Titan Medical Inc. (“

Titan”) (TSX: TMD; OTC: TMDIF) is

pleased to announce that, in connection with its amalgamation

agreement (“

Amalgamation Agreement”) with Conavi Medical

Inc. (“

Conavi”) providing for the combination of the

companies in an all-stock transaction (the “

Transaction”),

Conavi has closed its previously announced concurrent private

placement of subscription receipts (“

Subscription Receipts”)

for gross proceeds of US$7.7 million (the “

Offering”).

Pursuant to the Offering, Conavi issued

7,729,300 Subscription Receipts (7,526,025 of which were issued in

a brokered portion of the Offering, with the remainder in a

concurrent, non-brokered private placement) at a price of US$1.00

per Subscription Receipt to certain institutional and accredited

investors, including Conavi’s lead investors and principal

shareholders, Carlyle Services Limited Liability Company, CPOINT

Capital Corp. and Juno Pharmaceuticals LP. The brokered portion of

the Offering was led by Bloom Burton Securities Inc. (the

“Agent”) as exclusive agent and financial advisor. Each

Subscription Receipt shall entitle the holder to receive, upon

satisfaction of certain escrow release conditions (including

satisfaction or waiver of the closing conditions to the

Transaction) ("Escrow Release Conditions"), and without

payment of additional consideration, one unit in the capital of

Conavi consisting of one voting common share in the capital of

Conavi (each, a “Conavi Share”) and one warrant of Conavi

(each, a “Conavi Warrant”) to purchase one Conavi Share at

an exercise price of US$1.25 per Conavi Share. At the effective

time of the completion of Conavi’s proposed reverse take-over of

Titan (“Closing”), as described in the press releases of

Titan dated March 18, 2024, with subsequent amendments to the

Amalgamation Agreement announced on May 29, 2024, July 5, 2024 and

August 14, 2024, each Conavi Share and Conavi Warrant acquired upon

conversion of the Subscription Receipts will be automatically

exchanged and adjusted, on the basis of the Exchange Ratio (as

defined in the Amalgamation Agreement) for equivalent securities in

the capital of the reporting issuer resulting from the completion

of the Transaction (the "Resulting Issuer"), being common

shares in the capital of the Resulting Issuer (each a "Resulting

Issuer Share") and common share purchase warrants of the

Resulting Issuer (each whole common share purchase warrant, a

"Resulting Issuer Warrant"). The Resulting Issuer Warrants

will expire five years after completion of the Transaction.

In connection with the Offering, the Agent is

entitled to a cash fee equal to 7.0% of the gross proceeds in

respect of the brokered portion of the Offering. As additional

compensation, the Agent has been issued 35,329 broker warrants (the

“Broker Warrants”). Each Broker Warrant shall be exercisable

for purchase of one Conavi Share at a price of US$1.00 per Conavi

Share for 24 months following Closing of the Transaction, and will

be automatically exchanged and adjusted, on the basis of the

Exchange Ratio (as such term is defined in the joint management

information circular for the Transaction dated August 30, 2024,

which may be viewed under Titan’s profile at www.sedarplus.com)

(the “MIC”), for broker warrants of the Resulting Issuer.

Notwithstanding the foregoing, the Agent did not receive Broker

Warrants with respect to subscriptions from Carlyle Services

Limited Liability Company, CPOINT Capital Corp. and Juno

Pharmaceuticals LP, and the Agent’s cash fee entitlement is 3.5% of

the gross proceeds raised from such subscriptions.

The net proceeds of the Offering and 50% of the

Agent’s cash fee are being held in escrow and, upon the

satisfaction or waiver of the Escrow Release Conditions, the net

proceeds will be released to Conavi and the remaining portion of

the Agent’s cash fee will be released to the Agent.

Additional details of the Offering, including

the terms of share consolidations to be carried out by each of

Titan and Conavi, and additional details concerning the terms of

the Transaction and the Exchange Ratio, are disclosed in the

MIC.

Conavi intends to use the proceeds of the

Offering for product research and development and production

activities for Novasight 3.0, ongoing commercialization activities,

and for working capital and general corporate purposes.

The securities described herein have not been,

and will not be, registered under the U.S. Securities Act of 1933,

as amended (the "U.S. Securities Act") or any U.S. state

securities laws and may not be offered or sold in the United States

absent registration or an available exemption from the registration

requirements of the U.S. Securities Act and applicable U.S. state

securities laws. This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of the securities referenced in this press release, in any

jurisdiction in which such offer, solicitation or sale would be

unlawful.

The closing of the Transaction, which is subject

to the satisfaction or waiver of a number of customary closing

conditions, is expected to take place on or around October 11,

2024. In connection with closing of the Transaction, Titan is

expected to change its name to Conavi Medical Corp. and to complete

a 25-to-1 share consolidation. In addition, further to its press

release dated, September 30, 2024, Titan intends to voluntarily

delist from the Toronto Stock Exchange (“TSX”) and to apply

to re-list its shares on the TSX Venture Exchange

(“TSXV”).

Following Closing, it is expected that Titan’s

shares will continue to trade on a pre-consolidation and

pre-Transaction basis for two or three business days following

Closing of the Transaction while the parties seek the final

approval of the TSX and the TSXV. Upon receipt of such approvals,

Titan’s common shares are expected to be delisted from the TSX

effective as of close of markets on or around October 16, 2024.

Titan has received conditional approval from the TSXV for the

listing of the Resulting Issuer Shares under the symbol

“CNVI”, and subject to final approval of the TSXV, trading

on the TSXV (which will give effect to Titan’s name change, 25-to-1

share consolidation and Closing of the Transaction) is expected to

commence immediately on the trading day following delisting from

the TSX without any interruption in trading. A further update

regarding the process of delisting from the TSX and relisting on

the TSXV will be provided upon Closing of the Transaction.

About Titan Medical

Titan Medical Inc. (TSX: TMD; OTC: TMDIF), a

medical technology company incorporated under the Business

Corporations Act (Ontario) and headquartered in Toronto, Ontario,

has developed an expansive patent portfolio related to the

enhancement of robotic assisted surgery (RAS), including through a

single access point, and is currently focused on evaluating new

opportunities to further develop and license its intellectual

property.

About Conavi Medical

Conavi Medical Inc. is a privately-owned company

focused on designing, manufacturing, and marketing imaging

technologies to guide common minimally invasive cardiovascular

procedures. Its patented Novasight Hybrid™ System is the first

system to combine both IVUS and OCT to enable simultaneous and

co-registered imaging of coronary arteries. The Novasight Hybrid

System has 510(k) clearance from the U.S. Food and Drug

Administration; and regulatory approval for clinical use from

Health Canada, China’s National Medical Products Administration,

and Japan’s Ministry of Health, Labor and Welfare. For more

information, visit http://www.conavi.com/.

Cautionary Statement Regarding Forward-Looking

Information

This news release contains “forward-looking

statements” within the meaning of applicable Canadian and U.S.

securities laws, which reflect the current expectations of

management of Titan’s future growth, results of operations,

performance and business prospects and opportunities.

Forward-looking statements are frequently, but not always,

identified by words such as “may”, “would”, “could”, “will”,

“anticipate”, “believe”, “plan”, “expect”, “intend”, “estimate”,

“potential for” and similar expressions, although these words may

not be present in all forward-looking statements. Forward-looking

statements that appear in this release may include, without

limitation, references to the continued work of Titan and Conavi

towards the completion of the Transaction.

These forward-looking statements reflect

management’s current beliefs with respect to future events, and are

based on information currently available to management that, while

considered reasonable by management as of the date on which the

statements are made, are inherently subject to significant

business, economic and competitive uncertainties and contingencies

which could result in actions, events, conditions, results,

performance or achievements to be materially different from those

projected in the forward-looking statements. Forward-looking

statements involve significant risks, uncertainties and assumptions

and many factors could cause Titan’s actual results, performance or

achievements to be materially different from any future results,

performance or achievements that may be expressed or implied by

such forward-looking statements. Such factors and assumptions

include, but are not limited to, Titan’s ability to retain key

personnel; its ability to execute on its business plans and

strategies; its ability to continue to license some or all its

intellectual property to third parties and receive any material

consideration; the satisfaction of the Escrow Release Conditions;

the receipt of final required approvals from the TSX Venture

Exchange in connection with the Transaction or change of listing

and the timing thereof; the successful completion of the

Transaction and other factors listed in the “Risk Factors” sections

of Titan’s Annual Information Form for the fiscal year ended

December 31, 2023 and the MIC (which may be viewed at

www.sedarplus.com). Should one or more of these risks or

uncertainties materialize, or should assumptions underlying the

forward-looking statements prove incorrect, actual results,

performance, or achievements may vary materially from those

expressed or implied by the forward-looking statements contained in

this news release. These factors should be considered carefully,

and prospective investors should not place undue reliance on the

forward-looking statements.

Although the forward-looking statements

contained in the news release are based upon what management

currently believes to be reasonable assumptions and Titan has

attempted to identify important factors that could cause actual

actions, events, conditions, results, performance or achievements

to differ materially from those described in forward-looking

statements, Titan cannot assure prospective investors that actual

results, performance or achievements will be consistent with these

forward-looking statements. Except as required by law, Titan

expressly disclaims any intention or obligation to update or revise

any forward-looking statements whether as a result of new

information, future events or otherwise. Accordingly, investors

should not place undue reliance on forward-looking statements. All

the forward-looking statements are expressly qualified by the

foregoing cautionary statements.

Contacts

Titan Medical Inc.Chien HuangChief Financial

Officerinvestors@titanmedicalinc.com

Conavi Medical Inc.Stephen KilmerInvestor Relations(647)

872-4849stephen@kilmerlucas.com

###

521846245v.4

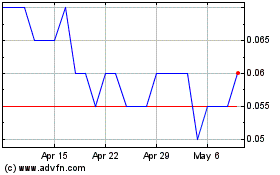

Titan Medical (TSX:TMD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Titan Medical (TSX:TMD)

Historical Stock Chart

From Jan 2024 to Jan 2025