PSU) expense

of $1,520 and $3,633 for the three and twelve months ended December

31, 2020, respectively, have been removed from Core FFO to conform

with the current period presentation. This change resulted in a

$1,520 and $3,633 increase in Core FFO and AFFO for the three and

twelve months ended December 31, 2020, respectively.

(3) Recurring capital expenditures

represent ongoing costs associated with maintaining and preserving

the quality of a property after it has been renovated. Capital

expenditures related to renovations or value-enhancement are

excluded from recurring capital expenditure.

RECONCILIATION OF SINGLE-FAMILY RENTAL

NOI AND SAME HOME NOI

For the periods ended December 31

Three months

Twelve months

(in thousands of U.S. dollars)

2021

2020

2021

2020

Net operating income (NOI), proportionate

same home portfolio

$

50,602

$

45,881

$

194,292

$

181,176

Net operating income (NOI), proportionate

non-same home portfolio

8,752

4,595

27,363

16,352

Net operating income (NOI), proportionate

total portfolio

59,354

50,476

221,655

197,528

Limited partners' share of NOI(1)

24,001

13,243

74,320

48,212

Net operating income from single-family

rental properties per financial statements

$

83,355

$

63,719

$

295,975

$

245,740

(1) Represents the limited partners'

interest in the NOI from SFR JV-1, SFR JV-2 and SFR JV-HD.

RECONCILIATION OF PROPORTIONATE SAME

HOME GROWTH METRICS

For the year ended December 31

(in thousands of U.S. dollars)

2021

2020

Variance

% Variance

Total revenue from rental properties

$

286,673

$

270,689

$

15,984

5.9

%

Total direct operating expenses

92,381

89,513

2,868

3.2

%

Net operating income (NOI)(1)

$

194,292

$

181,176

$

13,116

7.2

%

Net operating income (NOI)

margin(1)

67.8

%

66.9

%

(1) Non-IFRS measures; refer to Section 6

of the MD&A for definition.

RECONCILIATION OF U.S. MULTI-FAMILY

RENTAL NOI

For the periods ended December 31

Three months

Twelve months

(in thousands of U.S. dollars)

2021

2020

2021

2020

Net operating income (NOI), proportionate

portfolio

$

3,916

$

—

$

14,266

$

—

Less: net operating income (NOI) in

discontinued operations

—

—

(3,245

)

—

Interest expense, proportionate

portfolio

(1,388

)

—

(4,150

)

—

Other expenses, proportionate

portfolio

(426

)

—

(2,005

)

—

Fair value gain on multi-family rental

properties, proportionate portfolio

29,782

—

68,212

—

Income from equity-accounted

investments in U.S. multi-family rental properties per financial

statements(1)

$

31,884

$

—

$

73,078

$

—

Net operating income (NOI), proportionate

portfolio(2)

$

—

$

3,248

$

3,245

$

13,087

Net operating income (NOI), IFRS

reconciliation(2)

—

12,985

12,979

52,351

Interest expense

—

(8,077

)

(7,845

)

(33,464

)

Other expenses

—

(1,546

)

(1,176

)

(7,067

)

Fair value loss on multi-family rental

properties

—

—

—

(22,535

)

Loss on sale (1)

—

—

(84,427

)

—

Net income (loss) from discontinued

operations before income taxes per financial statements(1)

$

—

$

6,610

$

(77,224

)

$

2,372

(1) On March 31, 2021, the Company sold an

80% interest in its subsidiary, Tricon US Multi-Family REIT LLC, to

two institutional investors. This resulted in net income from

Tricon's U.S. multi-family rental business to be equity-accounted

for starting on March 31, 2021 and classified as discontinued

operations for all periods prior to that date. The loss on sale was

mainly attributable to the derecognition of goodwill.

(2) The total NOI from discontinued

operations represents 100% of Tricon's NOI before the syndication

of the U.S. multi-family rental portfolio on March 31, 2021. To

assist with comparability against financial results after March 31,

2021, the total NOI from discontinued operations has been

apportioned between Tricon's retained ownership interest (20%) and

Tricon's disposed ownership interest (80%).

PROPORTIONATE BALANCE SHEET

(in thousands of U.S. dollars, except per

share amounts which are in U.S. dollars, unless otherwise

specified)

Rental portfolio

Development portfolio

Corporate assets and

liabilities

Tricon proportionate

results

IFRS reconciliation

Consolidated

results/Total

A

B

C

D = A+B+C

E

D+E

Assets

Rental properties

$

5,404,540

$

—

$

—

$

5,404,540

$

2,573,856

$

7,978,396

Equity-accounted investments in

multi-family rental properties

199,285

—

—

199,285

—

199,285

Equity-accounted investments in Canadian

residential developments

—

98,675

—

98,675

—

98,675

Canadian development properties

—

133,250

—

133,250

—

133,250

Investments in U.S. residential

developments

—

143,153

—

143,153

—

143,153

Restricted cash

76,020

6,405

757

83,182

40,147

123,329

Goodwill, intangible and other assets

113

—

123,799

123,912

250

124,162

Deferred income tax assets

—

—

96,945

96,945

—

96,945

Cash

65,093

1,116

25,446

91,655

85,239

176,894

Other working capital items (1)

12,043

1,736

44,484

58,263

16,265

74,528

Total assets

$

5,757,094

$

384,335

$

291,431

$

6,432,860

$

2,715,757

$

9,148,617

Liabilities

Debt

2,142,433

34,199

13,962

2,190,594

1,726,839

3,917,433

Due to Affiliate

—

—

256,362

256,362

—

256,362

Other liabilities (2)

120,075

2,854

340,217

463,146

988,918

1,452,064

Deferred income tax liabilities

—

—

461,689

461,689

—

461,689

Total liabilities

$

2,262,508

$

37,053

$

1,072,230

$

3,371,791

$

2,715,757

$

6,087,548

Non-controlling interest

—

—

7,275

7,275

—

7,275

Net assets attributable to Tricon's

shareholders

$

3,494,586

$

347,282

$

(788,074

)

$

3,053,794

$

—

$

3,053,794

Net assets per share (3)

$

12.84

$

1.28

$

(2.90

)

$

11.22

Net assets per share (CAD) (3)

$

16.28

$

1.62

$

(3.68

)

$

14.22

(1) Other working capital items include

amounts receivable and prepaid expenses and deposits.

(2) Other liabilities include long-term

incentive plan, performance fees liability, derivative financial

instruments, other liabilities, limited partners' interests,

dividends payable, resident security deposits and amounts payable

and accrued liabilities.

(3) As at December 31, 2021, common shares

outstanding were 272,176,046 and the USD/CAD exchange rate was

1.2678.

TOTAL AUM

December 31, 2021

December 31, 2020

(in thousands of U.S. dollars)

Balance

% of total AUM

Balance

% of total AUM

Third-party AUM

$

6,816,668

49.6

%

$

2,850,004

32.2

%

Principal AUM

6,919,664

50.4

%

5,997,489

67.8

%

Total AUM

$

13,736,332

100.0

%

$

8,847,493

100.0

%

(1) The Company changed its definition of

AUM in the current year in order to better align with the fair

value of the assets comprising a portion of the AUM. The AUM in the

comparative period has been updated to conform with the current

period presentation. This change resulted in increases of $296,646

and $95,917 in third-party AUM and principal AUM, respectively, for

a total increase of $392,563 in the total AUM as at December 31,

2020.

RECONCILIATION OF NET INCOME TO

ADJUSTED EBITDAre

(in thousands of U.S. dollars)

Total proportionate

results

IFRS reconciliation

Consolidated

results/Total

For the three months ended December 31,

2021

Net income attributable to Tricon's

shareholders from continuing operations

$

125,122

$

—

$

125,122

Interest expense

24,297

11,351

35,648

Current income tax expense

615

—

615

Deferred income tax expense

53,507

—

53,507

Amortization and depreciation expense

2,818

—

2,818

Fair value gain on rental properties

(219,899

)

(41,777

)

(261,676

)

Fair value gain on Canadian development

properties

(10,098

)

—

(10,098

)

Fair value loss on derivative financial

instruments and other liabilities

72,726

57

72,783

Look-through EBITDAre adjustments from

non-consolidated affiliates

(40,089

)

—

(40,089

)

EBITDAre, consolidated

$

8,999

$

(30,369

)

$

(21,370

)

Equity-based, non-cash and non-recurring

compensation

56,050

—

56,050

Other adjustments (1)

308

38

346

Limited partners' share of EBITDAre

adjustments

—

30,331

30,331

Non-controlling interest's share of

EBITDAre adjustments

(219

)

—

(219

)

Adjusted EBITDAre

$

65,138

$

—

$

65,138

Adjusted EBITDAre (annualized)

$

260,552

(1) Includes the following

adjustments:

(in thousands of U.S. dollars)

Proportionate

IFRS reconciliation

Consolidated

Transaction costs

$

3,792

$

38

$

3,830

Realized and unrealized foreign exchange

loss

407

—

407

Look-through other adjustments from

non-consolidated affiliates

211

—

211

Lease payments on right-of-use assets

(643

)

—

(643

)

Other non-recurring adjustments

(3,459

)

—

(3,459

)

Total other adjustments

$

308

$

38

$

346

PRO-RATA ASSETS

Tricon's pro-rata assets include its share

of total assets of non-consolidated entities on a look-through

basis, which are shown as equity-accounted investments on its

proportionate balance sheet.

(in thousands of U.S. dollars)

December 31, 2021

Pro-rata assets of consolidated

entities (1)

$

6,134,900

U.S multi-family rental properties

343,499

Canadian multi-family rental

properties

40,629

Canadian residential developments

207,772

Pro-rata assets of non-consolidated

entities

591,900

Pro-rata assets, total

$

6,726,800

Pro-rata assets (net of cash), total

(2),(3)

$

6,542,032

(1) Includes proportionate total assets

presented in the proportionate balance sheet table above excluding

equity-accounted investments in multi-family rental properties and

equity-accounted investments in Canadian residential

developments.

(2) Reflects proportionate cash and

restricted cash of $174,837 as well as pro-rata cash and restricted

cash of non-consolidated entities of $9,931.

(3) Non-IFRS measure. Refer to the

"Glossary and Defined Terms" section for definition.

PRO-RATA NET DEBT TO ASSETS

(in thousands of U.S. dollars, except

percentages)

December 31, 2021

Pro-rata debt of consolidated

entities

$

2,190,594

U.S. multi-family rental properties

160,017

Canadian multi-family rental

properties

18,748

Canadian residential developments

101,707

Pro-rata debt of non-consolidated

entities

280,472

Pro-rata debt, total

$

2,471,066

Pro-rata net debt, total (1)

,(2)

$

2,286,298

Pro-rata net debt to assets

34.9

%

(1) Reflects proportionate cash and

restricted cash of $174,837 as well as pro-rata cash and restricted

cash of non-consolidated entities of $9,931.

(2) Non-IFRS measure. Refer to the

"Glossary and Defined Terms" section for definition.

RECONCILIATION OF PRO-RATA DEBT AND

ASSETS OF NON-CONSOLIDATED ENTITIES TO CONSOLIDATED BALANCE

SHEET

(in thousands of U.S. dollars)

December 31, 2021

Equity-accounted investments in U.S.

multi-family rental properties

Tricon's pro-rata share of assets

$

343,499

Tricon's pro-rata share of debt

(160,017

)

Tricon's pro-rata share of working capital

and other

(5,084

)

Equity-accounted investments in U.S.

multi-family rental properties

178,398

Equity-accounted investments in

Canadian multi-family rental properties

Tricon's pro-rata share of assets

$

40,629

Tricon's pro-rata share of debt

(18,748

)

Tricon's pro-rata share of working capital

and other

(994

)

Equity-accounted investments in

Canadian multi-family rental properties

20,887

Equity-accounted investments in

multi-family rental properties

$

199,285

Equity-accounted investments in

Canadian residential developments

Tricon's pro-rata share of assets

$

207,772

Tricon's pro-rata share of debt

(101,707

)

Tricon's pro-rata share of working capital

and other

(7,390

)

Equity-accounted investments in

Canadian residential developments

$

98,675

PRO-RATA NET DEBT TO ADJUSTED EBITDAre

(in thousands of U.S. dollars)

December 31, 2021

Pro-rata debt of consolidated entities,

excluding development and subscription facilities (1)

$

2,020,692

U.S. multi-family rental properties

debt

160,017

Canadian multi-family rental properties

debt

18,748

Pro-rata debt of non-consolidated

entities (stabilized properties)

178,765

Pro-rata debt (stabilized properties),

total

$

2,199,457

Pro-rata net debt (stabilized

properties), total (2)

$

2,027,076

Adjusted EBITDAre (annualized)

(3)

$

260,552

Pro-rata net debt to Adjusted EBITDAre

(annualized)

7.8x

(1) Excludes $34,199 of development debt

directly related to the consolidated Canadian development portfolio

and $135,703 of subscription facilities related to acquisitions of

vacant single-family homes, which do not currently contribute to

Adjusted EBITDAre.

(2) Reflects proportionate cash and

restricted cash (excluding cash held at development entities and

excess cash held at single-family rental joint venture entities) of

$167,096 as well as pro-rata cash and restricted cash of

non-consolidated entities for stabilized properties of $5,285.

(3) Adjusted EBITDAre is a non-IFRS

measure. Refer to the "Glossary and Defined Terms" section for

definition and the Reconciliation of net income to adjusted

EBITDAre table above.

Glossary and Defined Terms

The non-IFRS financial measures, non-IFRS ratios, and KPI

supplementary financial measures discussed throughout this press

release for each of the Company’s business segments are calculated

based on Tricon's proportionate share of each portfolio or business

and are defined and discussed below and in Section 6 of the

MD&A, which definitions and discussion and incorporated herein

by reference. These measures are commonly used by entities in

the real estate industry as useful metrics for measuring

performance; however, they do not have any standardized meaning

prescribed by IFRS and are not necessarily comparable to similar

measures presented by other publicly-traded entities. These

measures should be considered as supplemental in nature and not as

a substitute for the related financial information prepared in

accordance with IFRS. See Appendix A for a reconciliation to IFRS

financial measures where applicable.

Adjusted EBITDAre is a metric that management believes to

be helpful in evaluating the Company’s operating performance across

and within the real estate industry. Further, management considers

it to be a more accurate reflection of the Company’s leverage

ratio, especially as it adjusts for and negates non-recurring and

non-cash items. The Company’s definition of EBITDAre reflects all

adjustments that are specified by the National Association of Real

Estate Investment Trusts (“NAREIT”). In addition to the adjustments

prescribed by NAREIT, Tricon excludes fair value gains that arise

as a result of reporting under IFRS, consistent with its FFO

calculation methodology described above.

EBITDAre represents net income from continuing operations,

excluding the impact of interest expense, income tax expense,

amortization and depreciation expense, fair value changes on rental

properties, fair value changes on derivative financial instruments

and adjustments to reflect the entity’s share of EBITDAre of

unconsolidated entities. Adjusted EBITDAre is a normalized figure

and is defined as EBITDAre before stock-based compensation,

unrealized and realized foreign exchange gains and losses,

transaction costs and other non-recurring items, and reflects only

Tricon’s share of results from consolidated entities (by removing

non-controlling interests’ and limited partners’ share of

reconciling items).

The Company also discloses its Net Debt to Adjusted EBITDAre

ratio to assist investors in accounting for the Company’s

unconsolidated joint ventures and equity‐accounted investments, in

both debt and Adjusted EBITDAre, by calculating pro‐rata leverage

on a look‐through basis (excluding debt directly related to the

Canadian development portfolio and subscription facilities related

to acquisitions of vacant single-family homes, which do not

currently contribute to Adjusted EBITDAre).

Cost to maintain is defined as the annualized repairs and

maintenance expense, turnover expense and recurring capital

expenditures per home in service. The metric provides insight into

the costs needed to maintain a property's current condition and is

indicative of a portfolio's operational efficiency.

Pro-rata net assets represents the Company's

proportionate share of total consolidated assets as well as assets

of non-consolidated entities on a look-through basis (which are

shown as equity-accounted investments on its proportionate balance

sheet), less its cash and restricted cash.

Pro-rata net debt represents the Company's total current

and long-term debt per its consolidated financial statements, less

its cash and restricted cash (excluding debt directly related to

the Canadian development portfolio and subscription facilities

related to acquisitions of vacant single-family homes, which do not

currently contribute to Adjusted EBITDAre).

____________ 1 Non-IFRS measures are presented to illustrate

alternative relevant measures to assess the Company's performance.

For the basis of presentation of the Company’s Non-IFRS measures

and reconciliations, refer to the “Non-IFRS Measures” and Appendix

A. For definitions of the Company’s Non-IFRS measures, refer to

Section 6 of Tricon's MD&A. 2 Non-IFRS measures are presented

to illustrate alternative relevant measures to assess the Company's

performance. For the basis of presentation of the Company’s

Non-IFRS measures and reconciliations, refer to the “Non-IFRS

Measures” and Appendix A. For definitions of the Company’s Non-IFRS

measures, refer to Section 6 of Tricon's MD&A. 3 Non-IFRS

measures are presented to illustrate alternative relevant measures

to assess the Company's performance. For the basis of presentation

of the Company’s Non-IFRS measures and reconciliations, refer to

the “Non-IFRS Measures” and Appendix A. For definitions of the

Company’s Non-IFRS measures, refer to Section 6 of Tricon's

MD&A.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220302005927/en/

Wissam Francis EVP & Chief Financial Officer Tel:

416-323-2484 Email: wfrancis@triconresidential.com

Wojtek Nowak Managing Director, Capital Markets Tel:

416-925-2409 Email: wnowak@triconresidential.com

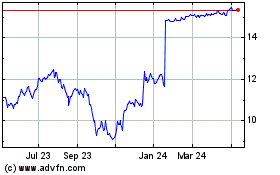

Tricon Residential (TSX:TCN)

Historical Stock Chart

From Nov 2024 to Dec 2024

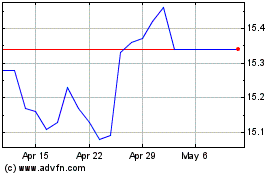

Tricon Residential (TSX:TCN)

Historical Stock Chart

From Dec 2023 to Dec 2024