AtmanCo Announces Annual Results for 2013

April 01 2014 - 6:00PM

Marketwired Canada

AtmanCo Inc. ("AtmanCo" or the "Company") (TSX VENTURE:ATW), a leader and

innovator in web psychometric test solutions for recruitment, organizational

development and talent measurement within companies, announces its results for

the 12 months ending December 31st, 2013.

Highlights for 2013

-- For the year, increased revenue from $575,064 to $1,214,203. Note that

the period ending December 31st 2012 consists of 7 months compared to 12

months for December 31st 2013.

-- Increase in deferred revenues of $356,443, from $174,685 on December

31st 2012 to $531,128 on December 31st 2013.

-- Recognition of an impairment loss on intangible assets used in the field

of cyberhealth of $418,346.

-- The Company has partnered with the CCAQ and CIIQ to expand its offering

in the automotive and real estate market.

"Last year was a significant period of transition for AtmanCo, following the

reverse takeover. We focused on license sales, based on the proven AtmanCo

solution, while increasing the growth of our human capital." said President and

CEO of AtmanCo, Michel Guay.

"Many appointments within our management team have added expertise and knowledge

that is beneficial to our business. The powerful diverse expertise that makes up

our team helps us meet the increasing needs of many clients in various

industries. The contribution of the new members, as well as the growth and

integration of new employees have allowed us to achieve our sales targets set

for 2013."

"Several activities were carried out during 2013 in order to align our website

redesign with our digital marketing strategy and position us to further promote

our AtmanCo solution on the web," said President and CEO Atman, Michel Guay.

On February 20th 2014, the Company accepted an offer to sell the assets of the

cyberhealth division. The assets include the technology, as well as some patents

and trademarks. The Company expects to close the transaction during the second

quarter. Following this transaction, the Company expects to receive a total of $

610,000 in cash from the buyer.

----------------------------------------------------------------------------

Dec 31st 2013 Dec 31st 2012 31 mai 2012

in thousands of $ $ $ $

(except for share amounts) (12 months) (7 months) (12 mois)

----------------------------------------------------------------------------

Extracted from the consolidated

financial statements

Revenues 1 214 575 500

Net earnings and overall

result(i) (1 629) (609) (343)

Net earnings per basic and

fully diluted share (0,04) (0,03) (0,02)

Cash and cash equivalents 509 1 188 -

----------------------------------------------------------------------------

(i)Net earnings and overall results for the twelve months ending December 31st

2013 include amortization of $293,925 and impairment loss on intangible assets

in the cyberhealth division for $418,346. The seven-month financial year ending

December 31st 2012 includes amortization of $88,683 and the costs related to the

reverse takeover for $129,047.

Above data includes a summary of highlights. For further information, please

consult the Corporation's consolidated financial statement as well as the

Management Report for the fiscal year ending December 31, 2013 at www.sedar.com

Forward looking statements

This press release contains forward-looking statements that reflect the

Company's current expectation regarding future events. There is a risk that

expectations and forward looking statements will not prove to be accurate.

Readers are cautioned not to place undue reliance on these forward looking

statements as they involve risks and uncertainties, which could make actual

results differ materially from those projected herein and depend on a number of

factors including, but not limited to, no history of profitability, future

financing, intellectual property and patents, key personnel, competitive

marketplace, technology obsolescence, share price volatility and other risks

detailed from time to time in the Company's filings. While AtmanCo anticipates

that subsequent events and developments may cause its views to change, AtmanCo

specifically disclaims any obligation to update these forward looking

statements, unless obligated to do so by applicable securities laws

Additional information regarding the Company are available on SEDAR www.sedar.com

ATMANCO PROFILE

Field of human resources

Using a management interface (Web platform) that is among the most advanced,

AtmanCo helps executives and managers recruit qualified human resources by

placing the right person in the right position.

By quickly obtaining results of psychometric tests, comparing profiles to job

norms and generating complementarity reports, managers are equipped throughout

their human resources processes.

The Company stands out in its marketing approach via its Website, direct sales

and partner network. For further information, visit www.atmanco.com

The TSX Venture Exchange and its Regulatory Services provider (as per meaning

assigned to this term in TSX Venture Exchange's policies) bear no liability as

to the relevance or accuracy of this press release.

FOR FURTHER INFORMATION PLEASE CONTACT:

AtmanCo inc.

Edith Bourgeois

CFO

514.935.5959 ext 304

www.atmanco.com

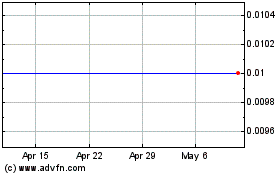

ATW Tech (TSXV:ATW)

Historical Stock Chart

From Apr 2024 to May 2024

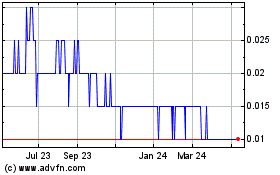

ATW Tech (TSXV:ATW)

Historical Stock Chart

From May 2023 to May 2024