AnalytixInsight Inc. (“AnalytixInsight”, or the

“Company”) (TSX-V: ALY) today provides a default status

report in accordance with the alternative information guidelines

set out in National Policy 12-203 – Management Cease Trade Orders

(“NP 12-203”).

As disclosed by the Company in a press release dated May 3,

2024, the Company failed to file its audited financial statements

for the year ended December 31, 2023 and the related Management’s

Discussion and Analysis and the certifications related to such

filings required from the Company’s chief executive officer and

chief financial officer (collectively, the “Required

Filings”) by the filing deadline of April 29, 2024 (the

“Default”).

In anticipation of the Default, the Company previously applied

to the Ontario Securities Commission (the “OSC”), as the

Company’s principal regulator, for a temporary management cease

trade order (“MCTO”) under NP 12-203. As stated in the

Company’s press release dated April 23, 2024 (the “Default

Announcement”), there was uncertainty regarding the Company’s

decision-making, and such uncertainty had rendered the Company and

its board of directors (the “Board”) unable to make the

determinations necessary to complete the preparation of its

financial statements for the year ended December 31, 2023,

including in relation to certain disputed expense items, and to

take the other actions necessary to finalize, approve and file the

Required Filings by the filing deadline of April 29, 2024. The MCTO

was issued by the OSC on May 1, 2024, and is expected to remain in

effect until two business days after the Default is remedied. The

MCTO prohibits trading in securities of the Company, whether direct

or indirect, by certain specified parties including each of the

Company’s directors and officers. The issuance of the MCTO does not

generally affect the ability of persons who are not directors,

officers or other insiders of AnalytixInsight to trade in

securities of the Company.

The Company intends to continue to make every effort to complete

the Required Filings as soon as possible. In that regard, a meeting

of the Board was held on May 7, 2024 (the “May 7 Board

Meeting”), at which matters necessitating approval of the Board

related to the Required Filings were discussed, including in

respect of the disputed expense items. At this meeting, it was also

reported by the Company’s management that the Company faced a

number of near-term liquidity issues, including that: (a) the

Company’s cash reserves had been significantly depleted due to

several unexpected payments, (b) the Company had been unable to pay

certain of its employees and consultants for the month of May in

accordance with their contracts, and (c) the Company’s revenues had

declined significantly over the past year and an anticipated

payment from MarketWall S.R.L. had not been received in early 2024

as expected, while its accrued payables had increased markedly. The

Company learned that the payment from MarketWall S.R.L. would not

be received at a shareholder meeting of MarketWall S.R.L. held on

March 21, 2024.

In light of the Company’s financial condition as of the May 7

Board Meeting, and the restrictions imposed on the Board pursuant

to the intended interim orders (the “Interim Orders”) of the

Court made in connection with legal proceedings disclosed in the

Company’s May 3, 2024 press release, the Board determined at its

May 7, 2024 meeting to seek approval of the Court to pursue funding

options as an activity that might be characterized as outside of

the ordinary course of business. A Court appearance respecting such

matter was held today and the Court authorized the Company to

explore funding options, provided that any proposed steps arising

from the exercise will be subject to Board and Court approval.

There is no assurance that new funding will be available to the

Company, on reasonable terms or at all. In the absence of new

funding, the Company may not be able to continue as a going

concern.

Earlier this week, the Company collected certain account

receivables early and used a portion thereof to pay the final

outstanding invoice of its auditor and other outstanding amounts

due to its employees and consultants. Subject to the work of the

Court-ordered inspector and any further determinations of the

Court, the Company will continue to make every effort to be in a

position to make the Required Filings on or prior to June 28,

2024.

The Company cautions that, if the Required Filings are not made

by May 30, 2024, the Company may be unable to confirm its 2024

opening balances and, as a result, unable to file its interim

financial statements for the three-month period ended March 31,

2024, and the related Management’s Discussion and Analysis and the

certifications related to such filings required from the Company’s

chief executive officer and chief financial officer, by the

applicable filing deadline for the Q1 2024 financial reporting of

May 30, 2024.

Other than as set out herein, the Company confirms that (a)

there have been no changes to the information contained in the

Default Announcement that would reasonably be expected to be

material to an investor, (b) the Company believes that there has

been no failure by the Company in fulfilling its stated intentions

with respect to satisfying the provisions of the alternative

information guidelines under NP 12-203, (c) there is no anticipated

specified default (as such term is defined in NP 12-203) subsequent

to the Default, and (d) there is no other material information

concerning the affairs of the Company that has not been generally

disclosed.

Should the Company fail to make the Required Filings on or

before June 28, 2024, the OSC may impose a cease trade order that

all trading in securities of the Company cease for such period of

time as the OSC may deem appropriate.

For more information about the Interim Orders, please refer to

the Company’s press release dated May 3, 2024, which is available

under the Company’s SEDAR+ profile at www.sedarplus.ca.

The Company intends to continue to comply with the alternative

information guidelines set out in NP 12‑203 until the Required

Filings are made, including by issuing bi-weekly default status

reports in the form of further news releases.

The issuance of this news release has been approved by the

Board, and more specifically Messrs. Veeravalli (independent),

Kadar (independent), and Gardner (independent).

About AnalytixInsight Inc.

AnalytixInsight is a data analytics and enterprise software

solutions provider. AnalytixInsight develops and markets

cloud-based platforms providing financial content, company analysis

and stock research solutions to the financial services industry.

AnalytixInsight holds a 49% interest in MarketWall S.R.L., a

developer of fintech solutions for financial institutions in

Italy.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this news release constitute

“forward-looking information” within the meaning of applicable

securities laws and the respective policies, regulations and rules

under such laws (“forward-looking statements”). These

forward-looking statements generally are identified by words such

as “anticipate”, “expect”, “intend”, “will” and similar

expressions, although not all forward-looking statements contain

these identifying words. Specific forward-looking statements in

this news release include, but are not limited to, statements

regarding: (a) the completion and filing of the Required Filings

and the expected timeframe for doing so; (b) the Interim Orders and

the anticipated consequences thereof; (c) the duration of the MCTO

and the potential imposition of a cease trade order that all

trading in securities of the Company cease for such period of time

as the OSC may deem appropriate; (d) the availability or

suitability of potential funding options to address the Company’s

funding needs and the intention to seek Court approval to pursue

funding options; and (e) the timeframe for the completion of the

audit of the Company’s annual financial statements for the year

ended December 31, 2023. Although the Company believes that the

expectations and assumptions on which such forward-looking

statements are based are reasonable, undue reliance should not be

placed on the forward-looking statements because the Company can

give no assurance that they will prove to be correct. Since

forward-looking statements and information address future events

and conditions, by their very nature they involve inherent risks

and uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this news

release including, without limitation, the risk that the issues to

be addressed by the Interim Orders and the Court-ordered inspector

are not resolved in a timely manner or at all, the risk that the

Company may not be able to make the Required Filings within the

anticipated timeframe or at all, the risk that the Court-ordered

inspector, or the audit of the Company’s 2023 financial statements,

may uncover additional issues and/or may not be completed in a

timely manner or at all, the risk that funding options are not

available to the Company, on reasonable terms or at all, to address

its funding needs, the risk that the OSC imposes a cease trade

order that all trading in securities of the Company cease for such

period of time as the OSC may deem appropriate and the risk of

further Court proceedings and the impact thereof. Additionally,

there are uncertainties inherent in forward-looking information,

including factors beyond the Company’s control. Readers are

cautioned that the foregoing list of factors is not exhaustive. The

forward-looking statements included in this news release are

expressly qualified by this cautionary note. The forward-looking

statements contained in this news release are made as of the date

hereof and the Company undertakes no obligation to update publicly

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, unless so required by

applicable laws.

Regulatory Statements

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES

PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX

VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THIS RELEASE.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240517140195/en/

Natalie Hirsch Interim CEO AnalytixInsight Inc.

natalie.hirsch@analytixinsight.com Tel: 647-955-2933

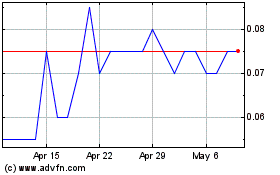

AnalytixInsight (TSXV:ALY)

Historical Stock Chart

From Nov 2024 to Dec 2024

AnalytixInsight (TSXV:ALY)

Historical Stock Chart

From Dec 2023 to Dec 2024