AVRICORE HEALTH INC. (TSXV: AVCR) (the

"

Company" or “

Avricore”) reports

on its mid-year results for 2024 demonstrating the Company’s

continued success in maintaining strong growth in revenues while

achieving net profitability.

In the six months ended June 30, 2024 revenues

grew by 84% year-over-year, topping $2,169,513 with gross profit

increasing 94% equalling $855,566. This was supported by Q2 2024

revenue increasing 91% against the same period in 2023 to

$1,045,206, with gross profit topping $370,775, a 62% gain.

This success led the Company to recording a net

profit of $222,559 and posting a net increase in cash of

$279,039.

“Our success comes from great partners, an

incredible team and a shared mission by all that believes everyone

deserves better access to care,” said Hector Bremner, CEO of

Avricore. “We’ve put that mission at the centre of what we do and

know that the passion for our mission is growing, and we can do so

much more in Canada and globally.”

Second Consecutive Profitable Quarter

The Company incurred a comprehensive income of

$222,559 for the six months ended June 30, 2024 (2023 - loss

$475,737). Revenue grew thanks to an increase in HealthTab™ systems

deployed and tests sold. Gross margin for the period was 39% (2023-

37%) outperforming the Company’s target margin of 30%. Share-based

compensation of $29,062 (2023 - $256,519) was recognized for stock

options granted, vested, and repriced during the period.

| |

Three months endedJune 30 |

Six months endedJune 30 |

| |

|

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

| Revenue |

$1,045,206 |

|

$548,049 |

|

$2,169,513 |

|

$1,177,290 |

| |

|

|

|

|

| % Change - year over

year |

91% |

|

|

84% |

|

|

|

|

|

|

|

|

|

Gross profit |

$370,775 |

|

$229,471 |

|

$855,566 |

|

$440,152 |

|

% Change - year over year |

62% |

|

|

94% |

|

|

We’ve Got What It Takes

As of this reporting period the Company had a

working capital of $609,108 (December 31, 2023 – $244,343) and

$329,357 (December 31, 2023 - $427,689) in accounts receivable.

Given the positive trend, we believe that our cash resources, along

with the net inflows of revenues from operations and the potential

exercising of options, are sufficient to fund our working capital

for the next twelve months. However, should growth opportunities

present themselves that would exceed this, we have strategic plans

that would ensure we meet demand.

| Sources and Uses of Cash: |

Period ended June 30, 2024 |

|

|

2024 |

|

2023 |

|

|

|

$ |

|

$ |

|

| Cash provided by (used in)

operating activities |

417,118 |

|

227,832 |

|

| Cash used in investing

activities |

(124,679) |

|

(418,488) |

|

| Cash provided by (used in)

financing activities |

(13,400) |

|

42,500 |

|

| Cash

and Cash Equivalents, closing balance |

555,610 |

|

472,371 |

|

The Right Direction

The following table highlights selected financial data for each

of the eight most recent quarters.

|

Quarter Ended |

June2024 |

|

March2024 |

|

Dec2023 |

Sep2023 |

|

June2023 |

|

Mar2023 |

|

Dec2022 |

|

Sep2022 |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

Revenue |

1,045,206 |

|

1,124,307 |

|

1,354,403 |

|

953,454 |

|

548,049 |

|

629,241 |

|

997,235 |

|

572,228 |

| Gross profit

(loss) |

370,775 |

|

484,791 |

|

501,466 |

|

261,778 |

|

229,471 |

|

210,681 |

|

168,845 |

|

215,961 |

| Share-basedcompensation |

1,598 |

|

27,464 |

|

142,765 |

|

304,328 |

|

168,518 |

|

88,001 |

|

243,000 |

|

58,354 |

| Comprehensive income

(loss) |

54,022 |

|

168,537 |

|

59,584 |

|

(285,062) |

|

(284,225) |

|

(191,512) |

|

(244,789) |

|

(180,398) |

| Net profit

(loss)/share |

0.00 |

|

0.00 |

|

(0.00) |

|

(0.00) |

|

(0.00) |

|

(0.00) |

|

(0.00) |

|

(0.00) |

|

Total Assets |

2,618,384 |

|

2,798,058 |

|

2,538,205 |

|

2,453,136 |

|

2,143,810 |

|

2,296,565 |

|

2,568,983 |

|

2,128,017 |

Looking Ahead

The Company sees several near-term positive

developments coming throughout the balance of 2024 and into

2025:

- Expanding its network of pharmacies

utilizing HealthTab,

- working with pharmacy partners to

ensure the maximizing of testing as part of their patient

approach,

- preparing for potential pharmacy

funding announcements by provinces that will support chronic

disease screening and testing, as well as Strep testing, by these

trusted healthcare professionals,

- expanding the UK feasibility study

in collaboration with its partners and securing NHS support for

pharmacy scope,

- increasing API connectivity

partners to better support patient health records,

- new market access pilots and

expansions,

- general policy shifts in key

markets which will open doors to further expansion.

Overall, the Company believes it can manage

stable growth through cashflow, putting it on a strong footing

going forward. If, and when, opportunities arise that would require

additional capital beyond current abilities, the Company can access

it and ensure it can meet demand. Growth in Canada will be a focus;

however, international markets present significant opportunity and

will eventually represent a larger share of revenues in time. The

market for health services and POCT in pharmacy is growing thanks

to public policy decisions which are supporting the approach.

Furthermore, standards being set for POCT in pharmacy are more in

line with HealthTab’s approach, making either previously used and

even recently developed approaches increasingly obsolete or unable

to meet the modern standard. The Company feels in light of all

this, that it is on the right track and is confident of its

strategy.

The Company also announces that at its annual

general meeting held on June 20, 2024, shareholders approved an

increase of 45,000 in the number of stock options available to be

issued under the Company’s stock option plan.

HealthTab™ Market Fast Facts

- Point of Care Testing Market to

reach $93.21 Billion USD in 2030 (Source)

- Nearly 13.6 Million Canadians

expected to be diabetic or prediabetic by 2030, with many

undiagnosed (Source)

- Over 1 in 3 Americans,

approximately 88 million people, have pre-diabetes (Source)

- Close to 160,000 Canadians 20 years

and older are diagnosed with heart disease each year, often it’s

only after a heart attack they are diagnosed. (Source)

- There are more that 10,000

pharmacies in Canada, 88,000 pharmacies in the US, nearly 12,000 in

the UK.

About HealthTab™

HealthTab™ is a turnkey point-of-care testing solution that

combines best-in-class point-of-care technologies with a secure,

cloud-based platform for tackling pressing global health issues.

With just a few drops of blood from a finger prick, the system

generates lab-accurate results on the spot and data is reported in

real time. The test menu includes up to 23 key biomarkers for

screening and managing chronic diseases, such as diabetes and heart

disease (e.g., HbA1c, Lipid Profile, eGFR). HealthTab™ has also

recently added capabilities for bacterial and viral tests, such as

strep and COVID-19.

The HealthTab™ network model is unlike anything in pharmacy

today. It gives knowledgeable and trusted pharmacists a greater

role in primary care delivery, while empowering patients to take

more control of their health. It also reduces costs and waiting

times and provides many potential revenue streams including

equipment leasing & consumables, direct access testing, disease

prevention & management programs, sponsored health programs,

decentralized clinical trials, real world data (RWD) sets, and

third-party app integration through API.

About Avricore Health Inc.

Avricore Health Inc. (TSXV: AVCR) is a pharmacy

service innovator focused on acquiring and developing early-stage

technologies aimed at advancing pharmacy practice and patient care.

Through its flagship offering HealthTab™, a wholly owned

subsidiary, the Company’s mission is to make actionable health

information more accessible to everyone by creating the world’s

largest network of rapid testing devices in community

pharmacies.

Contact:

Avricore Health Inc.Hector Bremner, CEO

604-773-8943info@avricorehealth.comwww.avricorehealth.com

Cautionary Note Regarding Forward-Looking

Statements Information in this press release that involves

Avricore Health's expectations, plans, intentions, or strategies

regarding the future are forward-looking statements that are not

facts and involve a number of risks and uncertainties. Avricore

Health generally uses words such as "outlook," "will," "could,"

"would," "might," "remains," "to be," "plans," "believes," "may,"

"expects," "intends," "anticipates," "estimate," "future,"

"positioned," "potential," "project," "remain," "scheduled," "set

to," "subject to," "upcoming," and similar expressions to help

identify forward-looking statements. In this press release,

forward-looking statements include statements regarding: the

completion of the placement and the expected timing thereof and the

Company's expected use of proceeds from the placement; the unique

features that the HealthTab™ platform offers to pharmacists and

patients. Forward-looking statements reflect the then-current

expectations, beliefs, assumptions, estimates and forecasts of

Avricore Health's management. The forward-looking statements in

this press release are based upon information available to Avricore

Health as of the date of this press release. Forward-looking

statements believed to be true when made may ultimately prove to be

incorrect. These statements are not guarantees of the future

performance of Avricore Health and are subject to a few risks,

uncertainties, and other factors, some of which are beyond its

control and may cause actual results to differ materially from

current expectations, including without limitation: failure to meet

regulatory requirements; changes in the market; potential downturns

in economic conditions; and other risk factors described in

Avricore's public filings. These forward-looking statements speak

only as of the date on which they are made, and the Company

undertakes no obligation to update them publicly to reflect new

information or the occurrence of future events or circumstances,

unless otherwise required to do so by law.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

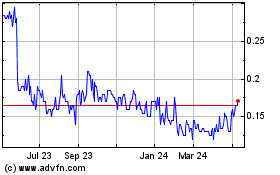

Avricore Health (TSXV:AVCR)

Historical Stock Chart

From Dec 2024 to Jan 2025

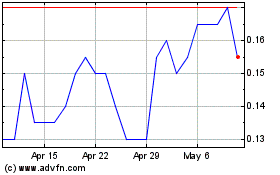

Avricore Health (TSXV:AVCR)

Historical Stock Chart

From Jan 2024 to Jan 2025